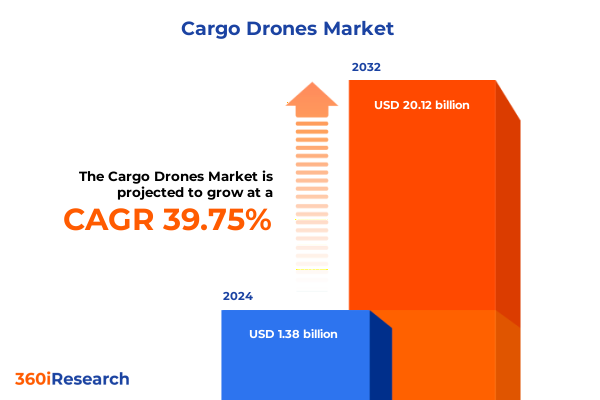

The Cargo Drones Market size was estimated at USD 1.92 billion in 2025 and expected to reach USD 2.58 billion in 2026, at a CAGR of 39.84% to reach USD 20.12 billion by 2032.

Revolutionizing Global Logistics with Autonomous Cargo Drones through Technological Innovation and Seamless Operational Transformation

Cargo drone technology is rapidly emerging as a transformative force in global logistics, offering an unprecedented combination of speed, efficiency, and access to remote or congested areas. Leveraging advancements in autonomous navigation, lightweight materials, and energy-dense power systems, these unmanned aerial vehicles are poised to reshape traditional supply chains, reducing delivery times and operational costs. As e-commerce demand continues its upward trajectory, cargo drones present a compelling solution for last-mile delivery challenges, particularly in regions where infrastructure investments have lagged behind consumer expectations.

Moreover, the convergence of digital technologies-artificial intelligence for route optimization, real-time telemetry for predictive maintenance, and cloud-based fleet management platforms-has accelerated the readiness of cargo drones for commercial deployment. Stakeholders across logistics, healthcare, retail, and defense sectors are conducting pilot programs to validate use cases ranging from urgent medical supply drops to automated parcel distribution in urban microhubs. This Executive Summary introduces key market drivers, regulatory landscapes, technological breakthroughs, and competitive dynamics, providing decision-makers with a foundational understanding of the cargo drone ecosystem.

Emergence of New Operational Paradigms as Cargo Drones Redefine Last Mile Delivery Supply Chain Efficiency and Environmental Sustainability

The cargo drone landscape has undergone profound shifts driven by breakthroughs in battery technology and propulsion systems. High-capacity lithium–sulfur and solid-state batteries have extended flight endurance, enabling long-range missions that were previously unfeasible. Concurrently, hybrid propulsion architectures combining electric motors with micro turbine generators have enhanced payload capabilities and reduced dependence on refueling infrastructure, democratizing cargo drone operations across industries.

Regulatory environments have also adapted, with aviation authorities in several jurisdictions introducing performance-based standards and beyond-visual-line-of-sight waivers. These policy evolutions have unlocked new corridors for drone corridors over agricultural zones, mining sites, and urban rooftops, catalyzing investments in dedicated vertiport networks and automated charging stations. Furthermore, the integration of advanced collision-avoidance sensors and secure communication protocols has elevated safety standards, driving broader acceptance among insurers and end users. Together, these technological and regulatory dynamics are redefining service models, enabling operators to transition from experimental trials to scalable commercial deployments.

Assessing the Broad Spectrum Effects of 2025 U.S. Trade Tariffs on Cargo Drone Manufacturing Ecosystems and Supply Chain Resilience

Since July 2025, the U.S. Commerce Department has launched national security investigations under Section 232 targeting imported drones and critical components, including polysilicon used in solar and semiconductor applications. These probes could result in increased tariffs of up to 25 percent on drones and sensors deemed a security risk, reflecting broader efforts to safeguard domestic industries and counter reliance on foreign suppliers. Stakeholders anticipate that such measures will raise the cost of imported drone platforms, compelling operators to reassess procurement strategies and accelerate investments in U.S.-based manufacturing facilities.

Parallel legislative initiatives have focused on mitigating perceived risks associated with Chinese drone manufacturers. Lawmakers have proposed bans on drones lacking verifiable supply chains, citing concerns over data security and forced labor allegations tied to certain regions of origin. These potential restrictions jeopardize the market access of established global brands and heighten supply chain uncertainty. At the same time, executive orders aim to bolster domestic production through federal grants and “Buy American” provisions, prompting industry leaders to forge public–private partnerships and reconfigure sourcing networks in response to evolving trade policies.

The cumulative impact of U.S. tariffs and trade restrictions is expected to introduce inflationary pressures across the cargo drone ecosystem. Rising input costs for aluminum, carbon fiber composites, and advanced electronics may compress OEM margins or shift expenses onto end users. Consequently, companies are evaluating vertical integration, nearshoring strategies, and collaborative consortia to secure critical components while maintaining competitive pricing and compliance with national security mandates.

Uncovering Critical Insights into Cargo Drone Market Segmentation by Drone Type Payload Capacity Range Application Power Source and End User

Analyzing the cargo drone market by drone type reveals a spectrum of aerodynamic designs tailored to specific mission profiles, from fixed-wing platforms with blended wing bodies optimized for endurance to multi-rotor systems such as hexacopters designed for precise urban parcel delivery. Hybrid configurations bridge the gap between straight-wing endurance and vertical takeoff flexibility, utilizing tilt-rotor and tilt-wing mechanisms to balance payload capacity with operational versatility. Within multi-rotor categories, quadcopters offer cost-effective, lightweight solutions, while octocopters and tricopters drive expanded redundancy for critical applications.

Evaluating payload capacity segments underscores distinct use-case alignments: sub-two-kilogram systems excel in rapid document or lab-sample delivery, whereas five-to-ten-kilogram drones enable robust e-commerce and industrial logistics tasks. Platforms above ten kilograms address middle-mile transport, supporting bulk medical supply distribution or remote infrastructure resupply. Range classifications further refine these deployments, with short-range models serving constrained urban corridors and medium-range drones linking dispersed microhub networks. Long-range variants deliver across rural or intercity routes where ground access is limited.

Application-based analysis illustrates that e-commerce delivery providers leverage drones for same-day parcel dispatch, while food delivery services integrate autonomous vehicles to satisfy consumer demand for rapid, contactless meals. Industrial logistics operators deploy drones for inventory replenishment across mining and construction sites, and healthcare organizations coordinate medical supply transport to remote clinics. Postal services in various regions are piloting autonomous networks to enhance last-mile efficiency.

Power source segmentation shows a strong preference for battery electric architectures, supplemented by fuel cell drones delivering extended endurance for specialized missions. Hybrid electric systems combine both energy sources to optimize operational range and reduce refueling downtime. Reviewing end-user categories highlights the broad applicability of cargo drones, with agriculture benefiting from seed or pesticide distribution, e-commerce companies exploiting rapid fulfillment capabilities, government and defense agencies conducting secure logistics, healthcare providers ensuring timely delivery of critical supplies, manufacturing firms managing just-in-time replenishment, and retailers exploring in-store to home delivery models.

This comprehensive research report categorizes the Cargo Drones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drone Type

- Payload Capacity

- Range

- Power Source

- Application

- End User

Exploring Regional Market Dynamics for Cargo Drones across the Americas Europe Middle East Africa and the Asia Pacific to Identify Growth Drivers

Within the Americas, the United States has emerged as the epicenter of cargo drone commercialization, driven by robust e-commerce growth, supportive regulatory frameworks, and sizable venture capital investment. Canada complements these dynamics by enabling cross-border pilot corridors and collaborating on harmonized safety standards. Latin American nations are exploring medical supply missions to remote communities, with governments facilitating public–private partnerships to overcome infrastructure gaps and accelerate humanitarian applications.

Europe, Middle East, and Africa collectively manifest a heterogeneous market landscape. European Union member states lead with unified drone regulations under EU-UAS rules, enabling continent-wide service rollouts. The United Kingdom pursues ambitious beyond-visual-line-of-sight corridors, while Middle Eastern countries leverage vast desert expanses for long-range cargo operations and free-trade zone logistics. In Africa, NGOs collaborate with startups to deliver vaccines and emergency supplies, using solar-powered drone stations to offset energy constraints.

Asia-Pacific exemplifies intense competitive rivalry and rapid adoption. China’s domestic giants develop nationwide drone highways, often supported by provincial subsidies. India prioritizes rural connectivity, selecting drone corridors for agricultural and medical use cases, and Japan integrates drones within existing postal and logistics networks. Australia’s isolated geographies spur innovation in autonomous inspection and remote supply, with regulators granting conditional approvals for large-scale deployments. These regional nuances highlight the strategic importance of localized partnerships, regulatory engagement, and infrastructure investment to unlock market potential across diverse territories.

This comprehensive research report examines key regions that drive the evolution of the Cargo Drones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements of Leading Cargo Drone Innovators Driving Advances in Technology Partnerships and Competitive Positioning

Leading innovators in the cargo drone sphere are intensifying efforts to differentiate through proprietary technology, strategic alliances, and operational scale. Zipline continues to pioneer medical logistics, expanding its autonomous distribution centers and refining vertical-takeoff fixed-wing capabilities for faster turnaround. Wing, a subsidiary of Alphabet, focuses on urban parcel delivery, investing in quiet-rotor designs and precision landing systems to minimize noise and expand municipal approval. Amazon Prime Air has scaled its pilot programs in select urban areas, integrating custom flight paths with retail data pipelines for seamless order fulfillment.

Strategic partnerships also define the competitive landscape. UPS Flight Forward collaborates with healthcare providers for on-demand transport of lab samples, while DHL engages aerospace OEMs to co-develop modular cargo drone fleets for contract logistics. Meanwhile, emerging players such as Volansi and Manna harness VTOL platforms optimized for middle-mile transport and rapid payload swaps, appealing to industries that require versatile fleet configurations. European innovators like Wingcopter emphasize tilt-rotor efficiency and streamlined certification pathways under EASA regulations.

Collaborations extend to component and software providers. Drone analytics firms are integrating AI-driven route optimization tools with air traffic management platforms, enabling real-time airspace deconfliction. Battery specialists partner with OEMs to tailor energy solutions for specific mission profiles, advancing modular battery packs and rapid-swap mechanisms. Through these ecosystems of alliances, leading companies are reinforcing competitive moats, accelerating time-to-market, and broadening service portfolios within the evolving cargo drone marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cargo Drones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- AutoFlight Europe GmbH

- DJI Technology Co., Ltd.

- Dronamics BG Ltd.

- EHang Holdings Limited

- Elroy Air, Inc.

- Joby Aviation, Inc.

- Kaman Corporation

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin Corporation

- Matternet, Inc.

- MightyFly, Inc.

- Pyka, Inc.

- Quantum Systems GmbH

- Sabrewing Aircraft Company, Inc.

- Skyports Limited

- Textron Inc.

- The Boeing Company

- UPS Flight Forward Inc.

- Volocopter GmbH

- Wingcopter GmbH

- Zipline International Inc.

Formulating Actionable Strategies for Industry Leaders to Capitalize on Cargo Drone Technology Adoption Regulatory Trends and Competitive Challenges

Industry leaders must prioritize cultivating robust partnerships with component suppliers to mitigate supply chain risks and secure preferential access to critical materials. By forging long-term agreements with domestic battery manufacturers, composite fabricators, and avionics specialists, companies can stabilize input costs and enhance production predictability. Simultaneously, engaging in consortia with regulatory agencies enables proactive shaping of performance-based standards, expediting operational approvals and clarifying compliance pathways.

Embracing scalable infrastructure investments-such as automated vertiports, charging stations, and integrated airspace management systems-is essential to transitioning from pilot programs to commercial service offerings. Organizations should explore public–private funding models to offset capital expenses, demonstrating the societal and environmental benefits of cargo drones to municipal stakeholders. Furthermore, adopting modular fleet architectures that support mixed-drone operations will allow operators to optimize asset utilization across diverse missions and geographies.

To maintain competitive advantage, companies should invest in advanced data analytics and AI-driven predictive maintenance platforms. Leveraging real-time telemetry for dynamic route planning, anomaly detection, and energy management will reduce operational downtime and extend asset lifecycles. In addition, focusing on sustainability metrics-such as emissions reductions and life-cycle assessments-will position leaders to capture corporate and consumer preference in an increasingly environmentally conscious marketplace.

Detailing the Robust Research Methodology Underpinning Cargo Drone Market Analysis and Ensuring Comprehensive Rigorous and Transparent Insights

This analysis integrates both primary and secondary research to deliver comprehensive market insights. Primary research comprised in-depth interviews with senior executives across drone OEMs, logistics providers, regulatory bodies, and component manufacturers. These discussions provided qualitative perspectives on technology roadmaps, strategic priorities, and investment trends. In addition, expert workshops and validation sessions were convened to corroborate emerging themes and refine segmentation frameworks.

Secondary research encompassed a systematic review of industry publications, white papers, government filings, and patent databases to map technological innovations and regulatory developments. Data triangulation techniques were utilized to reconcile disparate sources and ensure accuracy, while proprietary databases supplied historical performance benchmarks and comparative company profiles. The research methodology adhered to rigorous standards of transparency, reproducibility, and ethical data handling, enabling stakeholders to trust the validity of findings and derive actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cargo Drones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cargo Drones Market, by Drone Type

- Cargo Drones Market, by Payload Capacity

- Cargo Drones Market, by Range

- Cargo Drones Market, by Power Source

- Cargo Drones Market, by Application

- Cargo Drones Market, by End User

- Cargo Drones Market, by Region

- Cargo Drones Market, by Group

- Cargo Drones Market, by Country

- United States Cargo Drones Market

- China Cargo Drones Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Implications of Cargo Drone Innovations Market Developments and Policy Shifts for Industry Stakeholders

The convergence of technological innovation, evolving regulatory landscapes, and strategic partnerships has positioned cargo drones as a pivotal solution in modern logistics. Breakthroughs in powertrains and autonomy have broadened operational envelopes, enabling reliable service delivery from dense urban centers to remote rural communities. At the same time, national security concerns and trade policies have prompted a realignment of supply chains, underscoring the importance of diversified sourcing and domestic production capabilities.

Critical segmentation across drone types, payload capacities, range profiles, applications, power sources, and end-user industries reveals nuanced market dynamics and targeted growth opportunities. Regional variations-from North America’s regulatory momentum to Asia-Pacific’s scaled pilots-highlight the need for localized strategies. Leading companies are leveraging collaborative ecosystems and technology partnerships to strengthen competitive positioning and accelerate commercialization timelines.

As the cargo drone market matures, actionable recommendations such as infrastructure investments, data-driven maintenance systems, and policy engagement will guide industry leaders in capturing value. The insights and frameworks detailed herein serve as a strategic compass for stakeholders seeking to navigate complexity, capitalize on innovation, and shape the future of aerial logistics.

Connect with Ketan Rohom for Exclusive Access to the Comprehensive Cargo Drone Market Research Report and Drive Informed Strategic Decisions

To explore the full breadth of insights, data, and strategic guidance presented in this report, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the Cargo Drone Market Research Report. Connect directly with Ketan to discuss customized licensing options, volume discounts, and enterprise solutions that align with your organizational objectives. By engaging with Ketan, you’ll gain immediate access to comprehensive analysis covering market segmentation, competitive landscapes, technology roadmaps, and regulatory frameworks. Don’t miss the opportunity to equip your leadership team with the intelligence needed to make confident, data-driven decisions in the rapidly evolving cargo drone sector. Contact Ketan today to transform insight into action and position your organization at the forefront of logistics innovation.

- How big is the Cargo Drones Market?

- What is the Cargo Drones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?