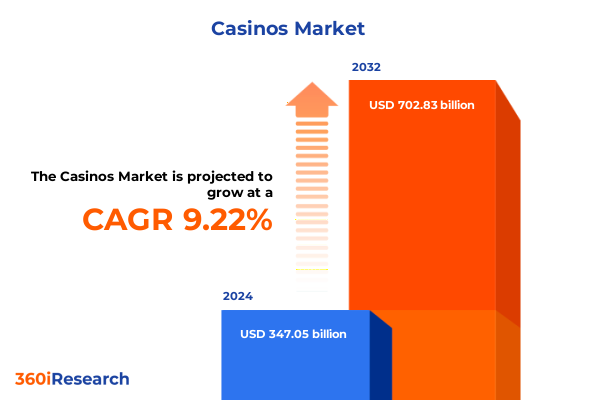

The Casinos Market size was estimated at USD 379.76 billion in 2025 and expected to reach USD 408.22 billion in 2026, at a CAGR of 9.19% to reach USD 702.83 billion by 2032.

Unveiling the Pivotal Innovations Regulatory Changes and Market Forces Redefining Casino Competitiveness in 2025

The casino industry in 2025 is defined by a convergence of digital innovation, evolving consumer expectations, and shifting regulatory frameworks that collectively influence competitive positioning. As operators navigate an increasingly complex environment, an understanding of the foundational drivers and current dynamics is essential. In recent years, the proliferation of mobile platforms and the integration of immersive technologies such as virtual reality have transformed how players engage with traditional casino offerings. Consequently, operators that invest in seamless omni-channel experiences are witnessing elevated engagement and extended customer lifetime value.

Concurrently, regulatory bodies across states have adapted their oversight to address the unique challenges posed by online wagering, data privacy, and anti-money-laundering requirements. These developments have prompted operators to enhance compliance infrastructures while balancing the need for innovation. In this context, collaboration with technology partners and regulators has become a strategic imperative. As a result, the industry’s ability to respond to regulatory shifts and leverage emerging technologies will define market leadership moving forward.

Examining the Technological Disruption Player Behavior Evolution and Responsible Gaming Imperatives Shaping Casino Experiences

The landscape of casino gaming has undergone transformative shifts driven by technological advancements and changing consumer behavior. Mobile penetration rates have soared, allowing wagering and interactive entertainment to transcend the confines of physical venues. Meanwhile, data analytics and artificial intelligence have empowered operators to deliver personalized promotions and real-time recommendations, significantly enhancing player loyalty and revenue diversification. As a result, the lines between land-based and digital casinos have blurred, compelling operators to adopt an integrated approach that prioritizes frictionless transitions between platforms.

In parallel, social gaming and skill-based contests have gained momentum among younger demographics, prompting operators to innovate game portfolios that cater to a broader spectrum of player preferences. At the same time, the emphasis on responsible gaming tools has intensified, leading to the implementation of real-time monitoring systems and self-exclusion features across channels. Together, these transformative shifts underscore the importance of agility, technological investment, and customer-centric design in shaping the industry’s next phase of growth.

Analyzing the Multifaceted Consequences of 2025 Trade Measures on Procurement Strategies and Operational Resilience in Casinos

United States tariffs introduced in 2025 have exerted a notable influence on the casino ecosystem by impacting the import costs of gaming equipment, technology components, and related services. Tariffs on electronic gaming machines and casino management systems have prompted operators to reassess supplier relationships and pursue new procurement strategies. As import costs rose, several leading operators renegotiated contracts and diversified their vendor base to mitigate margin erosion. Consequently, domestic manufacturers of gaming cabinets and systems have gained increased consideration, driving discussions around onshore production and supply chain resilience.

Moreover, the tariffs have catalyzed a broader industry conversation regarding the balance between cost pressures and the imperative to upgrade aging infrastructure. Some operators have accelerated their transition to cloud-based platforms and software-as-a-service models to reduce reliance on hardware imports. In parallel, partnerships between hardware providers and local technology firms have emerged, aiming to co-develop next-generation gaming solutions that comply with both tariff regulations and evolving player expectations. Ultimately, the 2025 tariff adjustments have reinforced the need for strategic supply chain management and innovation in procurement.

Uncovering Key Distinctions in Casino and Game Archetypes Plus Ownership Models to Guide Custom Strategy Formulation

Insight into the market’s segmentation reveals critical nuances that operators must consider when tailoring their offerings. Based on casino type, the bifurcation between land-based venues and online platforms highlights differing investment priorities, customer engagement tactics, and regulatory obligations. Land-based operators continue to emphasize experiential elements such as integrated resorts and VIP programs, whereas online platforms focus on user interface design, digital wallet integration, and cross-promotion with sports-betting verticals.

When examined by game type, the diversity of player preferences becomes even more apparent. Traditional games such as poker, slots, and table games coexist with emerging verticals like sports betting, each requiring distinct operational capabilities. Within poker, the strategic popularity of both Omaha and Texas Hold’em underscores the importance of tournament structures and prize pools. In the slots domain, operators balance classic and video variants to cater to nostalgic players as well as those seeking immersive audiovisual experiences. Sports betting continues to evolve through the dichotomy of in-play and pre-match offerings, demanding sophisticated real-time odds and risk management tools. Table games, meanwhile, span high-roller-focused baccarat and blackjack to mass-market staples such as craps and roulette, each with unique dealer training and pit-management requirements.

Considering ownership models, the distinction between government-owned and private enterprises informs both capital allocation and strategic objectives. Government-owned casinos often prioritize social impact, employment metrics, and community reinvestment, whereas private operators are driven by shareholder returns and growth optimization. Taken together, these segmentation insights illuminate the multifaceted nature of market opportunities and the need for tailored strategies across product, channel, and governance dimensions.

This comprehensive research report categorizes the Casinos market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Casino Type

- Game Type

- Ownership

Traversing the Diverse Regulatory Frameworks Consumer Preferences and Market Maturity Levels Across Global Casino Regions

Geographical dynamics play a pivotal role in shaping competitive intensity and consumer preferences across regions. In the Americas, the maturation of online regulation and the proliferation of integrated resort projects have driven a renaissance in destination gaming. Regions with established land-based hubs have witnessed digital extensions that amplify brand reach, while emerging jurisdictions have adopted dual licensing frameworks to attract investment.

Across Europe, the Middle East, and Africa, regulatory heterogeneity and market liberalization efforts have spurred both opportunity and complexity. Some European markets have introduced tighter responsible gaming standards and advertising restrictions, prompting operators to innovate within compliance boundaries. Meanwhile, select Middle Eastern jurisdictions have initiated pilot projects for tourism-oriented casinos, reflecting a cautious but exploratory stance toward gaming. In parts of Africa, digital penetration and mobile money ecosystems have enabled nascent online wagering markets with considerable growth potential.

Within Asia-Pacific, the interplay between mass-market gaming and luxury integrated resorts defines the landscape. Established centers continue to invest in ultra-premium amenities and high-stakes gaming, while alternative markets explore digital channels and skill-based concepts. Regulatory approaches vary widely, from monopolized land-based licensing to liberal online frameworks, creating a mosaic of strategic entry points for domestic and international operators alike.

This comprehensive research report examines key regions that drive the evolution of the Casinos market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Alliances Technology Partnerships and Portfolio Diversification Trends among Pioneering Casino Operators

Leading companies have adopted varying strategies to cement their positions in a dynamic environment. Major integrated resort operators have prioritized portfolio diversification by investing in adjacent entertainment, hospitality, and retail assets. This approach has enabled them to create holistic guest experiences and capture cross-selling opportunities. Simultaneously, pure-play online operators have focused on technology differentiation, leveraging scalable platforms, proprietary algorithms, and seamless payment integrations to outpace competitors.

Joint ventures and strategic alliances have emerged as critical vehicles for market entry and risk sharing. Partnerships between established gaming firms and regional hospitality groups have facilitated local expertise integration, regulatory navigation, and accelerated licensing. In parallel, tech-focused collaborations have driven the co-development of innovative game content and back-end solutions to meet evolving player demands. Meanwhile, some public sector owned entities have explored privatization and management contracts to access private capital, operational efficiencies, and global best practices. Collectively, these strategic maneuvers underscore the importance of adaptability and collaborative innovation among top-tier companies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Casinos market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aristocrat Leisure

- Bally's Corporation

- Boyd Gaming

- Caesars Entertainment

- DraftKings

- Entain

- Evolution Gaming

- Flutter Entertainment

- Française des Jeux

- Genting Malaysia Berhad

- Las Vegas Sands

- Light & Wonder

- Lottomatica Group

- Melco International Development

- Melco Resorts & Entertainment

- MGM China Holdings

- MGM Resorts International

- OPAP Organization of Football Prognostics

- Penn National Gaming

- Red Rock Resorts

- Super Group

- The Lottery Corporation

- Wynn Resorts

Empowering Operators to Lead Through Tech-Enabled Alliances Cost Optimization and Region-Specific Market Adaptation

Industry leaders should seize the momentum of digital transformation by forging deeper alliances with technology innovators specializing in AI, cloud computing, and immersive media. By co-creating tailored solutions, operators can accelerate deployment cycles, enhance security, and unlock new monetization streams. Furthermore, integrating responsible gaming features at the design stage of digital platforms will not only meet regulatory expectations but also foster long-term customer trust and brand loyalty.

To address cost pressures from external factors such as tariffs, operators must adopt dynamic procurement frameworks that emphasize supply chain visibility and modular sourcing. Engaging regional suppliers for hardware and partnering with software-as-a-service providers can mitigate import dependencies while maintaining access to advanced technologies. Additionally, leveraging advanced data analytics to optimize promotional spend and customer segmentation will drive more efficient capital allocation and improve campaign ROI.

Lastly, multinational operators should tailor regional strategies by aligning market entry and expansion plans with local regulatory nuances, demographic trends, and competitive intensity. Engaging local stakeholders through structured advisory councils and community partnerships will expedite licensing processes and reinforce corporate social responsibility credentials.

Detailing the Integrated Secondary Primary and Quality Assurance Techniques Ensuring Methodological Integrity of Our Casino Market Analysis

The research methodology underpinning this analysis combines rigorous secondary and primary data collection to ensure accuracy and relevance. Initially, comprehensive secondary research included the review of publicly available filings, regulatory publications, industry journals, and conference presentations. These insights provided context on macroeconomic factors, regulatory shifts, and technology trends shaping the casino landscape.

Subsequently, primary research involved structured interviews with senior executives, technology partners, and regulatory authorities across key markets. These firsthand perspectives validated secondary findings and offered nuanced insights into strategic priorities, investment rationales, and operational challenges. Data triangulation techniques were employed to reconcile discrepancies and ensure that conclusions reflected both quantitative metrics and qualitative themes.

Finally, the analysis underwent a multi-tiered quality assurance process, encompassing expert peer reviews and statistical checks. This approach guaranteed methodological integrity, minimized bias, and upheld the highest standards of market research rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Casinos market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Casinos Market, by Casino Type

- Casinos Market, by Game Type

- Casinos Market, by Ownership

- Casinos Market, by Region

- Casinos Market, by Group

- Casinos Market, by Country

- United States Casinos Market

- China Casinos Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Technological Agility Regulatory Acumen and Customer-Centric Strategies to Thrive in the Modern Casino Ecosystem

In conclusion, the casino industry in 2025 stands at an inflection point characterized by technological convergence, evolving consumer engagement models, and shifting regulatory landscapes. Operators that proactively embrace digital innovation, from AI-driven personalization to cloud-native infrastructure, will differentiate themselves in a crowded marketplace. At the same time, strategic procurement adaptations in response to tariff dynamics will safeguard profitability while enabling continued investment in customer experience.

Moreover, a nuanced understanding of market segmentation-spanning casino type, game variants, and ownership structures-along with region-specific regulatory and demand considerations, will inform more effective strategic planning. Leading companies are demonstrating that agile partnerships, whether through alliances with technology providers or joint ventures with local stakeholders, are key to navigating uncertainty and unlocking new growth avenues.

Ultimately, success in this environment hinges on the ability to integrate responsible gaming principles, data-driven insights, and tailored customer journeys across channels. By doing so, industry leaders can drive sustainable performance and create value for all stakeholders in the evolving casino ecosystem.

Engage with Our Expert Sales and Marketing Leader to Access Custom Market Intelligence and Drive Strategic Growth through Our Comprehensive Report

To gain deeper insights tailored to your organization’s strategic imperatives and to unlock the full potential of this in-depth market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through bespoke data applications, premium analytics, and targeted recommendations aligned with your growth objectives. Engage today to drive measurable outcomes, optimize return on investment, and secure a competitive edge in the evolving casino landscape

- How big is the Casinos Market?

- What is the Casinos Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?