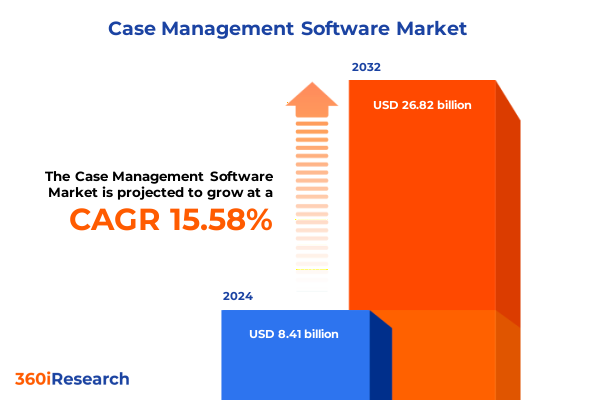

The Case Management Software Market size was estimated at USD 9.70 billion in 2025 and expected to reach USD 11.13 billion in 2026, at a CAGR of 15.62% to reach USD 26.82 billion by 2032.

Empowering Organizations with Next-Generation Case Management Solutions to Drive Operational Excellence and Stakeholder Engagement

In an era defined by rapid digital transformation and shifting customer expectations, case management software emerges as a pivotal enabler for organizations striving to deliver seamless service and operational agility. Modern enterprises confront complex, multi-channel processes that demand centralized visibility and real-time collaboration. By integrating workflows, automating routine tasks, and providing robust analytics, case management solutions empower cross-functional teams to resolve issues swiftly and maintain compliance in increasingly regulated environments.

Organizations that rely on manual or fragmented systems often experience bottlenecks, data silos, and inconsistent user experiences. These challenges undermine client satisfaction, inflate operating costs, and expose the enterprise to compliance risks. As stakeholders demand faster resolution times and personalized interactions, the imperative for a unified, intelligent case management platform becomes unmistakable.

This executive summary previews the critical shifts shaping the case management landscape, examines how economic policies influence technology adoption costs, and highlights strategic segmentation, regional, and vendor insights. Ultimately, this introduction sets the stage for decision makers to harness actionable guidance and build a resilient, future-ready case management strategy that aligns with evolving business imperatives.

Harnessing Artificial Intelligence and Cloud Innovation to Transform Case Management Workflows and Accelerate Digital Service Delivery

The case management domain is undergoing a profound metamorphosis as artificial intelligence and cloud-native architectures reshape traditional workflows. Cloud-first strategies enable rapid deployment, seamless updates, and flexible scaling, liberating IT teams from infrastructure overhead. Concurrently, AI-driven automation and machine learning models empower platforms to analyze complex case data, predict escalation risks, and recommend resolution pathways that optimize both service levels and resource allocation.

Beyond deployment and automation, low code development tools are democratizing customization by allowing business stakeholders to configure workflows without extensive developer involvement. This shift accelerates time-to-value and fosters continuous innovation, as teams iterate on processes in response to emerging challenges and regulatory requirements. Meanwhile, integration standards and open APIs facilitate interoperability with CRM, ERP, and communication systems, ensuring that case information remains synchronized across enterprise environments.

Collectively, these technological advances are driving a new paradigm in case management where platforms evolve from static repositories to adaptive ecosystems. As organizations embrace these trends, they unlock the potential for end-to-end process orchestration, deeper data insights, and a stronger foundation for delivering consistently high-quality outcomes.

Evaluating the Ripple Effects of United States Tariff Policies on Case Management Infrastructure Costs and Enterprise IT Investment Dynamics

Recent developments in tariff policy in the United States have introduced a fresh variable into the strategic calculus of technology procurement. Levies on critical hardware components, including semiconductors and data center equipment, have exerted upward pressure on capital expenditures for on-premise deployments. Enterprises that maintain significant in-house infrastructure are reexamining total cost of ownership considerations in light of elevated import costs and supply chain complexities.

Conversely, cloud providers absorb much of the capital cost burden, presenting organizations with a compelling alternative to traditional on-premise commitments. By migrating to cloud-hosted case management platforms, businesses can sidestep fluctuating hardware costs and benefit from predictable operational expenses. However, those enterprises with hybrid architectures must balance the agility gains of cloud environments against the contractual complexities and latency concerns of dispersed deployments.

As a result, technology leaders are recalibrating investment strategies, redirecting budget allocations toward subscription-based models and pay-as-you-go services. In some sectors, this shift accelerates cloud adoption; in others, it prompts a strategic reevaluation of on-premise assets in areas where data sovereignty or performance requirements remain paramount. Ultimately, understanding the ripple effects of these tariff policies is crucial for crafting resilient, cost-effective case management roadmaps.

Uncovering Strategic Insights from Detailed Case Management Market Segmentation to Inform Tailored Service and Deployment Approaches

Breaking down the case management software market by component reveals a clear divergence between packaged software offerings and professional services. While core platforms provide the foundational capabilities for workflow orchestration and data capture, integration and support services play a vital role in tailoring solutions to specific operational contexts. Organizations investing heavily in seamless interoperability often rely on specialized integration services to connect case management with legacy systems and modern applications alike.

Examining deployment preferences, hybrid cloud models have emerged as the de facto standard for enterprises prioritizing flexibility. These environments blend the security of dedicated on-premise infrastructure with the scalability and cost controls of public cloud resources. In contrast, organizations that operate within highly regulated industries or maintain stringent data sovereignty requirements continue to favor on-premise implementations, valuing direct control over hardware and network configurations.

When assessing adoption patterns by organizational size, large enterprises leverage their extensive IT budgets to implement enterprise-grade platforms with comprehensive customization and global support. Meanwhile, small and midsize organizations often gravitate toward modular, subscription-based software that minimizes upfront costs and accelerates deployment timelines. This dichotomy underscores the importance of vendor offerings that can seamlessly scale from tens to tens of thousands of users.

Diving into vertical markets, financial services institutions drive demand for sophisticated case management capabilities in banking, capital markets, and insurance, where regulatory compliance and audit trails are paramount. Government agencies require platforms that support multi-department collaboration and public accountability, while healthcare providers rely on specialized modules for hospitals and pharmaceutical operations to manage patient cases and clinical trials. Information technology and telecom companies harness case management to streamline support tickets and service provisioning, whereas manufacturing enterprises apply these solutions to product lifecycle management and supply chain exceptions. In the retail sector, organizations deploy case management tools to coordinate customer inquiries, returns, and fraud investigations.

Finally, understanding application-specific trends highlights that change management use cases focus on orchestrating updates and enhancements across platforms, incident management caters to urgent issue resolution, and knowledge management centralizes institutional expertise for rapid access. Simultaneously, problem management investigates root causes of recurring incidents, and service request management automates routine fulfillments, collectively forming a comprehensive suite of capabilities that address every stage of the case lifecycle.

This comprehensive research report categorizes the Case Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Organization Size

- Industry Vertical

- Application Type

Revealing Regional Growth Patterns and Adoption Trends Shaping the Global Case Management Software Landscape Across Key Geographies

In the Americas region, widespread cloud maturity and established digital transformation agendas fuel robust demand for case management software. Organizations across North and South America benefit from mature service provider ecosystems and a high density of technology partners, enabling rapid proof-of-concept cycles and steady adoption of advanced analytics features. Market stakeholders in this region continue to prioritize user experience enhancements and AI-driven automation to differentiate service delivery.

Europe, the Middle East, and Africa present a heterogeneous landscape marked by divergent regulatory frameworks and varying levels of cloud readiness. In Western Europe, strong data privacy laws and digital sovereignty initiatives have prompted investments in localized cloud infrastructure and on-premise solutions. The Middle East is witnessing accelerated modernization programs in government and finance, driving demand for case management platforms that support cross-border collaboration. Meanwhile, Africa’s digital economy is gaining momentum through mobile-first strategies and cloud adoption, particularly in urban centers focused on public sector reform and financial inclusion.

The Asia-Pacific region stands out for its rapid expansion of small and medium enterprises and agile technology adoption. China and India lead in terms of volumes, propelled by government digitization agendas and a shift toward service-oriented architectures. Southeast Asian markets are embracing cloud-native case management platforms as they modernize legacy systems, while Australia and New Zealand sustain stable growth driven by sophisticated use cases in healthcare and finance. Across APAC, the convergence of mobile access, AI innovation, and regulatory modernization underscores a dynamic trajectory for case management solutions.

This comprehensive research report examines key regions that drive the evolution of the Case Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Dynamics and Innovation Strategies of Leading Vendors in the Evolving Case Management Software Ecosystem

ServiceNow and Salesforce continue to set the bar with robust, AI-powered case management capabilities integrated into broader service and CRM ecosystems. Their platforms emphasize extensibility through developer toolkits, marketplace apps, and third-party integrations, catering to organizations seeking highly configurable solutions. Microsoft leverages its Azure cloud and Dynamics 365 suite to offer a unified development paradigm, integrating case management with productivity and communication tools that resonate with enterprise IT teams invested in the Microsoft stack.

Pegasystems remains a market influencer through its low code automation framework and industry-specific accelerators, enabling rapid deployment of customized workflows across financial services, healthcare, and government. IBM combines its deep consulting expertise with cloud-native case management offerings, targeting regulated sectors that demand rigorous governance and analytics. Oracle’s solution portfolio focuses on integration with enterprise resource planning and human capital management modules, appealing to organizations aiming for holistic, end-to-end process coverage.

Meanwhile, emerging vendors are carving niche positions by emphasizing vertical specialization, AI-driven predictive insights, and modular architectures. These newer entrants often attract small and midsize enterprises with simplified licensing models and turnkey implementations. Across the competitive landscape, partnerships between legacy system integrators and specialized software vendors are proliferating, reflecting a trend toward collaborative go-to-market strategies and solution bundling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Case Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbacusNext

- Actionstep

- Bloomberg

- Casefleet

- CaseFox

- CASEpeer LLC

- Casetext

- Clio

- CosmoLex

- Denovo Legal Software

- Filevine Inc

- iManage

- International Business Machines Corporation

- Leap

- Legal Files

- Legistify

- Litify

- Luminance AI

- MyCase

- Odyssey

- PracticePanther

- RELX Group

- Rocket Matter

- Smokeball

- Thomson Reuters

Designing Strategic Roadmaps and Tactical Initiatives to Enhance Operational Efficiency and Client Satisfaction in Case Management

Leaders should prioritize embedding advanced analytics and AI-powered automation into core case management workflows to derive actionable insights from unstructured data and anticipate case outcomes. By integrating natural language processing and predictive modeling, organizations can streamline intake processes, accelerate resolution times, and allocate resources more effectively. Such investments not only boost operational efficiency but also enhance user satisfaction through proactive service delivery.

Adopting a hybrid deployment strategy enables enterprises to balance security, performance, and scalability requirements. Deploying sensitive workloads on-premise while leveraging public cloud resources for burst capacity and innovation projects ensures that compliance mandates and data sovereignty concerns are addressed without sacrificing agility. Rethinking network architectures and optimizing data flows between environments will be essential to maximize the value of hybrid configurations.

To drive end-to-end success, technology leaders must align IT, operations, and business stakeholders around a unified roadmap that prioritizes user experience and continuous improvement. Establishing cross-functional governance models supports iterative enhancements, mitigates change resistance, and fosters accountability. Moreover, forging strategic alliances with cloud providers, system integrators, and AI specialists can accelerate solution deployment and expand the range of available capabilities.

Finally, embedding robust security and compliance frameworks throughout the case management lifecycle is critical. Organizations should adopt standardized controls, conduct regular audits, and implement real-time monitoring to safeguard sensitive information. This approach ensures that case management platforms remain resilient amid evolving threat landscapes and regulatory shifts.

Detailing a Rigorous Mixed-Method Research Framework Combining Primary Insights and Secondary Data for Market Validation

This research employs a mixed-method framework combining primary and secondary sources to ensure comprehensive coverage and robust validation. Primary data was collected through structured interviews with senior IT executives, case management platform architects, and business operations leaders across multiple industries. These conversations yielded firsthand insights into deployment challenges, user adoption barriers, and strategic priorities.

Complementing the interview data, a quantitative survey was administered to a broad cross-section of end users and decision makers, capturing trends in application usage, feature preferences, and satisfaction levels. Secondary research included analysis of corporate filings, technical white papers, regulatory publications, and reputable industry journals. Publicly available financial documents and vendor release notes were reviewed to track product roadmaps and partnership announcements.

The study applies a rigorous data triangulation process, cross-referencing primary interview findings with survey responses and secondary research to identify convergent themes. An expert panel consisting of technology consultants, compliance specialists, and digital transformation advisors performed iterative reviews to validate assumptions and refine key takeaways. This methodological approach ensures the final insights reflect both empirical evidence and practical applicability across diverse enterprise contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Case Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Case Management Software Market, by Component

- Case Management Software Market, by Deployment Type

- Case Management Software Market, by Organization Size

- Case Management Software Market, by Industry Vertical

- Case Management Software Market, by Application Type

- Case Management Software Market, by Region

- Case Management Software Market, by Group

- Case Management Software Market, by Country

- United States Case Management Software Market

- China Case Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Actionable Strategic Takeaways to Guide Decision Makers in Case Management Platform Investments

The analysis underscores that case management software has evolved into a strategic asset for organizations aiming to streamline operations, uphold regulatory compliance, and elevate customer and stakeholder experiences. Technological advancements-particularly in AI, cloud architectures, and low code customization-have transformed static workflow tools into adaptive platforms capable of driving continuous process improvements.

Key segmentation analysis reveals that both component and deployment choices significantly influence adoption strategies. Enterprises increasingly favor hybrid models that balance control and flexibility, while organizations of all sizes seek scalable solutions tailored to their specific operational contexts. Industry-vertical considerations further inform functionality requirements, from compliance-centric financial services to patient-focused healthcare and citizen-oriented government services.

Regional dynamics highlight maturity in the Americas, regulatory nuances in EMEA, and rapid adoption in Asia-Pacific, underscoring the importance of localized strategies. Vendor evaluation indicates that market leaders succeed by integrating AI-driven capabilities, fostering developer ecosystems, and offering vertical accelerators. Emerging players differentiate through niche focus and simplified deployment models.

Overall, enterprises that align technology investments with a clear strategic roadmap, prioritize user experience, and adopt flexible deployment architectures will be best positioned to harness the full potential of case management solutions and drive sustainable competitive advantage.

Engage with Ketan Rohom to Unlock Comprehensive Case Management Intelligence and Accelerate Strategic Technology Adoption Across Your Enterprise

To explore the full breadth of insights into case management software trends and positioning strategies, reach out to Ketan Rohom to acquire the comprehensive report tailored for decision makers. Engaging with the Associate Director, Sales & Marketing will connect you directly to an expert who can walk you through the methodology, highlight key findings, and discuss how these insights align with your strategic objectives. By partnering with this dedicated point of contact, stakeholders gain priority access to in-depth analyses, customized data extracts, and ongoing support to ensure that technology investments in case management yield maximum return and deliver measurable operational improvements.

Secure your copy today to leverage a trusted roadmap for digital transformation and propel your organization’s case management capabilities to the next level under guided expertise.

- How big is the Case Management Software Market?

- What is the Case Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?