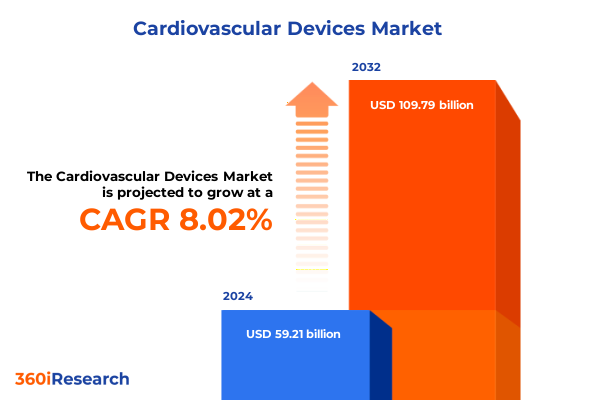

The Cardiovascular Devices Market size was estimated at USD 63.77 billion in 2025 and expected to reach USD 68.69 billion in 2026, at a CAGR of 8.06% to reach USD 109.79 billion by 2032.

Comprehensive Overview of Cardiovascular Devices Market Landscape and Key Drivers Shaping the Industry’s Future Trajectory

The executive summary begins by setting the stage for a comprehensive exploration of the cardiovascular devices landscape, underscoring the critical role these technologies play in enhancing patient outcomes. It outlines the overarching objectives of the research, which include illuminating the key market dynamics shaping innovation, regulatory evolution, and competitive positioning. By establishing the context and purpose, readers gain clarity on the strategic value embedded within the full report.

From the outset, the introduction emphasizes the convergence of clinical needs and technological breakthroughs, highlighting how advancements in diagnostic accuracy and therapeutic efficacy are catalyzing new opportunities. It also explains the methodology underpinning the analysis, ensuring stakeholders understand the rigor and relevance of the findings that follow. In doing so, this section fosters confidence in the depth and reliability of the insights presented.

Finally, the introduction charts the structure of the executive summary, previewing the subsequent sections on transformative shifts, tariff impacts, segmentation insights, regional considerations, company strategies, actionable recommendations, research framework, and the concluding call to action. This roadmap equips decision-makers with a clear view of the narrative flow, facilitating targeted engagement with the content most pertinent to their strategic initiatives.

Analysis of Transformative Technological, Regulatory, and Patient-Centric Forces Redefining Cardiovascular Device Innovation Trajectories

In recent years, the cardiovascular devices sector has experienced transformative shifts driven by rapid technological innovation and evolving stakeholder expectations. Digitization of patient data and the integration of artificial intelligence into diagnostic platforms are redefining how clinicians detect and monitor cardiac conditions. These advances, intertwined with growing emphasis on precision medicine protocols, have elevated the standard of patient care while opening new avenues for device manufacturers to differentiate their offerings.

Concurrently, regulatory landscapes in major markets have undergone significant refinement, moving toward expedited pathways for breakthrough technologies and incorporating real-world evidence into approval processes. This regulatory evolution has not only accelerated time-to-market for next-generation devices but also increased the emphasis on post-market surveillance and patient-centric outcome measures. As a result, companies are adopting more agile development frameworks to maintain compliance while fostering innovation.

Patient-centric care models and value-based reimbursement schemes further underscore the imperative for devices that deliver demonstrable clinical and economic benefits. These dynamics are prompting industry stakeholders to forge partnerships across the healthcare ecosystem, from providers and payers to technology firms and academic institutions. By embracing collaborative approaches, organizations are better positioned to navigate reimbursements, regulatory rigor, and competitive pressures while advancing the standard of care.

Examination of Aggregate Effects from 2025 U.S. Tariff Adjustments on Supply Chain Dynamics, Cost Structures, and Competitive Posture in the Market

The introduction of new tariff measures in early 2025 has imposed a multilayered impact on the cardiovascular devices market, particularly within the United States. Faced with augmented duties on imported medical components, manufacturers have had to reassess supply chain structures to mitigate cost fluctuations. The resulting operational adjustments demonstrate the sector’s resilience, as organizations pursue strategic partnerships and alternative sourcing arrangements to sustain production continuity.

Moreover, the cost pressures associated with tariff-induced price shifts have influenced procurement strategies across hospitals, clinics, and ambulatory centers. Institutions are increasingly exploring domestic manufacturing collaborations and inventory management enhancements to preserve budgetary alignment. Such measures not only alleviate immediate financial stress but also foster long-term supply chain diversification, which can help insulate stakeholders from future policy shifts.

Competitive dynamics have similarly evolved, with regional and smaller-scale suppliers gaining traction by capitalizing on reduced logistical complexities. At the same time, leading multinational corporations have intensified their focus on vertically integrated models, prioritizing localized assembly and component fabrication. Through proactive scenario planning and agile response frameworks, market participants are positioning themselves to navigate tariff volatility and safeguard seamless access to critical cardiovascular care solutions.

In-Depth Interpretation of Market Segmentation Across Device, Operation, Access, Application, and End-User Dimensions Revealing Strategic Pathways

Understanding the cardiovascular devices landscape requires an in-depth look at market segmentation, which uncovers the varied strategic imperatives across device, operation, access, application, and end user dimensions. Device versatility is evident as diagnostic and monitoring platforms-from ECG systems to implantable loop recorders-coexist with surgical interventions such as stents, heart valves, and vascular grafts, as well as therapeutic technologies encompassing blood pressure monitors, defibrillators, and pacemakers. Each device category demands tailored innovation pathways, informed by clinical application and technological complexity.

Operation type introduces a critical distinction, as invasive technologies necessitate stringent procedural protocols, while non-invasive devices align with patient comfort and remote monitoring trends. This dichotomy guides development investments toward improving safety profiles, enhancing portability, and integrating connectivity features. Access modalities further refine strategic focus, with transcutaneous solutions appealing to minimally invasive therapy preferences and transvenous applications addressing direct vascular interventions.

Applications within cardiac rhythm management, coronary artery disease, peripheral vascular disease, and stroke management drive specialized market approaches, each requiring unique clinical validations and reimbursement alignments. End user environments, ranging from ambulatory surgical centers to home care scenarios and large-scale hospitals and clinics, shape the distribution, service, and support frameworks that accompany device adoption. By converging these segmentation layers, stakeholders gain a holistic perspective on market opportunities and patient care imperatives.

This comprehensive research report categorizes the Cardiovascular Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Operation Type

- Access Type

- Application

- End User

Critical Review of Regional Dynamics Highlighting Growth Drivers and Unique Challenges in the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics exert a profound influence on cardiovascular device development and adoption, each geography presenting distinct opportunities and hurdles. In the Americas, the convergence of advanced healthcare infrastructure and robust research ecosystems supports early uptake of cutting-edge interventions, though reimbursement variability across public and private payers necessitates nuanced market entry plans. Meanwhile, supply chain modernization and trendsetting clinical trials underscore the region’s role as an innovation bellwether.

Across Europe, the Middle East, and Africa, divergent regulatory frameworks and economic landscapes create a mosaic of market conditions. Western European markets leverage harmonized approval pathways and value-based procurement strategies, while emerging EMEA economies are driving cost-effective solutions and locally adapted technologies. Healthcare digitization and infrastructure investments are rapidly reshaping patient engagement models, fostering demand for remote monitoring and telehealth-enabled cardiovascular care.

In the Asia-Pacific realm, demographic shifts and growing prevalence of chronic cardiac conditions are propelling demand for accessible diagnostics and streamlined therapies. Government-led healthcare reforms and expanding insurance coverage are facilitating broader patient access, while a vibrant manufacturing base and favorable production costs encourage localized device development. Collectively, regional insights inform strategic market prioritization and resource allocation for global stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Cardiovascular Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Cardiovascular Device Manufacturers and Their Strategic Initiatives in Innovation, Collaboration, and Market Positioning Trends

Leading industry participants are fortifying their market positions through a blend of product innovation, strategic alliances, and M&A activity. Major device manufacturers are unveiling next-generation minimally invasive stent platforms and wireless pacemaker systems designed to enhance patient comfort and procedural efficiency. Additionally, collaborative ventures with digital health enterprises are integrating remote monitoring capabilities and AI-driven analytics into comprehensive cardiac management solutions.

Partnerships with clinical research organizations and academic institutions are accelerating validation pathways, allowing companies to generate robust clinical evidence and patient outcome data. These alliances bolster competitive differentiation by underscoring real-world performance metrics and enhancing payer confidence in value-based reimbursement models. Concurrently, targeted acquisitions of niche technology providers are expanding portfolios in areas such as electrophysiology mapping and hemodynamic monitoring.

Supply chain resilience has become a focal point, with leading organizations investing in dual sourcing strategies and regional manufacturing hubs to mitigate logistical risks. In parallel, customer engagement models are shifting away from transactional sales toward service-driven relationships, encompassing turnkey device implantation programs, ongoing training, and remote technical support. These comprehensive approaches underscore the imperative for integrated solutions across the cardiovascular care continuum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiovascular Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACS Diagnostics

- Alivecor, Inc.

- Asahi Kasei Corporation

- B. Braun SE

- Baxter International Inc.

- Bexen Medical

- Biotronik SE & Co KG

- Boston Scientific Corporation

- BPL Medical Technologies Private Limited

- Edwards Lifesciences Corporation

- GE Healthcare

- HeartFlow Holding, Inc.

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.,

- Lepu Medical Technology(Beijing)Co.,Ltd.

- LivaNova PLC

- Medtronic PLC

- Microport Scientific Corporation

- Nihon Kohden Corporation

- Schiller AG

- Siemens Healthineers

- Terumo Cardiovascular Systems Corporation

- Tricog Health

- Vesalius Cardiovascular Inc.

- Zoll Medical Corporation

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Technologies and Mitigate Risk in Cardiovascular Devices Sector

Industry leaders should consider accelerating investments in digital health integration to deliver seamless, end-to-end cardiovascular care experiences. By embedding remote monitoring into device ecosystems and leveraging predictive analytics, organizations can drive improved adherence and earlier clinical interventions. Such technologically enhanced solutions not only improve patient outcomes but also fortify reimbursement value propositions in an increasingly outcome-driven environment.

Supply chain diversification is imperative in light of ongoing tariff and geopolitical uncertainties. Executives are advised to evaluate regional production partnerships and nearshoring opportunities that balance cost optimization with manufacturing agility. By embracing flexible sourcing frameworks, companies can reduce exposure to policy fluctuations and maintain consistent access to critical device components.

Cultivating strategic alliances across the healthcare continuum-from payers and providers to academic research centers-will enhance evidence generation and accelerate regulatory confidence. Stakeholders should prioritize collaborative research studies and real-world data initiatives that demonstrate both clinical efficacy and economic impact. Finally, strengthening service-centric business models through comprehensive training, technical support, and outcome management services will differentiate offerings and drive sustained customer loyalty.

Detailed Overview of Research Methodology Incorporating Primary Stakeholder Insights and Comprehensive Secondary Data Analysis for Robust Conclusions

The research methodology underpinning this executive summary combines rigorous secondary data analysis with extensive primary stakeholder engagement to ensure robust insights. Secondary sources include scientific literature, regulatory filings, clinical trial repositories, and industry white papers, providing a comprehensive contextual backdrop. These data streams are systematically evaluated to identify prevailing trends, technological advancements, and regulatory developments shaping the cardiovascular devices landscape.

Primary research components feature in-depth interviews with key opinion leaders, device developers, healthcare providers, and procurement specialists. These dialogues yield qualitative perspectives on market challenges, innovation priorities, and emerging clinical needs. By triangulating secondary findings with firsthand stakeholder feedback, the analysis achieves a balanced synthesis of quantitative data and experiential insights.

Data validation and quality control processes underpin all stages of the research framework. Insights are cross-checked against multiple sources to mitigate bias and ensure factual accuracy. Analytical models are subjected to peer review, and findings are distilled into actionable intelligence that aligns with the strategic imperatives of device manufacturers, investors, and healthcare system leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiovascular Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiovascular Devices Market, by Device Type

- Cardiovascular Devices Market, by Operation Type

- Cardiovascular Devices Market, by Access Type

- Cardiovascular Devices Market, by Application

- Cardiovascular Devices Market, by End User

- Cardiovascular Devices Market, by Region

- Cardiovascular Devices Market, by Group

- Cardiovascular Devices Market, by Country

- United States Cardiovascular Devices Market

- China Cardiovascular Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Executive Summary Findings with Strategic Implications and Forward-Looking Perspectives for Stakeholders in Cardiovascular Devices

The executive summary culminates in a synthesis of core findings, underscoring the intricate interplay of technological innovation, regulatory evolution, and market segmentation drivers. It highlights the pivotal role of supply chain adaptability in navigating tariff shifts and geopolitical dynamics, as well as the critical impact of regional market nuances on strategic expansion plans. Collectively, these insights inform a cohesive view of the cardiovascular devices ecosystem.

Strategic implications emerge for device developers seeking to differentiate through integrated digital platforms and outcome-driven value propositions. The analysis also underscores the necessity of forging collaborative pathways across payers, providers, and technology partners to validate clinical effectiveness and economic viability. Furthermore, segmentation insights illuminate untapped opportunities within diagnostic, surgical, and therapeutic device categories, guiding targeted product development roadmaps.

Looking ahead, stakeholders are encouraged to adopt agile operational frameworks and evidence-based market strategies that anticipate regulatory transformations and shifting patient needs. By synthesizing the detailed analyses within this summary, executives can craft informed, forward-looking decisions that harness emerging opportunities and navigate the complexities of the cardiovascular devices sector.

Engaging Invitation to Connect with Associate Director for Customized Market Research Solutions and Accelerate Informed Decision-Making

To explore how these comprehensive insights can be tailored to your strategic objectives and gain a competitive advantage, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to discuss your specific requirements. Our team will guide you through the nuances of the cardiovascular devices market and provide personalized recommendations to expedite your decision-making process. Connect directly with Ketan to secure your copy of the full market research report and unlock the detailed analysis your organization needs to thrive.

- How big is the Cardiovascular Devices Market?

- What is the Cardiovascular Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?