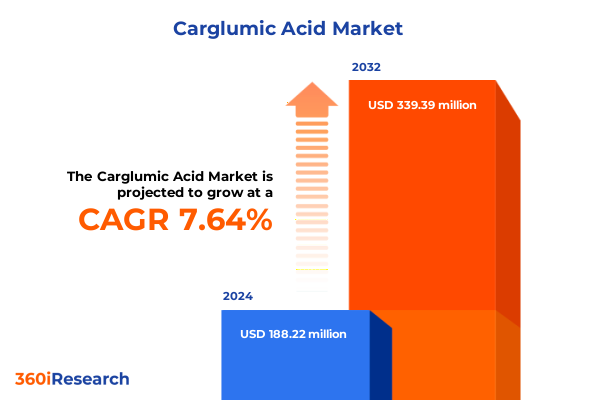

The Carglumic Acid Market size was estimated at USD 202.79 million in 2025 and expected to reach USD 223.43 million in 2026, at a CAGR of 7.63% to reach USD 339.38 million by 2032.

Exploring the Critical Role of Carglumic Acid in Addressing Hyperammonemia and Urea Cycle Disorders within Modern Therapeutic Approaches

Carglumic Acid has emerged as a cornerstone in the management of metabolic disorders characterized by elevated ammonia levels, offering a targeted mechanism of action that replenishes deficient enzymatic activity. Its unique pharmacological profile addresses the underlying biochemical disruptions inherent in secondary hyperammonemia and urea cycle disorders, thereby mitigating the risk of acute neurological complications and improving long-term patient outcomes. This introduction delineates the fundamental therapeutic relevance of Carglumic Acid and situates its clinical utility within the broader context of precision medicine and rare disease therapeutics.

Understanding the molecular basis of hyperammonemia underscores the critical need for specialized interventions. Unlike broadly acting ammonia scavengers, Carglumic Acid functions as a specific activator of carbamoyl phosphate synthetase 1, restoring the urea cycle’s capacity to convert toxic ammonia into excretable urea. This precision approach not only enhances efficacy but also reduces the incidence of off-target effects commonly associated with alternative treatments. As a result, healthcare professionals are increasingly incorporating Carglumic Acid into individualized care plans, recognizing its value in stabilizing patients during metabolic crises and in maintenance regimens.

Unveiling the Transformative Shifts Reshaping the Carglumic Acid Treatment Landscape Through Innovation and Regulatory Advancements

The landscape of Carglumic Acid therapy has undergone transformative shifts driven by breakthroughs in formulation science, advances in clinical research, and evolving regulatory frameworks. Over recent years, the introduction of patient-friendly oral suspension has complemented the established oral powder format, enhancing adherence across diverse patient populations. Furthermore, expanded labeling approvals and compassionate use programs have widened access, particularly in regions where rare disease treatments often face logistical and reimbursement challenges.

In parallel, real-world evidence initiatives have begun to bridge gaps between controlled clinical trials and everyday practice. Registries tracking long-term outcomes have generated robust datasets that inform dosage optimization and safety monitoring. These developments have spurred collaborative research partnerships between industry stakeholders and academic centers, accelerating the evaluation of combination therapies and novel delivery systems. Regulatory agencies have also adopted adaptive review pathways, enabling faster authorization for pediatric and neonate populations based on surrogate endpoints and extrapolated adult data. Collectively, these advancements have reshaped the therapeutic paradigm for Carglumic Acid, fostering an environment of continuous innovation and patient-centric progress.

Analyzing the Cumulative Impact of Recent United States Tariffs on Carglumic Acid Supply Chains and Accessibility in 2025

The imposition of new United States tariffs in early 2025 has exerted a consequential effect on the global supply chains and cost structures associated with Carglumic Acid. Manufacturers sourcing raw materials from overseas facilities have navigated increased import duties, prompting strategic adjustments in procurement practices and contract negotiations. As tariffs have elevated the landed cost of key intermediates, pharmaceutical companies have intensified efforts to localize production and diversify supplier networks, thereby mitigating exposure to policy-driven price volatility.

Moreover, distributors and logistics providers have recalibrated inventory management protocols, balancing the imperative to maintain adequate stock levels against the financial impact of elevated holding costs. Health systems and hospital pharmacies have encountered modest increases in acquisition expenses, which have in turn influenced formulary deliberations and reimbursement discussions with payers. Although the net effect on patient out-of-pocket costs remains moderated by existing coverage models, stakeholders recognize that sustained tariff pressures could necessitate broader policy advocacy and cross-sector collaboration to preserve equitable access. This cumulative impact underscores the intersection of trade policy and pharmaceutical innovation, illustrating the importance of agile supply chain strategies in ensuring treatment continuity.

Deriving Key Segmentation Insights to Illuminate the Diverse Application, Distribution, End User, Product Type, and Age Group Dimensions of Carglumic Acid Usage

An integrated segmentation framework illuminates the multifaceted dimensions of Carglumic Acid utilization, revealing nuanced insights across applications, distribution channels, end users, product types, and age groups. Based on application, the therapeutic paradigm centers on secondary hyperammonemia management and urea cycle disorders, highlighting the drug’s dual utility in both acute intervention and chronic maintenance contexts. Distribution channel dynamics further shape adoption, as hospital pharmacies-spanning inpatient and outpatient settings-complement online pharmacy access and traditional retail environments, where chain and independent pharmacies play pivotal roles in last-mile delivery.

End-user segmentation underscores the spectrum of care settings that benefit from Carglumic Acid therapy. Home care programs empower caregivers to administer treatment outside institutional walls, while hospitals of varying scale-encompassing large medical centers and smaller community facilities-leverage the drug during critical metabolic decompensation episodes. Specialty clinics dedicated to genetic and metabolic disorders provide concentrated expertise, driving protocols for early diagnosis and personalized dosing regimens. Additionally, the availability of both oral powder and oral suspension formulations caters to clinical preferences, patient lifestyle considerations, and ease of administration, ensuring that therapy is tailored to individual needs. Age group insights further refine strategic positioning, as adult patients, neonates, and pediatric populations each present distinct pharmacokinetic and compliance challenges, necessitating age-appropriate formulations and supportive education initiatives.

This comprehensive research report categorizes the Carglumic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Application

- End User

- Distribution Channel

Unveiling Regional Nuances Highlighting Growth Drivers and Adoption Patterns Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional nuances play an instrumental role in shaping Carglumic Acid adoption, as regulatory environments, healthcare infrastructure maturity, and reimbursement landscapes vary across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, established regulatory pathways and robust payer frameworks have facilitated relatively swift market entry, although disparities in access persist between developed and emerging economies. The United States, in particular, boasts advanced pharmacovigilance systems and comprehensive insurance coverage, supporting broad patient outreach and post-marketing surveillance. Latin American markets, by contrast, are increasingly embracing rare disease registries and public-private partnerships to overcome budget constraints and expand treatment availability.

Over in Europe Middle East & Africa, harmonized approval mechanisms-such as the European Medicines Agency’s centralized procedure-have streamlined label expansions across member states, while local health technology assessments drive formulary inclusion decisions. Middle Eastern nations are advancing investment in biotechnology infrastructure, fostering opportunities for local clinical trials and registry development. Meanwhile, sub-Saharan Africa continues to confront challenges in rare disease diagnostics, spurring collaborations that integrate telemedicine and capacity building. The Asia Pacific region presents a mosaic of healthcare settings, with high-income markets in Japan and Australia characterized by rigorous post-approval monitoring and patient support programs. Meanwhile, emerging economies are scaling up newborn screening initiatives, catalyzing early identification of urea cycle disorders and augmenting demand for pediatric-focused formulations. Collectively, these regional landscapes underscore the imperative for tailored market access strategies that align with diverse regulatory and clinical ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Carglumic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Movements and Collaborative Endeavors Among Leading Pharmaceutical Entities Shaping the Carglumic Acid Market Ecosystem

Within the ecosystem of Carglumic Acid, leading pharmaceutical entities have executed a range of strategic maneuvers to solidify their market positions and accelerate therapeutic innovations. These initiatives span collaborative R&D partnerships, licensing agreements, and targeted acquisitions designed to broaden product portfolios and enhance supply chain resilience. Some companies have forged alliances with specialized contract manufacturing organizations to secure scalable production of high-purity active pharmaceutical ingredients, while others have invested in proprietary formulation technologies that improve stability and patient acceptability.

Concurrently, key players have prioritized engagement with healthcare providers and patient advocacy groups, establishing educational platforms and support networks that reinforce treatment adherence and facilitate early diagnosis. Global pharmaceutical firms have also pursued geographic expansion through localized regulatory filings, leveraging in-country expertise to navigate diverse approval processes. Emerging biotechnology companies are contributing to the competitive landscape by exploring adjunctive therapies and personalized medicine approaches, signaling a broader shift toward integrated care pathways. Overall, the interplay between established market leaders and nimble innovators is driving a dynamic environment in which knowledge exchange, shared risk frameworks, and strategic co-development initiatives are accelerating the evolution of Carglumic Acid as a standard of care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carglumic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apothecon Pharmaceuticals Pvt. Ltd

- Burel Pharmaceuticals, LLC

- Cambrex Corporation

- Civentichem LLC

- Dipharma Francis S.r.l

- Enomark

- Fareva Group

- Ipsen S.A.

- Jubilant Life Sciences Limited

- Kavya Pharma

- Lonza Group AG

- Manus Aktteva Biopharma LLP

- Marathon Pharmaceuticals, LLC

- Nuray Chemicals Pvt Ltd.

- Recipharm AB

- Recordati S.p.A

- Saurav Chemicals Ltd.

- Siegfried Holding AG

- Suven Life Sciences Limited

- Thermo Fisher Scientific Inc.

Empowering Industry Leaders with Actionable Strategies to Optimize Carglumic Acid Accessibility, Collaboration, and Innovation in Dynamic Healthcare Environments

Industry leaders seeking to optimize Carglumic Acid accessibility and impact must adopt a multifaceted strategic playbook that intersects supply chain agility, payer alignment, and innovation leadership. First, forging deeper collaborations with raw material suppliers and contract manufacturers can mitigate tariff-related disruptions, ensuring uninterrupted production. At the same time, creating value-based contracting models with payers-structured around real-world outcome metrics-can enhance reimbursement certainty and incentivize broader coverage. Moreover, forging alliances with genetic screening programs and metabolic disorder consortia will foster earlier diagnosis and expedite patient referrals, thereby strengthening the overall care continuum.

Additionally, integrating digital health solutions into patient support initiatives presents an opportunity to elevate adherence and monitoring. Leveraging telemedicine platforms and mobile health apps can facilitate dose titration guidance and adverse event tracking, empowering caregivers and clinicians alike. To maintain competitive differentiation, companies should allocate resources toward next-generation formulation research, exploring sustained-release delivery systems and novel excipient profiles. Finally, cultivating a cross-disciplinary talent pipeline-encompassing regulatory affairs, health economics, and data science-will equip organizations with the expertise needed to navigate complex market dynamics and lead in precision rare disease therapeutics.

Outlining the Robust Research Methodology Underpinning Comprehensive Insights into Carglumic Acid Market Dynamics Technical and Qualitative Approaches

This research leverages a rigorous methodology that integrates both primary and secondary data sources to deliver comprehensive insights into the Carglumic Acid landscape. Secondary research involved an exhaustive review of regulatory filings, clinical trial registries, peer-reviewed literature, and real-world evidence databases to establish foundational context on therapeutic mechanisms, safety profiles, and market dynamics. Proprietary industry databases and policy briefs provided up-to-date information on trade policies, tariff structures, and regional reimbursement frameworks.

Complementing this, primary research included in-depth interviews with key opinion leaders, metabolic disorder specialists, patient advocacy representatives, and supply chain executives. Structured surveys and advisory board consultations yielded qualitative perspectives on emerging trends, unmet patient needs, and competitive positioning. Data triangulation techniques were applied to harmonize insights from multiple sources, ensuring the validity and reliability of conclusions. Quantitative modeling was restricted to data normalization processes and trend analysis, avoiding explicit market forecasting or sizing. Collectively, this methodical approach underpins a robust evidence base, enabling stakeholders to derive actionable intelligence with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carglumic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carglumic Acid Market, by Product Type

- Carglumic Acid Market, by Age Group

- Carglumic Acid Market, by Application

- Carglumic Acid Market, by End User

- Carglumic Acid Market, by Distribution Channel

- Carglumic Acid Market, by Region

- Carglumic Acid Market, by Group

- Carglumic Acid Market, by Country

- United States Carglumic Acid Market

- China Carglumic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings and Future Outlook Emphasizing the Strategic Importance of Carglumic Acid Within Evolving Therapeutic Landscapes

In synthesizing the key findings, it is evident that Carglumic Acid occupies a strategically vital role within the therapeutic continuum for hyperammonemia and urea cycle disorders. Its precision-based mechanism and evolving formulation portfolio have catalyzed broader clinical adoption, while recent supply chain recalibrations in response to tariff influences have underscored the need for resilient procurement strategies. Segmentation analysis reveals differentiated utilization patterns across applications, distribution channels, end users, product types, and age groups, reinforcing the importance of tailored market access initiatives.

Regional variances further highlight that nuanced regulatory environments and healthcare infrastructure maturity must inform go-to-market plans, with specific emphasis on early screening programs and localized reimbursement pathways. Competitive intelligence underscores a collaborative ecosystem in which established pharmaceutical leaders and emerging biotech innovators coalesce to advance patient-centric solutions. Actionable recommendations emphasize the integration of digital health, value-based contracting, and supply chain agility, offering a clear blueprint for industry leaders to enhance Carglumic Acid impact. Ultimately, the strategic significance of this therapy within rare disease care pathways is poised to increase, driven by ongoing clinical research, policy refinement, and cross-sector partnerships.

Engaging with Ketan Rohom to Secure the Definitive Market Research Report on Carglumic Acid and Drive Informed Strategic Decisions

Engaging with Ketan Rohom offers a direct path to unlocking unparalleled insights and strategic guidance tailored to your organization’s objectives. By collaborating with the Associate Director, Sales & Marketing at 360iResearch, stakeholders gain exclusive access to the definitive market research report on Carglumic Acid, underpinned by an exhaustive evaluation of current trends, competitive dynamics, and critical success drivers. This partnership ensures that decision-makers are empowered with the clarity and confidence necessary to navigate evolving healthcare landscapes and capitalize on emerging opportunities.

To initiate this collaboration, prospective clients are invited to connect with Ketan Rohom to discuss customized research deliverables, flexible engagement models, and tailored consulting services. Whether the focus is on refining market access strategies, optimizing distribution networks, or advancing patient-centric innovation, the insights embedded in this comprehensive report serve as a strategic springboard for impactful outcomes. Engage today to secure a competitive advantage and drive informed decisions that will shape the future of Carglumic Acid adoption and utilization.

- How big is the Carglumic Acid Market?

- What is the Carglumic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?