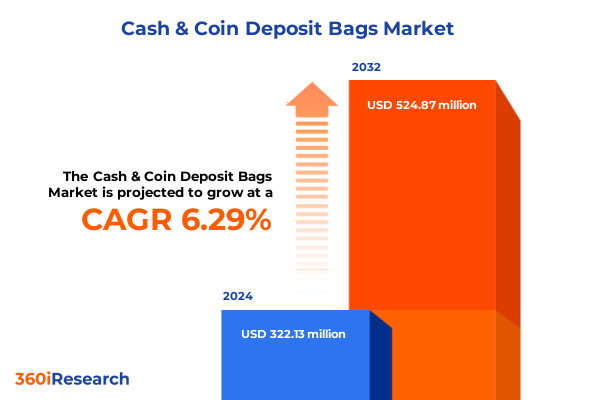

The Cash & Coin Deposit Bags Market size was estimated at USD 340.84 million in 2025 and expected to reach USD 361.98 million in 2026, at a CAGR of 6.36% to reach USD 524.87 million by 2032.

Understanding the Critical Role of Cash and Coin Deposit Bags in Securing Financial Transactions and Ensuring Operational Efficiency Across Industries

The integrity of cash and coin deposit bags underpins the confidence of financial institutions, retailers, and public agencies alike. These solutions serve as the frontline defense against internal discrepancies and external theft while enabling streamlined cash management workflows. As currency handling volumes continue to grow and security threats evolve, deposit bags have become far more than simple containers; they are engineered systems that integrate materials science, tamper-evident features, and user-centric design to deliver end-to-end reliability.

Providers of these bags must balance durability, transparency, and ease of verification. Advanced polymers and reinforced textiles mitigate puncture, tear, and weather exposures, while clear windows and numbered seals support rapid reconciliation. As the market transitions, organizations are seeking solutions that not only secure value in transit but also drive operational efficiency by minimizing handling errors and labor-intensive audits. Consequently, the stakes are higher than ever, demanding a strategic understanding of how cash and coin deposit bags factor into broader risk management and financial control frameworks.

Uncovering the Transformative Shifts Redefining the Cash and Coin Deposit Bag Market Driven by Technology Integration and Evolving Regulatory Requirements

The landscape for cash and coin deposit bags is undergoing a paradigm shift driven by converging technological, regulatory, and customer expectations. First, the infusion of smart sensing technologies is enabling real-time tracking of bag location and seal integrity, moving beyond passive tamper-evidence to active tamper-detection. Cryptographically secured RFID tags and smartphone-based seal verification apps herald a transition toward digitally enabled audit trails, reducing reconciliation times and loss exposure.

Simultaneously, new regulatory mandates on money handling and anti-money laundering are prescribing stricter chain-of-custody documentation. Institutions must demonstrate unbroken, verifiable custody of cash from point of collection through central processing. As a result, manufacturers are embedding serialized barcodes and digital timestamp capabilities within bag seals and integrating cloud-based custody logs. In parallel, evolving sustainability imperatives are prompting shifts toward recyclable polymer blends and organic fiber substrates, aligning security with environmental stewardship.

These transformative forces are synergistic: technology innovations facilitate compliance, regulatory demands spur design enhancements, and sustainability considerations reshape material selection. Consequently, industry participants are witnessing a wave of product differentiation and ecosystem development centered on traceability, resilience, and accountability.

Assessing the Far-reaching Effects of the 2025 United States Tariff Adjustments on the Cash and Coin Deposit Bag Industry’s Supply Chain and Cost Structures

The 2025 tariff adjustments in the United States have introduced significant cost pressures across the supply chain of cash and coin deposit bags, reshaping procurement strategies and material sourcing decisions. Tariffs on polymer imports have elevated raw material costs, prompting manufacturers to reevaluate suppliers, negotiate long-term agreements, and explore domestic polymer alternatives. Concurrently, textile tariffs targeting cotton-polyester blends have amplified the appeal of locally produced fabrics, galvanizing partnerships between bag fabricators and domestic mills.

Beyond direct input costs, these tariffs have triggered cascading effects on lead times and inventory management. To hedge against further trade policy volatility, distributors and end users are increasing safety stock levels, thus tying up working capital and increasing storage space requirements. Some forward-thinking manufacturers have responded by establishing regional production hubs and nearshoring operations, effectively shortening logistics corridors and mitigating exposure to fluctuating duties.

In totality, the cumulative impact of tariff shifts in 2025 extends beyond sticker price inflation; it compels a holistic reassessment of supply chain resilience, strategic sourcing, and inventory optimization, incentivizing agility and collaboration across the industry value chain.

Deriving Actionable Insights from Product Type Capacity Sales Channel and End Use Industry Segmentation to Illuminate Market Dynamics and Customer Preferences

Insights derived from product type analysis reveal that branded currency bags continue to resonate with financial institutions that prioritize premium security features and brand assurance, while cotton–polyester deposit bags appeal to users seeking a balance of cost-efficiency and durability in high-volume environments. Polyethylene security bags are rapidly gaining traction where transparency and high puncture resistance are prized, and tamper-evident cash bags are achieving adoption among sectors with rigorous audit protocols.

When examining market behavior across end-use industries, banking remains the largest adopter of advanced deposit bags, driven by rigorous compliance frameworks and high daily cash throughput. Government and public sector agencies leverage reinforced deposit solutions for tax collection and public service kiosks, whereas hospitality venues value lightweight, discreet pouches to expedite shift handoffs. Retailers deploy a mix of polyester and security-grade polyethylene bags to streamline point-of-sale reconciliations, and transportation and logistics firms utilize high-capacity tamper-evident sacks to consolidate multi-location pickups.

Capacity segmentation further refines strategic opportunity zones. Up-to-5-kg options are preferred for light-shift operations and self-service kiosks. Five-to-10-kg and 10-to-15-kg configurations serve mid-tier cash handlers balancing portability with volume. Above–15-kg capacities support centralized cash centers and large-scale retail chains that consolidate deposits infrequently but in bulk.

Finally, analyzing sales channels reveals that offline distribution through security product specialists and banking equipment resellers dominates in regions where personalized service and trust matter most, while online channels-particularly corporate websites offering configuration tools and e-commerce platforms facilitating rapid replenishment-are accelerating growth by delivering convenience and data-driven recommendations.

This comprehensive research report categorizes the Cash & Coin Deposit Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity

- End Use Industry

- Sales Channel

Examining Regional Market Nuances Across the Americas Europe Middle East Africa and Asia Pacific to Identify Growth Opportunities and Strategic Priorities

Regional nuances shape demand, regulatory compliance, and logistical considerations across the globe. In the Americas, the market is characterized by robust demand from retail banking and cash-in-transit operators, underpinned by sophisticated security requirements and well-established distribution networks. North American players often lead in the adoption of smart-seal technologies, while Latin American markets prioritize cost-effective solutions to address high-volume cash economies.

In Europe, the Middle East, and Africa, a blend of mature financial centers and emerging economies drives a dual-speed market. Western European banks integrate sustainable materials to meet stringent environmental standards, whereas Eastern European and Middle Eastern nations emphasize tamper-evident designs to combat cash-based fraud. African markets, marked by infrastructure variability, call for durable, low-maintenance deposit bags that resist harsh climatic conditions and intermittent handling facilities.

Asia-Pacific presents a mosaic of opportunity and complexity. In developed East Asian economies, high automation in cash processing centers makes compatibility with mechanized sorting equipment a critical requirement, stimulating demand for uniform-size, rib-reinforced bags. Meanwhile, Southeast Asian and South Asian regions value modular, lightweight deposit systems that can traverse mixed transport modes and variable security environments. Oceania’s focus on transparency and seal verification is driving experimentations with integrated QR-code tracking and mobile verification platforms.

This comprehensive research report examines key regions that drive the evolution of the Cash & Coin Deposit Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Manufacturers and Innovators Shaping the Competitive Landscape Through Strategic Partnerships Product Development and Market Expansion

Leading companies in the cash and coin deposit bag space are rapidly innovating and consolidating to defend market share and pioneer new standards. Established manufacturers with extensive distribution footprints are investing in R&D to integrate digital seals and blockchain-enabled custody logs, forging partnerships with fintech providers to enhance end-to-end security. Concurrently, agile challengers are specializing in niche materials such as biodegradable polymers and antimicrobial textiles, differentiating through sustainability and hygiene credentials.

Strategic alliances between deposit bag producers and logistics firms are emerging, enabling bundled offerings that combine secure packaging with cash-in-transit monitoring services. These collaborations streamline procurement for end users and create integrated value propositions. At the same time, technology startups are customizing solutions for specific verticals-such as hospitality-focused pouches with RFID-enabled shift tracking-forcing incumbents to respond with targeted product lines.

Through mergers and joint ventures, major players are expanding manufacturing capabilities into underserved regions, ensuring rapid delivery and local compliance. As a result, the competitive landscape is defined by a balance of global scale, technological prowess, and localized responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cash & Coin Deposit Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adsure Packaging Limited

- Amcor plc

- BankSupplies, Inc.

- Berry Global Group, Inc.

- Brady Corporation

- Budco Bank Supplies, Inc.

- Connover Packaging, Inc.

- Coveris Holdings S.A.

- Greif, Inc.

- Harcor Security Seals Pty Ltd

- Huhtamaki Oyj

- Illinois Tool Works Inc.

- Initial Packaging Solutions Ltd.

- ITW Envopak Limited

- Korozo Ambalaj Sanayi ve Ticaret A.S.

- Mega Fortris Group

- MMF Industries, Inc.

- Mondi plc

- Packaging Horizons Corporation

- Pactiv Evergreen, Inc.

- Sealed Air Corporation

- Shields Bag & Printing Co.

- Shosky Security, Inc.

- Sonoco Products Company

- TruSeal (Pty) Ltd.

- Winpak Ltd.

Delivering Practical Recommendations for Industry Leaders to Capitalize on Emerging Trends Strengthen Supply Chains and Enhance Customer Security Assurance

Industry leaders should prioritize end-to-end digital traceability by investing in smart-seal and IoT-enabled deposit bag systems that integrate seamlessly with existing cash management platforms. By collaborating with technology providers, organizations can co-develop cloud-based custody logs that automate reconciliation and bolster audit compliance. Such integration not only reduces shrinkage but also delivers actionable data insights on handling patterns and risk hotspots.

Supply chain resilience must be reinforced through dual-sourcing strategies and regional manufacturing footprints. Stakeholders should conduct scenario planning around tariff fluctuations and raw material shortages, establishing safety stock protocols and flexible production schedules. Additionally, forging collaborative ventures with domestic polymer producers and textile mills can secure preferential access to critical inputs while enhancing sustainability credentials.

To capture diversified end-use demand, companies should tailor product portfolios with modular design options-such as interchangeable capacity inserts and configurable seal types-thereby appealing to banking institutions, retailers, and logistics operators alike. Finally, elevating customer experience through online configurators and subscription-based replenishment services will drive recurring revenue streams and deepen client relationships.

Outlining the Robust Research Methodology Employed to Ensure Credibility Reliability and Comprehensiveness of Insights Within the Cash and Coin Deposit Bag Analysis

This analysis is founded on a multi-stage research methodology that ensures comprehensive coverage and robustness of insights. It began with a systematic review of regulatory filings, trade publications, and patent databases to map technological and compliance trends. Primary interviews with senior executives and key decision-makers across banking, retail, and logistics sectors provided qualitative depth, uncovering firsthand perspectives on operational pain points and future requirements.

Quantitative data were aggregated from proprietary distributor shipment records, customs import/export statistics, and manufacturers’ shipment logs, enabling triangulation of global demand patterns. Cross-validation with secondary sources such as industry whitepapers and technical standards documentation fortified data reliability. Regional experts contributed localized analyses to contextualize macro trends within specific markets.

Finally, scenario modeling was applied to assess the impact of tariff shifts and supply chain disruptions, informing the strategic implications presented. Rigorous peer review and iterative validation cycles ensured that insights are objective, actionable, and reflective of the latest industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cash & Coin Deposit Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cash & Coin Deposit Bags Market, by Product Type

- Cash & Coin Deposit Bags Market, by Capacity

- Cash & Coin Deposit Bags Market, by End Use Industry

- Cash & Coin Deposit Bags Market, by Sales Channel

- Cash & Coin Deposit Bags Market, by Region

- Cash & Coin Deposit Bags Market, by Group

- Cash & Coin Deposit Bags Market, by Country

- United States Cash & Coin Deposit Bags Market

- China Cash & Coin Deposit Bags Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Reflections on Key Findings Implications for Stakeholders and the Strategic Imperative to Embrace Security Innovation in Cash Handling

Across tenured and emerging product segments alike, the imperative to secure physical currency with tamper-evident, durable deposit solutions remains undiminished. The integration of digital tracking and traceability features signifies a watershed moment, bridging the gap between physical security and data-driven risk management. Simultaneously, regional variations in material preferences, regulatory oversight, and distribution infrastructures underscore the necessity for tailored strategies that accommodate local demands.

The tariff-induced cost dynamics of 2025 have illuminated vulnerabilities within global supply chains, accelerating the shift towards nearshoring and supplier diversification. Meanwhile, customer expectations for seamless procurement experiences and sustainable materials are reshaping the competitive calculus. Ultimately, stakeholders who embrace innovation in both product design and operational models will capture the lion’s share of growth and brand loyalty.

Looking ahead, the convergence of security, sustainability, and digitalization will define the next generation of cash and coin deposit bags, offering new avenues for differentiation and value creation. Organizations that act decisively on these insights will fortify their cash handling frameworks and unlock strategic advantages in a market prioritizing trust and resilience.

Connect with Ketan Rohom Associate Director Sales and Marketing for Tailored Insights and Secure Access to the Comprehensive Cash and Coin Deposit Bag Market Report

Elevate Your Strategic Edge by Securing Your Copy of the Comprehensive Research Report Through a Conversation with Ketan Rohom

- How big is the Cash & Coin Deposit Bags Market?

- What is the Cash & Coin Deposit Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?