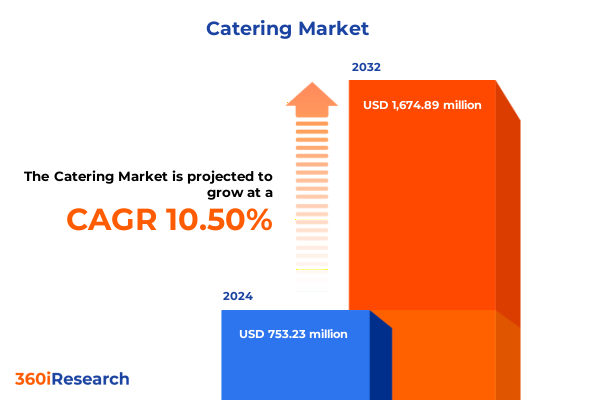

The Catering Market size was estimated at USD 832.55 million in 2025 and expected to reach USD 906.52 million in 2026, at a CAGR of 10.50% to reach USD 1,674.89 million by 2032.

Emerging Consumer Preferences and Operational Innovations Are Reshaping Catering Strategies and Defining Competitive Advantages Nationwide

The catering industry has undergone a remarkable evolution, transitioning from traditional banquet services to a dynamic ecosystem defined by technology-enabled convenience, experiential dining, and sustainability imperatives. In recent years, operators have navigated shifting consumer demands that prioritize health, personalization, and environmental stewardship, prompting a reevaluation of service models and menu innovation. As taste preferences diversify, caterers must balance operational cost pressures with the imperative to deliver memorable experiences fueled by creativity and convenience.

This executive summary offers an in-depth exploration of the transformative forces shaping the catering landscape, highlighting key industry inflection points, the cumulative impact of U.S. tariffs, strategic segmentation insights, and regional dynamics. By unpacking each dimension, decision-makers will gain a holistic understanding of the market’s future trajectory. Subsequent sections delve into competitive positioning, actionable recommendations, research methodology, and concluding insights, ensuring that stakeholders are equipped with the knowledge necessary to drive growth and maintain a competitive edge in this rapidly evolving sector.

Significant Industry Inflection Points Are Altering Service Delivery Models and Forcing Caterers to Embrace Technology and Sustainable Practices

The catering sector is experiencing a wave of transformative shifts driven by digitalization, sustainability demands, and evolving event formats. Technological advancements in online ordering platforms, AI-driven menu customization, and real-time logistics coordination have streamlined operations, reduced waste, and elevated the customer experience. Simultaneously, increasing consumer awareness of environmental impacts has pushed sustainability to the forefront, with plant-based menus, biodegradable packaging, and local sourcing becoming baseline expectations rather than niche offerings.

Moreover, the rise of hybrid and micro-events has compelled caterers to redefine service delivery models, adapting to an environment where intimate gatherings and virtual components coexist. This has fostered experimentation with mobile catering units, pop-up kitchens, and modular service setups that can be deployed rapidly at off-site locations. As a result, service providers are investing in flexible infrastructure and training to address the demands of ever-shifting event landscapes while maintaining consistent quality and brand integrity.

Escalating United States Import Measures Have Ripple Effects across Foodservice Inputs and Operational Expenses Impacting Margin Structures Deeply

Over the past year, the imposition of new tariffs on imported equipment, specialty ingredients, and packaging materials in the United States has reverberated throughout the catering value chain. Tariffs on steel and aluminum, originally levied under national security provisions, have increased the cost of commercial kitchen equipment, mobile carts, and on-site service fixtures. In parallel, duties on certain imported plastic films and disposable serviceware have driven caterers to seek alternative suppliers and invest in reusable or domestically produced materials, prompting a reassessment of procurement strategies.

These import measures have not only elevated direct operational expenses but also contributed to broader inflationary pressures on foodservice inputs. Rising costs of imported specialty cheeses, olives, spices, and wines have compelled menu adjustments and price restructuring. As a result, operators are increasingly turning to local producers to mitigate volatility and foster supply chain resilience. Cumulatively, these tariff-driven shifts underscore the importance of agile sourcing, supplier diversification, and value engineering to preserve margin structures in a more protectionist trade environment.

Analyzing Diverse Customer Segments Reveals Targeted Service Opportunities and Tailored Strategies That Drive Value across Multiple Channels

An in-depth examination of customer segments underscores the critical importance of tailoring service offerings to distinct requirements. When considering service type, the distinction between off-site and on-site catering defines operational models, with delivered meals, mobile catering, and outdoor events demanding different logistical capabilities than services rendered in banquet halls, corporate campuses, or hotels and restaurants. Similarly, food type segmentation illustrates that buffet and plated meal preferences contrast with the growing desire for full meal services or lighter snack and beverage options, each generating unique cost and staffing profiles.

The service model dimension further refines the strategic lens, as drop-off catering appeals to budget-conscious or self-service scenarios, while full-service models cater to clients seeking turnkey event management. End-user segmentation reveals varying expectations across corporate conferences, educational institutions, government defense events, healthcare facilities, social celebrations such as anniversaries, birthdays, and weddings, and sports events. Within each of these segments, subcategories-such as conferences versus meetings, schools versus training institutes, hospitals versus nursing homes-exhibit their own preference patterns and service thresholds. Finally, the dichotomy between chain or franchise-based providers and independent caterers highlights divergent approaches to brand standardization, localized customization, and scalability.

This comprehensive research report categorizes the Catering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Food Type

- Service Model

- End-User

- Provider Type

Regional Dynamics and Local Preferences Define Unique Catering Growth Patterns and Strategic Priorities from Americas to Asia-Pacific and EMEA

Regional variations in catering demand underscore the necessity for regionally tailored strategies. In the Americas, clients increasingly emphasize experiential dining and health-forward menus, creating opportunities for niche providers to differentiate through themed events and wellness-centric offerings. North American operators are also capitalizing on the popularity of food trucks and outdoor pop-ups, while Latin American markets demonstrate robust demand for traditional flavors and festive service formats that reflect cultural heritage.

In Europe, the Middle East, and Africa, regulatory frameworks and consumer preferences vary widely, with European markets placing a premium on traceability, organic sourcing, and artisanal craftsmanship. In contrast, the Middle East emphasizes high-volume banqueting for large-scale gatherings, and Africa’s growth is powered by infrastructural investments in hospitality and corporate events. Meanwhile, Asia-Pacific markets present a dual narrative, where mature economies like Japan and Australia demand premium, bespoke services, and emerging markets exhibit rapid adoption of mobile catering solutions and digital ordering platforms. Collectively, these regional nuances inform market entry, partnership, and menu development strategies.

This comprehensive research report examines key regions that drive the evolution of the Catering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Providers Are Leveraging Operational Excellence Brand Reputation and Innovation to Strengthen Market Position and Define Future Industry Standards

The competitive landscape features a spectrum of providers leveraging differentiated capabilities and brand equity. Global operators have invested in integrated service platforms to streamline order management, supply chain coordination, and customer engagement, enabling consistent delivery standards across diverse geographies. At the same time, mid-sized and emerging players capitalize on niche positioning-specializing in corporate wellness programs, private social celebrations, or themed culinary experiences-to gain relevance within targeted micro-segments.

Innovation in menu design and technology integration is a key differentiator among leading players, with firms deploying AI-driven forecasting tools to optimize inventory and mobile applications to enhance guest interactions. Additionally, strategic partnerships with local farmers, artisanal producers, and event management firms are becoming more prevalent, strengthening supply chains and broadening service portfolios. As the market continues to segment and specialization intensifies, providers that combine operational excellence with deep customer insights will command both loyalty and premium pricing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aramark Corporation

- Autogrill S.p.A.

- AVI Foodsystems Inc.

- Bon Appetit Management Company

- CH&CO Catering Group Ltd

- Compass Group PLC

- Delaware North Companies

- DO & CO Aktiengesellschaft

- Elior Group S.A.

- Emirates Flight Catering

- Gategroup Holding AG

- ISS A/S

- Kofler & Kompanie GmbH

- Mitie Group PLC

- Newrest Group Services SAS

- SATS Ltd.

- Searcys

- Sodexo S.A.

- SSP Group plc

- The Red Radish

- The RK Group

- Thompson Franks Ltd

- Thompson Hospitality

- Wolfgang Puck Catering

Strategic Imperatives for Caterers to Adapt Operational Efficiency Technology Integration and Sustainable Practices for Sustainable Long-Term Competitiveness

To navigate the evolving catering landscape, industry leaders should prioritize technology integration across procurement, operations, and customer engagement. Implementing advanced logistics platforms and demand planning tools will not only reduce waste and costs but also enhance responsiveness to last-minute changes. Furthermore, cultivating strategic relationships with local suppliers and sustainable producers can mitigate tariff-driven price volatility while reinforcing brand commitments to ethical sourcing and community impact.

Operational efficiency must be complemented by talent development initiatives focused on cross-functional skills spanning culinary innovation, event management, and digital marketing. By fostering a culture of continuous learning and equipping teams with the right tools, organizations can adapt more swiftly to shifting client expectations. Finally, embracing circular economy principles-such as reusable serviceware, compostable packaging, and waste-to-resource partnerships-will resonate with environmentally conscious audiences and position operators as responsible leaders in the catering sector.

Robust Multi-Method Approach Incorporating Qualitative Interviews Quantitative Surveys and Secondary Data Ensures Comprehensive and Reliable Market Insights

Our research methodology employs a robust, multi-dimensional approach to ensure the credibility and comprehensiveness of the insights presented. Qualitative interviews with industry executives and event planners provided contextual understanding of emerging trends and pain points, while quantitative surveys of caterers across all service models yielded statistically relevant data on operational practices and client preferences. Secondary sources-including regulatory filings, trade publications, and financial disclosures-were systematically reviewed to validate primary findings and uncover historical patterns.

Data triangulation techniques were applied to reconcile discrepancies and identify converging themes, with segmentation analysis mapping specific insights to service types, food categories, end-user groups, and provider models. Rigorous quality controls, including peer review by sector experts, ensured that the final deliverable reflects both the breadth and depth of the catering market’s current state.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catering Market, by Service Type

- Catering Market, by Food Type

- Catering Market, by Service Model

- Catering Market, by End-User

- Catering Market, by Provider Type

- Catering Market, by Region

- Catering Market, by Group

- Catering Market, by Country

- United States Catering Market

- China Catering Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Critical Findings and Pathways Forward Reinforces Strategic Clarity and Equips Stakeholders with Actionable Knowledge for Future Growth

In summary, the catering industry is at a crossroads defined by disruptive technologies, heightened sustainability expectations, and evolving event formats that demand agility and innovation. The interplay of tariff pressures, shifting consumer preferences, and regulatory dynamics underscores the need for strategic segmentation and regional customization. Market leaders that successfully integrate advanced digital tools, invest in talent development, and foster resilient supply chains will secure competitive advantages and drive long-term value.

As operators refine their service portfolios-leveraging insights from service type, food category, and end-user segmentation-and align them with regional nuances, they can capture new growth opportunities and enhance customer satisfaction. By translating these findings into actionable strategies, stakeholders will be well-positioned to navigate uncertainty, capitalize on emerging trends, and achieve sustainable success in the dynamic catering landscape.

Engage with Associate Director of Sales and Marketing to Unlock In-Depth Catering Market Insights and Secure the Comprehensive Report Insights Today

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides an opportunity to access unparalleled catering market expertise and secure the most comprehensive industry intelligence report available. A conversation with Ketan facilitates an in-depth understanding of unique regional dynamics, evolving customer preferences, and the strategic imperatives that will define success in the competitive catering sector. By leveraging his deep knowledge, decision-makers can pinpoint the most impactful insights to inform procurement, operational planning, and innovation roadmaps.

To obtain the full market research report, reach out to Ketan Rohom to discuss tailored licensing options, receive our executive briefing deck, and schedule a personalized walkthrough of the findings. This decisive step ensures that your team benefits from robust data, nuanced analysis, and actionable recommendations designed to elevate your positioning and drive sustainable growth in the catering industry.

- How big is the Catering Market?

- What is the Catering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?