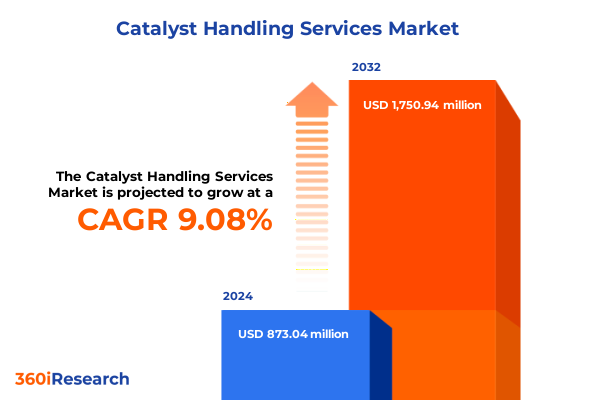

The Catalyst Handling Services Market size was estimated at USD 951.04 million in 2025 and expected to reach USD 1,041.31 million in 2026, at a CAGR of 9.11% to reach USD 1,750.93 million by 2032.

Discover the critical role of catalyst handling services in optimizing chemical processes and boosting operational efficiency across key industrial sectors

Catalyst handling services constitute a cornerstone of modern industrial operations, influencing the efficiency, sustainability, and safety of chemical, petrochemical, environmental, pharmaceutical, and refining processes. By facilitating the management of catalysts throughout their lifecycle-from activation and pretreatment through deactivation handling and regeneration-specialized service providers play a pivotal role in reducing costly downtime and optimizing catalyst performance. As global industries confront accelerating demands for cleaner production, tighter regulatory oversight, and higher throughput, the value of expert catalyst handling services has risen dramatically.

Within this context, the introduction of innovative packaging solutions, quality assurance protocols, and advanced storage and transportation methodologies has become essential. These enhancements not only mitigate risks related to catalyst degradation and environmental compliance but also bolster supply chain resilience. With digital monitoring and predictive maintenance technologies gaining traction, stakeholders can now harness real-time data to anticipate catalyst behavior under operational stress. Consequently, decision-makers are better equipped to align handling practices with broader sustainability and efficiency objectives.

This executive summary outlines the transformative shifts influencing catalyst handling services, examines the cumulative impact of recent tariff measures in the United States, and presents key segmentation, regional, and competitive insights. Ultimately, this analysis underpins actionable recommendations and a rigorous research methodology, culminating in strategic guidance for industry leaders aiming to navigate a rapidly evolving landscape.

Explore how technological advancements and sustainability imperatives are reshaping catalyst handling services to meet evolving industrial demands

The catalyst handling services industry is experiencing a profound evolution driven by converging technological and regulatory forces. Digital transformation stands at the forefront of these shifts, as cloud-based monitoring and Internet of Things sensors enable real-time tracking of catalyst condition, reducing unplanned shutdowns and extending catalyst lifetimes. Meanwhile, sustainability imperatives are prompting service providers to adopt greener pretreatment and regeneration methods, including low-energy calcination techniques and solvent-free washing processes.

In parallel, the demand for modular, on-site handling solutions has grown, allowing for rapid deployment in remote or high-throughput facilities. As global supply chains diversify, companies are also investing in robust packaging innovations that prevent cross-contamination and ensure compliance with increasingly strict environmental and safety regulations. Furthermore, collaboration across the value chain has intensified, with service firms partnering with catalyst manufacturers and end users to co-develop customized handling protocols that address specific process challenges.

Collectively, these advances underscore a shift from commoditized service offerings toward highly integrated solutions centered on data-driven insights and environmental stewardship. As a result, catalyst handling providers are transforming into strategic partners, guiding clients through complex operational landscapes while fostering resilience in the face of regulatory changes and market volatility.

Analyze the far-reaching effects of recent United States tariffs in 2025 on catalyst handling supply chains and operational strategies in North America

Recent tariff measures implemented by the United States throughout 2025 have exerted significant pressure on catalyst handling service providers and their clients. By introducing additional duties on imported catalysts and related materials, these measures have driven companies to reevaluate their sourcing strategies and localize portions of the handling value chain. As a consequence, domestic service providers have seen increased demand for onshored pre-treatment, activation, and regeneration operations, while international firms seek partnerships with U.S. entities to maintain market access.

In response, organizations have diversified their supplier base to balance cost exposure and supply chain risk. This transition has accelerated investment in local packaging and storage capabilities, diminishing reliance on cross-border logistics that incur higher tariff costs. Moreover, quality assurance protocols have been enhanced to ensure consistency amid newly sourced materials, as variations in feedstock purity can impact catalyst performance during activation processes such as calcination and reduction.

The combined effect of tariff pressures and supply chain realignment has prompted a strategic shift toward circular economics, where spent catalysts are reclaimed, regenerated, and reintroduced into the production cycle domestically. Consequently, facility upgrades for chemical and thermal regeneration have gained urgency, allowing service providers to capture value previously eroded by import levies. Ultimately, this realignment underscores the need for adaptive operational models that can respond swiftly to policy fluctuations while safeguarding process continuity.

Gain deep insights into market segmentation dynamics across end use industries, service types, process stages, and catalyst technology categories

An in-depth examination of catalyst handling services across distinct segmentation pillars reveals nuanced opportunities and challenges within each category. When evaluating end use industries, petrochemicals remain a dominant application due to the sector’s scale and complexity, yet environmental catalysts in industrial emissions control have experienced a surge in demand as regulatory bodies tighten air quality standards. Meanwhile, pharmaceutical operations, with their stringent purity requirements, emphasize precision in quality assurance and clean-room compatible packaging solutions.

Turning to service type, transportation and secure packaging are increasingly interwoven with advanced quality protocols to safeguard catalyst integrity during transit and storage. The evolution of bulk and drum packaging formats has enabled greater flexibility for clients managing varied catalyst volumes, while bag-based systems cater to smaller-scale or high-purity applications. Quality assurance measures now incorporate spectroscopic analysis and digital traceability, ensuring that every batch meets exacting specifications before activation or shipment.

Within the process stage segmentation, regeneration services-both chemical and thermal-have drawn substantial investment as companies seek to maximize catalyst reuse and minimize waste. Activation processes such as calcination and reduction are tailored to diverse catalyst chemistries, with process engineers adjusting parameters in real time based on feedback from in-line monitoring systems. Pre-treatment protocols, including drying and washing, are optimized to remove impurities and moisture, thereby preserving catalyst activity and preventing irreversible deactivation.

Finally, catalyst type analysis highlights that hydroprocessing catalysts remain central to refining operations, while polymerization catalysts support the expanding plastics and specialty materials markets. Custom and proprietary catalysts, under the specialty umbrella, are gaining traction for custom formulations that address unique process challenges, reflecting a broader trend toward bespoke solutions throughout the handling lifecycle.

This comprehensive research report categorizes the Catalyst Handling Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Stage

- Catalyst Type

- End Use Industry

Understand regional dynamics driving catalyst handling services across Americas, Europe Middle East Africa, and Asia Pacific industrial markets

Across the Americas, catalyst handling services are driven by the robust presence of petrochemical complexes and refining hubs in the Gulf Coast region, where major players rely on onshore regeneration facilities to minimize downtime and reduce import dependencies. Brazil’s expanding biofuel industry has also spurred demand for specialized pretreatment operations, particularly for catalysts used in biomass-derived feedstocks.

In Europe, the Middle East, and Africa, stringent emission regulations in the European Union have catalyzed growth in environmental catalyst handling services, with regenerative thermal oxidation becoming a standard for spent catalyst disposal and reclamation. The Middle East’s ongoing refinery expansion programs have heightened the need for hydroprocessing catalyst activation and deactivation management, while South Africa’s chemical sector focuses on localized storage and transportation networks to mitigate logistical constraints.

Turning to the Asia-Pacific region, demand is shaped by the rapid industrialization of Southeast Asian markets and China’s commitment to reducing air pollution, leading to an uptick in environmental catalyst applications. Japan and South Korea, with their advanced semiconductor and fine chemicals industries, emphasize high-purity packaging and clean-room handling standards. Meanwhile, India’s refining growth has driven adoption of cost-effective chemical regeneration services, enhancing the circular economy model and reducing reliance on fresh catalyst imports.

This comprehensive research report examines key regions that drive the evolution of the Catalyst Handling Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine the strategic positioning and competitive strengths of leading catalyst handling service providers driving innovation and value creation

Leading organizations in catalyst handling services have differentiated themselves through integrated solution portfolios, technological prowess, and strategic alliances. Companies with deep expertise in thermal regeneration boast proprietary furnace designs that optimize energy consumption and regeneration yields while minimizing environmental footprint. Others have focused on digital platforms offering predictive analytics, enabling clients to schedule maintenance windows based on real-time catalyst health indicators.

Strategic partnerships between handling service firms and catalyst manufacturers have also emerged as a critical differentiator, fostering co-development of catalyst formulations alongside tailored handling protocols. This collaborative approach ensures seamless transitions between activation, in-service operation, and end-of-life management, delivering enhanced performance and lower total cost of ownership. Furthermore, providers with global logistics networks have leveraged their footprint to offer standardized packaging and transportation solutions across multiple continents, ensuring consistent quality and compliance with international safety standards.

Smaller niche players have challenged incumbents by specializing in select service lines, such as custom chemical regeneration or high-precision drying techniques, appealing to industries with stringent purity requirements. As a result, the competitive landscape has evolved toward a hybrid model where scale and specialization coexist, compelling all service providers to continuously innovate in response to shifting client priorities and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catalyst Handling Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Anabeeb

- Axens S.A.

- BASF SE

- Cat Tech International Ltd.

- Catalyst Handling Resources

- Celtic Vacuum Ltd.

- Clariant AG

- Contract Resources

- CR3 Group

- DGC Holdings International Ltd

- Dialog Group Berhad

- Dickinson Group of Companies

- Drill & Drop B.V.

- Group Peeters

- Haldor Topsoe A/S

- Johnson Matthey PLC

- Shell Catalysts & Technologies B.V.

- Sinopec Shanghai Catalysts Co., Ltd

- W. R. Grace & Co.–Conn.

Implement targeted strategies for leaders to enhance catalyst handling operations through digital integration, sustainability partnerships, and risk mitigation

Industry leaders must prioritize the integration of digital monitoring and predictive maintenance tools within existing operational frameworks to enhance decision-making and reduce unplanned downtime. By leveraging advanced analytics, companies can pinpoint catalyst performance anomalies early, adjusting handling schedules and regeneration cycles proactively. Additionally, fostering partnerships with catalyst manufacturers and environmental regulators will accelerate the co-development of sustainable handling protocols and ensure compliance with evolving emission standards.

To strengthen supply chain resilience against policy shifts, service providers should diversify regional capabilities, establishing modular regeneration and packaging facilities in strategic locations. This approach not only mitigates tariff risks but also enhances responsiveness to fluctuating feedstock and catalyst sourcing dynamics. Emphasizing circular economy principles, organizations can implement chemical regeneration loops that reclaim high-value catalyst materials, reducing waste and lowering dependence on virgin catalysts.

Furthermore, investing in employee training programs centered on safety, quality assurance, and digital literacy will bolster operational excellence. By cultivating a workforce skilled in handling emerging catalyst chemistries and data management systems, companies can drive continuous improvement. Finally, embedding sustainability metrics into service agreements will align handling operations with broader corporate environmental goals, reinforcing long-term value creation for clients and stakeholders.

Uncover the rigorous research design and data validation processes applied to deliver robust insights on catalyst handling services market intelligence

The insights presented in this executive summary stem from a comprehensive research methodology that combines primary engagements with end users, service providers, and regulatory bodies alongside an extensive review of industry publications. Primary interviews were conducted with senior operations managers across petrochemical, refining, and environmental sectors to capture firsthand perspectives on handling challenges and emerging needs. These qualitative insights were validated against secondary sources such as technical whitepapers and trade association guidelines to ensure robustness.

Data integrity was maintained through rigorous triangulation, cross-referencing reported handling practices with documented case studies and process flow diagrams. Segmentation frameworks were developed by mapping service offerings against end use industry requirements, service types, process stages, and catalyst technology categories, enabling a multidimensional analysis of market dynamics. Geographical insights were refined through the examination of regional regulatory landscapes, infrastructure capacities, and supply chain configurations.

The competitive profiling of key service providers integrated publicly available annual reports, patent filings, and press releases to identify strategic initiatives and technological developments. Throughout the research process, adherence to ethical data collection standards and confidentiality agreements ensured the accuracy and impartiality of findings. This methodical approach underpins the actionable recommendations and strategic insights delineated herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catalyst Handling Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catalyst Handling Services Market, by Service Type

- Catalyst Handling Services Market, by Stage

- Catalyst Handling Services Market, by Catalyst Type

- Catalyst Handling Services Market, by End Use Industry

- Catalyst Handling Services Market, by Region

- Catalyst Handling Services Market, by Group

- Catalyst Handling Services Market, by Country

- United States Catalyst Handling Services Market

- China Catalyst Handling Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarize the pivotal findings on catalyst handling services trends, transformative drivers, and strategic imperatives shaping industry outlook

The catalyst handling services sector stands at a pivotal juncture defined by technological innovation, regulatory pressures, and evolving customer expectations. Key findings underscore the ascendance of digital monitoring and predictive analytics as essential components of modern service portfolios, enabling proactive lifecycle management and efficiency gains. Tariff-driven supply chain realignment has elevated domestic regeneration and handling capabilities, reinforcing the strategic significance of localized operations.

Segmentation analysis reveals differentiated growth pockets, particularly within environmental catalysts and specialty catalyst applications, where bespoke handling protocols unlock new value streams. Regional dynamics further shape service demand, with North America’s refinery networks emphasizing onshore regeneration, Europe’s environmental regulations driving emissions-focused services, and Asia-Pacific’s industrial expansion fueling broad-based handling requirements.

Competitive landscapes illustrate a blend of global incumbents leveraging scale and digital platforms alongside specialized niche players offering targeted expertise. As a result, service providers must balance breadth of offering with depth of specialization to maintain relevance. Collectively, these insights point to a future where integrated, data-driven, and sustainable handling services will determine competitive advantage, guiding industry stakeholders toward strategic investments and partnerships.

Take the next strategic step today and engage with Ketan Rohom to secure comprehensive catalyst handling services market intelligence for competitive advantage

To explore tailored insights, secure your copy of the comprehensive catalyst handling services report by reaching out to Ketan Rohom, the Associate Director for Sales & Marketing. He will guide you through the report’s strategic analysis, ensuring you receive in-depth perspectives on emerging trends, tariff impacts, and regional dynamics. By partnering with him, you can leverage actionable recommendations and segmentation frameworks designed to enhance operational efficiency and drive innovation in catalyst lifecycle management. Position your organization for competitive advantage by engaging with Ketan today to access the full suite of market intelligence and capitalize on the most critical insights shaping the catalyst handling services landscape.

- How big is the Catalyst Handling Services Market?

- What is the Catalyst Handling Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?