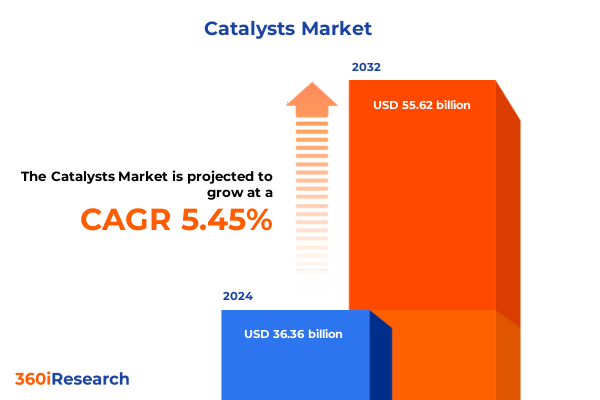

The Catalysts Market size was estimated at USD 38.26 billion in 2025 and expected to reach USD 40.29 billion in 2026, at a CAGR of 5.48% to reach USD 55.62 billion by 2032.

Unveiling the Catalysts Revolution That Is Driving Breakthrough Innovations Across Chemical Synthesis Environmental Solutions and Sustainable Technologies

The catalysts industry is experiencing an unprecedented surge in strategic importance as global value chains intensify their focus on efficient chemical transformations and sustainable production methods. Innovations in catalyst design and manufacturing are delivering step-changes in reaction efficiency, selectivity, and environmental compatibility. As companies across chemicals, refining, and emerging biotechnology sectors strive to balance performance with regulatory and sustainability mandates, catalytic solutions have emerged as a critical enabler of next-generation processes. With digitalization and advanced materials science accelerating discovery cycles, the catalysts landscape has become a focal point for organizations seeking competitive differentiation through technology leadership.

Amid macroeconomic uncertainties and shifting trade policies, stakeholders are reassessing sourcing strategies, partnership models, and research investments to secure resilient supply chains. Emerging end-use sectors such as renewable fuels, carbon capture, and green hydrogen are expanding the addressable base for catalyst providers, while traditional segments continue to demand performance enhancements and cost efficiencies. This dynamic environment calls for a nuanced understanding of evolving market drivers, challengers, and regulatory impacts. This executive summary distills core insights and strategic imperatives, offering decision-makers a structured overview of transformative trends, tariff influences, segmentation nuances, regional dynamics, leading competitors’ trajectories, and actionable recommendations. By framing the current catalysts ecosystem through a multi-dimensional lens, this introduction sets the stage for a deeper exploration of the forces shaping industry trajectories and the pathways to sustainable growth.

Navigating Unprecedented Transformations in Catalyst Technologies Underpinning Decarbonization Efforts Circular Economy Adoption and Next Generation Chemical Processes

Over the past few years, the catalysts sector has undergone a seismic shift driven by converging technological, regulatory, and market forces. First, decarbonization initiatives are propelling demand for catalysts that facilitate hydrogen production, CO₂ conversion, and biomass valorization. At the same time, circular economy principles are prompting developers to design catalysts with enhanced recyclability and longevity, reducing cradle-to-grave environmental footprints. Parallel advances in computational modeling and machine learning are dramatically accelerating the discovery of novel active materials and process optimization, shifting traditional R&D timelines from years to months.

In addition, stringent emissions regulations in major economies are spurring a new wave of environmental catalyst applications, particularly for air pollution control and wastewater treatment. Refiners and chemical manufacturers are investing in advanced hydrotreating and exhaust gas purification solutions to comply with low-emission mandates. Simultaneously, rising demand for specialty polymers is catalyzing innovation in polymerization catalysts that deliver superior molecular control and energy efficiency. These transformative shifts are redefining competitive landscapes, as incumbents and disruptive entrants alike vie to establish leadership in high-growth niches. Consequently, companies must adapt their strategic priorities, forge collaborative ecosystems, and invest in scalable manufacturing platforms to capitalize on emerging opportunities and mitigate evolving risks.

Assessing the Far-Reaching Consequences of the United States Tariffs Announced in 2025 on Catalyst Supply Chains Production and Innovation Dynamics

In 2025, new import tariffs imposed by the United States introduced significant ripple effects across catalyst supply chains, production economics, and innovation strategies. By raising duties on key raw materials and intermediate catalysts originating from select trade partners, the policy shift elevated input costs for domestic manufacturers, compelling them to reassess sourcing destinations and inventory buffers. As a result, some producers accelerated nearshoring initiatives, while others sought to secure alternative feedstocks from non-tariffed regions to preserve cost structures.

This tariff landscape also influenced global R&D collaboration patterns. Partnerships between U.S.-based catalyst developers and overseas research institutions faced new customs complexities, prompting streamlined licensing agreements and knowledge-transfer frameworks. At the same time, locally focused innovation hubs gained momentum as companies invested in domestic pilot plants and scale-up reactors to reduce cross-border dependencies. While higher tariffs initially strained margins, they ultimately triggered a wave of strategic realignment that diversified supply bases and fostered deeper internal capabilities.

Despite short-term disruptions, the recalibrated ecosystem offers a more resilient foundation for future growth. Firms that proactively adjusted to the tariff regime through multi-sourcing, vertical integration, and strategic alliances have positioned themselves to navigate evolving trade policies while continuing to deliver high-performance catalytic solutions.

Illuminating Critical Market Segmentation Perspectives Revealing How Product Types Applications End-Use Industries Material Types and Reaction Mechanisms Intersect

Deconstructing the catalysts market through multiple dimensions reveals nuanced opportunities and strategic levers for value creation. From a product perspective, the landscape spans bio-catalysts that harness enzymatic pathways, chemical catalysts encompassing heterogeneous catalysts such as both enzyme and metal catalysts, homogeneous catalysts, and versatile zeolite frameworks, alongside polymer catalysts that include metallocene and Ziegler-Natta variants designed for precision macromolecular engineering. Each segment commands unique performance attributes and cost profiles, shaping application suitability across diverse end uses.

Turning to applications, the catalysts ecosystem underpins a broad spectrum of chemical synthesis processes, from hydrogenation reactions that saturate aromatic compounds to isomerization steps that refine hydrocarbon structures. Environmental catalysts drive air pollution control through selective reduction of NOₓ and VOC emissions while advancing water treatment protocols for effluent purification. In refining, fluid catalytic cracking catalysts boost gasoline yields, whereas hydrotreating catalysts remove sulfur and metals to meet stringent fuel specifications.

Across end-use industries, agrochemical producers leverage catalyst advancements for precision synthesis of pesticides and fertilizers, enhancing yield and reducing waste. Automotive manufacturers integrate catalysts for exhaust treatment systems and emerging fuel cell technologies that enable zero-emission mobility. Chemical manufacturers rely on catalysts for basic chemical production, achieving higher throughput and lower energy consumption. Meanwhile, pharmaceutical companies exploit biocatalysis and tailored drug synthesis catalysts to drive greener, more cost-effective routes to active pharmaceutical ingredients.

Material selection further refines performance, with inorganic catalysts offering thermal robustness, metal catalysts-both base metals and noble metals-delivering tailored activity, and organic catalysts enabling unique reaction pathways. Finally, reaction type segmentation highlights oxidation processes that convert feedstocks into value-added products, polymerization routes incorporating addition and condensation mechanisms to create specialty polymers, and reduction reactions critical to refining and fine chemicals. By integrating these segmentation lenses, stakeholders can align investment priorities with specific technology enablers and market demands.

This comprehensive research report categorizes the Catalysts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Reaction Type

- Form

- End-Use

- Distribution Channel

Exploring Distinct Regional Dynamics in Catalyst Adoption Across the Americas Europe Middle East Africa and Asia-Pacific Markets Shaping Future Growth

Regional dynamics shape the trajectory of the catalysts industry in distinct ways. In the Americas, robust industrial infrastructure combined with supportive policy frameworks for clean energy deployment is driving investments in hydrogenation and carbon capture catalysts. The United States continues to lead in R&D intensity, while Canada’s growing petrochemical sector fuels demand for advanced refining catalysts. Mexico’s emerging chemical parks offer near-shore manufacturing potential, intensifying competition for catalytic solutions that balance cost and performance.

Within Europe, the Middle East, and Africa, regulatory commitments to emissions reduction and circular economy targets underpin a concerted push for environmental catalysts. Western Europe’s stringent air quality standards have catalyzed growth in selective catalytic reduction systems, whereas the Middle East is leveraging its hydrocarbon wealth to develop downstream refining capabilities with advanced hydrotreating and fluid catalytic cracking catalysts. In Africa, nascent industrialization and infrastructure development create incremental demand for basic chemical catalysts and water treatment solutions, supported by international partnerships and development financing.

Asia-Pacific remains the world’s fastest-growing region for catalyst consumption, propelled by China’s expansive chemical manufacturing base and government incentives for clean coal technologies and renewable chemicals. Japan’s leadership in fine chemical synthesis fosters a robust market for homogeneous catalysts and zeolite-based frameworks. South Korea and India are scaling up domestic refining capacities, intensifying adoption of high-performance hydrotreating and polymerization catalysts. In Southeast Asia, growing petrochemical projects and environmental compliance mandates are elevating demand for both conventional and emerging catalyst technologies.

This comprehensive research report examines key regions that drive the evolution of the Catalysts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Leadership Among Pioneering Catalyst Providers Disrupting Traditional Value Chains Through Partnerships and R&D

Leading catalyst providers are executing diverse strategies to fortify market positions and drive innovation. One multinational chemical conglomerate has intensified its portfolio diversification, expanding capabilities in specialty polymer catalysts through targeted acquisitions and joint ventures. This approach has enabled rapid integration of metallocene and Ziegler-Natta technologies into new geographic markets, while leveraging established distribution networks to accelerate customer adoption.

A second global player known for its noble metal catalyst platforms has prioritized sustainability by developing recyclable catalyst supports and low-energy activation processes. Strategic partnerships with academic institutions and national laboratories have streamlined its pipeline for environmental catalyst solutions, particularly in the air pollution control and water treatment segments. Concurrently, the company has scaled up capacity in regions where stringent emissions regulations offer high growth potential.

A leading research-intensive catalyst developer headquartered in Asia has leveraged its cost-competitive manufacturing base to capture share in the hydrogenation and hydrotreating markets. By integrating digital process controls and continuous manufacturing techniques, it has reduced cycle times and improved product consistency. Meanwhile, specialized biocatalysis providers are collaborating with pharmaceutical and agrochemical firms to co-develop enzyme catalysts tailored for complex molecule synthesis, demonstrating the power of cross-industry alliances to unlock new revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catalysts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Arkema S.A.

- Axens S.A.

- BASF SE

- Chevron Phillips Chemical Company LLC

- Chimet S.p.A.

- Clariant AG

- Clariant Catalysts AG

- CRI/Criterion Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Exxon Mobil Corporation

- Haldor Topsoe A/S

- Honeywell International Inc.

- Johnson Matthey PLC

- Mitsui Chemicals, Inc.

- Shell plc

- Sinopec Catalyst Co., Ltd.

- Toyo Engineering Corporation

- Umicore N.V.

- Vineeth Chemicals

- W. R. Grace & Co.

- Zeolyst International

Empowering Industry Leaders with Actionable Strategies to Strengthen Competitive Advantage Accelerate Sustainable Practices and Navigate Regulatory Complexities

To thrive amid accelerating change, industry leaders must adopt a multi-pronged strategic agenda. First, cultivating supply chain resilience is imperative; this requires proactive multi-sourcing of precursors, investment in near-shore production hubs, and real-time visibility into logistics networks. By diversifying raw material origins and maintaining strategic safety stocks, firms can mitigate tariff volatility and geopolitical disruptions while sustaining uninterrupted catalyst supply for critical operations.

Second, organizations should prioritize co-innovation and open collaboration models. Engaging in consortiums with peers, research institutes, and technology start-ups accelerates access to breakthrough materials and process innovations. Collaborative pilot programs and joint R&D funding mechanisms can de-risk early-stage technologies, enabling quicker scale-up and go-to-market execution. This collaborative posture is especially relevant for emerging domains like green hydrogen, CO₂ conversion, and advanced biocatalysis.

Third, embedding sustainability as a core design principle will drive long-term competitive advantage. Catalyst developers must integrate end-of-life recyclability, reduced energy intensity, and minimal environmental footprint into product roadmaps. Achieving this may involve the adoption of digital twin simulations for process optimization and the implementation of closed-loop recovery systems for precious metals.

Finally, leveraging advanced analytics and AI-driven process control will enhance product quality and operational efficiency. Real-time performance monitoring and predictive maintenance of catalyst beds can boost throughput and extend catalyst lifespan, delivering measurable cost savings. By executing on these recommendations, industry leaders can position themselves to capture growth, build resilience, and advance sustainability objectives.

Detailing the Rigorous Research Framework Employed to Gather Data Validate Insights and Ensure Methodological Integrity Throughout the Catalyst Market Analysis

The insights presented in this analysis are grounded in a rigorous, multi-phase research framework designed to ensure methodological transparency and robustness. The initial phase involved comprehensive secondary research encompassing scientific literature, patent databases, regulatory filings, and trade publications to map technology trends and competitive landscapes. This desk-research phase provided a foundation for identifying key market participants, product innovations, and emerging application areas.

Building on these findings, the primary research phase engaged a diverse panel of stakeholders through in-depth interviews and structured surveys. Respondents included R&D executives at catalyst producers, process engineers at end-use companies, technical directors at catalyst licensing firms, and policy advisors monitoring trade and environmental regulations. Interviews were conducted across major consuming regions to capture regional nuances in regulatory drivers, technology adoption, and supply chain practices.

Data triangulation was achieved by cross-referencing primary insights with quantitative indicators such as trade flow statistics and industry investment reports. A multi-analyst review process ensured consistency in data interpretation and minimized bias. The research team employed scenario-based modeling to assess the potential impact of tariff regimes and regulatory changes, incorporating both qualitative expert feedback and quantitative trend analysis.

This structured approach, combining broad secondary research with deep primary validation and iterative cross-checking, underpins the reliability of the strategic insights and recommendations contained in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catalysts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catalysts Market, by Product Type

- Catalysts Market, by Material Type

- Catalysts Market, by Reaction Type

- Catalysts Market, by Form

- Catalysts Market, by End-Use

- Catalysts Market, by Distribution Channel

- Catalysts Market, by Region

- Catalysts Market, by Group

- Catalysts Market, by Country

- United States Catalysts Market

- China Catalysts Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings Highlighting Strategic Implications and Underscoring the Imperative for Proactive Engagement in the Evolving Catalyst Landscape

As the catalysts landscape continues to evolve under the influence of technological breakthroughs, regulatory realignments, and shifting customer priorities, organizations must maintain a forward-looking posture. The convergence of decarbonization efforts, circular economy imperatives, and digital innovation presents both challenges and pathways for growth. Stakeholders that effectively navigate new tariff structures, harness segmentation insights, and adapt to regional dynamics will be best positioned to capture emerging opportunities.

Strategic investment in advanced catalyst platforms, informed by deep segmentation understanding, will enable companies to tailor solutions to high-value applications, from specialty polymers and fine chemicals to environmental remediation and alternate fuels. Meanwhile, regional engagement strategies that align production footprints with policy incentives and end-use demand will enhance agility and local relevance.

Collaboration and sustainability must remain central to long-term value creation, as cross-industry alliances and green design principles unlock performance gains and future-proof product portfolios. Ultimately, the intersection of robust research methodologies, strategic foresight, and disciplined execution will determine leadership in the next chapter of the catalysts industry. This synthesis underscores the imperative for proactive decision-making and continuous innovation to thrive in an increasingly complex and dynamic environment.

Engage with Associate Director of Sales and Marketing Ketan Rohom to Unlock Tailored Insights and Secure the Comprehensive Market Intelligence Report Today

If you’re ready to transform your strategic vision and harness granular insights from an authoritative analysis of catalyst technologies, reach out to Associate Director of Sales and Marketing Ketan Rohom. Engage directly to discuss tailored solutions that align with your organization’s objectives and secure access to the in-depth market research report. With a comprehensive understanding of evolving market dynamics, regulatory shifts, and competitive landscapes, this report will empower you to identify emerging opportunities, optimize investment decisions, and accelerate innovation roadmaps. Contact Ketan today to arrange a personalized consultation and obtain immediate access to premium intelligence that will enhance your decision-making and position you at the forefront of the catalysts industry.

- How big is the Catalysts Market?

- What is the Catalysts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?