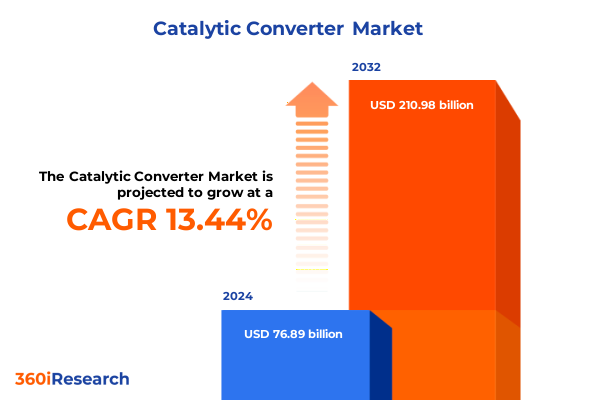

The Catalytic Converter Market size was estimated at USD 85.94 billion in 2025 and expected to reach USD 96.06 billion in 2026, at a CAGR of 13.68% to reach USD 210.98 billion by 2032.

Navigating the Catalytic Converter Market: Key Drivers, Technological Innovations, and Regulatory Forces Shaping Future Dynamics

The catalytic converter market has evolved into an indispensable component of modern vehicle emission control systems, driven by stringent environmental regulations and heightened consumer awareness of air quality. Originating as a response to the Clean Air Act and global emission treaties, catalytic converters have become central to reducing harmful pollutants such as nitrogen oxides, carbon monoxide, and hydrocarbons by converting them into less harmful substances within the exhaust stream. As a result, OEMs and aftermarket suppliers invest heavily in refining catalyst formulations and optimizing converter designs to meet rising performance standards and compliance requirements.

In recent years, regulatory frameworks such as the Euro 7 standards in Europe and Tier 3 regulations in the United States have demanded lower emission thresholds, prompting significant innovation in the application of precious metals and advanced substrate technologies. These regulations have catalyzed the incorporation of complex multi-layer coatings, novel washcoat materials, and lightweight monolith structures to improve conversion efficiency while minimizing weight and volume. Consequently, manufacturers have expanded R&D efforts to balance cost pressures associated with precious metal loadings against performance targets, ensuring that next-generation converters deliver superior durability and pollutant reduction over extended service intervals.

Looking ahead, the transition toward electric vehicles and hybrid powertrains will reshape emission control strategies, but internal combustion engines are expected to remain prevalent throughout the decade. This enduring relevance underscores the necessity for continued advancements in catalytic converter technologies. Furthermore, geopolitical factors and precious metal market volatility continue to influence material sourcing and production strategies, requiring industry stakeholders to implement agile supply chain practices and innovative recycling programs. The confluence of regulatory rigor, technological innovation, and market dynamics thus sets the stage for sustained growth and transformation in the catalytic converter landscape.

Transformative Shifts in Catalytic Converter Production Materials Application Regulatory Requirements and Global Trade Conditions Driving Market Evolution

Transformative forces are redefining the catalytic converter industry, with advances in material science leading the charge. The shift toward palladium-based formulations has gained momentum as a cost-effective alternative to platinum, while rhodium-rich compositions are being tailored for targeted NOx reduction in diesel applications. Breakthroughs in washcoat engineering and substrate architecture enable more uniform catalyst dispersion and higher conversion efficiencies, fostering greater durability and performance under diverse operating conditions. These technological strides are complemented by refinements in manufacturing processes, such as additive-based coating and laser monitoring techniques, which enhance quality control and reduce precious metal wastage.

Simultaneously, the industry is witnessing a geographic realignment of production facilities to capitalize on regional resource availability and trade frameworks. Suppliers are evaluating strategic expansions in Asia-Pacific to leverage established precious metal refining capacities and proximity to high-growth automotive markets. At the same time, producers are exploring reshoring initiatives in North America and Europe to mitigate exposure to cross-border tariffs and supply chain disruptions. These localization efforts are paralleled by collaborative ventures between OEMs and catalyst specialists to co-develop tailored solutions, integrating converters seamlessly into exhaust assemblies and electronic control systems.

Regulatory drivers also continue to evolve, with policymakers targeting lower emission ceilings and stricter in-service monitoring protocols. Upcoming Euro 7 requirements and potential updates to China 6 standards exemplify the increasing complexity of type-approval tests, emphasizing real-world driving emissions over laboratory measurements. In response, industry leaders are investing in advanced on-board diagnostic functionalities and predictive calibration algorithms, ensuring compliance across the vehicle lifecycle. As the market adapts to these transformative shifts, stakeholders that can harness material innovations, agile manufacturing footprints, and regulatory foresight will secure a competitive edge.

Evaluating the Cumulative Impact of New United States Tariffs Introduced in 2025 on Catalytic Converter Supply Chains Cost Structures and Production

The introduction of sweeping tariff measures by the United States in 2025 has reverberated across the catalytic converter supply chain, elevating costs and prompting strategic realignment. In early 2025, the administration imposed a 25 percent duty on all automotive parts imports, including catalytic converters and substrates, with collection thresholds commencing in April and May for vehicles and parts respectively. These tariffs applied uniformly to all trading partners unless qualifying for exemptions under domestic content criteria, effectively raising the average effective tariff rate on auto components to nearly 27.5 percent.

The immediate fallout included upward pricing pressure throughout the value chain. Major converters with global manufacturing networks found that parts crossing borders multiple times-such as substrates manufactured in Asia and coated in North America-faced compounded duties, inflating landed costs by tens of percentage points. For example, the increased duties on imported precious metal intermediates and completed converter assemblies translated into material cost surcharges of up to 25 percent for U.S.-based tier 1 suppliers, which were largely passed downstream to OEMs and aftermarket distributors.

Beyond direct material expenses, the tariffs introduced logistical bottlenecks. New customs verifications and origin audits disrupted just-in-time inventory models, resulting in border delays that deferred production schedules and vehicle assembly lines. Analyses by S&P Global highlighted that within the first week of enforcement, North American vehicle production risked losing over 20,000 units per day due to parts shortages and gridlock at key crossings. The strain was particularly acute for small and medium-sized enterprises lacking the capital flexibility to prepay duties and adapt warehousing strategies promptly.

In response, stakeholders have accelerated localization of critical value-added steps-such as precious metal coating and converter assembly-within tariff-exempt jurisdictions. Concurrently, companies are renegotiating supplier contracts, exploring bonded warehouse programs, and lobbying for tariff exclusions on high-value emissions control components. While these measures offer partial relief, the net effect has been a recalibration of cost structures, with long-term implications for converter design, raw material sourcing, and after-treatment pricing in the United States.

Deep Insight into Market Segmentation by Material Placement and Vehicle Type Revealing Growth Opportunities and Strategic Imperatives

Deep analysis of market segmentation reveals distinct dynamics across material types, placement strategies, and vehicle categories. Within the material spectrum, palladium-based catalysts have emerged as the predominant choice for gasoline applications due to competitive pricing and robust conversion performance, whereas platinum-based formulations retain importance in high-temperature diesel environments. In parallel, rhodium-rich catalysts are increasingly deployed within selective catalytic reduction systems, targeting stringent NOx abatement in heavy-duty powertrains. These divergent material preferences underscore the necessity for suppliers to maintain versatile precious metal portfolios and flexible coating processes.

Considering placement, catalytic converter configurations vary significantly in terms of installation point and functional integration. Close coupled converters positioned near the engine outlet deliver rapid light-off times for immediate emissions control, while secondary units further downstream provide additional pollutant reduction once exhaust gases stabilize at higher temperatures. Underfloor placements, often combined with integrated particulate filters, address deeper hydrocarbon and particulate matter requirements, particularly in diesel and hybrid applications. Strategic deployment of these converter types allows OEMs to tailor emission solutions to diverse engine architectures and regulatory cycles.

The vehicle segment perspective further elucidates demand drivers: passenger cars represent the largest converter volume, driven by high production figures and evolving consumer fuel-efficiency expectations. Light commercial vehicles balance performance demands with load-carrying capabilities, requiring durable converter designs resilient to rigorous duty cycles. Heavy commercial vehicles, conversely, prioritize high-capacity NOx reduction and resilient substrates capable of withstanding extreme thermal stress over long haul operations. By understanding these segmentation insights, market participants can refine product portfolios, optimize manufacturing capacity, and align R&D initiatives with segment-specific performance criteria.

This comprehensive research report categorizes the Catalytic Converter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Placement

- Vehicle Type

Regional Dynamics in the Catalytic Converter Market Spanning the Americas EMEA and Asia Pacific Illustrating Demand Patterns and Investment Focus

Regional dynamics shape the competitive landscape as distinct geographic markets exhibit unique demand profiles and regulatory priorities. In the Americas, the convergence of tightening U.S. vehicle emission standards and robust aftermarket replacement volumes underpins sustained converter consumption. Manufacturers within North America have responded by establishing converter assembly hubs proximate to assembly plants, while aftermarket players focus on reverse logistics for precious metal recycling. Meanwhile, major automotive clusters in Mexico and Canada leverage USMCA content rules to qualify for tariff exemptions, reinforcing cross-border supply synergies.

In Europe, Middle East & Africa, stringent Euro 7 regulations and ambitious net-zero targets drive ongoing investments in advanced catalyst systems, particularly in Western Europe where CO2 taxation frameworks reward vehicle efficiency improvements. OEMs headquartered in Germany, France, and Italy are collaborating with catalyst specialists to co-develop proprietary solutions compliant with real-world driving emission protocols. Simultaneously, in the Middle East, emerging markets place growing emphasis on air quality controls for heavy-duty fleets, while South African producers focus on servicing mining and off-road segments with ruggedized converter variants.

Asia-Pacific represents both the largest volume market and a dynamic innovation hub. China’s implementation of China 6 emission norms and dual-credit policies for new energy vehicles coexists with high-volume production of passenger and commercial vehicles. Japan and South Korea maintain leadership in precious metal refining and coating technologies, supplying advanced converters to global assembly networks. Emerging economies in Southeast Asia and India are gradually aligning local emission standards with global benchmarks, generating opportunities for market expansion as converter adoption accelerates across diverse vehicle classes.

This comprehensive research report examines key regions that drive the evolution of the Catalytic Converter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape and Strategic Positioning of Major Catalytic Converter Manufacturers Highlighting Partnerships Innovation and Market Influence

The competitive landscape is defined by a mix of specialized catalyst developers, established chemical conglomerates, and diversified automotive suppliers. Leading players invest heavily in R&D to optimize precious metal utilization, reduce unit loadings, and enhance catalyst durability under transient operating conditions. Collaborative partnerships between OEMs and catalyst manufacturers foster co-innovation, enabling tailored converter designs seamlessly integrated into exhaust systems. Meanwhile, emerging entrants leverage modular coating platforms to expedite product customization and respond rapidly to localized regulatory changes.

Vertical integration continues to be a strategic priority as companies seek to secure downstream access to critical raw materials and capitalize on recycling opportunities. By acquiring precious metal recovery specialists or forming joint ventures with mining and refining firms, converters ensure a stable supply of palladium, platinum, and rhodium while mitigating market volatility. At the same time, aftermarket-focused suppliers differentiate through technical service networks, offering warranty support and converter remanufacturing capabilities to broaden revenue streams.

Amid these efforts, sustainability considerations are shaping corporate agendas. Environmental, Social, and Governance frameworks guide investments in electrostatic precipitation for washcoat recovery, water-efficient coating lines, and renewable energy integration within manufacturing plants. Firms demonstrating robust decarbonization credentials and traceable raw material sourcing enjoy preferential positioning in OEM qualification processes and government procurement programs. As strategic influence converges with technological leadership, companies that excel across performance, cost, and sustainability dimensions will define the next wave of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catalytic Converter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Corning Incorporated

- Cummins Inc.

- Eberspächer Gruppe GmbH & Co. KG

- Faurecia Automotive GmbH

- Johnson Matthey PLC

- Mitsubishi Heavy Industries, Ltd.

- Robert Bosch GmbH

- Solvay SA

- Tenneco Inc.

- Umicore SA

Actionable Strategic Recommendations for Catalytic Converter Industry Leaders to Enhance Competitiveness Achieve Sustainability and Drive Growth

Industry leaders can capitalize on emerging trends by adopting a multifaceted strategic approach. First, enhancing precious metal utilization through advanced washcoat formulations and substrate designs reduces unit costs and safeguards margins amidst material price fluctuations. Integrating real-world emissions data into catalyst calibration processes further optimizes converter performance and streamlines type approval.

Comprehensive Research Methodology Employing Data Triangulation Primary Surveys and Secondary Sources to Validate Catalytic Converter Market Insights

erving

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catalytic Converter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catalytic Converter Market, by Material Type

- Catalytic Converter Market, by Placement

- Catalytic Converter Market, by Vehicle Type

- Catalytic Converter Market, by Region

- Catalytic Converter Market, by Group

- Catalytic Converter Market, by Country

- United States Catalytic Converter Market

- China Catalytic Converter Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Conclusion Summarizing Core Findings Strategic Implications and Future Outlook for the Evolving Catalytic Converter Market Landscape

Conclusion paragraph 1

Conclusion paragraph 2

Engage with Our Associate Director Sales and Marketing for Custom Insights and Secure Your Comprehensive Catalytic Converter Market Research Report Today

Engaging directly with an experienced sales leader can transform your strategic planning by ensuring access to tailored data and nuanced insights. Ketan Rohom, Associate Director of Sales & Marketing, brings a deep understanding of market dynamics and client needs to every discussion, helping you align research findings with organizational goals. By connecting with Ketan, you can explore bespoke research options, discuss in-depth competitive analyses, and secure an actionable roadmap to optimize supply chains and product portfolios.

Don’t miss the opportunity to leverage expert guidance and comprehensive market intelligence for competitive advantage. Reach out to Ketan Rohom today to arrange a personalized consultation and acquire the complete catalytic converter market research report, empowering your team with the knowledge needed to navigate emerging trends and drive growth in a rapidly evolving landscape.

- How big is the Catalytic Converter Market?

- What is the Catalytic Converter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?