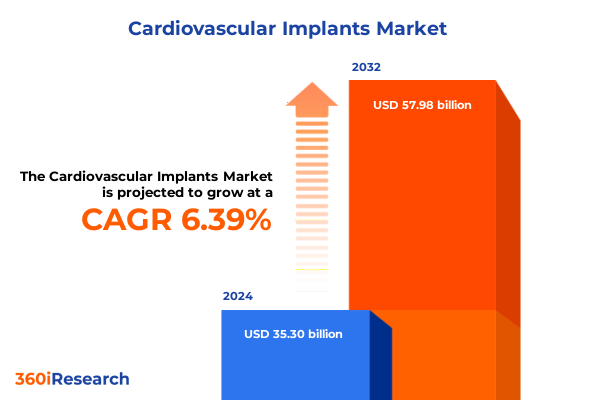

The Cardiovascular Implants Market size was estimated at USD 37.60 billion in 2025 and expected to reach USD 39.78 billion in 2026, at a CAGR of 6.37% to reach USD 57.98 billion by 2032.

Exploration of the Evolving Cardiovascular Implants Landscape and the Technological Innovations Redefining Patient Care and Clinical Practices

Cardiovascular disease continues to exert a profound toll on public health, standing as the leading cause of mortality across diverse demographic groups in the United States. Heart disease and stroke combined now surpass fatalities from all forms of cancer and accidental injury, underscoring an urgent need for advanced therapeutic interventions. Each year, tens of thousands of patients confront the challenges of valvular heart disease, arrhythmias, ischemic events, and heart failure, driving sustained demand for innovative implants that restore function and improve quality of life. Moreover, the convergence of an aging population and rising prevalence of comorbidities such as hypertension and diabetes has elevated the strategic imperative for devices that deliver precise, durable, and minimally invasive solutions.

Against this backdrop, the cardiovascular implants market has witnessed a dynamic transformation. Cutting-edge technologies, including transcatheter valve replacement systems, leadless pacing platforms, and bioresorbable scaffolds, are redefining procedural protocols and patient pathways. Concurrently, regulatory bodies have accelerated approval timelines for breakthrough devices, while reimbursement models are shifting to reward value-based outcomes. This evolving landscape demands that stakeholders-from device developers to healthcare providers-recalibrate research priorities, manufacturing strategies, and clinical practices to seize emerging opportunities and address persistent challenges. As a result, a comprehensive assessment of market drivers, technological advances, and policy influences is critical for navigating this complex ecosystem and charting a course toward sustainable growth.

In-Depth Analysis of Transformational Shifts Driving Disruption in the Cardiovascular Implants Sector from Design to Regulatory Pathways

Recent years have borne witness to transformative shifts that have recalibrated every facet of cardiovascular implant development-from material science to interventional approaches. Innovations in minimally invasive techniques have matured beyond incremental improvements, ushering in a new era of catheter-based heart valve therapies that reduce procedural trauma and accelerate patient recovery. Pioneering applications of pulsed field ablation have opened avenues for targeted arrhythmia treatment, offering enhanced safety profiles compared to traditional thermal modalities. Leadless pacing technology has similarly taken a quantum leap forward with the introduction of dual-chamber communication systems that synchronize atrial and ventricular pacing without transvenous leads, expanding patient eligibility for minimally invasive rhythm management.

Moreover, the fusion of artificial intelligence and machine learning with implant platforms is beginning to influence device design and post-procedural monitoring. AI-driven analytics enable predictive maintenance of pacemakers and defibrillators, flagging early indicators of device malfunction or arrhythmia recurrence. In parallel, next-generation bioresorbable stents are being engineered with smart polymer alloys that dissolve over controlled timelines, reducing long-term thrombosis risks while supporting vessel healing. Regulatory agencies have responded by establishing adaptive pathways that facilitate expedited clinical trials for such breakthrough therapies, fostering a regulatory environment that balances patient safety with rapid access to cutting-edge technology. These shifts collectively herald a more patient-centric, data-driven future for cardiovascular interventions, reshaping the strategic priorities of manufacturers and care providers alike.

Assessment of the Cumulative Impact of Recently Enacted United States Tariffs on Cardiovascular Implant Supply Chains and Cost Structures

In 2025, the U.S. government implemented new tariff measures targeting imported medical components and finished devices, introducing levies as high as 145 percent on goods originating from key manufacturing hubs in Asia. These tariffs have reverberated throughout the cardiovascular implant supply chain, elevating input costs for producers reliant on overseas fabrication of specialized alloys, polymers, and electronic components. Manufacturers have reported substantial increases in logistics expenses and customs duties, with some industry leaders projecting cost inflations disproportionally affecting devices that require complex, multi-component assembly.

For domestic producers, the tariffs have yielded mixed outcomes. While some organizations have accelerated plans to repatriate manufacturing facilities and invest in localized production capabilities, logistic constraints and stringent regulatory requirements for site validation have hindered rapid reconfiguration of global operations. A number of large cardiovascular device firms have sought to mitigate the impact by diversifying supplier bases, renegotiating long-term contracts, and passing a portion of increased costs downstream through pricing adjustments. However, contractually fixed reimbursement rates in healthcare ecosystems have limited the extent to which higher device prices can be realized, placing further pressure on profit margins and prompting a reevaluation of strategic investments.

In sum, the cumulative impact of the 2025 U.S. tariff regime has underscored the vulnerability of the cardiovascular implant sector to geopolitical shifts. Firms are now prioritizing supply chain resilience, exploring tariff exemption petitions, and reinforcing relationships with domestic partners to shield operations from future trade volatility.

Key Product, Technology, Application and End-User Segmentation Insights Revealing Growth Opportunities Across the Cardiovascular Implant Value Chain

The cardiovascular implant market is delineated by a multifaceted segmentation framework that illuminates clinical needs, device characteristics, and care delivery pathways. In terms of product portfolios, manufacturers offer a spectrum from mechanical heart valves-available in both durable metal designs and tissue-based constructs derived from bovine, equine, or porcine sources-to sophisticated electronic platforms such as implantable cardioverter defibrillators configured for single- or dual-chamber therapy. Occlusion devices tailored for atrial septal defect and patent foramen ovale closure sit alongside rhythm management tools ranging from single-loft leadless pacemakers to biventricular systems for resynchronization, and vascular grafts fashioned from both biological allografts and synthetic conduits with proprietary coatings.

Material composition further differentiates device lines, with an emphasis on biologically sourced tissues, advanced metallic alloys, and high-performance polymers engineered to optimize biocompatibility and mechanical resilience. Technological categories overlap with these material choices; bare metal scaffolds remain prevalent in peripheral interventions, while drug-eluting and bioabsorbable platforms gain traction for temporary coronary support. Interventional approach segmentation spans minimally invasive catheter-based procedures and traditional open surgical techniques, reflecting the coexistence of hybrid operating suites. Clinical applications range from acute myocardial infarction management to long-term heart failure support, demanding a diverse arsenal of implantable solutions. Finally, end-user segmentation captures the distinct operational rhythms of ambulatory surgical centers, acute care hospitals, and specialty cardiovascular clinics, each presenting unique procurement, training, and reimbursement dynamics. This layered segmentation matrix is essential for identifying targeted growth vectors and aligning product development with evolving clinical imperatives.

This comprehensive research report categorizes the Cardiovascular Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Technology

- Approach

- Application

- End-User

Critical Regional Dynamics Shaping the Adoption and Distribution Patterns of Cardiovascular Implants Across the Americas, EMEA and Asia-Pacific Markets

Regional market dynamics for cardiovascular implants are shaped by distinct economic, regulatory, and demographic factors. In the Americas, a robust payer environment, well-established hospital networks, and high per capita healthcare spending have fueled widespread adoption of premium implant technologies. North American regulatory agencies have fostered innovation through accelerated device pathways, while private equity investment has supported the consolidation of specialized cardiovascular centers.

Across Europe, the Middle East, and Africa, significant heterogeneity emerges. Western European nations benefit from cohesive regulatory standards and public-private research consortia that facilitate multicenter clinical trials. Conversely, emerging markets in the Middle East and Africa exhibit growing demand driven by increasing healthcare infrastructure investments and rising prevalence of cardiovascular risk factors. However, cost containment policies and variable reimbursement schemes necessitate strategic pricing and flexible market entry models.

The Asia-Pacific region presents a dual narrative: advanced economies such as Japan and Australia spearhead technological uptake, supported by aging populations and progressive reimbursement frameworks. Simultaneously, burgeoning markets in Southeast Asia and India offer high-growth potential as healthcare capacity expands and governments prioritize cardiovascular disease management. Local manufacturing initiatives and public health programs aimed at early intervention are catalyzing demand for affordable yet clinically effective implant solutions. These regional insights underscore the importance of tailored market strategies that address varied healthcare architectures and patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Cardiovascular Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Insights into Leading Cardiovascular Implant Manufacturers Highlighting Innovation Portfolios and Market Positioning Strategies

Key players in the cardiovascular implants space continue to leverage differentiated innovation strategies and strategic partnerships to consolidate market positions. Medtronic, recognized for its portfolio of stents and defibrillators, has prioritized supply chain diversification and tech-driven optimization of its manufacturing footprint to offset international tariff pressures and maintain product accessibility. Abbott has focused on expanding its percutaneous valve offerings and integrating digital telemonitoring capabilities to enhance long-term patient management.

Edwards Lifesciences has cemented its leadership in transcatheter heart valve therapies, reinforcing its product pipeline through targeted acquisitions and joint development agreements with academic research centers that drive iterative improvements in device design. Boston Scientific continues to advance its bioresorbable scaffold technology while strengthening post-market surveillance programs to validate real-world performance. Johnson & Johnson Medical Devices Group, leveraging its scale, integrates cross-divisional expertise to pursue next-gen occluders, graft materials, and leadless pacing modules, underpinned by substantial R&D investments.

Emerging firms and niche innovators are also influencing the competitive landscape, applying additive manufacturing, nanotechnology-infused coatings, and AI-driven diagnostics to carve out specialized opportunities. Collectively, these strategic maneuvers demonstrate a sector actively realigning research priorities, forging collaborative ecosystems, and deploying capital to support continuous device innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiovascular Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Asahi Kasei Corporation

- B. Braun Melsungen AG

- BIOTRONIK

- Boston Scientific Corporation

- Cardinal Health

- Edwards Lifesciences

- Getinge

- Impulse Dynamics

- Johnson & Johnson

- Lepu Medical Technology

- LivaNova PLC

- Medtronic

- Meril Life Sciences

- MicroPort Scientific Corporation

- Sahajanand Medical Technologies (SMT)

- Stryker

- Terumo Corporation

- Translumina Therapeutics

- W. L. Gore & Associates

Actionable Recommendations for Industry Leaders to Navigate Market Complexity, Optimize Value Chains and Accelerate Sustainable Growth in Cardiovascular Implants

To thrive amidst evolving market conditions, industry leaders must adopt a proactive, integrated approach. First, strengthening supply chain resilience is paramount; diversification of component sourcing, coupled with near-shoring opportunities for critical manufacturing stages, can mitigate tariff volatility and logistics disruptions. Second, investing in regulatory intelligence and early engagement with approval agencies will accelerate time-to-market for breakthrough devices and optimize labeling claims that underscore clinical benefits.

Third, fostering collaborative alliances with healthcare providers and payers is essential for demonstrating real-world value. Structured outcomes studies and health economic analyses should be embedded within product development cycles to support favorable reimbursement decisions. Fourth, embracing digital health integration-through remote monitoring platforms, AI-enabled analytics, and patient engagement tools-will distinguish product offerings and enhance long-term adherence, ultimately improving therapy outcomes.

Finally, tailoring commercialization strategies to regional nuances by leveraging local partnerships, adaptive pricing models, and market-specific training programs will ensure broader uptake across varied healthcare systems. By executing these targeted actions, device manufacturers and service providers can navigate geopolitical headwinds, harness technological momentum, and secure sustainable growth in the dynamic cardiovascular implants landscape.

Comprehensive Research Methodology Detailing Data Sources, Analytical Frameworks and Validation Processes Underpinning the Cardiovascular Implants Analysis

This analysis integrates a rigorous, multi-dimensional research methodology designed to ensure data accuracy and comprehensive insight generation. Primary research included in-depth interviews with C-suite executives, R&D leaders, and clinical practitioners across major cardiovascular centers to capture firsthand perspectives on technological adoption and market challenges. Similarly, we engaged procurement and supply chain specialists to assess the operational impacts of tariff changes and regulatory shifts.

Secondary research encompassed a systematic review of peer-reviewed journals, regulatory filings, company presentations, and policy briefs from leading health authorities. Data triangulation techniques were employed to validate findings across disparate sources, while proprietary databases provided historical device usage trends. Quantitative analyses leveraged statistical models to explore correlations between demographic factors and device utilization rates, without undertaking new forecasting exercises.

The final report underwent multiple layers of editorial and subject-matter expert validation, ensuring that conclusions reflect prevailing industry realities. Charting methodologies and segmentation frameworks adhere to best practices in healthcare market research, delivering a transparent, reproducible foundation for stakeholders to inform strategic decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiovascular Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiovascular Implants Market, by Product Type

- Cardiovascular Implants Market, by Material

- Cardiovascular Implants Market, by Technology

- Cardiovascular Implants Market, by Approach

- Cardiovascular Implants Market, by Application

- Cardiovascular Implants Market, by End-User

- Cardiovascular Implants Market, by Region

- Cardiovascular Implants Market, by Group

- Cardiovascular Implants Market, by Country

- United States Cardiovascular Implants Market

- China Cardiovascular Implants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Conclusive Perspectives on the Future Trajectory of Cardiovascular Implant Technology Adoption, Policy Trends and Market Evolution Drivers

The collective insights presented in this executive summary underscore a dynamic cardiovascular implants sector defined by rapid technological evolution, shifting regulatory landscapes, and complex global supply chain considerations. Breakthrough innovations in minimally invasive procedures, bioresorbable materials, and AI-enabled device platforms are poised to redefine therapeutic paradigms and expand the scope of treatable conditions. Concurrently, trade policy changes and regional market disparities highlight the necessity for agile, locally informed strategies.

As the industry converges on a patient-centric, outcomes-driven model, device manufacturers, healthcare providers, and policymakers must align efforts to ensure equitable access to advanced therapies. Strategic collaborations and targeted investments in digital health infrastructure will be critical to unlocking long-term value and sustaining innovation momentum. Looking ahead, the successful integration of emerging technologies with robust clinical evidence and adaptive regulatory practices promises to enhance patient outcomes while reinforcing the commercial vitality of the cardiovascular implants ecosystem.

Engage with Ketan Rohom to Access the Full Cardiovascular Implants Market Research Report and Leverage Strategic Insights for Informed Decision-Making

To unlock the detailed insights, data tables, and strategic frameworks presented in this executive summary, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full cardiovascular implants market research report. With personalized guidance and a deep understanding of how to apply these findings to your organization’s objectives, Ketan can help you harness the comprehensive analysis across product innovations, regulatory impacts, and competitive landscapes. Reach out to explore tailored solutions, obtain exclusive access to proprietary data, and secure your role at the forefront of the rapidly evolving cardiovascular implants sector. Elevate your decision-making with the complete market intelligence and expert support designed to drive patient outcomes and business growth.

- How big is the Cardiovascular Implants Market?

- What is the Cardiovascular Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?