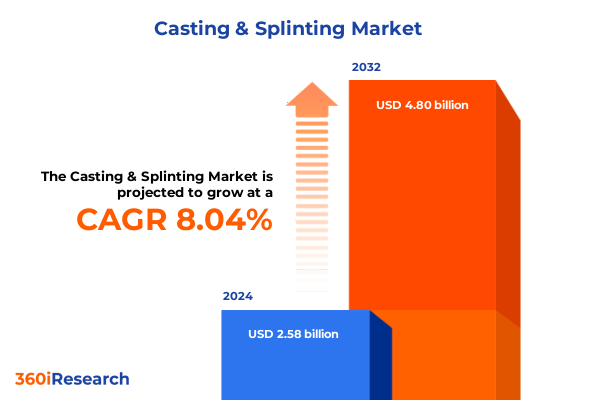

The Casting & Splinting Market size was estimated at USD 2.75 billion in 2025 and expected to reach USD 2.94 billion in 2026, at a CAGR of 8.25% to reach USD 4.80 billion by 2032.

Setting the Stage for a New Era in Casting and Splinting through Unprecedented Innovation and Patient-Centric Care

The casting and splinting sector stands at a pivotal juncture, propelled by rapid advancements in materials science, digital health integration, and a renewed emphasis on patient-centric outcomes. This introduction outlines the fundamental forces driving transformation, from the adoption of lightweight, high-performance materials to the shift toward value-based care models that prioritize faster healing and enhanced patient comfort. As clinical requirements evolve and reimbursement landscapes adjust, providers and manufacturers alike must navigate a complex interplay of technological innovation and regulatory oversight.

Against this backdrop, this executive summary presents a structured overview of the catalysts shaping the industry’s trajectory. It highlights how leading-edge developments in polymer chemistry and additive manufacturing are redefining the possibilities for custom-fitted immobilization devices. With an increasing focus on reducing procedural time and minimizing complications, healthcare providers are exploring novel application techniques and digital workflows. This section lays the groundwork for understanding the critical trends, competitive dynamics, and stakeholder expectations that will influence decision-making at every level, enabling organizations to align their strategies with emerging opportunities in casting and splinting.

How Technological Innovations and Evolving Clinical Practices Are Redefining Casting and Splinting Delivery Models and Patient Outcomes

The landscape of casting and splinting has undergone a profound metamorphosis in recent years, driven by technological breakthroughs and evolving clinical protocols. Advanced digital scanning tools now enable precise anatomical mapping that eliminates the traditional reliance on off-the-shelf molds, ushering in a new era of personalized device fabrication. Concurrently, additive manufacturing platforms have matured to support custom splint geometries, delivering both static and dynamic splints that optimize immobilization and promote early mobilization when clinically appropriate.

Material science has similarly experienced disruptive innovation. High-temperature thermoplastics offer superior strength-to-weight ratios for complex anatomical contours, while low-temperature variants provide rapid formability at the point of care. Meanwhile, fiberglass and plaster of Paris remain staples in acute fracture management, but are now supplemented by synthetic and thermoplastic casting systems that reduce overall procedure time. The integration of telehealth follow-up protocols further enhances patient engagement, enabling clinicians to monitor device fit and healing progress remotely. These transformative shifts underscore the industry’s pivot toward integrated digital-physical workflows that balance efficiency with enhanced clinical outcomes.

Assessing the Full Spectrum of United States Tariff Measures in 2025 and Their Implications for Raw Material Costs and Supply Chain Resilience

United States tariff measures implemented in 2025 have introduced a new layer of complexity for manufacturers and suppliers of casting and splinting materials. Section 301 tariffs applied to imported thermoplastic resins, including those used in both high-temperature and low-temperature applications, have elevated raw material costs and pressured margin structures. Concurrent levies on fiberglass roving imports have similarly impacted supply chain economics, compelling stakeholders to reassess existing procurement strategies and inventory practices.

In response, manufacturers have accelerated diversification of sourcing, securing alternative material streams from domestic producers and nontraditional international partners. Nearshoring initiatives have gained momentum, with several companies establishing resin compounding operations closer to major orthopedic device fabrication centers. To mitigate cost volatility, long-term off-take agreements and value-based contracting models have been introduced, aligning supplier incentives with volumetric stability. While these tariff measures have initially strained operational budgets, they have also catalyzed supply chain resilience and fostered collaborative vendor partnerships that will endure beyond the tariff horizon.

Unveiling Critical Product, Material, End User, and Application Segmentation Trends Driving Tailored Solutions in Casting and Splinting

A nuanced segmentation framework reveals distinct growth vectors and tailored requirements across product types, material compositions, end-user environments, and application scenarios. Within product portfolios, traditional fiberglass casts continue to play a central role in immobilization, yet synthetic and thermoplastic casts are rapidly gaining favor for their lighter weight and enhanced durability. Splints, encompassing both static and dynamic configurations, address a diverse range of rehabilitative needs, while corrective casting systems target specific deformity corrections and complex postoperative immobilization protocols.

Material segmentation underscores divergent adoption patterns. Fiberglass remains a workhorse in acute fracture management, plaster of Paris is preferred for intricate molding in clinical settings, and thermoplastics-available in high-temperature and low-temperature formulations-offer clinicians the flexibility to deliver rapid onsite casting and customized splinting solutions. End users span ambulatory surgical centers seeking efficient outpatient workflows, home healthcare providers prioritizing portability and ease of application, hospitals-both private and public-managing heavy caseloads, and specialized orthopedic clinics focusing on targeted rehabilitative care. Application segmentation further refines the landscape, with corrective casting aligning with pediatric and structural deformity interventions, fracture management distinguishing between upper limb and lower limb fractures, and post-operative immobilization protocols integrating seamlessly into enhanced recovery programs.

This comprehensive research report categorizes the Casting & Splinting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Application

Comparative Landscape Analysis across the Americas, EMEA, and Asia-Pacific Regions Highlighting Growth Drivers and Market Dynamics

Regional dynamics vary considerably across the Americas, Europe Middle East and Africa, and Asia Pacific, each shaped by distinct healthcare infrastructures, reimbursement systems, and clinical practice norms. In the Americas, the proliferation of outpatient surgical centers and robust home healthcare networks has accelerated adoption of lightweight thermoplastic systems and custom splints, while private and public hospitals in North America are balancing traditional plaster techniques with innovative synthetic offerings. Latin America continues to invest in infrastructure upgrades, fostering a gradual shift toward advanced casting technologies in major urban centers.

Within Europe Middle East and Africa, divergent regulatory pathways and reimbursement mechanisms drive heterogeneity. Western European markets emphasize environmental sustainability and standardized approval processes, leading to broad uptake of reusable and recyclable casting materials. In the Gulf region and parts of Africa, infrastructure constraints necessitate cost-effective, easily deployable systems, often favoring plaster of Paris in community health clinics. Asia Pacific presents a tapestry of maturity levels, with Japan and Australia pioneering digital workflows and China expanding domestic thermoplastic manufacturing, while Southeast Asian markets are strengthening home healthcare capabilities to manage an aging population. These regional insights highlight the importance of adaptable strategies that align product offerings with the unique clinical and economic drivers of each geography.

This comprehensive research report examines key regions that drive the evolution of the Casting & Splinting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Casting and Splinting Manufacturers Showcasing Strategic Initiatives and Competitive Differentiators

Leading companies in the casting and splinting space are pursuing differentiated strategies that leverage technological innovation, strategic partnerships, and targeted acquisitions. Global medtech giants have integrated additive manufacturing capabilities to accelerate custom device production, while specialized orthotic and prosthetic firms have deepened clinical collaborations to refine dynamic splint designs. Cross-sector alliances between polymer suppliers and digital health providers are streamlining end-to-end workflows, from material procurement through post-application monitoring.

Organizations are also emphasizing sustainability through investments in recyclable and renewable material formulations, positioning themselves to meet tightening environmental regulations and evolving customer expectations. Several market players are enhancing their service portfolios with educational platforms and clinician training programs, fostering deeper end-user engagement and driving preference for proprietary casting and splinting systems. Innovative distribution models, including direct-to-clinic partnerships and subscription-based consumable programs, are further distinguishing market leaders and reshaping value propositions. The competitive landscape is thus defined by an intricate balance of R&D intensity, strategic alliances, and agile commercialization tactics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Casting & Splinting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AliMed, Inc.

- Bird & Cronin, Inc.

- BSN Medical GmbH

- Cardinal Health, Inc.

- Corflex, Inc.

- DeRoyal Industries, Inc.

- DJO Global, Inc.

- Johnson & Johnson

- McKesson Corporation

- Medline Industries, LP

- Prime Medical, Inc.

- Smith & Nephew plc

- Zimmer Biomet Holdings, Inc.

- Össur hf.

Strategic Imperatives for Business Leaders to Capitalize on Emerging Opportunities and Strengthen Market Positioning

To navigate the rapidly evolving casting and splinting environment, industry leaders should prioritize several strategic imperatives. First, investment in digital design and additive manufacturing platforms will expedite patient-specific device production and drive procedural efficiency. Second, diversification of supply chains through nearshoring and long-term partnership agreements can stabilize material input costs and bolster operational resilience amidst tariff uncertainties.

Concurrently, firms should cultivate clinician and patient engagement programs that highlight the clinical benefits and ease of use associated with advanced thermoplastics and dynamic splints. Expanding training initiatives and in-service demonstrations will facilitate faster adoption across ambulatory and home-based care settings. Moreover, integrating sustainability metrics into product development pipelines will preempt regulatory pressures and align with growing environmental stewardship mandates. Finally, targeted expansion into underpenetrated regions requires collaboration with local distributors and healthcare providers to tailor offerings that respect regional reimbursement and practice conventions. These actionable recommendations will empower decision-makers to capture value across diverse market segments and geographies.

Employing Robust Multimethod Research Techniques to Deliver Comprehensive and Credible Casting and Splinting Market Insights

The research underpinning this report combines both primary and secondary methodologies to ensure comprehensive and credible insights. Primary research involved in-depth interviews with orthopedic surgeons, rehabilitation specialists, material scientists, and procurement executives across diverse healthcare settings. These conversations provided real-world perspectives on device performance, clinical workflows, and purchasing criteria. Supplementing this qualitative data, a targeted survey of end users captured quantitative metrics on device preferences, application frequencies, and post-application satisfaction levels.

Secondary research encompassed a thorough review of peer-reviewed journals, industry white papers, regulatory filings, and manufacturer technical documentation. Market intelligence was triangulated with import-export data and tariff schedules to assess supply chain implications. An advisory panel comprising clinical experts and industry veterans validated preliminary findings through iterative feedback sessions. Finally, rigorous data integrity protocols-including consistency checks and anomaly detection-ensured the reliability of all insights. This multimethod approach yields a robust foundation for strategic decision-making and highlights the dynamic complexities inherent in the casting and splinting sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Casting & Splinting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Casting & Splinting Market, by Product Type

- Casting & Splinting Market, by Material

- Casting & Splinting Market, by End User

- Casting & Splinting Market, by Application

- Casting & Splinting Market, by Region

- Casting & Splinting Market, by Group

- Casting & Splinting Market, by Country

- United States Casting & Splinting Market

- China Casting & Splinting Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Illuminate Pathways for Innovation and Sustainable Growth in Casting and Splinting

This executive summary has distilled key developments in casting and splinting, from material innovations and digital workflow integration to the implications of U.S. tariffs and the nuanced demands of segmented end-user cohorts. The synthesis of regional analyses underscores the necessity of adaptive strategies that align product portfolios with localized healthcare contexts. Competitive intelligence reveals that differentiation through sustainability, clinician engagement, and flexible distribution models will define success in the years ahead.

As the industry continues to evolve, stakeholders must remain vigilant to emerging regulatory changes, advances in additive manufacturing, and shifting patient expectations. The convergence of technology and clinical practice heralds new possibilities for improving patient outcomes and operational efficiency. By leveraging the insights and recommendations presented herein, organizations can chart a course toward sustainable growth and maintain a leadership position within the complex, rapidly transforming world of casting and splinting.

Connect with Ketan Rohom to Acquire Tailored Casting and Splinting Market Intelligence That Fuels Strategic Growth

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive report can equip your organization with the actionable intelligence needed to navigate the dynamic casting and splinting environment. By securing full access, you will gain unparalleled visibility into the nuanced factors shaping material innovations, evolving care models, and regulatory headwinds in 2025 and beyond. Reach out to Ketan today to discuss tailored solutions that address your strategic priorities and unlock sustainable competitive advantage through data-driven insights.

- How big is the Casting & Splinting Market?

- What is the Casting & Splinting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?