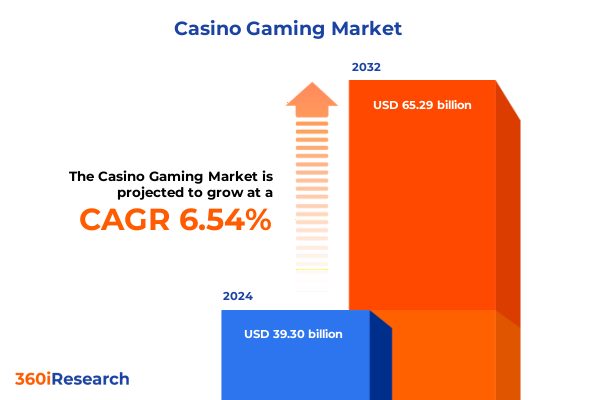

The Casino Gaming Market size was estimated at USD 41.82 billion in 2025 and expected to reach USD 44.52 billion in 2026, at a CAGR of 6.57% to reach USD 65.29 billion by 2032.

Unveiling the Revolutionary Technological and Consumer Trends Shaping Modern Casino Gaming Dynamics Across Diverse Markets and Demographics

The modern casino gaming industry stands at a crossroads defined by rapid digital transformation, shifting consumer behaviors, and evolving regulatory expectations. In recent years, advances in mobile technology and data analytics have catalyzed a shift from traditional brick-and-mortar experiences to omnichannel ecosystems where players engage seamlessly across online, real-money, and social gaming platforms. Concurrently, regulatory bodies in major jurisdictions have updated licensing frameworks and responsible gaming mandates, compelling operators and equipment suppliers to reassess compliance strategies and invest in enhanced monitoring tools.

As emerging generations enter the marketplace, demand for personalized experiences and novel game formats has intensified, prompting operators to experiment with virtual reality demonstrations, skill-based games, and integrated loyalty programs. These innovations are simultaneously challenging legacy revenue models and opening avenues for new monetization approaches. In parallel, global supply chain disruptions have underscored the importance of agile sourcing and partnerships, while heightened scrutiny around sustainability and social responsibility has emerged as a strategic imperative. This introduction frames the critical forces shaping contemporary casino gaming dynamics and sets the stage for an exploration of the transformative shifts, regulatory impacts, segmentation insights, and regional trends that define the industry’s trajectory today and in the years ahead.

Examining Paradigm Shifts Driven by Digital Disruption Regulatory Evolution and Emerging Technologies Reshaping Casino Gaming Worldwide

The casino gaming landscape is undergoing paradigm shifts fueled by digital disruption, regulatory evolution, and next-generation gaming technologies. Operators have accelerated the adoption of cloud-native platforms and real-time analytics to harness player data, optimize marketing campaigns, and deliver highly targeted promotions. Elsewhere, the proliferation of mobile gaming applications and live-dealer streaming solutions has blurred the lines between online and land-based venues, prompting integrated resorts to expand their digital touchpoints and deliver unified loyalty experiences.

Regulatory bodies are simultaneously revising policies to address emerging risks around data privacy, anti-money laundering compliance, and responsible gaming safeguards. As a result, leading operators are investing in blockchain-enabled verification systems and advanced AI-driven monitoring platforms to enhance transparency and reduce regulatory friction. Furthermore, immersive technologies such as virtual reality gaming lounges and augmented reality experiences are transforming casino floors into interactive entertainment hubs, attracting younger demographics and driving incremental foot traffic. These transformative shifts underscore the need for operators to align their technology roadmaps with regulatory strategies and evolving consumer expectations in order to maintain resiliency and competitive relevance in a rapidly changing industry.

Assessing the Aggregate Consequences of 2025 Tariff Measures on United States Casino Gaming Equipment Imports and Operational Expenditures

In 2025, the United States’ implementation of increased tariffs on imported gaming equipment has reverberated across the casino gaming ecosystem, driving cost pressures and prompting strategic adjustments throughout the supply chain. The imposition of higher duties on electronic table games and slot machine components has led manufacturers to reevaluate sourcing strategies and accelerate investments in domestic production capabilities. This shift has introduced both challenges and opportunities: operators face elevated procurement costs while suppliers expand their manufacturing footprints within the U.S. to mitigate tariff burdens and maintain delivery timelines.

As procurement costs rise, many casino operators are exploring alternative sourcing arrangements and negotiating long-term agreements to lock in favorable pricing. At the same time, emerging domestic manufacturers are leveraging advanced automation to offset labor expenses and deliver competitively priced products. The net effect has been a gradual realignment of the supply ecosystem, with domestic production gaining market share and traditional import-reliant suppliers forging joint ventures with U.S. partners. This realignment not only mitigates the immediate financial impact of tariffs but also enhances supply chain resilience, reduces lead times, and fosters closer collaboration between operators and equipment vendors.

Uncovering Critical Perspectives from Game Type and Payment Method Segmentations Driving Strategic Opportunities in Casino Gaming Markets

A deep dive into market segmentation reveals critical insights that can inform strategic decision-making across multiple dimensions. When evaluating game types, the market divides into electronic table games including video poker and virtual table games, slots, and traditional table games such as baccarat, blackjack, craps, poker, and roulette. Understanding how each segment performs allows operators to tailor floor plans, allocate marketing budgets, and optimize player engagement programs. For example, operators focusing on virtual table games can capitalize on the latest advancements in AI-enhanced randomness and immersive user interfaces to attract tech-savvy audiences, while those emphasizing classic table games may deepen partnerships with high-roller clubs and VIP programs to drive loyalty among established patrons.

In parallel, payment method analysis underscores the importance of offering a comprehensive suite of transactional options, including cash, credit cards, debit cards, e-wallets, and prepaid cards. Integrating digital wallets not only elevates convenience for players but also generates rich behavioral data that can be used to refine promotional strategies and enhance fraud detection. Meanwhile, maintaining robust cash-handling infrastructure ensures accessibility for traditionalists who prefer in-person interactions. By aligning game mix with preferred payment channels, operators can maximize revenue per square foot and reinforce customer satisfaction through frictionless payment experiences.

This comprehensive research report categorizes the Casino Gaming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Game Type

- Component

- Property Type

- Channel Type

- Operator Type

Revealing Distinct Regional Trends and Market Dynamics Among the Americas EMEA and Asia-Pacific Casino Gaming Ecosystems

A regional lens on the casino gaming industry reveals distinct trends and opportunities across key global zones. In the Americas, large integrated resorts continue to expand their footprint in emerging markets such as Mexico and Brazil, buoyed by liberalizing regulations and growing tourism. Meanwhile, the U.S. market has seen steady investments in tribal and destination properties, supported by favorable state-level legislation in new jurisdictions. Cross-border synergies between gaming hubs in the Caribbean and North America have also intensified collaboration in marketing and loyalty programs.

Across Europe, the Middle East, and Africa, operators are navigating a complex regulatory mosaic that ranges from tightly controlled jurisdictions to rapidly expanding markets in the Gulf region. The rise of digital licensing frameworks in Europe has created a surge in online gaming entrants, many of which are exploring partnerships with land-based operators to diversify offerings. In Africa, nascent markets in South Africa and Kenya are witnessing pilot projects for mobile-first casino solutions designed to leverage high smartphone penetration.

In the Asia-Pacific region, the liberalization of gaming regulations in select Southeast Asian countries and the reopening of Macau’s flagship resorts post-pandemic have fueled a robust recovery. Operators are investing in integrated entertainment districts that combine gaming with retail, dining, and cultural experiences to meet the expectations of a growing middle-class demographic. This tri-regional analysis underscores the need for tailored strategies that respond to unique regulatory, cultural, and economic drivers.

This comprehensive research report examines key regions that drive the evolution of the Casino Gaming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovations and Competitive Positioning Among Leading Casino Gaming Enterprises in a Rapidly Evolving Sector

Leading enterprises within the casino gaming sector are deploying differentiated strategies to secure competitive advantage and drive growth. International Game Technology has intensified its focus on modular slot platforms and back-end analytics, partnering with major operators to deliver turnkey solutions that streamline floor operations. Aristocrat Leisure has capitalized on its content portfolio by launching cross-platform game titles that unify land-based and online player experiences, while Scientific Games has prioritized digital innovation through strategic acquisitions of mobile gaming studios and AI technology providers.

Regional leaders such as Konami Gaming have leveraged their manufacturing expertise to introduce cost-efficient electronic table games tailored for U.S. operators, mitigating tariff impacts through nearshore production. Meanwhile, Novomatic has expanded its presence in the Americas via localized partnerships, emphasizing compliance advisory services and integrated casino management systems. These companies’ aggressive investment in R&D, coupled with an emphasis on data-driven player analytics, reflects the sector’s broader shift toward integrated entertainment ecosystems that blend physical and digital touchpoints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Casino Gaming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 888 Holdings Plc

- Abbiati Casino Equipment S.r.l.

- AMATIC Industries GmbH

- Angel Group Co., Ltd.

- Aristocrat Leisure Limited

- Aruze Gaming Technologies Co., Ltd.

- BETSSON AB

- Caesars Entertainment Inc.

- CTC Holdings

- Entain plc

- Euro Games Technology Ltd.

- Everi Holdings Inc.

- Evolution AB

- Flutter Entertainment plc

- GameBridge Casino Equipment

- Incredible Technologies, Inc.

- Inspired Entertainment, Inc.

- Interblock dd

- International Game Technology PLC

- Jackpot Digital, Inc.

- Kindred Group plc by Française des Jeux

- Konami Gaming Inc.

- Light and Wonder Inc.

- Matsui Gaming Machine CO.,LTD.

- New Vision Gaming

- NOVOMATIC AG

- PlayAGS Inc.

- R. Franco technologies, S.L.U.

- TCS John Huxley Limited.

Formulating Actionable Strategies and Best Practices for Casino Gaming Leaders to Enhance Resilience Growth and Regulatory Compliance

Industry leaders seeking to thrive in the evolving casino gaming landscape should prioritize a multi-pronged approach that balances technological advancement, regulatory engagement, and customer-centric innovation. First, operators should accelerate the deployment of digital platforms and omnichannel loyalty programs to meet modern players’ expectations and capture cross-segment revenue opportunities. Second, building strategic alliances with domestic equipment manufacturers and technology providers can mitigate the impact of external tariff pressures and reinforce supply chain resilience.

Furthermore, proactive engagement with regulatory bodies at the state and federal levels will be essential to shape responsible gaming standards and secure favorable licensing conditions. Investing in advanced analytics for AML (anti-money laundering) compliance and responsible play monitoring will reduce regulatory risks and foster trust among stakeholders. Leaders should also explore emerging opportunities in virtual and skill-based gaming formats, harnessing immersive technologies to attract younger demographics while preserving the social gaming appeal of classic table games. Finally, incorporating sustainable practices-spanning energy-efficient casino operations and community development initiatives-will enhance brand reputation and ensure long-term stakeholder value.

Detailing Rigorous Research Approaches Data Sources and Analytical Techniques Underpinning Comprehensive Casino Gaming Market Insights

This analysis is grounded in a comprehensive research methodology encompassing qualitative and quantitative approaches. Primary data collection included in-depth interviews with senior executives from leading casino operators, equipment manufacturers, and payment solution providers. These expert consultations were complemented by a series of focus groups with high-frequency players to understand evolving preferences and pain points. Secondary research involved a thorough review of regulatory filings, company annual reports, industry presentations, and government publications covering licensing frameworks and tariff schedules.

Data triangulation was applied to validate insights, cross-referencing proprietary databases on casino floor performance with industry peer benchmarks and publicly available financial disclosures. Advanced analytical techniques, including regression analysis and scenario modeling, were employed to assess the impacts of tariff changes and technology adoption rates. The final report underwent a rigorous peer review process, including feedback from an external advisory board of gaming economists and regulatory specialists, ensuring robustness and relevance for senior decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Casino Gaming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Casino Gaming Market, by Game Type

- Casino Gaming Market, by Component

- Casino Gaming Market, by Property Type

- Casino Gaming Market, by Channel Type

- Casino Gaming Market, by Operator Type

- Casino Gaming Market, by Region

- Casino Gaming Market, by Group

- Casino Gaming Market, by Country

- United States Casino Gaming Market

- China Casino Gaming Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Takeaways to Navigate the Future Landscape of Casino Gaming with Confidence and Emerging Opportunities

The cumulative findings underscore the casino gaming industry’s transformation into a digitally enabled, data-centric sector governed by sophisticated regulatory frameworks. Key takeaways include the critical role of omnichannel integration in capturing growth across diverse demographics, the strategic imperative of navigating tariff landscapes through domestic partnerships, and the opportunity presented by emerging game formats and payment innovations. Regional differentiation remains pronounced, requiring operators to customize strategies for the Americas, EMEA, and Asia-Pacific markets based on unique regulatory and cultural conditions.

Ultimately, success will hinge on an operator’s ability to blend technological foresight with operational agility, embed responsible gaming principles into core strategies, and foster collaborative ecosystems with equipment suppliers and technology partners. By synthesizing these insights, industry stakeholders can chart a clear course toward sustainable growth, competitive differentiation, and enhanced resilience in the face of dynamic market forces and regulatory evolutions.

Engage Directly with Associate Director Ketan Rohom to Unlock Exclusive Casino Gaming Market Research Insights and Drive Your Strategic Advantage

Discover how partnering with Associate Director Ketan Rohom can accelerate your strategic ambitions by providing unparalleled access to in-depth analysis of the casino gaming sector. Engage directly to explore tailored offerings and secure exclusive pricing on the comprehensive market research report. Reach out to gain clarity on emerging trends, regulatory developments, and competitive benchmarks that will empower you to navigate volatility and capture new growth opportunities. By leveraging this strategic engagement, you will access customized insights, detailed data appendices, and interactive presentations designed to inform critical decisions and enhance your market positioning. Take the next step in reinforcing your competitive edge by scheduling a consultation and securing immediate delivery of the executive summary and full report.

- How big is the Casino Gaming Market?

- What is the Casino Gaming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?