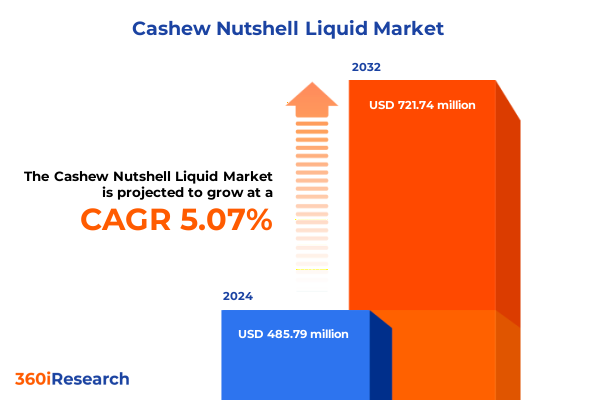

The Cashew Nutshell Liquid Market size was estimated at USD 509.21 million in 2025 and expected to reach USD 534.05 million in 2026, at a CAGR of 5.10% to reach USD 721.74 million by 2032.

Exploring the Versatile World of Cashew Nutshell Liquid as a Sustainable Industrial Ingredient Driving Innovation Across Multiple Sectors

Cashew Nutshell Liquid (CNSL) has emerged as a versatile, renewable bio-based material that bridges the gap between traditional petrochemical derivatives and the growing demand for sustainable industrial feedstocks. Extracted from the honeycomb-like inner coating of the cashew nutshell, this naturally occurring mixture of phenolic lipids-including anacardic acid, cardanol, and cardol-offers unique structural attributes such as strong thermal resistance, inherent hydrophobicity, and versatile chemical reactivity. These characteristics have sparked heightened interest among manufacturers seeking to enhance performance, reduce environmental impact, and diversify supply chains away from petroleum sources.

The foundational importance of CNSL lies in its dual functionality as both a performance enhancer in coatings, adhesives, and friction materials, and as a renewable intermediate for specialty polyols and resin modifiers. Whereas historical utilization centered primarily on low-value applications, recent research and development initiatives have expanded its utility across high-growth sectors, including automotive, industrial manufacturing, and oilfield chemicals. As such, CNSL has transcended its role as an agro-industrial byproduct and positioned itself as a cornerstone of bio-based innovation, offering companies a pathway to meet stringent regulatory standards, consumer expectations for green products, and corporate sustainability targets.

Navigating the Transformational Trends Reshaping the Cashew Nutshell Liquid Landscape from Sustainability to Enhanced Functional Performance

Over the past few years, the Cashew Nutshell Liquid market has undergone a series of transformative shifts propelled by regulatory momentum, technological breakthroughs, and evolving end-user requirements. Sustainability mandates and carbon reduction targets have prompted manufacturers to re-evaluate reliance on crude oil–derived phenolics, leading to significant investment in CNSL extraction and purification technologies. Advancements in solvent extraction, thermal cracking, and distillation have enabled producers to isolate high-purity cardanol grades, thereby unlocking applications in color-critical epoxy curing agents and waterborne coatings that were once deemed impractical for naturally sourced feedstocks.

Concurrent with processing innovations, growing R&D collaboration between chemical developers, automotive OEMs, and coatings formulators has yielded next-generation CNSL polyols and polymeric resin systems. These novel materials capitalize on the inherent aromatic backbone and long aliphatic side chain of cardanol to deliver enhanced adhesion, moisture resistance, and thermal stability. Moreover, the convergence of digital process controls and scalable biorefinery models has streamlined production costs, creating a more competitive landscape for CNSL relative to petrochemical alternatives. As a result, CNSL is increasingly recognized not just as an environmental imperative but as a strategic enabler for product differentiation and performance optimization across diverse industrial segments.

Assessing the Broad Impact of Recent United States Tariff Measures on Cashew Nutshell Liquid Procurement and Supply Chain Dynamics

In early 2025, the United States introduced sweeping tariff measures that reverberated across the global cashew value chain, creating significant headwinds for raw material sourcing and price stability. A universal 10% duty on all imports, coupled with country-specific surcharges-most notably a 46% levy on Vietnamese cashew products-has led to a pronounced contraction in shipments entering the U.S. market. As a result, manufacturers of cashew nutshell liquid have faced elevated procurement costs and disruptions in their established import routes, prompting many to reassess alternative sourcing strategies and inventory management practices.

The higher duties on Vietnamese-origin material have proved particularly impactful given Vietnam’s historical role as a primary processor of Ivorian raw cashews for U.S. re-export. Exports from Vietnam to the United States declined sharply in the first half of 2025, with customs data revealing a 22% year-on-year volume decrease through May, while total export values remained resilient due to price adjustments. These dynamics have spurred domestic and regional processors to explore direct procurement from African nations such as Côte d’Ivoire and Nigeria, where comparatively lower tariffs offer more favorable commercial terms. Nevertheless, the tariff-induced shift has increased supply chain complexity, driving manufacturers to diversify supplier portfolios, invest in buffer stocks, and negotiate longer-term contracts to buffer against ongoing policy volatility.

Diving Deep into Market Segmentations to Uncover Strategic Opportunities Based on Type, Extraction, End Use, Application, and Distribution Patterns

A nuanced understanding of market segmentations reveals the strategic pathways by which Cashew Nutshell Liquid can capture value and address specific performance requirements. When examining product type, distinctions emerge between polymerized CNSL used for high-viscosity resin systems, raw CNSL applied in basic phenolic formulations, and refined CNSL targeted at premium cardanol derivatives. Each tier demands tailored processing infrastructure, quality controls, and downstream formulation expertise, creating discrete channels of opportunity for specialized producers. Transitioning to extraction methodologies, the choice between distillation for high-purity cardanol, solvent extraction for scalable yield, and thermal cracking for cost-efficient polymer recovery informs both capital investment profiles and product portfolios.

Equally critical is the alignment with end-user segments. Automotive OEMs leverage CNSL-based friction particles and binding resins to meet stringent safety and emissions requirements, while the coating industry integrates high-purity cardanol in anticorrosion primers and low-VOC finishing systems. Industrial manufacturing clients employ CNSL-derived adhesives and polymeric modifiers to improve mechanical resilience, and the oil & gas sector utilizes specialized oilfield chemicals formulated from CNSL polyols for enhanced thermal stability under extreme conditions. Application-oriented segmentation further underscores divergent demand patterns for adhesives in precision assembly, brake lining materials in transportation, advanced coating monomers in infrastructure maintenance, lubricants in machinery operation, and oilfield chemical blends in drilling and extraction processes. Lastly, distribution channel choices between direct sales relationships, industrial distributors, and emerging online sales platforms dictate the scalability, customer engagement model, and service expectations for CNSL suppliers.

This comprehensive research report categorizes the Cashew Nutshell Liquid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Extraction Method

- End User

- Application

- Distribution Channel

Examining Regional Variations in Demand and Adoption of Cashew Nutshell Liquid across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional analysis affirms that the global Cashew Nutshell Liquid market is shaped by unique demand drivers, regulatory environments, and supply chain configurations across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, growing adoption of bio-based coatings and a maturing renewable chemicals ecosystem have catalyzed investments in North American distillation capacity, enhancing local availability of refined cardanol. Regulatory incentives for sustainable industrial processes in key states have further accelerated uptake among automotive and industrial manufacturing end users, establishing the region as a critical growth platform.

Across Europe Middle East Africa, stringent environmental standards and circular economy mandates have elevated the role of CNSL in replacing phenolic resins within construction, transportation, and packaging sectors. European formulators continue to prioritize low-VOC, non-toxic alternatives, making high-purity cardanol derivatives particularly attractive. Meanwhile, Middle Eastern manufacturers, buoyed by petrochemical expertise and emerging chemical parks, are exploring hybrid resin systems that blend CNSL with local feedstocks. In Africa, proximity to raw cashew production has created nascent refining clusters in West African nations, signalling an opportunity to develop integrated local value chains. In the Asia Pacific, the interplay of low-cost processing hubs in Vietnam and India, regulatory shifts toward green chemistry, and burgeoning end-user markets in China, Japan, and South Korea underpin continued dominance as both an exporter and consumer of CNSL and its derivatives.

This comprehensive research report examines key regions that drive the evolution of the Cashew Nutshell Liquid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Examining Their Strategic Initiatives Shaping the Competitive Cashew Nutshell Liquid Market Landscape

The competitive landscape in the Cashew Nutshell Liquid sector is defined by a blend of specialized technology innovators, diversified chemical manufacturers, and integrated biorefinery operators. Cardolite, a recognized leader in CNSL technology, has invested heavily in proprietary distillation processes and Ultra LITE technology to deliver ultra-low-color cardanol grades suitable for premium epoxy curing agents and waterborne coatings. Their focus on life cycle analysis and USDA certified bio-based labeling has positioned them at the forefront of sustainability-driven formulation excellence.

COIM USA’s strategic acquisition of the Palmer International site in New Boston, Texas marks a significant capacity expansion for renewable polyols derived from CNSL, complementing their existing Isoexter polyester portfolio and signaling long-term intent to deepen market presence in North America. Neville Chemical, with a century-long legacy of producing low molecular weight thermoplastic and liquid resins, has extended its R&D capabilities into CNSL-derived phenolic resins and tackifying agents, creating performance advantages in coatings, adhesives, inks, and rubber applications through proprietary formulations and customer-focused service models. Together, these companies, alongside a cadre of regional processors and boutique specialty players, continue to innovate around product quality, application development, and sustainable certification to differentiate themselves in an evolving competitive arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cashew Nutshell Liquid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adarsh Industrial Chemicals

- C.Ramakrishna Padayatchi

- Cardolite Corporation

- Cashewchem India

- Cat Loi Cashew Oil Production & Export Joint Stock Company

- Golden Cashew Products Pvt. Ltd.

- K Subraya Anantha Kamath and Sons

- K2P Chemicals

- KIMMY COMPANY LIMITED

- Kumar Metal Industries Pvt. Ltd.

- Muskaan Group

- Olam International Limited

- Paladin Paints & Chemicals Pvt. Ltd.

- Palmer International, Inc.

- R. K. Agro Processing

- Rishabh Group of Companies

- SAHYADRI CASHEW PROCESSORS

- Satya Cashew Chemicals Pvt. Ltd.

- Senesel Sp. z o.o.

- Shivam Cashew Industry

- Sridevi Group

- Zantye Group

Delivering Practical Recommendations for Industry Leaders to Capitalize on Emerging Opportunities within the Cashew Nutshell Liquid Value Chain

As the Cashew Nutshell Liquid market transitions from niche byproduct to mainstream bio-based feedstock, industry leaders must adopt proactive strategies to capitalize on emerging opportunities. Prioritizing investments in advanced purification capabilities-such as vacuum distillation and solvent recovery loops-will enable production of high-purity cardanol grades that command premium pricing in the coatings and adhesive sectors. Strategic partnerships with end-user formulators to co-develop tailored resin systems can expedite product adoption while securing long-term offtake commitments and reinforcing collaborative innovation networks.

Furthermore, diversifying supplier portfolios through direct procurement agreements with West African processors and selective regional distributors will mitigate tariff-induced supply chain disruptions, ensuring continuity of raw CNSL feedstock at competitive costs. Emphasizing transparent sustainability metrics, third-party certification, and cradle-to-gate life cycle assessments will resonate with OEMs and regulatory bodies, unlocking new market segments and justifying value-based pricing models. Finally, leveraging digital sales channels and data-driven demand forecasting can optimize inventory levels, reduce working capital requirements, and enhance customer engagement across direct, distributor, and online platforms.

Unveiling the Rigorous Research Methodology Underpinning the Comprehensive Cashew Nutshell Liquid Market Analysis and Validation Processes

This market analysis is underpinned by a robust research methodology combining extensive secondary and primary data collection, as well as rigorous validation processes. Secondary research involved a comprehensive review of industry reports, trade publications, regulatory filings, company websites, and reputable news sources to map market structure, competitive dynamics, and the impact of trade policies. Primary research entailed in-depth interviews with key stakeholders, including senior executives at leading CNSL producers, end-user formulators, distribution channel managers, and regulatory experts, to obtain firsthand insights on market trends, operational challenges, and growth opportunities.

Analyst-driven triangulation techniques were employed to cross-verify qualitative and quantitative findings, ensuring consistency and reliability of the intelligence gathered. Data integrity was further reinforced through peer review and engagement with subject matter specialists in bio-based chemicals, who provided critical feedback on technical feasibility, supply chain considerations, and regulatory compliance. The integration of trade flow analysis, patent landscape evaluation, and interactive workshops with industry participants has enabled a holistic view of the Cashew Nutshell Liquid ecosystem, delivering actionable insights that reflect both current realities and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cashew Nutshell Liquid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cashew Nutshell Liquid Market, by Type

- Cashew Nutshell Liquid Market, by Extraction Method

- Cashew Nutshell Liquid Market, by End User

- Cashew Nutshell Liquid Market, by Application

- Cashew Nutshell Liquid Market, by Distribution Channel

- Cashew Nutshell Liquid Market, by Region

- Cashew Nutshell Liquid Market, by Group

- Cashew Nutshell Liquid Market, by Country

- United States Cashew Nutshell Liquid Market

- China Cashew Nutshell Liquid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing Comprehensive Conclusions to Highlight Key Takeaways and Future Implications for Stakeholders in the Cashew Nutshell Liquid Arena

In conclusion, Cashew Nutshell Liquid has firmly established itself as a high-potential bio-based alternative to petrochemical phenolics, driven by its intrinsic functional advantages and alignment with global sustainability imperatives. The confluence of technological innovation in extraction, purification, and application development has broadened its appeal across automotive, coatings, friction, and industrial manufacturing sectors. Nonetheless, policy shifts such as recent U.S. tariff measures underscore the importance of agility in supply chain management and strategic alignment with regional market dynamics.

Moving forward, success will hinge on the ability of producers and formulators to deliver differentiated, high-purity CNSL derivatives, foster collaborative partnerships across the value chain, and maintain robust research and development pipelines. By leveraging targeted investments, embracing transparent sustainability credentials, and optimizing distribution strategies, stakeholders can navigate emerging challenges and unlock the full potential of this renewable, high-performance material.

Engage with Ketan Rohom to Secure Exclusive Insights and Drive Strategic Growth Opportunities in the Cashew Nutshell Liquid Market Today

To explore this comprehensive market research report and gain tailored, strategic insights into the evolving Cashew Nutshell Liquid sector, please reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan will guide you through exclusive data, in-depth analysis, and bespoke advisory services designed to empower your organization’s decision-making process and fuel sustained growth within this dynamic biomaterials market. Secure your copy today and position your team at the forefront of opportunity.

- How big is the Cashew Nutshell Liquid Market?

- What is the Cashew Nutshell Liquid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?