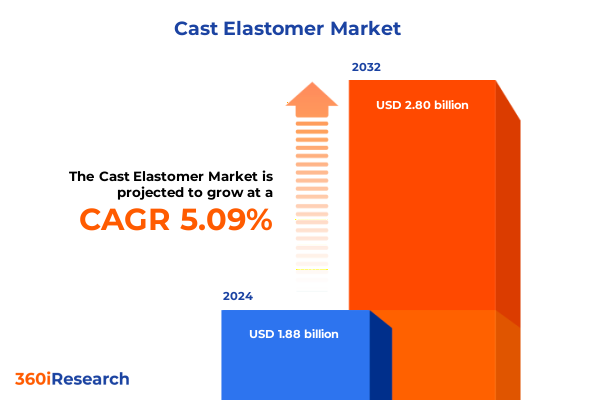

The Cast Elastomer Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.07 billion in 2026, at a CAGR of 5.13% to reach USD 2.80 billion by 2032.

Navigating the Core Dynamics of the Cast Elastomer Industry through an Authoritative Introduction to Key Market Drivers and Foundational Trends

Cast elastomers represent a versatile class of thermoset materials characterized by their exceptional resilience, durability, and ability to absorb energy across a wide range of operating conditions. Produced through precise casting processes that convert reactive monomers into fully cured elastomeric components, they have become indispensable in industries that demand high performance under mechanical stress, chemical exposure, or extreme temperatures. From vibration‐damping mounts in heavy machinery to medical device components requiring biocompatibility, these materials bridge critical application gaps that conventional elastomers or rigid plastics cannot address.

Driven by an intersection of technological advancement and evolving customer requirements, the cast elastomer industry is witnessing a synthesis of innovation and functionality. Manufacturers are refining formulations to achieve finely tuned hardness profiles, enhanced chemical resistance, or accelerated cure times. Concurrently, end‐use sectors continue to prioritize lightweighting, durability, and long lifecycle performance, reinforcing the importance of cast elastomers as foundational materials in both legacy and emerging applications.

Amidst these developments, this report offers an authoritative introduction to the fundamental drivers shaping the cast elastomer market. It illuminates pivotal trends in raw material selection, regulatory influences on formulation design, and emerging customer expectations. Furthermore, it lays the groundwork for a deeper exploration of segmentation, regional dynamics, leading competitors, and strategic recommendations that follow.

Unveiling Transformative Shifts Reshaping the Cast Elastomer Landscape with Technological, Regulatory, and Consumer-Driven Paradigm Changes

The cast elastomer landscape is undergoing profound transformation as technological breakthroughs, sustainability imperatives, and shifting customer preferences redefine traditional value chains. Automated casting lines equipped with real-time monitoring now deliver consistent part quality at unprecedented throughput rates. Moreover, the integration of advanced simulation tools allows formulators to predict mechanical behavior under complex loading scenarios, accelerating the development cycle for new material grades.

Concurrently, an intensified focus on environmental responsibility has spurred the adoption of bio‐based polyols and low-VOC reactive systems. Producers are investing in green chemistry to reduce carbon footprints without sacrificing performance, responding to both evolving regulations and end-user sustainability mandates. Additionally, digital connectivity has become a strategic asset, enabling remote performance tracking of deployed components through embedded sensors and IoT platforms.

Beyond manufacturing innovations, the customer landscape itself is shifting. End‐use industries demand greater customization, requiring modular approaches to hardness, shape, and chemical resistance. As a result, strategic partnerships between raw material suppliers, compounders, and OEMs are becoming more common, facilitating co-development of next-generation cast elastomer solutions. Taken together, these transformative shifts underscore a market in dynamic flux-ready to reward organizations that align technological prowess with agile, customer-centric strategies.

Assessing the Cumulative Impact of 2025 United States Tariffs on Cast Elastomer Raw Materials and Strategic Industry Responses

In 2025, a series of tariff adjustments on key chemical imports into the United States have exerted a cumulative influence on the cast elastomer supply chain. Tariffs imposed on aromatic isocyanates and specialty polyols have driven up upstream costs, placing pressure on compounders and manufacturers to absorb margin erosion or pass costs downstream. This dynamic has prompted many organizations to reevaluate supplier portfolios, seeking alternative sources in domestic or low-tariff markets to mitigate volatility.

Moreover, the presence of duties on certain prepolymer imports has accelerated strategic initiatives to localize production. Several major chemical producers announced planned capacity expansions of MDI and TDI facilities on U.S. soil, aiming to secure feedstock supply while sidestepping tariff burdens. At the same time, smaller specialty compounders have explored tolling partnerships to maintain cost competitiveness without committing to large‐scale capital investments.

Despite the immediate challenges of reallocating supply chains and managing price fluctuations, the tariff landscape has yielded a silver lining: a renewed emphasis on resilient sourcing strategies. Companies are adopting dual-sourcing models, building safety stock buffers, and negotiating long‐term agreements to stabilize input costs. Accordingly, the cast elastomer sector is adapting nimbly, converting policy-driven disruption into an opportunity for greater supply chain robustness moving forward.

Deriving Actionable Insights from Multi-Dimensional Segmentation of the Cast Elastomer Market Including Type Material Hardness Application and End-Use Industry Analysis

A nuanced dissection of market segmentation reveals how distinct cast elastomer categories respond to varied operational demands. When examined through the lens of process type, cold cast elastomers excel in low-temperature, low-volume applications such as prototypes or decorative parts, offering ease of handling and extended working times. In contrast, hot cast variants, which cure rapidly under elevated temperatures, are indispensable for high-volume manufacturing scenarios where throughput and cycle time efficiency dictate project viability.

Material composition further differentiates performance profiles. Polyurea systems are prized for their rapid cure kinetics and outstanding resistance to chemicals, making them well-suited for applications such as pipeline linings and abrasion-resistant coatings. Polyurethane formulations, segmented into polyester-based and polyether-based chemistries, enable a spectrum of mechanical properties: polyester‐based grades deliver superior abrasion and tensile strength, whereas polyether‐based grades offer enhanced hydrolytic stability and flexibility in fluctuating thermal environments.

Hardness segmentation underscores the functional breadth of cast elastomers. Hard grades in the Shore D 30–70 range provide structural support in machinery mounts, while medium hardness offerings (Shore A 60–90) strike a balance between load-bearing capability and vibration damping for seals, gaskets, and bushings. Soft variants (Shore A 30–60) cater to sensitive applications, including medical component inserts and protective liners, where gentle conformity and shock absorption are paramount.

Application and end-use segmentation illuminate the market’s diversity. Cast elastomer products serve as critical components in bushings and mounts that minimize equipment wear, medical parts requiring biocompatibility, and pads and liners engineered for precision fit. They also function as durable pipe linings and hoses, high-performance gaskets and seals, ergonomic shoe soles, and sturdy wheels and rollers. End-use industries span aerospace structures, agricultural machinery, automotive and transportation assemblies, construction equipment, electronics housings, footwear production, healthcare devices, industrial and machine tool contexts, mining operations, oil and gas infrastructure, and printing and packaging machinery. Each vertical imposes distinct demands, driving tailored formulation and processing strategies across the cast elastomer landscape.

This comprehensive research report categorizes the Cast Elastomer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Hardness

- Application

- End-Use Industry

Exploring Pivotal Regional Variations in Demand and Innovation for Cast Elastomers across the Americas EMEA and Asia-Pacific Territories

Regional dynamics shape both demand trajectories and innovation priorities in the cast elastomer sector, reflecting the unique economic, regulatory, and end-market characteristics of each territory. In the Americas, robust infrastructure spending and a resurgence of domestic manufacturing have fueled demand for heavy-duty vibration dampening and structural mounting solutions. North American producers benefit from proximity to OEMs in the automotive and oil and gas sectors, while Latin American markets are adopting cast elastomer solutions for agricultural equipment and mining applications.

Across Europe, the Middle East, and Africa, stringent environmental regulations and sustainability targets have catalyzed demand for low-VOC formulations and bio-based chemistries. European manufacturers lead the way in compliant production processes, investing heavily in green polyol feedstocks and energy-efficient cure technologies. Meanwhile, Middle Eastern oil and gas projects continue to leverage cast elastomers for corrosion-resistant linings, and African infrastructure initiatives are beginning to incorporate vibration-isolating bearings and mounts into heavy machinery.

In Asia-Pacific, rapid industrialization and electrification trends underpin accelerated cast elastomer adoption. China’s expansive construction and electronics sectors drive consumption of medium and hard grades, while India’s growing automotive assembly plants require tailored mounts and seals. Simultaneously, Southeast Asian manufacturers are expanding capacity for locally produced reactive chemistries to capture regional growth, illustrating a broader shift toward on-shore raw material capabilities and integrated compounder networks in the region.

This comprehensive research report examines key regions that drive the evolution of the Cast Elastomer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Dynamics among Leading Cast Elastomer Manufacturers Driving Innovation and Market Leadership

Leading manufacturers in the cast elastomer domain are distinguished by their strategic investments in innovation, supply chain resilience, and collaborative partnerships. Major chemical producers have expanded specialty prepolymer capacity, aligning upstream capabilities with compounder requirements for rapid cure and niche performance attributes. Additionally, established compounders are forging alliances with original equipment manufacturers to co-develop bespoke formulations that meet stringent operational criteria in sectors such as aerospace and medical devices.

Competitive differentiation has also emerged through acquisition activity, enabling organizations to broaden their product portfolios and enter adjacent markets. Smaller niche players capitalize on deep technical expertise to serve specialized application areas, while larger firms leverage economies of scale to offer integrated global supply solutions. Furthermore, customer support capabilities-ranging from on-site technical service to digital performance monitoring-have become decisive factors in vendor selection.

Innovation pipelines are increasingly focused on sustainable chemistries, with leading firms investing in bio-based isocyanate alternatives and recyclable formulations. These developments aim to preempt regulatory compliance challenges and align with customer commitments to circular economy principles. By combining material science R&D, strategic M&A, and service-oriented delivery models, the most successful companies continue to secure their positions at the forefront of the cast elastomer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cast Elastomer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argonics, Inc.

- BASF SE

- Carlisle Polyurethane Systems

- Chemline Inc.

- Era Polymers Pty Ltd.

- Herikon B.V.

- Huntsman Corporation

- ISOTHANE LTD.

- Lanxess AG

- LUC Group

- Mitsui Chemicals, Inc.

- NOTEDOME LTD.

- Pearl Polyurethane Systems LLC

- Polycoat Products

- PT. Mulia Mitra Solus

- PURIN Poliüretan Kimya San. ve Tic.Ltd.Şti.

- RECKLI GmbH

- SAPICI S.p.A.

- SHANDONG INOV POLYURETHANE CO., LTD.

- Sika AG

- Stratasys, Ltd.

- The Dow Chemical Company

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Position in the Cast Elastomer Sector

Industry leaders can strengthen their competitive advantage by embracing a multifaceted approach that aligns technology, partnerships, and sustainability commitments. First, diversifying raw material sourcing through dual-supplier strategies reduces exposure to tariff-driven cost spikes and supply chain disruptions. At the same time, investments in polyurea and advanced polyurethane chemistries will accelerate time-to-market for high-value applications requiring fast cure and enhanced chemical resistance.

Moreover, companies should deepen collaboration with OEMs by establishing joint innovation centers that integrate simulation capabilities and rapid prototyping. Such partnerships facilitate customized solutions, minimizing iteration cycles and ensuring that elastomeric components meet precise performance criteria. In parallel, implementing digital monitoring systems-such as embedded sensors and cloud-based analytics-enables real-time insights into part behavior, unlocking opportunities for predictive maintenance services.

Sustainability must also be a strategic cornerstone. By transitioning to bio-based polyols and low-VOC cure agents, organizations can satisfy tightening environmental standards while appealing to end users’ green procurement policies. Finally, exploring aftermarket service models for component refurbishment and lifecycle extension will open new revenue streams. Collectively, these actions will empower companies to capitalize on emerging trends, mitigate risk, and secure long-term growth in the cast elastomer sector.

Detailing a Rigorous Research Methodology Combining Primary Engagement and Secondary Analysis to Ensure Comprehensive and Reliable Cast Elastomer Market

The findings presented in this report are grounded in a rigorous research methodology designed to ensure both comprehensiveness and reliability. Primary engagement consisted of in-depth interviews with senior executives from raw material suppliers, compounders, and end-use OEMs. These discussions provided firsthand perspectives on formulation trends, supply chain challenges, and customer requirements. Simultaneously, a quantitative survey captured data on processing capacities, product mix, and technological investments across the value chain.

Secondary analysis involved a thorough review of patent literature, technical journals, industry association publications, and regulatory filings. Trade and customs data were analyzed to quantify regional production flows and import-export patterns. Data triangulation was then employed to validate insights, comparing primary feedback against secondary benchmarks and publicly disclosed company information.

Segmentation definitions were established through iterative consultation with industry stakeholders, ensuring that categories such as process type, material chemistry, hardness range, application area, and end-use vertical accurately reflect market realities. Regional performance was assessed by mapping demand drivers against macroeconomic and infrastructure indicators. Throughout the research process, all findings were subjected to peer review by experienced market analysts to uphold analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cast Elastomer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cast Elastomer Market, by Type

- Cast Elastomer Market, by Material Type

- Cast Elastomer Market, by Hardness

- Cast Elastomer Market, by Application

- Cast Elastomer Market, by End-Use Industry

- Cast Elastomer Market, by Region

- Cast Elastomer Market, by Group

- Cast Elastomer Market, by Country

- United States Cast Elastomer Market

- China Cast Elastomer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude on the Future Trajectory of the Cast Elastomer Industry Amid Evolving Market Dynamics

In synthesizing the key insights from this examination of the cast elastomer market, several strategic imperatives emerge. Technological innovation-spanning rapid cure systems, digital quality control, and sustainable chemistries-will continue to redefine capabilities and cost structures. At the same time, geopolitical and policy-driven factors, such as United States tariffs, underscore the need for resilient, diversified supply chain models that can withstand external shocks.

Segmentation analysis has highlighted the importance of tailoring formulations to specific application requirements, whether that entails the abrasion resistance of polyester-based polyurethanes or the flexibility of soft Shore A grades. Regional dynamics reveal that the Americas lead in heavy machinery applications, EMEA drives environmentally compliant production, and Asia-Pacific fuels volume growth through industrial and infrastructure investment.

Competitive strategies are converging around value-added service offerings, mergers and acquisitions for portfolio expansion, and sustainability roadmaps that align with circular economy objectives. For industry stakeholders, the path forward lies in balancing incremental performance enhancements with broader value chain integration. By applying the recommendations outlined herein, organizations can transform current challenges into opportunities and position themselves to lead in an increasingly complex and high-performance cast elastomer landscape.

Engage with Associate Director Ketan Rohom to Secure Your Detailed Cast Elastomer Market Research Report and Gain Unparalleled Strategic Insight

To obtain the comprehensive research report on the cast elastomer market and unlock unparalleled strategic insight that will inform your next moves, engage with Associate Director Ketan Rohom. With his extensive experience in guiding sales and marketing strategies, Ketan will walk you through the breadth and depth of our analysis, ensuring you understand every facet of segmentation, regional performance, and competitive dynamics. He can tailor your purchase to the ideal package-whether you need in-depth case studies on polyurea applications, detailed profiles of emerging regional producers, or actionable roadmaps for navigating tariff-led cost pressures. Reach out to Ketan to secure your copy today and position your organization at the forefront of innovation in the cast elastomer sector

- How big is the Cast Elastomer Market?

- What is the Cast Elastomer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?