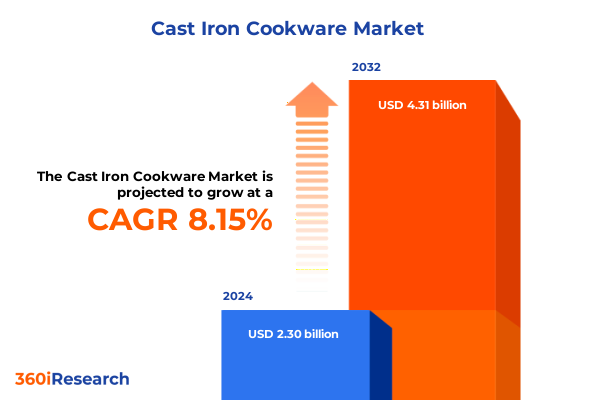

The Cast Iron Cookware Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 8.43% to reach USD 4.31 billion by 2032.

Understanding the Rising Popularity and Enduring Appeal of Cast Iron Cookware Across Modern Culinary and Lifestyle Trends

Cast iron cookware has transcended mere culinary utility to become a symbol of enduring quality and contemporary lifestyle appeal. While rooted in centuries of culinary tradition that celebrated its remarkable heat retention and robustness, modern households and professional kitchens alike have reignited their interest in these versatile pieces. The intrinsic capacity of cast iron pans, skillets, and Dutch ovens to deliver consistent, high-heat performance has resonated strongly with a generation that values authentic cooking experiences and durable product investments. Moreover, the rise of artisanal culinary movements and the burgeoning interest in farm-to-table dining have cast these heavy-duty vessels into the spotlight as the go-to tools for both casual home chefs and seasoned professionals.

Furthermore, evolving consumer priorities around sustainability and minimalist living have fueled the cookware’s resurgence, as many users now recognize its eco-conscious credentials and long lifespan. This renewed enthusiasm is supported by growing social media trends showcasing cast iron recipes, techniques, and restoration projects that celebrate each item’s patina and unique heritage. Consequently, cast iron cookware is not only appreciated for its functional benefits but also embraced as a statement of culinary passion and conscientious consumption. Amidst this backdrop, the stage is set for stakeholders to delve into a market defined by innovation, premiumization, and a deeply-rooted appreciation for tradition.

Examining the Transformational Shifts Driving Innovation Adoption and Consumer Expectations Within the Cast Iron Cookware Industry

In recent years, the cast iron cookware landscape has undergone a profound transformation driven by shifts in consumer behavior, manufacturing innovations, and channel evolution. As home cooks increasingly seek experiences that bridge the gap between rustic authenticity and modern convenience, product developers have introduced pre-seasoned surfaces, enameled finishes in vibrant hues, and refined casting techniques to appeal to diverse tastes. At the same time, there has been a notable democratization of these premium goods, with an expanding array of price points catering to both entry-level enthusiasts and high-end connoisseurs.

Moreover, the proliferation of digital channels has dramatically reshaped how cast iron offerings are discovered, evaluated, and purchased. Online marketplaces and direct-to-consumer platforms have amplified brand visibility and fostered community-driven feedback loops that guide iterative product enhancements. Concurrently, specialty retailers and brick-and-mortar showrooms have adapted, offering experiential touchpoints where consumers can see, feel, and test cookware before committing. Consequently, industry players have had to refine their omnichannel strategies, integrating e-commerce agility with the tactile assurance of offline engagement.

Additionally, sustainability imperatives and regulatory scrutiny have prompted manufacturers and suppliers to optimize material sourcing and production processes. This has led to reduced carbon footprints through localized foundries and more efficient energy use, thereby bolstering the value proposition for eco-minded buyers. Ultimately, these converging trends have accelerated innovation while setting elevated benchmarks for quality, performance, and customer experience within the cast iron cookware sector.

Assessing the Cumulative Consequences of United States Tariff Measures on the Cast Iron Cookware Sector Throughout 2025

The introduction and escalation of U.S. tariffs in 2025 targeting imported cast iron cookware have reshaped cost structures and strategic sourcing decisions across the value chain. Initially implemented to protect domestic foundries and curb trade imbalances, the cumulative tariff burden has translated into higher landed costs for many imported enameled and bare cast iron products. Consequently, distributors and retailers have confronted margin compression and, in many cases, have been compelled to adjust pricing, which has influenced consumer purchasing patterns.

Furthermore, domestic manufacturers have experienced both relief and new challenges amid these trade measures. While tariff protection has enhanced the competitiveness of U.S.-based foundries by narrowing the gap with lower-cost overseas rivals, pressure remains to scale production and uphold quality standards. In response, some domestic producers have invested in advanced manufacturing technologies and process automation to boost throughput, minimize production costs, and maintain consistency. This has yielded a more resilient domestic supply base but has also necessitated capital expenditure and operational realignment.

In addition, the ripple effects of tariff-driven supply chain realignments have spurred partnerships with alternate low-cost domestic metal suppliers, and, in certain instances, prompted companies to explore nearshoring strategies. As a result, lead times have shortened for some product categories, while for others, particularly specialty enameled lines, availability has tightened due to limited local capacity. These cumulative impacts underscore the importance for stakeholders to continually monitor trade policy developments and reassess sourcing tactics to sustain competitiveness in a dynamically tariff-influenced marketplace.

Uncovering Key Consumer and Trade Segment Dynamics Across Product, Surface Finish, Distribution, and End User Categories in Cast Iron Cookware

Analysis across product type reveals a pronounced consumer preference for skillets and Dutch ovens, which together embody versatility for stovetop searing and oven-based stews. Meanwhile, griddles and grill pans have climbed in prominence as at-home grilling experiences continue to captivate culinary enthusiasts. The fondue pot segment remains a niche favorite, drawing interest from those seeking interactive dining experiences and specialty applications. Transitioning to surface finish, the bare category holds strong appeal for traditionalists who value the authentic patina that develops with seasoning; within this realm, both pre-seasoned and regularly seasoned offerings coexist, catering to novice cooks and seasoned professionals alike. Conversely, the enameled segment has carved out its own loyal following, especially through colored finishes that add aesthetic flair, while plain enameled variants align with minimalist kitchen designs.

Moreover, distribution channel insights underscore an evolving dynamic between traditional and digital touchpoints. Department stores continue to attract those desiring an immersive retail environment, yet online channels have become indispensable for convenience-driven and younger demographics, fostering robust direct-to-consumer engagement. Specialty cookware stores maintain their authority by providing expert guidance and hands-on demonstrations that resonate with serious home chefs and commercial kitchen buyers. Finally, examining end user distinctions, the commercial segment remains steady with durable, high-volume cast iron demands from restaurants, hotels, and institutional kitchens, while the home segment has surged, driven by the experiential cooking trend among residential consumers. These intersecting segment dynamics highlight the multifaceted nature of the market and the necessity for tailored strategies that align with distinct consumer and trade cohorts.

This comprehensive research report categorizes the Cast Iron Cookware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Surface Finish

- End User

- Distribution Channel

Delivering Powerful Regional Perspectives on Demand Patterns and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, the cast iron cookware market is anchored by both legacy domestic manufacturers and a broad base of passionate home cooks who prize durability and authenticity. North American consumers demonstrate a strong appetite for versatile cookware that serves weekend grilling rituals and weekday meal preparation alike. At the same time, Latin American markets exhibit growing demand for affordable enameled pieces that marry color vibrancy with functionality. Transitioning to Europe, Middle East & Africa, premiumization sets the tone, with Western European consumers gravitating toward heritage brands known for artisanal craftsmanship and sophisticated enameled palettes. In the Middle East, cast iron’s heat retention aligns well with traditional cooking methods, and modern upscale developments have spurred interest in designer finishes. Africa presents emerging pockets of growth where expanding hospitality sectors are exploring heavy-duty cookware for commercial kitchens.

Meanwhile, the Asia-Pacific region paints a diverse picture. In North Asia, culinary traditions featuring woks and flat pans have gradually integrated cast iron griddles and skillets, driving interest in fusion cooking techniques. Southeast Asian markets respond favorably to budget-friendly cast iron options that withstand high-heat stir-frying, while Australia and New Zealand balance between outdoor grilling culture and indoor culinary pursuits, thus sustaining demand for versatile cookware forms. Moreover, emerging markets across South Asia are showing early-stage adoption, propelled by rising middle-class incomes and increased interest in home cooking innovations. Across these regions, supply chain considerations, consumer education, and channel maturation all play pivotal roles in shaping growth trajectories and competitive positioning.

This comprehensive research report examines key regions that drive the evolution of the Cast Iron Cookware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Positioning, Product Innovation, and Competitive Strengths of Leading Cast Iron Cookware Makers Shaping Industry Evolution

Within the dynamic landscape of cast iron cookware, certain established and emerging players are defining competitive benchmarks through strategic innovation and brand equity. One renowned domestic foundry has leveraged its multi-generational legacy to reinforce its reputation for intrinsically durable, pre-seasoned skillets and Dutch ovens, complemented by targeted product launches that refresh signature lines with modern colorways. An iconic European tabletop specialist has doubled down on premium enameled collections, offering limited-edition finishes and collaborations with culinary influencers to maintain aspirational brand positioning. Additionally, a boutique American startup has disrupted the market through small-batch handcrafted pans, focusing on minimalist aesthetics and transparent sourcing to appeal to design-conscious consumers.

Meanwhile, a global cookware conglomerate has optimized its supply chain network to balance cost efficiencies with geographic reach, ensuring rapid fulfillment and strong presence across both online marketplaces and brick-and-mortar retailers. Another key player has invested heavily in surface innovation, rolling out proprietary non-stick-enabling seasoning technologies that reduce seasoning time while preserving the sought-after patina. Furthermore, specialty importers and distributors have carved out niche dominance by curating exclusive lines from artisanal foundries worldwide and offering value-added services such as cast iron restoration and seasoning workshops. Together, these companies illustrate how diverse strategic approaches-from heritage marketing to manufacturing optimization and experiential branding-are instrumental in shaping market leadership and competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cast Iron Cookware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appalachian Cast Iron Co.

- Bhagya Cast Iron Cookware

- Camp Chef

- Castey Global S L

- Country Door. Inc.

- Cuisinart

- Fissler GmbH

- GRIZZLY Cookware

- Hawkins Cookers Limited

- KAMA-ASA

- Lancaster Cast Iron

- Lava Cookware UK Ltd

- Le Creuset

- Lodge Manufacturing Company

- Marquette Castings

- Meyer Corporation

- Newell Brands Inc.

- Skeppshult Gjuteri AB

- TableCraft Products Company

- The Indus Valley

- The Vollrath Company, LLC

- Tramontina USA, Inc.

- TTK Prestige Limited

- VERMICULAR

- Victoria Cookware

- Vinod Cookware

Outlining Practical and Impactful Strategies That Industry Leaders Can Adopt to Enhance Resilience and Drive Growth in the Cast Iron Cookware Segment

Industry participants seeking to fortify their market standing must prioritize a balanced approach that addresses both operational efficiency and consumer engagement. First, diversifying sourcing strategies by integrating domestic foundries alongside vetted international suppliers can mitigate tariff exposure and shorten lead times, thus enhancing supply chain resilience. Parallel to this, investing in process automation and lean casting techniques will boost throughput and drive cost efficiency without sacrificing the material integrity that end users demand.

In tandem, brands should cultivate robust digital ecosystems that facilitate direct-to-consumer transactions and immersive online experiences, leveraging augmented reality tools for virtual product demonstrations and recipe integrations that spark user confidence. At the same time, expanding partnerships with specialty retailers and professional culinary institutions can reinforce product credibility and generate word-of-mouth advocacy among serious cooks. As product finish has emerged as a core differentiator, continuous R&D into novel enameling processes and seasoning technologies will position manufacturers at the cutting edge of performance and aesthetics.

Lastly, aligning product portfolios with sustainability imperatives-such as low-waste packaging, traceable raw material sourcing, and refurbishing services-will resonate with the growing segment of environmentally conscious consumers. By adopting these multifaceted strategies, industry leaders can not only navigate present challenges but also unlock new avenues for growth and brand loyalty in the evolving cast iron cookware market.

Detailing the Comprehensive Mixed Research Methodology Employed to Earn Insights and Ensure Rigor in Cast Iron Cookware Market Analysis

This analysis is grounded in a comprehensive research methodology designed to ensure both depth and rigor in uncovering market insights. Primary market intelligence was obtained through in-depth interviews with senior executives, product developers, distribution channel managers, and culinary experts, enabling a nuanced understanding of operational realities and emerging trends. These qualitative data points were complemented by a structured survey of end users across residential and commercial segments, yielding quantifiable insights into usage patterns, purchase drivers, and brand perceptions.

Secondary research sources included industry association publications, trade journals, and publicly available financial disclosures, which provided contextual data on trade policy impacts, macroeconomic indicators, and competitive landscapes. Additionally, proprietary databases tracking product launches and retail performance metrics were leveraged to map innovation trajectories over time. To ensure analytical rigor, findings were triangulated through cross-validation across multiple data sources and methodological approaches. Moreover, a peer review process involving independent industry consultants helped refine the analysis, identify potential blind spots, and affirm the robustness of conclusions. Together, these methodological layers deliver a holistic perspective on the cast iron cookware sector, underpinning the strategic insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cast Iron Cookware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cast Iron Cookware Market, by Product Type

- Cast Iron Cookware Market, by Surface Finish

- Cast Iron Cookware Market, by End User

- Cast Iron Cookware Market, by Distribution Channel

- Cast Iron Cookware Market, by Region

- Cast Iron Cookware Market, by Group

- Cast Iron Cookware Market, by Country

- United States Cast Iron Cookware Market

- China Cast Iron Cookware Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Highlight Essential Strategic Imperatives and Summarize Core Insights of the Cast Iron Cookware Industry Landscape

The investigation into the cast iron cookware market reveals a convergence of tradition and innovation, fueled by consumer demands for durable, versatile, and aesthetically compelling products. Key findings underscore the ongoing shift toward premium, specialty finishes and omnichannel engagement models, as well as the tangible effects of recent trade policy measures on cost structures and supply chain design. By dissecting segment-level preferences around product type, surface finish, distribution channel, and end user, and by synthesizing regional patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific, the analysis offers a richly layered view of market dynamics.

Strategic imperatives emerge for stakeholders to fortify their position: harnessing manufacturing optimizations to offset tariff pressures, embracing digital innovations to deepen customer connections, and prioritizing sustainability to meet evolving consumer values. Corporate leaders must also remain vigilant to trade developments and agile in their portfolio management, ensuring that product assortments align with the diverse expectations of home cooks and professional kitchens alike. Taken together, these insights form a strategic blueprint for navigating a cast iron cookware market characterized by both venerable legacy appeal and rapid modernization. As the landscape continues to evolve, companies that integrate these core imperatives will be best positioned to capitalize on opportunities and maintain enduring competitive advantage.

Encouraging Immediate Engagement to Secure Comprehensive Cast Iron Cookware Market Intelligence Directly From Leadership

To explore the in-depth findings and capitalize on the strategic insights uncovered in this comprehensive cast iron cookware market analysis, readers are invited to arrange a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. This targeted discussion will unveil bespoke recommendations, address specific organizational needs, and facilitate a clear path toward leveraging the intelligence in actionable business strategies. By engaging directly, decision makers can ensure timely access to proprietary data, prioritize areas of investment, and unlock the full value of market nuances that can drive competitive advantage. Connect with Ketan today to secure your market intelligence briefing and position your company at the forefront of the cast iron cookware industry’s evolution.

- How big is the Cast Iron Cookware Market?

- What is the Cast Iron Cookware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?