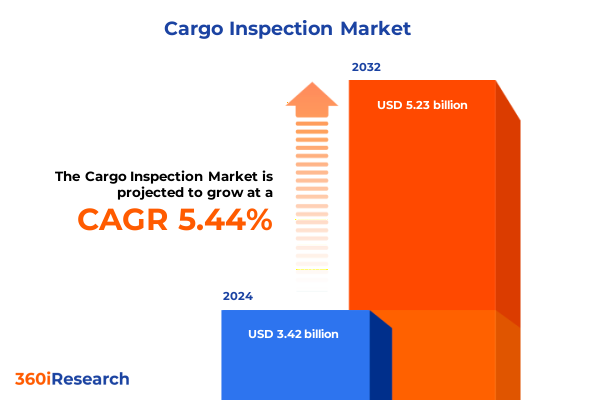

The Cargo Inspection Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 5.52% to reach USD 5.23 billion by 2032.

Setting the Stage for Cargo Inspection Market Evolution by Examining Core Drivers and Imperatives to Enhance Global Trade Security and Efficiency

The cargo inspection sector stands at a pivotal crossroads as escalating global trade volumes and evolving security imperatives converge. Digital documentation tools are reshaping traditional workflows, with electronic air waybill adoption already surpassing 75% worldwide and projected to near 90% by the end of 2025, markedly reducing handling times and human error. At the same time, artificial intelligence–powered imaging solutions are supplementing conventional X-ray and gamma-ray systems, harnessing predictive analytics to identify anomalies with unprecedented precision and accelerating cargo throughput.

Simultaneously, customs authorities are embracing AI-driven risk assessment models to predict potential compliance breaches, leading to significant reductions in manual inspections and facilitating expedited clearances. These technological advances are complemented by automated trace detection devices, which deliver analysis in mere seconds and heighten screening effectiveness at critical checkpoints. As stakeholders navigate this complex landscape, integrating these cutting-edge capabilities has become imperative to uphold security while optimizing operational efficiency across diverse trade corridors.

Examining the Transformative Shifts That Are Redefining Cargo Inspection Through AI Integration, Remote Technologies, and Regulatory Harmonization

Cargo inspection is being fundamentally reshaped by a confluence of emerging technologies and interagency collaborations. The proliferation of Internet of Things sensors embedded within containers, vehicles, and infrastructure now transmits realtime condition data-encompassing temperature, humidity, and location-to centralized analytics platforms, enabling continuous monitoring of cargo integrity at every leg of its journey. At the same time, blockchain-enabled ledgers are under exploration to create immutable audit trails for shipment documentation, reinforcing transparency and trust between shippers, carriers, and regulatory bodies.

Furthermore, remote inspection capabilities powered by drones and teleoperation interfaces are expanding the reach of security teams into hazardous or inaccessible environments, cutting both response times and personnel risk. These developments are underpinned by rapidly evolving compliance frameworks that demand agile software updates and modular system architectures to accommodate new threat signatures and regulatory directives. Together, these transformative shifts underscore the industry’s inexorable move toward integrated, data-driven security ecosystems that balance resilience, scalability, and interoperability.

Assessing the Cumulative Impact of Recent United States Tariff Measures on Cargo Inspection Operations, Port Throughput, and Compliance Workflows in 2025

The reinstatement and expansion of United States tariffs in early 2025 have exerted multifaceted pressures on cargo inspection workflows and port operations. Presidential Proclamations restored a 25% ad valorem tariff on steel and aluminum imports, eliminating exemptions previously granted to major trading partners and broadening coverage to derivative products, which in turn necessitated the recalibration of scanning protocols and documentation procedures for a wider spectrum of goods. Concurrently, the removal of the de minimis exemption has propelled a surge in formal entries processed by U.S. Customs and Border Protection, challenging existing inspection capacities and precipitating logistical bottlenecks that ripple across the supply chain.

These trade measures have translated into tangible operational disruptions at key gateways. The Port of Los Angeles reported an anticipated 35% decline in inbound cargo volumes from Asia following the April tariff hikes, as major retailers paused shipments to reassess cost structures and alternative sourcing strategies. International carriers such as Hapag-Lloyd have likewise signaled adjustments to their service networks and cost forecasts in response to the shifting trade landscape, highlighting the persistent uncertainty that companies must now navigate within cargo inspection and logistics planning.

Uncovering Key Segmentation Insights Across Deployment Modes, Application Areas, Technological Variants, and End User Verticals in Cargo Inspection

Analyzing deployment modes reveals a clear dichotomy between mobile inspection units and permanent installations. Mobile systems grant border patrol and seaport teams the agility to conduct ad hoc checks and respond swiftly to emerging threats, whereas fixed installations at major logistics hubs and airports deliver sustained high-throughput scanning capabilities. This strategic balance enables operators to tailor solutions to specific environments, ensuring that resource-intensive permanent scanners are complemented by versatile mobile platforms to address fluctuating inspection demands.

Diving deeper into application domains uncovers differentiated requirements for quality control, regulatory compliance checks, and security screening. High-energy detectors excel at identifying contraband and illicit materials, supporting security screening at cargo-only flight terminals, while trace detection and nonintrusive inspection techniques bolster quality assurance for high-value or hazardous goods. Underpinning these functions are diverse technological variants-electron mobility spectrometry and nuclear quadrupole resonance within ETD devices, cobalt-60 and iridium-192 sources in gamma-ray scanners, and dual-view or single-view configurations in X-ray platforms-all designed to address specific threat profiles. Finally, end users ranging from aviation and border control agencies to logistics providers and seaport authorities leverage these tailored solutions to satisfy stringent safety mandates and streamline cargo flows.

This comprehensive research report categorizes the Cargo Inspection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Deployment

- Application

- End User

Delineating Critical Regional Insights Spanning the Americas, Europe Middle East & Africa, and Asia Pacific to Understand Diverse Market Dynamics

Regional dynamics manifest distinct growth trajectories and regulatory climates across the Americas, Europe Middle East & Africa, and Asia Pacific. In North and South America, advanced container scanning units and AI-enhanced imaging systems are rapidly adopted at major ports and land border crossings, driven by a heightened focus on intercepting illicit shipments under strengthened customs enforcement. Meanwhile, the removal of de minimis exemptions in the United States has placed additional demands on CBP resources, accelerating investments in both permanent and mobile scanners to alleviate congestion at strategic entry points.

Across Europe Middle East & Africa, regulatory convergence around nonintrusive inspection standards and privacy protections has spurred the deployment of low-dose backscatter technologies and privacy-enhancing features in X-ray systems, enabling compliance with stringent directives while maintaining operational throughput. In the Asia Pacific region, trailblazing ports such as Shanghai are pioneering extensive fleets of vehicle scanners and mobile X-ray units to meet the surging complexity of maritime trade routes, reflecting a commitment to harnessing next-generation detection technologies to safeguard high-value supply chains.

This comprehensive research report examines key regions that drive the evolution of the Cargo Inspection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation in Cargo Inspection Through Strategic Contracts, Technological Advancements, and Global Deployments

Leading providers in the cargo inspection domain have solidified their influence through major contract awards and technological breakthroughs. OSI Systems, operating under the Rapiscan Systems brand, has reported a series of multi-million-dollar orders for vehicle and cargo inspection platforms in the first half of 2025, reinforcing its position as a dominant supplier of integrated scanning solutions for border control and seaport applications. Meanwhile, Smiths Detection continues to expand its global footprint through the qualification of its IONSCAN 600 explosives trace detector on the TSA’s Air Cargo Screening Technology List, delivering rapid detection capabilities that align with evolving security requirements.

At the forefront of advanced imaging, Nuctech has introduced dual-energy X-ray systems optimized for electric vehicle freight, addressing the challenges of battery pack screening with enhanced material discrimination and throughput. Leidos, though misattributed in certain contract reports, remains a critical partner in maintaining large-scale screening infrastructures under TSA logistics agreements, underscoring the importance of comprehensive service offerings alongside equipment innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cargo Inspection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alex Stewart International Corporation

- ALS Limited

- Applus+ Servicios Tecnológicos, S.A.

- Bureau Veritas SA

- DEKRA SE

- Det Norske Veritas AS

- DNV Group AS

- Intertek Group plc

- Kiwa NV

- SGS SA

- TÜV SÜD AG

- Underwriters Laboratories, LLC

Delivering Actionable Recommendations to Industry Leaders for Harnessing Emerging Technologies and Streamlining Compliance in Cargo Inspection Ecosystems

Industry leaders should prioritize the integration of AI and machine learning models into existing inspection frameworks to elevate detection accuracy and automate anomaly flagging, thereby reducing manual intervention and operational bottlenecks. Empirical data indicates that AI-driven logistics and clearance systems can cut customs processing times by up to 40%, underscoring the tangible efficiency gains available through intelligent automation.

To navigate the heightened complexity of tariff compliance and documentation requirements, organizations must invest in agile software platforms capable of accommodating multiple duty rates and real-time regulatory updates. Analysis of automotive trade compliance under the new tariff regime reveals that administrative burdens alone can elevate effective tariff rates by over 100%, making digital compliance tools integral to minimizing risk and controlling costs.

Furthermore, forging strategic partnerships with regulatory bodies and technology providers will be crucial to pilot next-generation detection modalities-such as muon tomography and blockchain-enabled traceability solutions-while ensuring that workforce training programs keep pace with evolving operational protocols. This balanced focus on technology, compliance, and human capital will position organizations to sustain secure and efficient cargo operations in a volatile trade landscape.

Detailing the Rigorous Research Methodology Employing Primary Stakeholder Engagement and Secondary Data Analysis to Ensure Comprehensive Market Insights

This research methodology combined extensive primary stakeholder engagement with rigorous secondary data analysis to furnish a holistic view of the cargo inspection market. Primary insights were gleaned through confidential interviews with customs officials, port authority representatives, and procurement executives, providing direct perspectives on operational challenges, technology adoption drivers, and regulatory reforms.

Complementing these firsthand accounts, secondary research encompassed a meticulous review of government publications, regulatory directives, trade association reports, and reputable industry news sources. This dual approach ensured validation and triangulation of critical findings, enhancing the depth and reliability of the analysis across deployment models, technology segments, and regional dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cargo Inspection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cargo Inspection Market, by Technology

- Cargo Inspection Market, by Deployment

- Cargo Inspection Market, by Application

- Cargo Inspection Market, by End User

- Cargo Inspection Market, by Region

- Cargo Inspection Market, by Group

- Cargo Inspection Market, by Country

- United States Cargo Inspection Market

- China Cargo Inspection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Draw a Compelling Conclusion on the Future of Cargo Inspection as a Pillar of Secure and Efficient Global Trade

The synthesis of technological advancements, evolving regulatory landscapes, and shifting trade policies underscores the transformative trajectory of cargo inspection. As digitalization accelerates, the integration of AI, IoT, and remote inspection modalities is redefining security paradigms, while heightened tariff measures and compliance requirements continue to test operational resilience. Coupled with the diverse regional responses to market demands-from advanced imaging deployments in the Americas to privacy-centric protocols in Europe Middle East & Africa and rapid expansion of scanning infrastructure in Asia Pacific-the industry is poised for sustained innovation.

In this dynamic environment, organizations that align strategic investments with actionable intelligence and collaborate across public-private boundaries will be best positioned to shape the future of secure, efficient trade facilitation. The collective evolution of technology, policy, and practice promises a new era of cargo inspection that secures global supply chains without compromising throughput.

Engaging Decision Makers with a Clear Call To Action to Collaborate with Ketan Rohom for Access to the Definitive Cargo Inspection Market Research Report

To gain unparalleled insights into the evolving dynamics of cargo inspection and to equip your organization with the strategic intelligence needed to thrive, reach out to Ketan Rohom, who brings a wealth of expertise in market research and industry engagement as Associate Director, Sales & Marketing. Connect directly to explore tailored options and secure full access to the definitive cargo inspection market research report, ensuring you stay ahead of emerging opportunities and regulatory shifts. Act now to leverage this comprehensive analysis and inform your next strategic decisions with confidence.

- How big is the Cargo Inspection Market?

- What is the Cargo Inspection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?