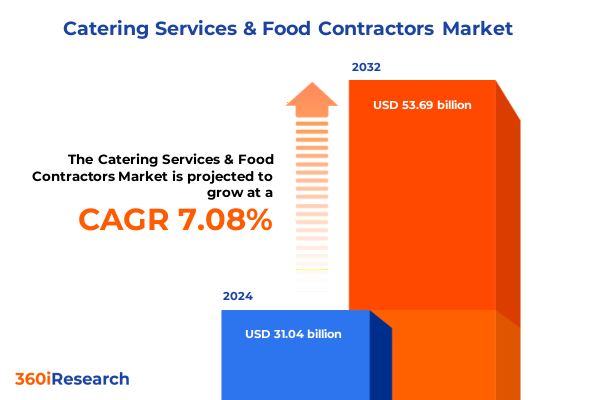

The Catering Services & Food Contractors Market size was estimated at USD 33.20 billion in 2025 and expected to reach USD 35.51 billion in 2026, at a CAGR of 7.10% to reach USD 53.69 billion by 2032.

A comprehensive overview of evolving dynamics and strategic imperatives shaping the catering services and food contracting ecosystem

Catering services and food contracting represent a dynamic segment within the broader hospitality and foodservice landscape, delivering customized meal experiences to corporate, educational, healthcare, and social settings. As clients increasingly prioritize quality, convenience, and health-driven options, providers have evolved operational models to meet diverse demands. Technological integration, supply chain complexity, and a heightened focus on sustainability have converged to redefine best practices across event types, delivery methods, and contract structures.

This executive summary presents a strategic overview of the latest trends, regulatory shifts, and segmentation insights shaping this ecosystem. It synthesizes key regional dynamics, major vendor strategies, and actionable recommendations designed to guide senior executives, procurement specialists, and operations leaders. By distilling in-depth research findings into clear narratives and decision-ready intelligence, this document lays the foundation for informed strategy development and enhanced competitive positioning.

Emerging consumer preferences and technological innovations driving transformative shifts in catering services and food contracting operations nationwide

The landscape of catering services and food contracting has undergone transformative shifts driven by evolving consumer preferences and emerging technologies. Clients now seek highly personalized menus that align with nutritional goals, ethical sourcing, and environmental responsibility. In parallel, digital ordering platforms, artificial intelligence–powered demand forecasting, and automated kitchen equipment have streamlined operations and reduced waste. As a result, providers are investing in integrated technology stacks and forging partnerships with specialized vendors to deliver seamless end-to-end experiences.

Moreover, the supplier landscape has adapted to emphasize regional sourcing networks and resilient logistics. Fluctuations in commodity prices, labor availability, and regulatory requirements have prompted the industry to pursue agile supply chain strategies. Consequently, catering firms increasingly employ data analytics to balance inventory levels, optimize delivery routes, and ensure consistent food quality. These cumulative shifts underscore the need for innovative approaches that blend operational efficiency with customer-centric service design.

Assessing how recent United States tariff measures are reshaping cost structures and strategic sourcing in the catering and food contracting domain in 2025

Assessing the cumulative impact of recent United States tariff measures reveals significant implications for cost structures and strategic sourcing within the catering and food contracting sector. Tariffs on imported staples such as specialty oils, cheeses, and packaging materials have elevated input costs, compelling providers to reevaluate supplier contracts and menu compositions. In response, many operators have accelerated diversification efforts, forging relationships with domestic producers and exploring alternative ingredient profiles that mitigate import dependencies.

Furthermore, the need to manage margin pressures has spurred creative pricing models and service bundling strategies. Some contract caterers have introduced tiered service levels or hybrid offerings that combine core meal programs with premium add-ons. This approach enables clients to retain cost predictability while accessing enhanced customization. As the tariff landscape continues to evolve, providers who integrate flexible sourcing networks and agile procurement frameworks will maintain strategic advantage in a competitive environment.

Uncovering granular market intelligence through meal type, event type, delivery method, contract type, and end-user segmentation insights

Uncovering deep segmentation insights illuminates distinct demand patterns across meal types, event types, delivery methods, contract durations, and end-user categories. When segmenting by meal type, demand for beverages and snack offerings has surged in morning briefing sessions, while breakfast spreads featuring health-forward ingredients have become cornerstones of education and healthcare contracts. Conversely, luncheon menus centered on diverse protein and vegetable selections dominate corporate cafeterias, and buffet-style dinner presentations remain a fixture at large-scale social gatherings.

Translating event-type segmentation into operational strategy highlights that corporate events and conferences prioritize logistical precision and branded presentation, whereas social celebrations and weddings place greater emphasis on experiential elements and thematic customization. Trade shows present a unique hybrid model requiring high-throughput solutions like boxed meals and portable food stations, while short-duration social events frequently leverage plated service for elevated guest experiences. The selection among boxed meals, buffet formats-spanning breakfast, lunch, and dinner buffets-family-style platters, interactive food stations, and plated service reflects both client expectations and contract type, whether long-term partnerships, one-time engagements, or short-term seasonal agreements.

Analyzing end-user segmentation reveals that corporate clients demand consistency, compliance, and data-driven reporting, educational institutions focus on nutrition benchmarks and budget adherence, healthcare providers prioritize dietary restrictions and regulatory oversight, and hospitality venues seek experiential differentiation to drive guest satisfaction. By weaving these segmentation layers together, providers can calibrate service design to maximize efficiency, guest engagement, and contract renewals.

This comprehensive research report categorizes the Catering Services & Food Contractors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Meal Type

- Event Type

- Delivery Method

- Contract Type

- End-User

Illuminating regional demand drivers and opportunity hotspots across the Americas, Europe, Middle East & Africa, and Asia-Pacific catering landscapes

Regional distinctions in the catering and food contracting industry reveal varied demand drivers and strategic imperatives. In the Americas, strong corporate travel and event ecosystems contribute to robust demand for turnkey catering solutions, with emphasis on health-centric breakfasts and mobile snack deliveries. The United States and Canada exhibit mature supply chains, enabling leading providers to leverage technology platforms for real-time menu customization and seamless billing integration.

Across Europe, Middle East & Africa, diversity in cultural preferences and regulatory environments demands high adaptability. In Western European markets, sustainability certifications and farm-to-table sourcing drive menu innovation, whereas Middle Eastern hubs prioritize high-volume banquet services segmented by indoor and outdoor formats. Meanwhile, emerging African economies are witnessing growth in structured food contracting models as multinational corporations expand regional operations. In the Asia-Pacific region, rapid urbanization and expanding corporate sectors underpin growth in buffet and plated service formats. Providers in Japan and Australia differentiate through integration of local culinary traditions and advanced automation to manage peak volumes during large trade shows and social ceremonies.

This comprehensive research report examines key regions that drive the evolution of the Catering Services & Food Contractors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading enterprises and competitive strategies shaping the top-tier catering services and food contracting market participants

Leading stakeholders in the catering services and food contracting arena continue to refine their competitive positioning through technology adoption, strategic partnerships, and sustainability initiatives. Major global enterprises invest in digital platforms that offer integrated event management, real-time dietary compliance monitoring, and AI-driven cost optimization. Concurrently, mid-tier providers carve niche leadership by specializing in sectors such as healthcare or higher education, tailoring service models to stringent regulatory and nutritional requirements.

Innovation extends to strategic collaborations with local farms, artisan producers, and logistics specialists, enabling differentiated menus and resilient supply chains. Companies also accelerate ESG commitments by implementing waste-reduction protocols, reusable packaging programs, and energy-efficient kitchen operations. These concerted efforts enhance brand reputation and support compliance with evolving environmental regulations. As competition intensifies, organizations that align technological capabilities with purpose-driven initiatives will secure leadership in the increasingly discerning catering market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catering Services & Food Contractors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABM Industries Incorporated

- Aramark Corporation

- Autogrill S.p.A.

- BaxterStorey Ltd

- Centerplate LLC

- Chefs Culinar Nord GmbH & Co. KG

- Compass Group PLC

- Delaware North Companies Inc.

- DO & CO Aktiengesellschaft

- Elior Group SA

- Gategroup Holding AG

- ISS A/S

- Kofler & Kompanie GmbH

- Searcys Limited

- Sodexo S.A.

- TajSATS Air Catering Ltd.

- Thompson Hospitality, LLC

- Westbury Street Holdings Limited

- Yum China Holdings, Inc.

Actionable recommendations aimed at driving innovation, resilience, and growth within the catering services and food contracting industry

Actionable recommendations for industry leaders focus on harnessing digital innovation to streamline operations and elevate guest experiences. Operators should prioritize integration of end-to-end platforms that centralize ordering, event scheduling, and analytics. By adopting predictive demand modelling, providers can reduce waste and optimize labor allocation. Leadership teams are encouraged to pilot automation solutions in high-volume settings, such as self-service kiosks or robotic food stations, to enhance throughput and consistency.

Simultaneously, executives should reinforce supply chain resilience through diversified sourcing strategies. Establishing partnerships with regional producers and exploring nearshoring options can mitigate geopolitical and tariff-driven risks. Investing in sustainability frameworks-such as circular packaging initiatives and food-waste reclamation programs-not only reduces environmental impact but also resonates with corporate and institutional clients. Finally, fostering cross-functional collaboration between culinary, procurement, and client-service teams will accelerate innovation cycles and strengthen contract renewals, positioning providers for sustained growth.

Methodological framework integrating primary research, secondary data analysis, and qualitative-quantitative assessments to uncover catering market dynamics

The research methodology underpinning this analysis combines robust primary and secondary approaches to ensure comprehensive coverage and analytical rigor. Primary insights derive from in-depth interviews with C-suite executives, procurement specialists, and operational leaders across corporate, education, healthcare, and hospitality sectors. Complementing these discussions, a structured survey collected perspectives on key pain points, service expectations, and investment priorities from over two hundred decision-makers.

Secondary research encompassed analysis of industry journals, regulatory filings, and vendor white papers to map technology adoption curves, tariff impacts, and sustainability benchmarks. Data triangulation techniques were applied to reconcile varying definitions and metrics, while qualitative-quantitative integration facilitated the identification of emergent themes and strategic inflection points. This mixed-methods framework delivers actionable clarity on market dynamics, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catering Services & Food Contractors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catering Services & Food Contractors Market, by Meal Type

- Catering Services & Food Contractors Market, by Event Type

- Catering Services & Food Contractors Market, by Delivery Method

- Catering Services & Food Contractors Market, by Contract Type

- Catering Services & Food Contractors Market, by End-User

- Catering Services & Food Contractors Market, by Region

- Catering Services & Food Contractors Market, by Group

- Catering Services & Food Contractors Market, by Country

- United States Catering Services & Food Contractors Market

- China Catering Services & Food Contractors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summative perspectives highlighting core findings and future-facing considerations for catering services and food contracting stakeholders

In summary, the catering services and food contracting landscape presents a blend of opportunity and complexity driven by evolving client demands, technological advancements, and regulatory shifts. Providers that embrace customization, digital integration, and sustainable practices will differentiate themselves in a competitive market. Regional nuances-from mature North American supply chains to emerging Asia-Pacific corporate sectors-require tailored strategies that align with local preferences and operational realities.

As the industry continues to adapt to tariff influences and segmentation dynamics, organizations that leverage data-driven insights and strategic partnerships will achieve greater resilience and profitability. This executive summary serves as a roadmap for navigating current challenges and capitalizing on emerging trends, equipping decision-makers to chart a course toward sustainable growth and market leadership.

Engage with Ketan Rohom to access the definitive catering services and food contracting research report and elevate your strategic decision-making

Engaging with Ketan Rohom as your primary liaison unlocks direct access to the comprehensive research report on catering services and food contracting. As Associate Director of Sales & Marketing, Ketan Rohom will guide you through tailored insights and executive briefings, ensuring your organization fully leverages the strategic analysis contained within the study. With his expertise in market requirements and stakeholder priorities, he can recommend the most relevant sections, data visualizations, and proprietary findings to address your unique business challenges and growth objectives.

To initiate the purchase process and secure immediate delivery of the report, contact Ketan Rohom directly via your preferred professional outreach channel. His consultative approach ensures a seamless transaction and will schedule a personalized debrief to walk your leadership team through the report’s key takeaways. By partnering with Ketan Rohom, decision-makers gain a trusted advisor who can help transform research insights into actionable roadmaps, driving enhanced competitiveness in the catering services and food contracting domain.

- How big is the Catering Services & Food Contractors Market?

- What is the Catering Services & Food Contractors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?