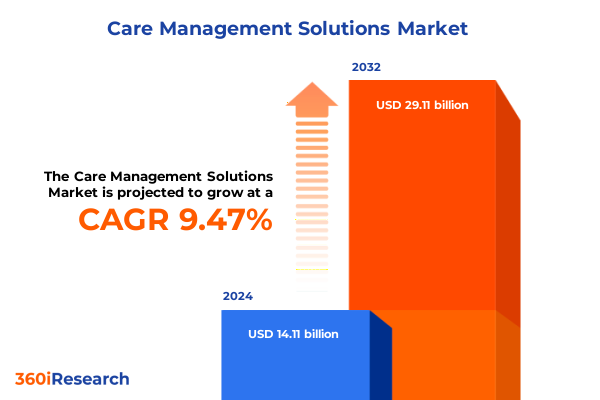

The Care Management Solutions Market size was estimated at USD 15.32 billion in 2025 and expected to reach USD 16.63 billion in 2026, at a CAGR of 9.60% to reach USD 29.11 billion by 2032.

Unveiling the strategic imperatives driving investment in integrated care management platforms amid rising patient expectations

In the context of an industry marked by increasing patient expectations, regulatory complexity, and technological acceleration, an effective care management framework has emerged as a strategic imperative. Healthcare systems around the globe are under unprecedented pressure to optimize outcomes while containing costs, prompting executives to reevaluate their operational models and invest in integrated platforms that facilitate seamless collaboration among stakeholders. During this period of profound change, payers, providers, and employers alike are seeking solutions that not only streamline workflows but also harness data to deliver personalized care pathways.

Against this backdrop, it becomes essential to articulate the foundational drivers that underpin the current evolution in care management. Rapid advancements in digital health, including cloud-enabled analytics and interoperable electronic health records, have unlocked new possibilities for real-time patient monitoring and risk stratification. Concurrently, shifts in reimbursement models toward value-based care have underscored the need for proactive population health management. In response, a holistic approach that blends consulting expertise with robust product capabilities is becoming the hallmark of market leaders intent on delivering measurable clinical and financial impact.

Exploring the technological and cultural catalysts propelling the transformation of care management toward proactive, patient-centric models

The landscape of care management solutions is undergoing a fundamental transformation driven by emerging technologies and evolving stakeholder demands. At the heart of this transformation is the integration of artificial intelligence and machine learning into data analytics workflows, enabling stakeholders to forecast patient risks with unprecedented accuracy. By leveraging predictive analytics, organizations can shift from reactive interventions to anticipatory care, thereby improving outcomes and reducing avoidable hospitalizations.

Moreover, the rise of patient engagement tools powered by mobile applications and telehealth capabilities has redefined the traditional care continuum. Individuals are now empowered to participate actively in their own health journeys, fostering a shift toward preventive care. This cultural evolution has been accompanied by an intensified focus on interoperability standards and cloud-native architectures, which facilitate seamless data exchange across disparate systems. As a result, the industry is moving away from standalone solutions toward modular platforms that can be rapidly configured to meet unique organizational needs.

Assessing the ripple effects of 2025 tariffs on care management solution costs, sourcing strategies, and deployment architectures

In 2025, the imposition of targeted tariffs on imported digital health components and software licensing has had a cascading effect on the cost structures within the care management ecosystem. Many solution providers have encountered increased expenses for hardware gateways and edge devices, prompting them to explore alternative sourcing strategies and regional manufacturing partnerships. This shift has not only altered procurement roadmaps but also spurred greater investment in open-source architectures that can mitigate reliance on tariff-exposed components.

Furthermore, the elevated costs associated with certain cloud-enablement toolsets, previously sourced from regions subject to higher duties, have led enterprises to renegotiate cloud service agreements or relocate workloads to domestic data centers. While these adjustments have introduced complexity into deployment decisions, they have simultaneously accelerated the adoption of hybrid models that balance cost control with scalability. Consequently, stakeholders are reexamining their total cost of ownership analyses, factoring in tariff-induced premiums and the longer-term benefits of robust, compliant infrastructures.

Decoding the multifaceted segmentation dynamics influencing component choices, deployment preferences, end-user demands, and application priorities

When analyzing market segmentation through the lens of component composition, it becomes apparent that organizations are balancing investments between comprehensive solution platforms and a suite of specialized services. The services portfolio comprises strategic consulting that defines care models, implementation offerings that orchestrate system integration, and ongoing support and maintenance engagements that ensure operational continuity. Meanwhile, product solutions deliver the technological backbone for care coordination, data aggregation, and workflow automation.

In terms of deployment modalities, there is a clear dichotomy between cloud-based and on-premise configurations. Cloud-native environments foster agility, with private cloud infrastructures catering to stringent data sovereignty requirements and public cloud variants providing rapid scalability for peak usage. Conversely, on-premise deployments remain prevalent among enterprises that prioritize full control over infrastructure and have established legacy systems.

From an end-user standpoint, distinct demand patterns emerge among employers seeking to manage workforce health benefits, healthcare providers refining patient pathways, and payers focused on risk optimization. Within the provider segment, ambulatory care centers, clinics, and hospitals each exhibit unique adoption profiles and workflow complexities. Payer organizations, whether government agencies or private insurers, leverage these platforms to underwrite value-based contracts and drive quality-based incentive programs.

Finally, application-driven segmentation reveals that care coordination remains core to day-to-day operations, while data analytics capabilities span both descriptive insights and predictive modeling. Patient engagement solutions bridge the communication gap between caregivers and individuals, and population health management frameworks support large-scale preventive interventions. Risk stratification further bifurcates into clinical risk algorithms that flag potential health deteriorations and financial risk engines that assess cost viability.

This comprehensive research report categorizes the Care Management Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User

- Application

Unraveling the disparate regional trajectories and strategic imperatives driving adoption of care management across global markets

A regional lens offers critical perspective on the divergent trajectories and strategic imperatives shaping care management adoption across the globe. In the Americas, maturity in value-based care models and substantial healthcare IT budgets have catalyzed widespread implementation of sophisticated analytics and patient engagement platforms. Stakeholders in North America are particularly focused on integrating data streams from remote monitoring devices and telehealth programs to manage chronic disease populations.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing data protection and cross-border interoperability have driven investment in secure cloud architectures. The European Union’s stringent data privacy regulations have led to innovative hybrid deployments that balance local data residency requirements with centralized analytics capabilities. In the Middle East and Africa, governments are prioritizing digital health initiatives to expand care access, resulting in collaborative public-private partnerships.

Meanwhile, the Asia-Pacific region is characterized by rapid digital transformation and a burgeoning private healthcare sector. High growth markets in this region are leveraging mobile-first engagement tools to bridge rural care gaps, while established economies are at the forefront of integrating artificial intelligence into population health strategies. These divergent regional dynamics underscore the importance of tailored approaches and localized partnerships to drive successful care management outcomes.

This comprehensive research report examines key regions that drive the evolution of the Care Management Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing competitive strategies and innovation pathways adopted by leading care management technology providers

In the competitive arena of care management technology, a select group of providers distinguishes itself through strategic partnerships, continuous platform enhancements, and a commitment to interoperability. Key players are forging alliances with telehealth vendors and device manufacturers to enrich their ecosystems and deliver end-to-end patient journeys. Meanwhile, investment in research and development remains a top priority, with many firms allocating significant resources toward artificial intelligence and natural language processing capabilities.

These companies are also pursuing modular platform architectures, empowering clients to adopt only the functionalities they require while maintaining the option to scale in alignment with evolving business needs. To address the growing significance of hybrid deployments, leading vendors offer flexible licensing models that accommodate on-premise, private cloud, and multi-cloud environments. Customer success and managed services have emerged as differentiators, with a growing emphasis on outcome-based contracting to align vendor incentives with client performance metrics.

Through targeted acquisitions and joint ventures, these firms are expanding their geographic footprints and bolstering vertical expertise in areas such as behavioral health, chronic care management, and maternity care. As competition intensifies, differentiation increasingly hinges on a provider’s ability to deliver demonstrable clinical impact, rapid time to value, and robust security frameworks that satisfy the most demanding compliance mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Care Management Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Health Catalyst, Inc.

- IBM Corporation

- Inovalon Holdings, Inc.

- Koninklijke Philips N.V.

- McKesson Corporation

- Oracle Cerner Corporation

- Teladoc Health, Inc.

- UnitedHealth Group Incorporated

Empowering care management leaders with actionable strategies to future-proof platforms and accelerate value realization

Industry leaders must prioritize adaptability by architecting platforms that can evolve alongside regulatory shifts and technological breakthroughs. To achieve this, organizations should champion modular solution designs that allow incremental feature adoption without disrupting core workflows. Equally important is the establishment of cross-functional teams that integrate clinical, technical, and operational expertise to guide deployment and measure impact.

Second, fostering strategic partnerships with telehealth and device manufacturers can accelerate innovation. By collaborating on joint pilots, stakeholders can validate use cases and refine integration blueprints. This approach not only accelerates time to market but also drives user adoption by delivering cohesive end-to-end experiences.

Third, leaders should invest in data governance frameworks that ensure the ethical use of patient information while enabling advanced analytics. Effective data stewardship, underpinned by clear policies and robust encryption, will build trust with patients and regulators alike, unlocking the full potential of descriptive and predictive insights.

Finally, organizations should adopt outcome-based contracting models that align financial incentives with quality metrics and patient satisfaction. By sharing risk and reward with solution providers, stakeholders can drive continuous improvement and ensure that care management initiatives deliver measurable clinical and financial returns.

Detailing a rigorous mixed-method research framework that consolidates executive perspectives, policy analysis, and data triangulation

The research methodology underlying this report combines both qualitative and quantitative tactics to ensure a comprehensive and balanced perspective. Primary data was gathered through in-depth interviews with senior executives across payers, providers, and employer groups, supplemented by workshops with clinical and IT leaders to validate emerging best practices. This engagement facilitated the identification of pressing challenges related to interoperability, patient engagement, and risk stratification.

Secondary research efforts included a thorough review of publicly available financial reports, regulatory filings, and policy whitepapers, complemented by an examination of peer-reviewed academic literature focused on digital health innovation. This triangulation of data sources provided a robust foundation for mapping technology roadmaps and investment priorities.

To refine our insights, we conducted a rigorous data normalization process, reconciling discrepancies between reported performance metrics and anecdotal feedback. The final analysis integrated scenario modeling to stress-test the impact of external factors such as tariff fluctuations and regional regulatory changes. Throughout the research lifecycle, stringent validation protocols were applied to ensure consistency, eliminating any anomalies and reinforcing the credibility of the conclusions presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Care Management Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Care Management Solutions Market, by Component

- Care Management Solutions Market, by Deployment Mode

- Care Management Solutions Market, by End User

- Care Management Solutions Market, by Application

- Care Management Solutions Market, by Region

- Care Management Solutions Market, by Group

- Care Management Solutions Market, by Country

- United States Care Management Solutions Market

- China Care Management Solutions Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the critical convergence of technology, policy, and strategy that will define the future of care management solutions

As care management solutions continue to evolve, the imperative for agile, data-driven platforms has never been greater. The convergence of advanced analytics, cloud-native architectures, and patient engagement capabilities is charting a new era of proactive, value-based care. Organizations that invest in modular solutions and robust data governance will be best positioned to meet rising expectations while navigating cost pressures and regulatory complexities.

Looking ahead, the interplay between regional policy environments, emerging tariff landscapes, and technological innovation will shape strategic decision-making. Stakeholders must remain vigilant, fostering partnerships that bridge clinical and technical domains, and adopting contracting models that align incentives across the ecosystem. By doing so, they can unlock sustainable improvements in health outcomes and operational efficiencies, ensuring that care management solutions deliver tangible impact for patients and providers alike.

Unlock transformative competitive advantage by acquiring the definitive care management solutions market research report with expert guidance

If you are ready to deepen your understanding of care management solutions and gain a competitive edge through data-driven insights and strategic guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive report. This authoritative analysis will empower your organization with the clarity to navigate evolving challenges, capitalize on emerging opportunities, and make informed decisions in real time. By partnering with Ketan Rohom, you will benefit from personalized support and expert recommendations tailored to your unique objectives. Act now to ensure you have the critical intelligence necessary to accelerate innovation, optimize operational efficiency, and drive sustainable growth within the care management landscape. Your pathway to transformative insights begins with a conversation-contact Ketan Rohom today to purchase your market research report and position your enterprise for success in an increasingly complex healthcare environment

- How big is the Care Management Solutions Market?

- What is the Care Management Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?