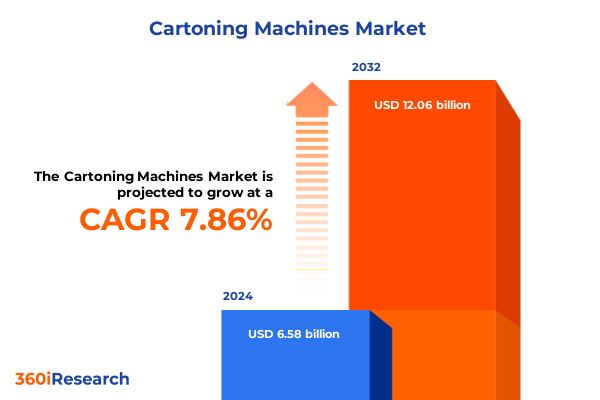

The Cartoning Machines Market size was estimated at USD 7.03 billion in 2025 and expected to reach USD 7.52 billion in 2026, at a CAGR of 8.00% to reach USD 12.06 billion by 2032.

Introduction to the Evolution of Cartoning Machines as a Pivotal Force in Modern Packaging Operations Embracing Automation and Sustainability Across Industries

The cartoning machines sector has evolved from simple mechanical packers to highly sophisticated systems that form, load, and seal cartons with unparalleled speed and precision. What once began as basic end-of-line automation solutions has now transformed into integrated production platforms powered by digital controls and data-driven optimization. Manufacturers seeking to meet rapidly changing consumer demands and stringent regulatory requirements are increasingly relying on these advanced systems to deliver consistent output, reduce waste, and maintain compliance across industries. As a result, modern cartoning machines play a pivotal role in ensuring operational efficiency, product integrity, and brand differentiation.

How Smart Automation Digital Integration and Sustainable Design Are Driving the Next Wave of Innovation and Competitive Advantage in Cartoning Technology

In recent years, the landscape of cartoning equipment has been reshaped by a convergence of technologies that prioritize connectivity, adaptability, and environmental stewardship. Industry 4.0 paradigms have become central to machine design, with IoT-enabled sensors and digital twins offering real-time performance monitoring, predictive maintenance triggers, and process analytics that drive continuous improvement. At the same time, the surge in demand for sustainable packaging fuels innovations such as glue-free interlocking carton closures and recyclable cartonboard compatibility, reducing material consumption and lifecycle impacts. Through modular architectures and collaborative robotics, manufacturers can now rapidly reconfigure packaging lines for multi-SKU throughput, enabling agile responses to seasonal promotions and direct-to-consumer fulfillment requirements. These transformative shifts not only bolster production resilience but also create new revenue streams through value-added services, including remote diagnostics and subscription-based maintenance models.

Assessing the Broad Repercussions of 2025 United States Tariffs on Cartoning Machine Supply Chains Manufacturing Costs and Industry Competitiveness

The 2025 United States tariff measures, encompassing a 25% levy on steel and aluminum imports and a reciprocal 20% tariff on EU-sourced packaging machinery, have significantly altered supply chain economics and capital investment decisions. Manufacturers that previously imported specialized components or turnkey machines now face elevated landed costs, driving many to reassess sourcing strategies and localize assembly to mitigate duty exposure. Major European equipment suppliers, which account for over $6.1 billion in annual exports to the U.S., are experiencing margin pressures that may slow new equipment rollouts and extend replacement cycles by up to 18 months according to industry analysis. Concurrently, numerous U.S. producers are absorbing tariff-driven increases by optimizing packaging formats-reducing carton board grades and simplifying design features-to maintain price competitiveness without eroding consumer value perception. As trade policy continues to evolve, firms must navigate a complex matrix of customs classifications, free trade zone designations, and potential duty suspensions to preserve operational agility and safeguard profitability.

Unveiling Critical Market Dynamics through End Use Industry, Packaging Material, Machine Type, and Automation Level Segmentation Insights

A nuanced analysis of the cartoning machines market emerges when examining the interplay of end-use industries, packaging substrates, machine configurations, and automation tiers. In consumer goods, manufacturers of household products and personal care items demand systems that deliver high hygiene standards and rapid changeovers, while cosmetics producers focus on compact line layouts supporting haircare, makeup, and skincare boxed formats. Within food and beverage, flexible solutions that handle bakery items such as bread and pastries stand alongside beverage cartoning for carbonated and non-carbonated multipacks, as well as dairy packaging of cheese and milk, all requiring precision loading and tamper-evident sealing. Pharmaceutical applications further drive demand for cleanroom-compatible cartoners designed for injectable vials, liquid sachets, and tablet cartons. The choice of packaging material-from cardboard and corrugated substrates to paperboard and various plastics-dictates material handling modules and adhesive or interlocking closing mechanisms. Horizontal machines excel in high-speed, rigid-package operations, whereas vertical machines serve delicate or free-form products with minimal down-time. The rise of fully automatic systems underscores the value of servo-driven controls and electronic format adjustments, though semi-automatic and manual cartoners continue to hold strategic relevance for niche applications and smaller production volumes.

This comprehensive research report categorizes the Cartoning Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Material

- Machine Type

- Automation Level

- End Use Industry

Differentiating Market Growth Patterns and Investment Opportunities Across the Americas, Europe Middle East Africa, and Asia-Pacific Regions

Regional market characteristics reveal distinct growth drivers and investment priorities. In the Americas, the United States leads with aggressive automation adoption, fueled by e-commerce expansion, sustainability mandates, and tax incentives that favor domestic manufacturing. Canadian and Latin American markets are following suit, with rising consumer demand for packaged foods and pharmaceuticals driving millennial-focused product innovations. Across Europe, Middle East, and Africa, particularly in Western Europe, regulatory frameworks around recyclability and extended producer responsibility are accelerating shifts toward glue-free carton technologies and digital traceability, while the Middle East leverages free trade zones to import high-performance machinery for petrochemical and FMCG sectors. In the Asia-Pacific region, robust growth in food processing, personal care, and pharmaceuticals-combined with competitive labor costs-bolsters the deployment of both entry-level semi-automatic cartoners and advanced smart machines. Rapid urbanization in China, India, and Southeast Asia further accentuates the need for scalable solutions that balance cost efficiency with environmental compliance.

This comprehensive research report examines key regions that drive the evolution of the Cartoning Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers Shaping the Cartoning Machines Market through Innovation Strategic Partnerships and Operational Excellence

The competitive landscape of cartoning machinery is dominated by a handful of global leaders that continuously redefine performance benchmarks through technological excellence and service offerings. Syntegon Technology, formerly Bosch Packaging Technology, commands market leadership with high-speed, GMP-compliant machines and integrated track-and-trace capabilities that satisfy stringent pharmaceutical and food safety regulations. IMA Group distinguishes itself through modular multi-format cartoners that excel in regulated sectors and support rapid format conversions. Marchesini Group is renowned for its hygienic, easy-clean designs tailored to cosmetics and healthcare packaging. ULMA Packaging and Schneider Packaging Equipment offer versatile platforms that accommodate a wide range of carton sizes and weights, while regional specialists like Tishma Technologies and Romaco Group deliver agile, energy-efficient solutions for mid-volume operations. These key players invest heavily in R&D to introduce augmented reality–enabled maintenance tools, AI-driven defect detection, and subscription-based service models, setting the innovation pace across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cartoning Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADCO Manufacturing Corporation

- Bradman Lake Group Ltd.

- Coesia S.p.A.

- Econocorp Inc.

- IMA Industria Macchine Automatiche S.p.A.

- Jacob White Packaging Ltd.

- Krones AG

- Marchesini Group S.p.A.

- Omori Machinery Co., Ltd.

- Optima packaging group GmbH

- PMI Cartoning, Inc.

- ProMach, Inc.

- Syntegon Technology GmbH

- Tetra Pak International S.A.

- The Barry-Wehmiller Companies, Inc.

- Uhlmann Pac-Systeme GmbH & Co. KG

Strategic Imperatives for Industry Leaders to Leverage Automation Sustainability and Digitalization to Gain Market Leadership in Cartoning Solutions

To advance market leadership and operational resilience, industry stakeholders should prioritize the deployment of predictive maintenance platforms that reduce unplanned downtime by leveraging historical performance data and machine-learning algorithms. Collaborative robotics integration can enhance worker safety and throughput in compact facilities, particularly where manual cartoning persists. Embracing sustainable design principles, such as eliminating solvent-based adhesives and supporting mono-material cartons, will align packaging lines with evolving environmental regulations and consumer expectations. Strategic sourcing through diversified supplier networks and free trade zone strategies can mitigate tariff exposure, while nearshoring critical component assembly enhances supply-chain agility. Finally, channeling investments into operator training and digital skill development ensures seamless adoption of advanced controls and analytics, maximizing return on capital equipment and fostering a culture of continuous improvement.

Transparency in Research Methodology Highlighting Data Sources Expert Interviews and Analytical Framework Underpinning the Cartoning Machines Executive Summary

This executive summary synthesizes insights from a thorough review of proprietary industry databases, expert interviews with engineering and supply chain executives, and analysis of public financial disclosures from leading cartoning equipment manufacturers. Primary research included discussions with production managers across consumer goods, pharmaceutical, and food and beverage segments to validate machine performance benchmarks and adoption drivers. Secondary research leveraged trade publications, regulatory filings, and tariff schedules to assess the impact of trade policies and material costs on machinery procurement. Quantitative data points were triangulated across multiple sources to ensure consistency, while thematic trends were identified through a rigorous coding process. The methodological framework combines bottom-up analysis of installed base data with top-down evaluation of macroeconomic indicators, ensuring that the report’s conclusions are both granular and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cartoning Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cartoning Machines Market, by Packaging Material

- Cartoning Machines Market, by Machine Type

- Cartoning Machines Market, by Automation Level

- Cartoning Machines Market, by End Use Industry

- Cartoning Machines Market, by Region

- Cartoning Machines Market, by Group

- Cartoning Machines Market, by Country

- United States Cartoning Machines Market

- China Cartoning Machines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Perspectives on Seizing Growth Opportunities and Navigating Challenges in the Evolving Global Cartoning Machines Landscape

The global cartoning machines market stands at an inflection point, where rapid technological advancements collide with shifting trade policies and sustainability imperatives. Companies that embrace digital integration and eco-friendly packaging designs will capture efficiency gains and brand loyalty, while those that remain tethered to legacy systems risk operational bottlenecks and regulatory non-compliance. The convergence of smart sensors, AI-enabled diagnostics, and flexible automation platforms positions cartoning machinery at the heart of next-generation packaging lines. Stakeholders who proactively navigate tariff complexities, invest in skill development, and foster collaborative supplier ecosystems will be best placed to seize growth opportunities across regions and industry verticals. As demand for packaged goods continues to evolve, the ability to deliver reliable, sustainable, and agile packaging solutions will define market leadership in the years ahead.

Connect Directly with Ketan Rohom to Secure Comprehensive Cartoning Machines Market Intelligence and Unlock Strategic Insights for Your Business Growth

To access the full breadth of insights, data, and strategic guidance tailored for the cartoning machines market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep industry knowledge and can arrange a bespoke consultation to align the report’s findings with your organization’s specific needs. Whether you require detailed segment analyses, regional forecasts, or competitor benchmarking, partnering with Ketan ensures you receive actionable intelligence to drive growth. Connect today to secure your copy of the comprehensive market research report and position your team at the forefront of packaging innovation.

- How big is the Cartoning Machines Market?

- What is the Cartoning Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?