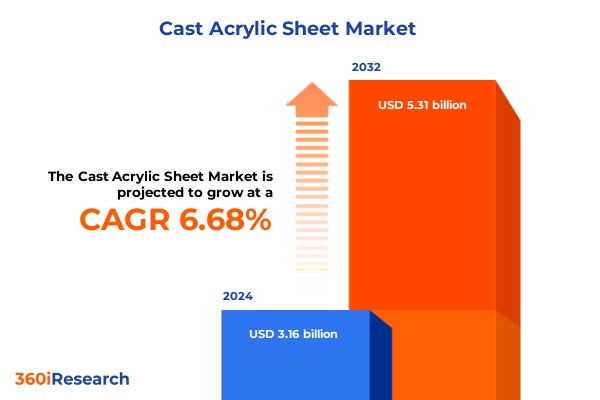

The Cast Acrylic Sheet Market size was estimated at USD 3.36 billion in 2025 and expected to reach USD 3.58 billion in 2026, at a CAGR of 6.72% to reach USD 5.31 billion by 2032.

Exploring the Versatile World of Cast Acrylic Sheet: Unveiling the Material’s High-Performance Qualities and Expansive Applications

Cast acrylic sheet, a high-purity form of polymethyl methacrylate, has emerged as a cornerstone material in industries requiring exceptional optical clarity and durable performance. Renowned for its shatter-resistant properties, lightweight nature, and versatile fabrication options, this synthetic polymer has become a preferred alternative to traditional glass across architectural glazing, signage, and protective barriers. Its inherent ability to transmit light while resisting impact and ultraviolet degradation positions it as a resilient solution in both indoor and outdoor environments.

Manufacturers employ two primary casting techniques-cell cast and continuous cast-to produce sheets that meet varied specifications in thickness, surface finish, and structural integrity. Cell cast acrylic offers superior thickness consistency and mechanical strength, making it ideal for demanding applications, whereas continuous cast processes yield cost efficiencies and uniform appearance suitable for large-scale signage and display systems. These complementary methods ensure that the market can accommodate bespoke requirements without compromising on quality.

The expanding demand for cast acrylic sheet is fueled by the material’s proven track record in sectors such as transportation, where lightweight glazing reduces vehicle mass and improves fuel efficiency, and in the medical field, where biocompatible enclosures and laboratory apparatus leverage acrylic’s chemical resistance and optical transparency. As the material’s performance benchmarks continue to inspire new use cases, stakeholders are adapting to shifting consumer and regulatory expectations with a focus on innovation.

Looking ahead, the industry is witnessing a convergence of digital fabrication technologies and eco-centric initiatives that promise to redefine how cast acrylic sheet is specified, produced, and repurposed. From laser-cutting capabilities that allow intricate design overlays to renewable energy integrations in manufacturing, the material’s evolution underscores its central role in shaping resilient, efficient, and sustainable solutions for tomorrow’s infrastructure and product design landscapes.

Navigating Industry-Defining Shifts in Cast Acrylic Production with Digital Customization, Sustainability, and Supply Chain Resilience

Over the past year, the cast acrylic sheet industry has experienced transformative shifts driven by a quest for tailored solutions and sustainable practices. Digital fabrication, including high-precision CNC machining and laser engraving, has empowered fabricators to deliver complex geometries and personalized aesthetics at scale, catering to clients seeking distinct branding and architectural expression. This customization wave, supported by on-demand production models, has reduced lead times and fostered agile responses to evolving market requirements.

Concurrently, supply chain resilience has become paramount as manufacturers contend with geopolitical uncertainties and tariff fluctuations. Many industry participants are exploring nearshoring initiatives, establishing production hubs closer to major consumption centers in the Americas to minimize logistical risk and currency exposure. This trend aligns with broader strategies to secure upstream feedstock through strategic partnerships and vertical integration, ensuring consistent material availability and cost predictability.

Sustainability has further reshaped the landscape, with regulators and buyers alike demanding eco-friendly materials and end-of-life solutions. Companies are adopting closed-loop recycling systems and bio-based resin alternatives to reduce carbon footprints and comply with directives such as the European Single-Use Plastics Directive and California’s circular economy mandates. Blockchain-enabled traceability platforms are also gaining traction, allowing transparent verification of recycled content and reinforcing trust among environmentally conscious stakeholders.

Assessing the Multifaceted Impact of 2025 US Tariff Reforms on Cast Acrylic Sheet Supply Chains and Domestic Production Dynamics

In 2025, the United States enacted a series of tariff reforms targeting imported plastic products, including cast acrylic sheets, in an effort to bolster domestic manufacturing. The additional levies, which raised duties on selected polymer feedstocks by up to a quarter, translated into landed cost increases of approximately one-fifth to one-quarter for acrylic sheet imports, with procurement managers reporting surges of 18 to 22 percent in import expenses.

These escalated tariffs prompted a strategic pivot among downstream fabricators and original equipment manufacturers. Many began exploring nearshore manufacturing hubs within Latin America to mitigate the steepest cost burdens and optimize transportation routes. Simultaneously, larger players accelerated investments in domestic polymerization facilities, expanding capacity along the Gulf Coast and in the Rust Belt to capitalize on existing petrochemical infrastructure and favorable logistics networks.

Stakeholders have also embraced technological innovations to offset input cost pressures. Research and development efforts are now prioritizing alternative chemistries and high-performance copolymers that reduce dependence on imported methyl methacrylate, while long-term supply agreements and just-in-time inventory frameworks help optimize working capital and minimize exposure to further tariff volatility. Collectively, these measures underscore the industry’s adaptability in navigating a more protectionist trade environment.

Decoding Key Market Segmentation Layers to Understand the Diverse Demand Patterns in Cast Acrylic Sheets Across Multiple Dimensions

Understanding market segmentation in the cast acrylic sheet industry requires an appreciation of how material composition drives performance outcomes and end-use suitability. Material Type segmentation distinguishes between cell cast acrylic, valued for its exceptional mechanical resilience and uniform thickness, and continuous cast acrylic, which offers economies of scale and consistent visual clarity for high-volume signage and display applications. This dichotomy enables fabricators to align product selection with structural demands and cost objectives.

Product Form segmentation further refines market dynamics, with sheets dominating architectural glazing and retail displays due to their easy integration into large panels, while rods and expanded mesh variants cater to specialized structural and design requirements. These diverse geometries allow designers and engineers to leverage acrylic’s lightweight strength in both load-bearing contexts and ornamental installations.

Color preferences also shape demand, as clear and transparent formulations are preferred for applications demanding maximum light transmission, whereas colored options-subdivided into opaque and translucent-provide branding flexibility and diffuse lighting effects in signage and decorative furnishings. The interplay between visual impact and functional attributes drives innovation in pigmentation techniques and UV inhibitors to ensure durability across environmental exposures.

Finish Type segmentation highlights the importance of surface characteristics, with anti-reflective coatings reducing glare in digital display and medical equipment contexts, while glossy and matte finishes address aesthetic preferences in furniture and interior design. Textured surfaces further expand the creative palette, offering tactile depth and non-slip properties for architectural partitions and protective barriers.

Application segmentation reveals that architecture leads demand through facades, partitions, and skylights, leveraging acrylic’s weather resistance and structural integrity; automotive applications use molded acrylic components to reduce vehicle weight; furniture makers integrate chairs, shelving, and tables with acrylic accents for modern design appeal; and signage fabricators employ indoor and outdoor display solutions optimized for visibility and longevity.

Finally, End-Use Industry segmentation underscores construction’s bifurcation into commercial and residential projects, where acrylic enhances energy efficiency and aesthetic versatility, while the medical sector’s growth in laboratory and equipment applications draws on acrylic’s chemical inertness. Retail utilization in display cases and store fixtures capitalizes on the material’s optical clarity and formability to showcase merchandise effectively, and transportation infrastructure relies on acrylic’s durability in protective barriers and wayfinding systems.

This comprehensive research report categorizes the Cast Acrylic Sheet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Form

- Color

- Finish Type

- Application

- End-Use Industry

Unearthing Regional Market Variations Revealing How the Americas, EMEA, and Asia-Pacific Are Shaping the Future of Cast Acrylic Sheets

Regional analyses of the cast acrylic sheet market unveil contrasting drivers and strategic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a robust domestic petrochemical base underpins steady supply, while recent tariff realignments have encouraged local fabrication and reduced reliance on overseas imports. Manufacturers in the region prioritize just-in-time delivery models and service integration to meet short lead-time demands and to capitalize on North American growth in infrastructure and signage projects.

Across Europe Middle East & Africa, stringent regulatory frameworks and a heightened emphasis on sustainability steer procurement decisions. Buyers in this region are increasingly sourcing recycled and bio-based acrylics to align with the European Union’s environmental directives and to respond to consumer demand for eco-friendly materials. Concurrently, the Middle East’s investment in landmark architectural developments continues to drive demand for high-performance glazing and decorative applications, reinforcing the region’s strategic importance.

The Asia-Pacific landscape remains the largest consumption hub, driven by rapid urbanization and extensive manufacturing capacity in China, India, and Southeast Asia. Competitive pricing structures and vertical integration across the value chain sustain the region’s export orientation, supplying markets worldwide. Nevertheless, cost sensitivities and fluctuating feedstock prices underscore the need for innovation and diversification, prompting local producers to invest in high-margin, value-added finishing capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cast Acrylic Sheet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Sustainability, and Capacity Expansion in the Cast Acrylic Sheet Marketplace

Leading companies in the cast acrylic sheet arena are distinguished by their commitment to operational excellence, sustainability, and technological advancement. Global chemical conglomerates such as Arkema and Mitsubishi Chemical have prioritized capacity expansions and product portfolio enhancements, focusing on specialty grades with improved UV resistance and mechanical toughness. Their extensive R&D investments facilitate the introduction of novel copolymer blends that address emerging performance requirements in automotive and architectural markets.

Specialty resin producers like Evonik and Lucite International are leveraging partnerships with biotechnology firms to pioneer bio-derived methyl methacrylate feedstocks and to scale closed-loop recycling initiatives. These collaborations underscore an industry-wide shift toward circular economy practices, with take-back programs and blockchain-based traceability frameworks ensuring a reliable supply of recycled material without compromising quality.

Mid-tier fabricators and distribution specialists such as Plaskolite have differentiated through integrated service offerings, combining precision fabrication, custom finishing, and just-in-time logistics to deliver turnkey solutions. Their agile manufacturing footprints enable rapid response to regionally diverse specifications, positioning them as preferred suppliers for projects requiring both technical acumen and design flexibility. Through these strategic imperatives, leading companies are setting new benchmarks for performance, sustainability, and customer engagement in the cast acrylic sheet marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cast Acrylic Sheet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites GmbH

- Acrypoly

- Akmy Polyplast LLP

- Aristech Surfaces LLC by Trinseo

- Arkema S.A.

- Asia Poly Holdings Berhad

- Gevacril Srl

- Irpen S.A.U.

- Polyplastics Co., Ltd.

- POLYVANTIS Sanford LLC

- PT. ASTARI NIAGARA INTERNASIONAL

Crafting Actionable Strategies for Industry Leaders to Thrive Amid Disruption in the Cast Acrylic Sheet Supply Chain and Market Dynamics

Industry leaders seeking to navigate the evolving cast acrylic sheet environment should consider a multi-pronged strategy that balances cost efficiency with innovation. Securing diversified feedstock channels through strategic partnerships and nearshore sourcing will mitigate future trade uncertainties and reduce exposure to tariff volatility. Concurrently, investing in bio-based resin development and closed-loop recycling infrastructure can elevate sustainability credentials while ensuring compliance with emerging environmental regulations.

Adopting advanced digital fabrication and automation platforms enhances agility, enabling precise customization and faster time to market for bespoke applications. Companies should augment this capability by integrating robust CRM and ERP solutions to streamline order management and optimize production planning. Developing end-to-end premium service offerings-ranging from in-house finishing to integrated logistics-will differentiate suppliers and cultivate long-term customer relationships.

Finally, fostering cross-functional collaboration between R&D, operations, and commercial teams will be essential to translate market insights into viable product innovations. By embedding lifecycle assessment and carbon tracking into product development cycles, organizations can proactively address stakeholder demands for transparency and measurable sustainability outcomes. This holistic approach will empower industry leaders to capitalize on growth opportunities while building resilience against future disruptions.

Illuminating the Rigorous Research Methodology Behind Our Comprehensive Analysis of Global Cast Acrylic Sheet Industry Trends and Insights

To develop a comprehensive understanding of the global cast acrylic sheet industry, our research methodology combined rigorous qualitative and quantitative techniques. We conducted in-depth interviews with senior executives, technical experts, and procurement managers across key regions, capturing firsthand insights into evolving supply chain dynamics, material preferences, and regulatory challenges. These primary perspectives were complemented by extensive secondary research, encompassing trade association publications, corporate filings, and regulatory databases, ensuring a robust contextual foundation.

Data points were systematically triangulated through cross-verification across multiple sources to maintain accuracy and consistency. Market segmentation matrices were constructed using both top-down and bottom-up approaches, aligning end-use patterns with production capacities and distribution networks. Regional analyses incorporated country-level macroeconomic indicators and infrastructure investment trends to gauge demand drivers. Sustainability assessments drew on lifecycle analyses and third-party certification frameworks to evaluate environmental performance metrics.

This multi-layered methodology ensured that the findings and recommendations are grounded in real-world intelligence and reflect the latest industry developments. Each insight was subjected to internal peer review and expert validation, guaranteeing that the final report delivers actionable intelligence and strategic clarity for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cast Acrylic Sheet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cast Acrylic Sheet Market, by Material Type

- Cast Acrylic Sheet Market, by Product Form

- Cast Acrylic Sheet Market, by Color

- Cast Acrylic Sheet Market, by Finish Type

- Cast Acrylic Sheet Market, by Application

- Cast Acrylic Sheet Market, by End-Use Industry

- Cast Acrylic Sheet Market, by Region

- Cast Acrylic Sheet Market, by Group

- Cast Acrylic Sheet Market, by Country

- United States Cast Acrylic Sheet Market

- China Cast Acrylic Sheet Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Insights on the Cast Acrylic Sheet Landscape to Summarize Critical Takeaways for Stakeholders and Decision-Makers

The cast acrylic sheet industry stands at a strategic inflection point driven by tariff realignments, sustainability imperatives, and technological innovations. While protective trade measures have catalyzed domestic manufacturing resurgence, they have also introduced cost pressures that necessitate agile sourcing and process optimization. Simultaneously, the rise of circular economy practices and bio-based materials is reshaping value chains, compelling companies to integrate environmental stewardship into their core strategies.

Market segmentation underscores the diversity of demand profiles, from structural glazing and automotive components to specialty furniture applications and medical enclosures. Regional dynamics reveal that each geography requires tailored approaches-whether by leveraging local petrochemical hubs, complying with stringent environmental regulations, or capitalizing on rapid urbanization in emerging markets. Leading industry players are differentiating through service integration, capacity expansions, and sustainability initiatives, setting benchmarks for performance and customer engagement.

Looking forward, actionable strategies centered on feedstock diversification, digital manufacturing, and cross-functional collaboration will be critical to sustaining growth and resilience. By aligning innovation with market needs and regulatory expectations, stakeholders can unlock new value streams and secure competitive advantage.

Connect with Ketan Rohom to Secure Exclusive Access to the Definitive Cast Acrylic Sheet Market Research Report and Unlock Growth Opportunities

Unlock a deeper understanding of cast acrylic sheet dynamics and strategic opportunities by securing the full market research report. Ketan Rohom, Associate Director, Sales & Marketing, offers personalized guidance to demonstrate how this intelligence can drive your organization’s growth and operational resilience. Engage with Ketan Rohom today to discuss tailored solutions, gain exclusive access to detailed data, and chart a clear path forward in this rapidly evolving industry landscape.

- How big is the Cast Acrylic Sheet Market?

- What is the Cast Acrylic Sheet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?