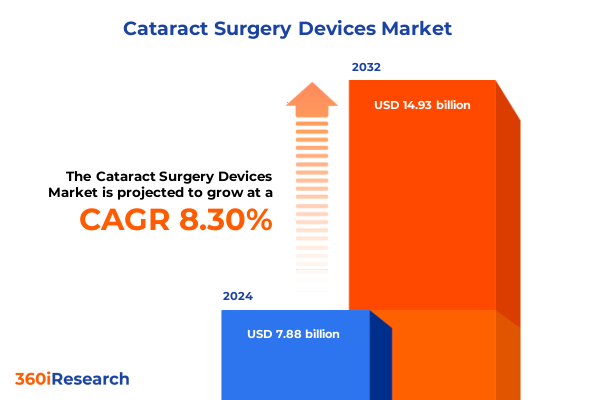

The Cataract Surgery Devices Market size was estimated at USD 8.50 billion in 2025 and expected to reach USD 9.18 billion in 2026, at a CAGR of 8.36% to reach USD 14.93 billion by 2032.

Exploring the Evolving Landscape of Cataract Surgery Devices Against a Backdrop of Innovation, Clinical Demand, and Regulatory Complexity

The advent of sophisticated surgical devices, the maturation of laser-assisted techniques, and the steady expansion of geriatric populations have collectively thrust cataract surgery into a period of unparalleled innovation and complexity. Surgeons and device manufacturers alike are navigating an increasingly crowded landscape in which clinical outcomes, operational efficiencies, and patient satisfaction metrics define competitive advantage. Amid this dynamism, healthcare providers face mounting pressure to adopt solutions that deliver reproducible visual acuity improvements while managing cost constraints and supply chain vulnerabilities.

Against this backdrop, tomorrow’s device leaders will be those who not only harness technological breakthroughs but also anticipate shifting reimbursement models and regulatory imperatives. Investment in next-generation intraocular optics and advanced phacoemulsification platforms is challenging legacy approaches, yet the learning curve associated with novel systems underscores the importance of comprehensive training and practice management solutions. Ultimately, the convergence of clinical demand, macroeconomic headwinds, and progressive value-based care paradigms positions today’s cataract surgery devices market as one of the most strategically critical segments in ophthalmology.

Unraveling the Technological and Procedural Disruptions Redefining Patient Outcomes and Workflow Efficiencies in Cataract Surgery Devices

Technological and procedural advances are redefining the standard of care in cataract interventions, shifting focus from mere lens extraction to a holistic vision correction strategy. The integration of femtosecond laser systems into pre-operative planning and capsulotomy execution has enhanced precision and reduced intraoperative variability, enabling surgeons to achieve more predictable refractive outcomes. Simultaneously, the development of extended depth of focus intraocular lenses has broadened the potential for spectacle independence, particularly among patients with presbyopic needs.

The ripple effects of these innovations extend into care pathways and patient engagement. Healthcare centers are restructuring workflow protocols around laser-assisted suites, and ophthalmology clinics are investing in digital pre-assessment platforms to curate personalized procedural plans. Manual small incision and extracapsular extraction methods are being revisited in resource-constrained environments, underscoring the importance of adaptable technology portfolios. Across all settings, the emphasis on patient-centric metrics-such as contrast sensitivity and postoperative quality of life-drives continuous refinement of device capabilities and procedural algorithms.

Assessing the Ripple Effects of Recent United States Tariff Measures on Supply Chains, Pricing Dynamics, and Manufacturer Strategies through 2025

The introduction of new tariff measures by the United States Trade Representative in early 2025 has introduced heightened cost pressures throughout the device supply chain. Imposed under Section 301 of the Trade Act, these duties have affected imports of surgical instrumentation, laser system components, and consumable disposables. As a result, manufacturers and distributors have recalibrated sourcing strategies, relocating certain production lines to tariff-free jurisdictions or renegotiating supplier contracts to mitigate margin erosion.

In parallel, healthcare providers are confronting upward pricing adjustments, which in some cases have been offset by revised reimbursement codes and supplemental facility fees. Trade associations have engaged with federal regulators to advocate for tariff exemptions on critical ophthalmic devices, arguing that undue financial burdens risk restricting patient access to advanced surgical options. Going forward, the interplay between tariff policy, supply chain resilience, and clinical adoption rates will remain a decisive factor in shaping procurement decisions and competitive positioning through the remainder of 2025.

Distilling Critical Insights from Product Type Technology and End User Segmentation to Uncover Growth Levers in Cataract Surgery Devices

Insight into device performance and market momentum emerges most clearly when analysis is structured around product type, technology, and end user. Examining product categories reveals that femtosecond laser systems are garnering robust adoption in tertiary care centers due to their capacity to execute precise capsulotomies, whereas phacoemulsification equipment retains widespread use across hospitals and outpatient facilities for its versatility. Intraocular lenses form the fastest diversifying product category, as manufacturers push boundaries with monofocal, multifocal, toric, and aspheric designs alongside the latest extended depth of focus optics to meet refined patient expectations.

Technological segmentation spotlights the nuanced shift toward laser-assisted procedures, especially in advanced urban clinics, where arcuate incision and lens fragmentation modules enhance surgical control. Nevertheless, manual small incision techniques persist in ambulatory surgery centers and eye institutes where cost efficiency and procedural throughput remain paramount. Lastly, understanding end-user dynamics brings to light that ambulatory surgery centers are leading capital investment in modular phaco platforms, while ophthalmology clinics increasingly demand bundled maintenance and training packages to support in-office cataract care. This layered segmentation approach underscores the imperative for device providers to align product roadmaps with both clinical sophistication and economic realities.

This comprehensive research report categorizes the Cataract Surgery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

Mapping Regional Trajectories in the Americas Europe Middle East & Africa and Asia Pacific to Highlight Geographical Drivers and Constraints

Geographic analysis reveals distinctive growth vectors and operational hurdles across the Americas, Europe Middle East & Africa, and Asia Pacific regions. In the Americas, large hospital systems in North America are amplifying investments in premium intraocular lenses, driven by competitive provider networks and patient willingness to pay for enhanced visual outcomes. Latin America is characterized by a dual focus on cost-effective phacoemulsification equipment and philanthropic outreach programs that expand access in underserved communities.

Turning to Europe Middle East & Africa, regulatory harmonization under the European Medical Device Regulation has elevated safety standards but elongated product approval timelines. Gulf Cooperation Council nations are accelerating modern cataract surgery adoption through public–private partnerships, while sub-Saharan markets continue to rely on manual extracapsular extraction due to limited infrastructure. Across the Asia Pacific, rapid private hospital expansion in China and India fuels demand for integrated laser suites, whereas Oceania’s mature healthcare systems emphasize incremental upgrades and sustainability initiatives in device procurement. These regional insights illustrate the need for adaptable strategies that reflect divergent market maturities and policy environments.

This comprehensive research report examines key regions that drive the evolution of the Cataract Surgery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning and Competitive Capabilities of Leading Manufacturers Shaping the Cataract Surgery Devices Market

An examination of leading manufacturers in the cataract surgery devices domain highlights a spectrum of strategic postures ranging from platform diversification to targeted innovation. Industry incumbents with legacy phacoemulsification portfolios are bolstering their offerings through strategic acquisitions of femtosecond laser specialists and premium lens developers. Meanwhile, pure-play lens manufacturers are channeling R&D toward advanced polymer chemistries and blue-light filtering technologies to differentiate within the high-volume intraocular lens segment.

Other key players are forging collaborations with software firms to integrate digital planning tools and augmented reality guidance into surgical workflows. Partnerships between device companies and clinical research organizations accelerate evidence generation for new lens designs, reinforcing sales efforts with peer-reviewed clinical data. Collectively, these strategic maneuvers underscore a competitive arena in which scale, innovation agility, and the ability to deliver comprehensive service ecosystems define leadership in the cataract surgery devices sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cataract Surgery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alcon, Inc.

- Bausch & Lomb Incorporated

- Carl Zeiss Meditec AG

- Essilor International S.A.

- HAAG-Streit Holding AG

- HOYA Surgical Optics, Inc.

- Johnson & Johnson Vision Care, Inc.

- Lenstec, Inc.

- NIDEK Co., Ltd.

- PhysIOL SA

- Rayner Intraocular Lenses Limited

- STAAR Surgical Company

- Topcon Corporation

- Ziemer Ophthalmic Systems AG

Translating Sector Analysis into Strategic Actions to Fortify Market Positioning Operational Resilience and Innovation Roadmaps

To capitalize on the dynamic shifts within cataract surgery devices, industry leaders should prioritize a multi-pronged strategy that aligns product innovation with operational scalability and market access. First, expanding modular service offerings that bundle training, maintenance, and digital planning capabilities will unlock new revenue streams and deepen customer engagement. Second, pursuing strategic alliances with regional distributors and clinical networks can accelerate market entry into emerging markets while minimizing local regulatory friction.

Third, organizations must institute agile R&D pipelines that emphasize iterative design and rapid evidence generation, ensuring that next-generation intraocular optics and laser modules reach surgeons with validated clinical benefits. Fourth, proactive engagement with policymakers and payers on tariff exemptions and favorable reimbursement coding will safeguard device affordability and promote equitable patient access. By integrating these elements into a cohesive execution roadmap, market participants can fortify resilience against tariff headwinds and sustain leadership through continuous innovation.

Detailing the Rigorous Multi Source Methodology Underpinning the Analysis to Ensure Robustness Relevance and Analytical Integrity

This research leverages a triangulated methodology combining primary insights from surgeon interviews, device distributor surveys, and payer consultations with secondary data drawn from regulatory filings, clinical trial registries, and company disclosures. Comprehensive device registries were mined to validate product launch timelines and gain/loss of market exclusivity. In parallel, analysis of reimbursement schedules and tariff announcements provided context for pricing dynamics and policy impacts.

Quantitative findings were synthesized using comparative matrices to map competitive positioning, while scenario modeling assessed the relative implications of evolving procedural preferences. Qualitative stakeholder feedback enriched interpretation of adoption barriers, training imperatives, and service model expectations. This rigorous approach ensures that the resultant intelligence reflects both the operational realities of device commercialization and the clinical aspirations of end users across diverse geographies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cataract Surgery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cataract Surgery Devices Market, by Product Type

- Cataract Surgery Devices Market, by Technology

- Cataract Surgery Devices Market, by End User

- Cataract Surgery Devices Market, by Region

- Cataract Surgery Devices Market, by Group

- Cataract Surgery Devices Market, by Country

- United States Cataract Surgery Devices Market

- China Cataract Surgery Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Core Takeaways and Strategic Implications to Illuminate the Path Forward in the Cataract Surgery Devices Landscape

In an era defined by technological convergence and shifting policy landscapes, cataract surgery devices stand at the forefront of ophthalmic innovation. Precision femtosecond platforms, advanced intraocular optics, and increasingly integrated digital ecosystems are collectively reshaping the standard of care. At the same time, tariff challenges and regional regulatory disparities underscore the complexity of achieving global scale and harmonized access.

The intricate interplay between clinical efficacy, operational efficiency, and market access requires that device providers adopt a holistic perspective-one that integrates advanced engineering, stakeholder collaboration, and policy advocacy. Organizations that master this integration will not only capture the immediate benefits of improved patient outcomes but also establish the foundational resilience necessary for future waves of ophthalmic innovation.

Engage Directly with Ketan Rohom for a Personalized Overview and Pathway to Acquire the Complete Market Intelligence Report

To explore deeper insights and secure a competitive edge in the rapidly evolving cataract surgery devices landscape, schedule a personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. During this engagement, you will receive a tailored overview of the full market research report, an outline of how the actionable insights align with your strategic objectives, and guidance on customized data packages designed to address your most pressing business challenges. Reach out today to transform intelligence into impact and accelerate your organization’s growth trajectory.

- How big is the Cataract Surgery Devices Market?

- What is the Cataract Surgery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?