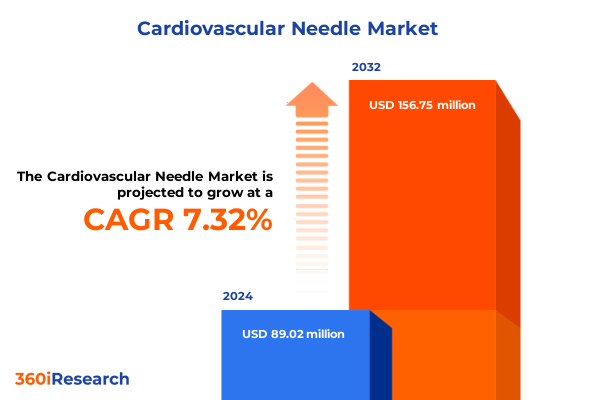

The Cardiovascular Needle Market size was estimated at USD 95.56 million in 2025 and expected to reach USD 102.05 million in 2026, at a CAGR of 7.32% to reach USD 156.75 million by 2032.

Discover how innovation in materials science safety regulations and minimally invasive procedures converge to reshape the cardiovascular needle market

The cardiovascular needle market stands at the crossroads of medical innovation and patient safety, driven by a convergence of technological advancements and regulatory mandates. Emerging materials like nickel titanium and advanced polymers have redefined needle performance, enhancing flexibility and biocompatibility. Simultaneously, escalating concerns about needlestick injuries have propelled the adoption of safety needle systems, accelerating the shift away from conventional designs. In parallel, the evolution of minimally invasive cardiovascular procedures continues to expand the application spectrum of specialized needles, ranging from complex vascular access to targeted drug delivery.

These dynamic forces underscore the market’s transformative potential and underscore the importance of a nuanced understanding of its drivers. This report delves into the critical factors reshaping the industry, spotlighting the interplay between product innovation and clinical imperatives. By examining how materials science, application demands, and safety regulations intersect, this introduction sets the stage for an in-depth exploration of the key trends and strategic imperatives that will define the cardiovascular needle landscape in the coming years.

Explore the paradigm shift driven by stringent safety mandates advanced materials and outpatient procedural growth in the cardiovascular needle arena

The cardiovascular needle landscape is undergoing transformative shifts as regulatory frameworks mandate enhanced safety mechanisms and clinical protocols prioritize patient outcomes. Active and passive safety needles, once considered niche, are now central to device portfolios to mitigate needlestick risks. This adoption reflects broader healthcare imperatives to reduce occupational hazards and align with organizations such as OSHA and WHO advocating stringent safety standards. Consequently, manufacturers are investing heavily in R&D to refine activation mechanisms, ensuring user-friendly deployment without compromising procedural efficiency.

Simultaneously, the integration of advanced materials such as nickel titanium alloys has facilitated the development of needles that strike an optimal balance between flexibility and tensile strength, crucial for navigating tortuous vascular pathways. This shift has catalyzed growth in large gauge and small gauge offerings alike, enabling clinicians to tailor needle selection to specific cardiovascular interventions. Moreover, the rise of outpatient procedures in ambulatory surgery centers has amplified demand for versatile devices optimized for rapid setup and disposal, signaling a departure from traditional hospital-centric utilization.

Understand how 2025 US tariffs on stainless steel and polymer inputs are reshaping sourcing strategies and supply chain resilience

United States tariff policies enacted in 2025 have introduced new complexities for cardiovascular needle manufacturers and supply chains. Heightened duties on imported stainless steel and polymer components have elevated production costs, forcing suppliers to reassess their geographic sourcing strategies. Some industry leaders have responded by reshoring select manufacturing operations, prioritizing domestic production to mitigate tariff exposure and maintain price stability for end users. However, this approach has necessitated substantial capital investments and operational realignments, challenging smaller players with limited financial flexibility.

On the other hand, regional distribution hubs have gained prominence as companies seek to optimize cross-border logistics and leverage preferential trade agreements. By consolidating inventory within the Americas and strategically deploying safety needle systems closer to key markets, manufacturers can circumvent some tariff burdens while ensuring timely delivery. Despite these adaptations, the cumulative impact of tariffs underscores the criticality of agile supply chain management and proactive collaboration with material suppliers to navigate the evolving trade environment.

Gain nuanced interpretation of how product types end users applications gauges materials and coatings collectively influence cardiovascular needle dynamics

Insightful segmentation analysis reveals that product type, end-user context, application domain, gauge variation, material composition, and coating technology each exert a distinct influence on market trajectories. Within the spectrum of automatic, conventional and safety needles, hypodermic and introducer variants address foundational procedural requirements, while active safety and passive safety iterations cater to emerging clinical and regulatory demands. Venues ranging from ambulatory surgery centers to clinics and hospitals exhibit unique procurement priorities, reflecting procedural complexity and throughput considerations.

Cardiovascular surgery applications continue to drive demand for larger gauges optimized for vascular access and drug delivery, whereas medium and small gauge needles facilitate precise anesthetic administration and intricate catheterization tasks. Nickel titanium needles deliver superior flexibility during navigation of tortuous vessels, contrasting with stainless steel options that offer cost efficiencies and high tensile strength. Coating choices from polymer blends to silicone lubricants further enhance insertion performance and patient comfort, underscoring the nuanced interplay between product design and clinical outcomes.

This comprehensive research report categorizes the Cardiovascular Needle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gauge

- Material

- Coating

- End User

- Application

Examine the distinct regulatory reimbursement and procurement forces shaping cardiovascular needle utilization across global regions

Regional dynamics within the global cardiovascular needle market underscore divergent growth drivers and strategic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a well-established healthcare infrastructure and rising emphasis on outpatient interventions fuel demand for advanced safety needle systems and nickel titanium variants. Procurement cycles are further shaped by consolidated group purchasing organizations and evolving reimbursement frameworks, prompting suppliers to demonstrate robust quality certifications and cost-effectiveness.

Conversely, the Europe Middle East & Africa region exhibits heterogeneous adoption patterns driven by a mosaic of regulatory landscapes and economic maturity. Western European markets lead in the uptake of active safety needles, supported by stringent EU directives on device safety, while emerging markets within the Middle East and Africa present untapped opportunities as healthcare spending scales. In the Asia-Pacific region, expanding hospital networks and growing procedural volumes in cardiovascular surgery catalyze demand for versatile gauge options. Here, price sensitivity remains a critical factor, motivating local production partnerships and volume-based procurement models.

This comprehensive research report examines key regions that drive the evolution of the Cardiovascular Needle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how leading corporations and niche innovators leverage safety mechanisms material expertise and strategic partnerships to secure market advantage

Leading stakeholders in the cardiovascular needle domain are distinguished by their strategic investments in safety innovation, material science, and global manufacturing footprints. Major medical device conglomerates leverage integrated R&D pipelines to introduce advanced active safety mechanisms, often securing regulatory clearance across multiple jurisdictions to accelerate market entry. Their vast distribution networks and broad product portfolios enable bundled offerings that span anesthetic delivery to complex vascular interventions, reinforcing their competitive edge.

Meanwhile, specialized manufacturers focus on niche segments such as polymer-coated introducer needles or nickel titanium safety systems, securing a foothold through targeted partnerships with ambulatory surgery centers and procedural training programs. These collaborations foster product adoption while generating critical user feedback for iterative design enhancements. In parallel, regional players leverage cost-efficient production in proximity to key markets, adapting coatings and gauge configurations to meet localized clinical preferences and price dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiovascular Needle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Assut Europe Sarl

- Aurolab

- B. Braun Melsungen AG

- Barrett Surgical Needles

- DemeTECH Corporation

- FCI Ophthalmics

- FSSB Surgical Needles

- Fumis Medical

- Johnson & Johnson Services, Inc.

- KLS Martin Group

- MANI, Inc.

- Medtronic plc

- Medtronic plc

- Peters Surgical

- RUMEX International

- Scanlan International, Inc.

- Serag-Wiessner GmbH

- Surgical Specialties Corporation

- Sutures India Pvt. Ltd.

- Teleflex Incorporated

- W.L. Gore & Associates, Inc.

Maximize competitive advantage by aligning regulatory clinical and supply chain efforts while forging material and manufacturing partnerships

Industry leaders can fortify their market position by championing cross-functional collaboration between regulatory affairs, clinical teams, and supply chain managers. Proactively engaging with healthcare providers and safety committees to co-develop needle activation training modules will facilitate smoother integration of advanced safety technologies. Additionally, establishing strategic alliances with polymer and nickel titanium suppliers can ensure prioritized access to cutting-edge materials, reducing vulnerability to tariff fluctuations.

Further, adopting a flexible manufacturing model that balances domestic and nearshore production capabilities will enhance responsiveness to regional demand shifts and regulatory changes. Investing in digital supply chain platforms with real-time visibility into inventory and logistics can mitigate disruptions and optimize cost-to-serve. Finally, cultivating robust post-market surveillance and user feedback channels will support continuous product refinement, ultimately driving clinician confidence and broader adoption of next-generation cardiovascular needle solutions.

Uncover the systematic research approach combining clinical interviews secondary data and expert validation to ensure report rigor

This research synthesis is anchored in a comprehensive approach that integrates primary interviews with cardiologists, interventional radiologists, and procurement specialists across diverse healthcare settings. Secondary data sources encompass peer-reviewed journals, device registries, and regulatory filings to validate product performance and safety claims. Trade association reports and tariff databases provide contextual insights into policy shifts and international trade dynamics. Market participants are profiled through public financial disclosures and patent analyses to gauge innovation trajectories and competitive positioning.

Qualitative insights are enriched by multi-country case studies exploring adoption barriers and best-practice implementation models. Triangulation of quantitative and qualitative findings ensures robust conclusions, while expert panel workshops validate key assumptions and forecasted thematic trends. Ethical considerations adhere to medical research guidelines, guaranteeing objectivity and credibility. This methodology underpins the report’s reliability, offering stakeholders a transparent lens through which to evaluate strategic opportunities within the cardiovascular needle market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiovascular Needle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiovascular Needle Market, by Product Type

- Cardiovascular Needle Market, by Gauge

- Cardiovascular Needle Market, by Material

- Cardiovascular Needle Market, by Coating

- Cardiovascular Needle Market, by End User

- Cardiovascular Needle Market, by Application

- Cardiovascular Needle Market, by Region

- Cardiovascular Needle Market, by Group

- Cardiovascular Needle Market, by Country

- United States Cardiovascular Needle Market

- China Cardiovascular Needle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesize the convergence of safety material geopolitical and regional factors that will shape the future trajectory of cardiovascular needles

The cardiovascular needle market is poised for substantial evolution driven by safety imperatives, material innovations, and geopolitical trade dynamics. Safety needle adoption will continue to accelerate under stringent regulatory oversight, while advanced materials like nickel titanium and silicone coatings will expand clinical capabilities. Regional strategies must account for diverse reimbursement schemes and procurement frameworks to effectively penetrate growth markets. In this context, companies that harmonize R&D, supply chain agility, and stakeholder collaboration will lead the next wave of market expansion.

Ultimately, success in this market will hinge on a deep understanding of segmentation nuances-balancing product features with end-user needs, application requirements, and regional preferences. By leveraging robust research methodologies and fostering continuous innovation, industry players can not only navigate the complexities of tariff landscapes and regulatory mandates but also deliver best-in-class needle solutions that enhance patient outcomes and clinician safety.

Unlock unparalleled market intelligence and personalized guidance to seamlessly acquire the cardiovascular needle research report from our Associate Director

To explore the comprehensive insights and actionable opportunities within the cardiovascular needle market, procure the in-depth market research report by connecting with Ketan Rohom. As Associate Director of Sales & Marketing at our firm, Ketan will facilitate access to detailed analyses, proprietary datasets, and strategic guidance tailored to your organization’s needs. Engage with Ketan to receive an executive summary, customization options, and a seamless purchasing process that empowers you to navigate the market’s complexities with confidence.

- How big is the Cardiovascular Needle Market?

- What is the Cardiovascular Needle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?