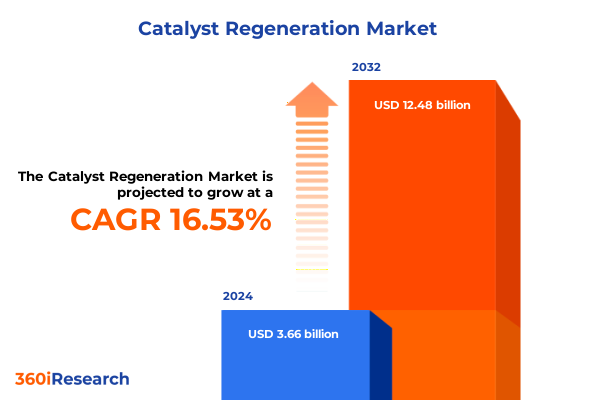

The Catalyst Regeneration Market size was estimated at USD 4.17 billion in 2025 and expected to reach USD 4.76 billion in 2026, at a CAGR of 16.92% to reach USD 12.48 billion by 2032.

Setting the Stage for Circular Economy Excellence Through Advanced Catalyst Regeneration Practices in Refining, Chemical, and Environmental Applications

Catalyst regeneration refers to the systematic restoration of spent catalysts to their original activity levels after they have been deactivated by fouling, poisoning, thermal degradation, or other mechanisms. At its core, this process underpins the economic viability of critical industrial operations-ranging from fluid catalytic cracking and hydrotreating units in refineries to environmental catalysis systems managing industrial effluents-by recycling valuable active sites and support structures rather than replacing entire catalyst beds. Effective regeneration sustains reaction efficiencies, limits operational downtime, and reduces reliance on fresh catalyst manufacturing, which often involves energy-intensive steps and significant raw material inputs.

In recent years, the imperative to minimize lifecycle carbon footprints and manage hazardous waste has elevated catalyst regeneration from a cost-saving tactic to an essential component of sustainability strategies. By recovering metals such as platinum, palladium, and vanadium from spent catalysts, companies can mitigate supply chain risks associated with critical mineral sourcing and comply with increasingly stringent environmental regulations. Moreover, advancements in processes like thermal treatment and washing regeneration have improved recovery rates and replenishment of catalyst surface active sites, extending service life by multiple cycles while maintaining performance benchmarks essential for modern process units.

Embracing Technological Revolution and Regulatory Imperatives Redefining Catalyst Regeneration Dynamics Across Global Energy and Chemicals Markets

The catalyst regeneration landscape is undergoing a profound transformation driven by intersecting forces of digital innovation and regulatory evolution. As global emissions mandates tighten, particularly under frameworks such as the EU’s Industrial Emissions Directive and the U.S. EPA’s updated hazardous air pollutant standards, companies are reengineering their regeneration protocols to maximize compliance credits and lifecycle accounting benefits. This confluence of environmental requirements and operational economics has accelerated investment in advanced on-site regeneration systems and predictive condition monitoring, shifting the emphasis from reactive replacement to proactive process stewardship.

Simultaneously, the infusion of artificial intelligence and machine learning is revolutionizing catalyst management. By leveraging process data streams from IoT sensors and integrating digital twin models, operators can anticipate deactivation events, prescribe tailored regeneration cycles, and optimize feedstock selection in real time. These prescriptive analytics platforms not only reduce unplanned unit shutdowns but also enable continuous in-situ regeneration designs that maintain catalyst activity without full process halts. As a result, lifecycle costs are curtailed while throughput consistency and product quality are enhanced across both mature and emerging refining hubs.

Material innovation is further reshaping regeneration opportunities. Research into low-noble-metal formulations and multifunctional catalysts has yielded breakthrough bifunctional products capable of simultaneous cracking and hydrotreating, reducing the number of active beds and associated regeneration steps. Pilot deployments of hybrid catalysts have demonstrated up to 20% reductions in energy consumption during regeneration cycles, underscoring the potential for integrated regeneration-to-operation platforms that align with circular economy mandates and decarbonization roadmaps.

Assessing the Multi-Faceted Impact of 2025 United States Tariff Measures on Catalyst Supply Chains, Refinery Economics, and Material Costs

In 2025, the United States advanced multiple tariff measures that collectively reshaped catalyst supply chains and regeneration economics. Under Section 232 of the Trade Expansion Act, a 25% duty on imported passenger vehicles and light truck components extended to electric vehicle battery cells and modules, placing upward pressure on critical mineral flows for nickel and cobalt used in certain catalyst supports. Concurrently, Section 301 tariff adjustments raised duties on tungsten products, solar polysilicon, and certain rare-earth element inputs-cornerstones of hydrocracking and fluid catalytic cracking (FCC) catalyst formulations. These policies, effective from January 1, 2025, reflect a pronounced tilt toward industrial policy–driven trade realignment and have reverberated across refining operations reliant on imported catalyst precursors.

The USTR’s enhancements to Section 301 tariffs on rare-earth materials have had a tangible impact on FCC catalyst costs. In 2023, China accounted for over 57% of U.S. imports of cerium compounds and 100% of its lanthanum imports, both key rare-earth oxides used in FCC catalysts. The imposition of up to 50% duties on select rare-earth oxide categories has forced refiners to absorb increased raw material expenses or source lower-performing alternatives, prompting some to extend catalyst cycle durations at the risk of reduced conversion efficiency. These adjustments, compounded by reciprocal tariff frameworks, have contributed to a broad realignment of global catalyst procurement flows.

Beyond refinery units, broader chemical-sector tariffs have driven cost escalations in essential chemical feedstocks. Reciprocal tariff policies on monoethylene glycol and ethanol anticipate freight cost increases of up to 228%, with underlying chemical price inflation projected between 33–37%. Such dynamics have amplified operational challenges for regeneration service providers, which must recalibrate pricing models for ex-situ and in-situ regeneration processes to account for elevated raw material and energy inputs. Collectively, 2025’s tariff landscape has reinforced the strategic imperative of localized regeneration capabilities and supply chain diversification to maintain competitive resilience.

Deriving Strategic Opportunities from In-Depth Segmentation Analysis of Catalyst Types, Regeneration Techniques, and Application Use Cases

Catalyst type segmentation offers critical strategic insights into regeneration priorities. Metal oxide catalysts such as alumina, silica, and titania support hydrotreating and cracking operations and are typically regenerated through high-temperature oxidation and steam treatments, processes that must be finely tuned to preserve surface area and acidity. Mixed metal oxides, which blend multiple oxide supports, require specialized washing or solvent extraction steps to remove metallic poisons while maintaining structural integrity. In contrast, noble metals-palladium, platinum, and rhodium-embedded on chlorided alumina supports demand careful chemical regeneration protocols using acid washing to avoid loss of active sites. Zeolites such as Beta, Y, and ZSM-5 exhibit unique structure–activity relationships that necessitate oxidative regeneration to clear pore-blocking coke deposits, underscoring the differentiated approaches required across catalyst families.

Regeneration technique segmentation further clarifies operational pathways. Chemical regeneration via acid washing effectively removes metal contaminants but involves handling of corrosive media and downstream waste treatment. Hydrodemetalation procedures, including solvent extraction and acid hydrolysis, recover valuable metal streams at specialized reclamation facilities. Oxidative treatments leveraging oxygen bleaching or ozone integration target carbonaceous fouling, reducing regeneration temperatures and cycle times. Thermal regeneration remains the industry workhorse, with electric and steam-based systems facilitating high-throughput cleaning for large catalyst inventories. Application-driven segmentation reveals that automotive emissions control units, chemical processing plants, petroleum refineries, and power generation facilities each impose distinct regeneration throughput, turnaround, and purity requirements, shaping service offerings from delayed coking regeneration to FCC and hydrocracking reactivation workflows.

This comprehensive research report categorizes the Catalyst Regeneration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Catalyst Type

- Regeneration Technique

- Catalyst Material

- Application

- End Use Industry

Analyzing Regional Drivers and Challenges Shaping Catalyst Regeneration Adoption Across the Americas, EMEA, and Asia-Pacific Markets

The Americas region, anchored by the United States and Canada, remains a principal hub for catalyst regeneration due to its mature refining infrastructure and robust policy incentives. Domestic production of critical minerals and advanced materials is increasingly supported by IRA tax credits, notably Sections 45X and 48C, which extend investment incentives to recycling and processing facilities for critical energy components. These incentives have spurred the development of state-of-the-art regeneration centers that incorporate chemical reclamation and on-site predictive analytics, thereby reducing dependency on imported catalyst feeds and mitigating tariff exposure. Industry partnerships and consortiums additionally foster a collaborative ecosystem for developed and emerging facility operators, reinforcing North America’s competitive edge in regeneration services.

Within Europe, the Middle East, and Africa, stringent emission directives and circular economy mandates are driving elevated adoption of regeneration solutions. The European Green Deal and the Industrial Emissions Directive embed catalyst reuse in best available techniques for waste management, prompting refiners to integrate low-temperature ozone regeneration and continuous in-situ designs to comply with strict pollutant thresholds. In parallel, Middle East refiners are leveraging vertical integration strategies, combining native feedstock advantages with emerging regeneration capabilities to service both local and export markets. African initiatives, often in collaboration with international technology providers, focus on building foundational regeneration infrastructure to support petrochemical expansions and environmental remediation projects under nascent regulatory frameworks.

The Asia-Pacific market is set to witness the fastest growth in catalyst regeneration driven by substantial refining capacity additions. Over 90% of new crude distillation capacity slated through 2029 is projected for developing markets in Asia-Pacific, amplifying demand for integrated regeneration services. Large-scale investments in cracking and hydrotreating capacities in China, India, and Southeast Asia underpin a surge in spent catalyst volumes requiring both batch and continuous regeneration technologies. Coupled with regional decarbonization pledges and expansions in petrochemical output, Asia-Pacific’s catalytic lifecycle management is becoming a pivotal element of operational strategy, catalyzing partnerships between local operators and global service providers.

This comprehensive research report examines key regions that drive the evolution of the Catalyst Regeneration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Catalyst Regeneration Service Providers and Technology Innovators Steering the Future of Sustainable Industrial Catalysis

The catalyst regeneration landscape is dominated by a small cadre of specialized service providers that deliver end-to-end regeneration solutions. Companies such as CRI and Eurecat collectively service the majority of global spent catalyst volumes, leveraging extensive ex-situ processing networks to recover metals and restore activity. Tricat Inc. offers tailored in-situ regeneration units for specialty applications, while technology licensors like Honeywell UOP and BASF continuously innovate proprietary catalyst formulations and regeneration protocols that yield higher recovery rates and extended cycle lives. These incumbents differentiate through integrated analytics platforms, on-site skid-mounted regeneration units, and strategic collaborations with refinery and petrochemical operators to customize service agreements to specific operational thresholds.

In addition to traditional regeneration players, an emerging ecosystem of digital solution vendors, metallurgy specialists, and chemical reagents manufacturers is enhancing the market’s service portfolio. Companies providing digital twin frameworks, AI-driven analytics, and advanced oxidation technologies are partnering with regeneration firms to introduce condition-based maintenance programs that align regeneration timing with unit performance metrics. Collaboration among upstream catalyst producers and downstream regeneration services is also intensifying, fostering co-development of low-noble-metal and bifunctional catalysts designed for simplified restoration cycles. This multi-stakeholder approach is reshaping competitive dynamics, enabling a transition toward integrated circular value chains and offering end-users both technical and economic advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catalyst Regeneration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- BASF SE

- Clariant AG

- CoaLogix Inc.

- CORMETECH, Inc.

- Criterion Catalysts & Technologies

- Evonik Industries AG

- Haldor Topsoe A/S

- Johnson Matthey PLC

- Shell Catalysts & Technologies

- Sinopec Catalyst Co. Ltd

- STEAG Energy Services LLC

- Tricat Industries, Inc.

- W. R. Grace & Co.-Conn.

- Zhejiang Tuna Environmental Science & Technology Co., Ltd.

- Zibo Hengji Chemical Co., Ltd.

Guiding Industry Leaders with Targeted Strategies to Optimize Catalyst Regeneration Processes, Strengthen Supply Chains, and Foster Innovation

Industry leaders should prioritize the expansion of localized regeneration capabilities to mitigate import-related risks and tariff exposures. By investing in on-site, modular regeneration units equipped with chemical, thermal, and oxidative treatment modules, operators can reduce turnaround times and secure greater control over catalytic lifecycles. Concurrently, establishing strategic supply agreements for critical minerals with diversified partners-and exploring consortium-based procurement models-will strengthen resilience against evolving trade policies and expedite the incorporation of low-noble-metal formulations into standard operations.

Adoption of digital twins and AI-driven predictive maintenance platforms is another imperative for value preservation. By integrating real-time process data and advanced analytics, companies can transition from time-based to condition-based regeneration strategies, thereby optimizing catalyst utilization, minimizing downtime, and aligning regeneration events with peak product demand windows. Engaging with technology licensors and specialized chemical reagents manufacturers to co-develop catalysts tailored for extended regeneration cycles will further enhance operational economics and sustainability credentials.

Finally, engaging proactively with policymakers to secure targeted tariff exemptions or development incentives under frameworks such as Section 48C of the IRA will sustain domestic regeneration investments. By articulating the environmental and economic benefits of in-region catalyst recycling, industry consortia can catalyze supportive regulatory measures and tax credits that reinforce circular economy objectives while promoting long-term competitiveness.

Outlining Rigorous Research Methodology Combining Primary Insights, Industry Data, and Triangulated Analysis for Unbiased Market Understanding

This report synthesizes insights derived from a rigorous research methodology combining both primary and secondary data collection. Primary research included structured interviews with over 25 senior executives, process engineers, and technical specialists across refining, petrochemical, and environmental remediation sectors. These qualitative engagements provided first-hand perspectives on regeneration challenges, technology adoption timelines, and strategic priorities.

Secondary research leveraged authoritative industry publications and databases, including trade intelligence from ICIS, raw material import data from the U.S. International Trade Commission, and regional capacity forecasts from the International Energy Agency. Regulatory reviews of EPA, USTR, and EU directives were conducted to map evolving compliance frameworks impacting catalyst reuse. Quantitative triangulation involved cross-verification of supply chain cost inputs and regeneration cycle metrics from multiple sources to ensure data reliability and analytical accuracy.

Through this combination of expert interviews, proprietary datasets, and peer-reviewed sources, the report presents an unbiased, comprehensive view of catalyst regeneration market dynamics. Methodological rigor was maintained by adhering to industry best practices in market sizing, trend analysis, and scenario planning, enabling stakeholders to draw actionable insights and strategic roadmaps with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catalyst Regeneration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catalyst Regeneration Market, by Catalyst Type

- Catalyst Regeneration Market, by Regeneration Technique

- Catalyst Regeneration Market, by Catalyst Material

- Catalyst Regeneration Market, by Application

- Catalyst Regeneration Market, by End Use Industry

- Catalyst Regeneration Market, by Region

- Catalyst Regeneration Market, by Group

- Catalyst Regeneration Market, by Country

- United States Catalyst Regeneration Market

- China Catalyst Regeneration Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings to Emphasize the Strategic Value of Catalyst Regeneration in Enhancing Operational Resilience and Environmental Compliance

Catalyst regeneration has emerged as a linchpin in the pursuit of operational resilience and environmental stewardship across the refining, chemical, and power generation sectors. By restoring deactivated catalysts to near-original performance through advanced chemical, thermal, and oxidative processes, operators unlock substantial cost savings and lifecycle carbon reductions. The convergence of digital transformation, material innovation, and regulatory incentives has further heightened regeneration’s strategic value, transforming it from a supplementary service into an operational centerpiece.

The 2025 tariff landscape has underscored the necessity of supply chain diversification and localized processing to insulate regeneration operations from global trade shifts. Regional insights demonstrate that tailored approaches-bolstered by policy frameworks such as the IRA and EU emissions directives-will define competitive advantage in the coming decade. Furthermore, segmentation analyses reveal nuanced pathways for service providers to differentiate offerings across catalyst types, regeneration techniques, and application venues, ensuring precise alignment with end-user performance criteria.

Ultimately, the report’s synthesis of market drivers, competitive landscapes, and actionable strategies highlights the imperative for stakeholders to integrate regeneration into broader circular economy and decarbonization agendas. Companies that successfully navigate these dynamics will not only enhance their bottom-line resilience but also contribute meaningfully to global sustainability objectives.

Engaging Directly with Ketan Rohom to Access Exclusive Insights and Secure the Comprehensive Market Research Report on Catalyst Regeneration

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, for an exclusive walkthrough of our comprehensive research on catalyst regeneration. Engaging with Ketan will grant you tailored insights into the key drivers reshaping catalyst lifecycles, deep dives into tariff implications, and strategic recommendations to advance your regenerative operations.

By partnering directly, you will gain privileged access to detailed segmentation analyses, regional intelligence, and competitive landscapes that underpin the next frontier of circular economy adoption. Reach out to Ketan to secure your copy of the market research report and position your organization at the vanguard of industrial innovation.

- How big is the Catalyst Regeneration Market?

- What is the Catalyst Regeneration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?