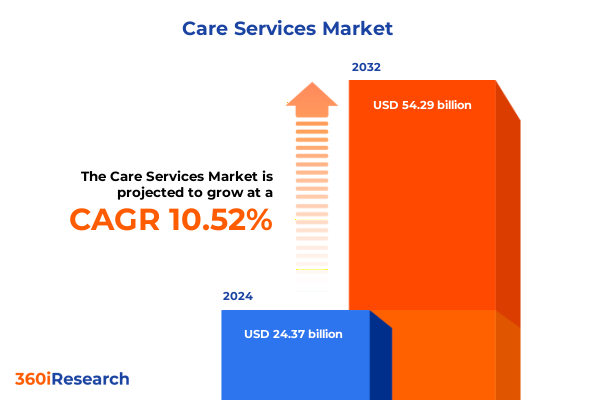

The Care Services Market size was estimated at USD 26.92 billion in 2025 and expected to reach USD 29.74 billion in 2026, at a CAGR of 10.53% to reach USD 54.29 billion by 2032.

Understanding the Complex Dynamics Shaping the Future of Care Services Amid Demographic, Technological, and Policy Disruptions

As the care services industry strides into a new era, stakeholders face a convergence of demographic, technological, and regulatory forces reshaping every facet of service delivery. The population aged 65 and older rose to 61.2 million in 2024, marking a 3.1% increase from 2023 and underscoring an urgent need for adaptive, scalable care models that can support Americans’ evolving health and wellness demands. Simultaneously, digital solutions are no longer optional enhancements but core enablers: nearly 90% of health system executives anticipate that digital technologies will accelerate in 2025, with half expecting those innovations to substantially influence operations and patient experiences. Added to these dynamics are significant policy shifts, including increased import duties on medical devices and supplies, which threaten to disrupt supply chains and amplify cost pressures across care settings.

Against this backdrop of rising demand, digital acceleration, and regulatory uncertainty, industry leaders must navigate an intricate web of challenges while capitalizing on emerging opportunities. Providers and payers alike are rethinking traditional paradigms, from in-home and residential care to advanced therapy services and hospice models. With tariffs potentially adding up to 50% on critical items such as syringes, semiconductors, and medical gloves, the imperative to build resilient domestic sourcing strategies and optimize operational agility has never been clearer. This introduction sets the stage for an in-depth exploration of market shifts, segmentation strategies, regional dynamics, and practical recommendations to guide executives and decision-makers in forging a path forward.

Identifying the Pivotal Transformations Revolutionizing Care Delivery Through Digital Innovation, Value-Based Models, and Home-Based Solutions

The care services landscape is undergoing pivotal transformations that extend far beyond incremental improvements, driven by technological breakthroughs, consumer expectations, and new care models. Digital innovation sits at the forefront of this evolution, with 70% of global health care respondents planning to invest heavily in platforms for digital tools and services, while 60% are prioritizing foundational systems such as electronic medical records and enterprise resource planning software. Organizations that remove manual workflows in favor of automated, data-driven solutions will not only enhance operational efficiency but also unlock new avenues for clinical excellence. In parallel, artificial intelligence and remote monitoring technologies are increasingly enabling predictive intervention and personalized care delivery in home settings, reducing emergent readmissions and fostering continuity of care through smart sensors, wearable devices, and AI-powered dashboards.

Equally transformative is the transition toward home-based care. By 2025, McKinsey estimates that up to $265 billion of services will shift from institutional to in-home settings, reflecting patients’ desire for convenience, safety, and cost-effective management of chronic conditions. This shift compels providers to build integrated networks that span virtual, in-home, and specialized residential facilities, ensuring seamless coordination across care episodes. Moreover, value-based care models are gaining traction, incentivizing providers to focus on outcomes and total cost of care rather than episodic interventions. At the same time, regulatory changes and pricing reforms are prompting manufacturers and service providers to explore direct-to-consumer partnerships and alternative distribution channels, as evidenced by pharmaceutical discussions to sell medications directly to patients to mitigate margin compression.

Together, these transformative shifts signal a new chapter in care services where digital literacy, patient empowerment, and integrated care pathways converge to redefine quality, efficiency, and access.

Assessing the Comprehensive Impact of 2025 U.S. Tariff Measures on Care Service Supply Chains, Costs, and Patient Access Across the Industry

The United States’ 2025 tariff measures have introduced a new layer of complexity to care service supply chains, exerting pressure on costs, delivery timelines, and ultimately, patient access. A fact sheet from a leading health association highlights that medical supply expenses represent over 10% of an average hospital’s budget, with tariffs on Chinese-made semiconductors, syringes, and needles set to escalate from 25% to 50%, while duties on batteries, medical gloves, and other critical minerals rise to 25%. These adjustments are reverberating through procurement functions, with essential items such as sterile IV bags, blood pressure monitors, personal protective equipment, and emergency ventilators already flagged in shortage trackers, delaying life-saving care and stretching clinical resources thin.

Furthermore, major device manufacturers are bracing for substantial revenue impacts. For instance, GE Healthcare has signaled an expected $500 million hit to 2025 revenues due to reciprocal tariffs, adjusting its full-year guidance to account for $375 million of imposed duties on bilateral China tariffs alone. The ripple effects extend beyond manufacturers to payers and patients alike. Surveys indicate that 95% of payers anticipate double-digit cost inflation in drugs and devices, a trend that is already influencing premium filings. Notably, UnitedHealthcare of Oregon attributed nearly 3% of its 19.8% small group premium increase to tariff uncertainty, while other insurers project mid-single-digit premium adjustments directly linked to rising import costs.

As U.S. and EU trade negotiations hint at potential 15% tariffs on European imports including medical devices, providers and manufacturers must shore up contingency plans, diversify sourcing strategies, and engage in policy advocacy to mitigate ongoing and future trade disruptions. The cumulative impact of these tariff measures underscores the urgency for care service stakeholders to build supply chain resilience, protect margins, and safeguard patient care continuity.

Unveiling Critical Segmentation Insights to Strategically Navigate Diverse Care Service Offerings, End Users, Delivery Modes, Settings, and Reimbursement Dynamics

A nuanced understanding of market segmentation is essential for tailoring services and interventions that align with patient needs, operational realities, and reimbursement frameworks. Based on service type, the care services market encompasses assisted living, home healthcare, hospice, skilled nursing, and therapy offerings. Within assisted living, independent living, memory care, and respite care each address distinct acuity and support requirements, while home healthcare extends across personal care, skilled nursing care, social work services, and therapy modalities. Therapy services themselves subdivide into exercise therapy and manual therapy, and further into occupational therapy, physical therapy, and speech therapy, with specialized subdisciplines such as activities of daily living training, assistive technology, articulation therapy, and language intervention enhancing personalization.

Delivery mode segmentation differentiates between in-person and remote care, where in-person approaches include both group services and individual sessions, and remote interactions leverage telephone and video conferencing to maintain connectivity across distances. End users are categorized by age groups-adults (18 to 44 and 45 to 64), pediatric populations (0 to 12 and 13 to 17), and seniors (65 to 74, 75 to 84, and 85 and above)-requiring tailored engagement strategies, clinical pathways, and outcome measures. Settings range from acute care hospitals and long-term acute care facilities to in-home environments and residential facilities such as assisted living complexes, group homes, and nursing homes. Equally important is payer type segmentation, which spans out-of-pocket payments, private insurance comprised of commercial and long-term care plans, and public insurance including Medicaid, Medicare, and military health care, each with distinct reimbursement rules, coverage priorities, and authorization protocols.

Leveraging this multifaceted segmentation framework enables organizations to refine service design, optimize resource allocation, and develop targeted value propositions that resonate with specific patient cohorts and payer requirements.

This comprehensive research report categorizes the Care Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Mode

- End User Age Group

- Setting

- Payer Type

Exploring Regional Care Service Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Market Entry and Growth Strategies

Regional market dynamics play a decisive role in shaping care service strategies, with unique regulatory environments, demographic trends, and infrastructure capabilities influencing growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust reimbursement frameworks and high telehealth adoption rates have accelerated the integration of virtual care, home health, and alternative site models, particularly in the United States and Canada, where policy adjustments during the pandemic laid the groundwork for sustained remote service delivery. Conversely, Latin American markets are witnessing rising demand for basic home healthcare and community-based services, driven by urbanization and nascent private insurance sectors.

Within Europe Middle East & Africa, regulatory harmonization efforts such as the European Union’s Medical Device Regulation have heightened quality standards and spurred cross-border collaborations, while national systems vary widely in their reliance on public insurance schemes. The Middle East is investing heavily in health infrastructure modernization, creating opportunities for integrated care networks and digital health platforms. Africa’s health systems, though challenged by resource constraints, are embracing mobile health initiatives and telemedicine to extend care reach.

Asia-Pacific represents a heterogeneous landscape characterized by rapid aging in Japan and Australia, where seniors already represent a significant share of the population, and by growth in emerging markets like China, India, and Southeast Asia, where expanding middle classes, rising chronic disease prevalence, and governmental health reforms are fueling demand for home-based and assisted care. Governments across the region are incentivizing private sector partnerships and digital health adoption, making it imperative for providers to tailor service models to local reimbursement structures and cultural expectations.

This comprehensive research report examines key regions that drive the evolution of the Care Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Leveraging Innovation, Strategic Partnerships, and Operational Excellence to Thrive in the Evolving Care Services Landscape

A diverse roster of industry players is driving innovation, scale, and consolidation across the care services ecosystem. Leading home health and hospice providers such as Amedisys and LHC Group have leveraged technology investments to streamline care coordination, while Brookdale Senior Living has expanded its portfolio of memory care and assisted living communities through strategic acquisitions. On the medical device front, firms like GE Healthcare and Medtronic are adapting to trade disruptions by securing long-term supply contracts and increasing domestic manufacturing capacity to mitigate tariff volatility. Startups and digital health companies, including Teladoc and Amwell, continue to disrupt traditional care channels with direct-to-consumer telehealth platforms that cater to both primary care and specialized therapy services.

Pharmaceutical and biotech companies are responding to price reform pressures by exploring alternative distribution strategies. For example, discussions to enable direct patient access to medications aim to streamline supply chains and reduce intermediary costs. Meanwhile, integrated care networks formed through partnerships between payers and providers are advancing value-based reimbursement models, aligning financial incentives with patient outcomes. The competitive landscape also includes private equity and venture capital investors who are fueling growth through targeted capital infusions into niche providers, digital therapeutics, and consumer-centric service models. Across segments, organizations that combine operational excellence, regulatory acumen, and customer-centric innovation are poised to capture market share and set new care standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Care Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alere in Home Care, LLC

- BAYADA Home Health Care Inc.

- CareSide

- Carewell-Service Co., Ltd.

- Christies Care Ltd.

- ECON Healthcare Group

- Fresenius SE & Co. KGaA

- Genesis HealthCare LLC

- Home Instead, Inc. by Honor Technology, Inc.

- LHC Group, Inc. by UnitedHealth Group

- LifePoint Health, Inc.

- National Healthcare Corporation

- NTUC Health Co-operative Ltd.

- Pacific Healthcare Nursing Homes

- Regal Health Pty Ltd.

- Roche Healthcare Limited

- Safehands Live In Care Ltd.

- Senocare Services Pvt. Ltd.

- Sonida Senior Living Corporation

- St Luke’s ElderCare Ltd.

- Sunrise Senior Living, LLC

- Vital Home Health Services.

Formulating Actionable Strategies for Industry Leaders to Enhance Resilience, Optimize Service Delivery, and Capitalize on Emerging Opportunities in Care Services

To navigate the complexities of the care services market and position for sustained success, industry leaders should adopt a suite of actionable strategies. First, diversifying supply chains by engaging multiple domestic and near-shore suppliers can reduce exposure to tariff fluctuations and logistical delays, mirroring the long-term contracts and domestic sourcing strategies employed by top hospital operators. Second, embedding digital transformation across clinical and administrative functions-through investments in electronic health records, AI-driven analytics, and telehealth platforms-will streamline workflows, enhance patient engagement, and improve clinical decision-making.

Third, expanding home-based care portfolios and hybrid service models allows organizations to meet evolving patient preferences for convenience and safety, while capitalizing on the projected $265 billion shift to in-home services by 2025. Fourth, forging partnerships with payers to pilot value-based reimbursement arrangements can incentivize quality improvement and cost containment, aligning provider incentives with long-term health outcomes. Fifth, building advocacy coalitions with trade associations and policy makers to seek tariff exemptions for critical medical supplies will help stabilize input costs and protect patient access. Lastly, prioritizing workforce development-through flexible staffing models, upskilling programs, and remote training capabilities-will address chronic labor shortages and enhance organizational resilience in an increasingly competitive talent landscape.

Detailing a Robust Research Methodology Incorporating Primary Expert Interviews, Surveys, and Data Analysis to Ensure Comprehensive Market Insights

This market research draws upon a rigorous methodology designed to ensure the accuracy, relevance, and comprehensiveness of its insights. Primary research components include in-depth interviews with senior executives, clinical directors, and supply chain leaders across provider organizations, payers, and device manufacturers. These interviews were complemented by surveys capturing operational metrics, strategic priorities, and investment plans from over 200 respondents spanning care delivery, therapy services, and medical technology sectors. Secondary research sources encompass an exhaustive review of government publications from the U.S. Census Bureau, Congressional Budget Office, and health care agencies; trade association reports; peer-reviewed journals; and regulatory filings.

Data triangulation techniques were employed to validate findings, cross-referencing quantitative data with qualitative perspectives to identify converging trends and potential market inflection points. A structured framework guided the analysis of segmentation, regional dynamics, and competitive landscapes, ensuring consistency in definitions and metrics. Quality assurance measures, including senior analyst peer reviews and stakeholder validation workshops, were integrated throughout the research process to minimize bias and address data gaps. The resultant insights reflect a balanced synthesis of empirical data and expert judgment, equipping decision-makers with actionable intelligence to navigate the evolving care services environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Care Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Care Services Market, by Service Type

- Care Services Market, by Delivery Mode

- Care Services Market, by End User Age Group

- Care Services Market, by Setting

- Care Services Market, by Payer Type

- Care Services Market, by Region

- Care Services Market, by Group

- Care Services Market, by Country

- United States Care Services Market

- China Care Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Concluding Insights on the Future Trajectory of Care Services Highlighting Strategic Imperatives for Sustainable Growth and Competitive Advantage

As the care services industry adapts to demographic shifts, technological breakthroughs, and policy reforms, a clear set of strategic imperatives emerges. Stakeholders must embrace digital transformation not as an adjunct but as a foundational element of care delivery, harnessing AI, remote monitoring, and integrated platforms to enhance patient outcomes and operational efficiency. The strategic pivot toward home-based care and value-based reimbursement models underscores the necessity of building flexible service networks capable of delivering personalized, outcome-focused interventions. At the same time, organizations must shore up supply chain resilience in the face of evolving tariff landscapes by diversifying sourcing strategies and engaging in proactive policy advocacy.

Segmented market approaches enable more precise alignment of services with patient cohorts, payer requirements, and care settings, while regional insights highlight the importance of tailoring entry and growth strategies to local regulatory and cultural contexts. Innovative companies that successfully navigate these dynamics combine strategic partnerships, operational rigor, and customer-centric solutions. By implementing the actionable recommendations outlined herein-ranging from workforce development initiatives to value-based collaboration frameworks-industry leaders can secure a competitive edge and drive sustainable growth. Ultimately, the future trajectory of care services will favor organizations that deliver on the promise of accessible, high-quality, and cost-effective care.

Take the Next Step: Connect with Associate Director Ketan Rohom to Acquire the Full Market Research Report on Care Services Trends and Strategies

Unlock an exclusive opportunity to deepen your strategic foresight and drive transformative growth in care services by securing the comprehensive market research report. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore customized insights, discuss our tailored solutions, and receive a seamless purchasing experience. Partner with an experienced guide to translate actionable intelligence into strategic initiatives that empower your organization to anticipate shifts, mitigate risks, and outperform in an evolving care services landscape.

- How big is the Care Services Market?

- What is the Care Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?