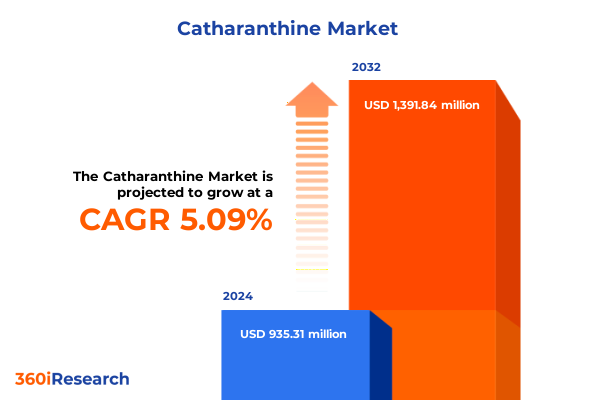

The Catharanthine Market size was estimated at USD 983.54 million in 2025 and expected to reach USD 1,039.23 million in 2026, at a CAGR of 6.13% to reach USD 1,491.84 million by 2032.

Setting the Stage for Catharanthine Market Dynamics and Strategic Imperatives for Stakeholders Across Industrial and Therapeutic Applications

The evolving Catharanthine market represents a confluence of scientific innovation, regulatory advances, and shifting stakeholder priorities that is poised to reshape therapeutic and industrial landscapes. This introduction articulates the significance of Catharanthine, an alkaloid derived primarily from Catharanthus roseus, and outlines the drivers propelling its adoption across pharmaceutical, nutraceutical, cosmetic, and research segments. As interest intensifies in alkaloid-based therapeutics, understanding the foundational market forces becomes imperative for strategic planning and investment.

Through a nuanced examination of market catalysts, ranging from technological breakthroughs in extraction and synthesis to evolving regulatory frameworks and sustainability demands, this section lays the groundwork for comprehending how Catharanthine will influence product development pipelines and supply chain dynamics. By clarifying the core attributes of the market environment, this introduction ensures that decision-makers, investors, and researchers gain a cohesive perspective to navigate emerging opportunities and challenges with confidence and foresight.

Unveiling the Major Transformative Forces Reshaping Catharanthine Extraction Technologies Therapeutic Applications and Supply Chains Worldwide

Recent years have witnessed an unprecedented acceleration in the mechanisms driving Catharanthine market transformation. Advances in biotechnology have enabled the refinement of plant cell fermentation and precision breeding techniques, dramatically enhancing yield and purity. Simultaneously, breakthroughs in green chemistry are lowering environmental footprints by reducing solvent usage and waste, propelling sustainable extraction protocols into mainstream adoption.

Shifts in therapeutic innovation are equally pronounced, as Catharanthine’s role in oncology research combined with its expanding potential in cardiovascular and neuroprotective applications has attracted increased funding and collaboration across industry and academia. Regulatory bodies are responding in tandem, instituting harmonized frameworks that streamline approval processes for plant-derived active pharmaceutical ingredients while imposing rigorous quality and safety standards. These converging forces are unleashing new commercial models and partnerships, underscoring a seismic realignment in supply chains, investment patterns, and stakeholder interactions across global Catharanthine markets.

Assessing the Multifaceted Impact of 2025 United States Tariff Policies on Catharanthine Supply Import Channels and Industry Competitiveness

In 2025, the United States implemented a revised tariff structure targeting specific bioactive compounds, including Catharanthine, in an effort to bolster domestic production. These measures have generated multifaceted repercussions throughout the value chain, affecting import costs, sourcing strategies, and manufacturer profitability. Multinational producers have been compelled to reassess their supply networks, exploring domestic cultivation initiatives and forging partnerships with local biotech firms to mitigate tariff-induced cost pressures.

At the same time, certain portions of the market have experienced supply constraints, driving increased investment in synthetic production pathways and alternative sourcing from lower-tariff jurisdictions. This reallocation of resources has elevated research collaborations aimed at synthetic analogues, while simultaneously prompting concentrated lobbying efforts to renegotiate duty provisions. The overarching consequence is a more localized manufacturing ecosystem that prioritizes resilience, albeit at the expense of near-term margin compression, emphasizing the importance of agile operational strategies.

Deriving Critical Market Perspectives from End Use Source Grade and Form Segmentation to Inform Catharanthine Commercial Strategies

The Catharanthine market reveals distinct narratives when examined through the lens of end use, source, grade, and form segmentation. Based on end use, the cosmetic domain bifurcates into hair care and skin care products where Catharanthine’s antioxidant properties are leveraged for premium formulations, and nutraceutical applications span dietary supplements and functional foods enriched with alkaloid-driven health benefits. Pharmaceutical applications concentrate on cardiovascular and oncology therapeutic development, reflecting the compound’s clinical potential, while the research sphere encompasses academic and industrial investigations advancing process innovation and bioactivity profiling.

When viewed through source segmentation, the distinction between natural extraction and synthetic production reveals divergent cost structures and purity outcomes, with synthetic routes gaining traction for consistency despite higher upfront R&D investments. Grade categorization further differentiates the market, as analytical grade materials fulfill stringent laboratory requirements, cosmetic grade variants cater to formulation aesthetics, and pharma grade supplies underpin regulatory-compliant drug manufacture. Finally, form segmentation-comprising granules, liquid concentrates, and powder-addresses varied downstream processing needs, influencing handling logistics and dosage precision. Together, these segmentation insights form an integrated perspective for tailoring commercial strategies.

This comprehensive research report categorizes the Catharanthine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Grade

- Form

- End Use

Uncovering Regional Differentiators across Americas Europe Middle East Africa and Asia Pacific Dynamics in Catharanthine Markets

Across the Americas, robust research ecosystems and established pharmaceutical hubs in the United States and Canada drive sustained demand for high-purity Catharanthine, supported by regulatory incentives and strong private investment. Latin American nations contribute through expanding cultivation initiatives that leverage favorable climates, creating complementary supply sources and reinforcing regional value chains. Transitioning to Europe Middle East & Africa, stringent European quality standards and Middle Eastern investment in biotech incubators foster high-value processing and distribution centers, while African nations ramp up agronomic trials to diversify cultivation landscapes.

In the Asia-Pacific region, burgeoning pharmaceutical and nutraceutical segments in markets such as China, India, and Australia underscore the importance of scale and cost competitiveness. Regional policy shifts toward promoting indigenous plant-derived compounds have spurred contract manufacturing growth and cross-border R&D partnerships. Together, these regional dynamics highlight disparate regulatory environments, investment drivers, and infrastructure maturity levels, necessitating geographically tailored market entry and expansion strategies that optimize the interplay between local capabilities and global demand.

This comprehensive research report examines key regions that drive the evolution of the Catharanthine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Intelligence and Strategic Positioning of Leading Stakeholders in the Global Catharanthine Value Chain Landscape

Leading players in the Catharanthine domain have adopted differentiated strategies to capture value across the supply chain. Major pharmaceutical companies are pursuing in-licensing of innovative extraction technologies alongside co-development partnerships with biotechnology firms, seeking to secure exclusive rights to high-purity derivatives and reinforce clinical pipelines. Nutraceutical and cosmetic innovators, recognizing consumer demand for botanical extracts, are integrating vertically by investing in dedicated downstream processing facilities that ensure continuity of supply and quality control.

Emerging synthetic biology specialists are forging alliances with academic institutions to accelerate metabolic engineering efforts, targeting proprietary production strains that promise scalable yields at reduced unit costs. Meanwhile, contract research and manufacturing organizations are expanding capabilities to accommodate multi-grade production, positioning themselves as essential cogs in the ecological network that services both raw material providers and end-use brand owners. These strategic maneuvers underscore a competitive environment where collaboration, technology ownership, and operational excellence define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catharanthine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BioCrick BioTech

- Biomol GmbH

- Biosynth

- Cambridge Bioscience Limited

- Cayman Chemical Company

- ChemFaces

- Clearsynth

- Conscientia Industrial Co., Ltd.

- Enzo Life Sciences, Inc.

- Hainan Yueyang Biotech Co.,Ltd

- Hefei Home Sunshine Pharmaceutical Technology Co., Ltd.

- LKT Laboratories, Inc.

- Merck KGaA

- Parchem

- Sandoo Pharmaceuticals and Chemicals Co.,Ltd.

- The Good Scents Company

- Thermo Fisher Scientific Inc.

Shaping Strategic Roadmaps with Actionable Recommendations for Industry Leaders to Navigate Catharanthine Market Complexities and Opportunities

Industry leaders should consider advancing integrated supply chain models that blend domestic cultivation with flexible synthetic manufacturing, thereby reducing exposure to tariff volatility and ensuring uninterrupted availability of high-potency Catharanthine. Investments in next-generation extraction and purification platforms will yield operational efficiencies and sustainability gains, enabling companies to meet elevated regulatory and consumer expectations. Furthermore, establishing joint ventures with regional agritech pioneers can expedite market access while fostering collaborative advancements in strain improvement and agronomic practices.

From a formulation standpoint, prioritizing R&D on novel delivery systems will unlock new application areas in both therapeutic and personal care segments. Engagement in regulatory dialogue-through industry associations and direct government outreach-can shape favorable policy frameworks and expedite approval pathways. By deploying data-driven market intelligence to anticipate end-use trends and customizing product portfolios accordingly, organizations will position themselves to capitalize on evolving demand patterns and maintain a competitive edge.

Detailing Robust Research Framework and Methodological Approaches Underpinning the Catharanthine Market Analysis for Credibility and Rigor

This analysis is grounded in a comprehensive research framework integrating primary interviews with key opinion leaders, including formulation scientists, extraction technologists, and pharmaceutical executives. Complementary secondary research involved an exhaustive review of scientific publications, regulatory filings, patent literature, and trade data to validate market trends and competitive movements. Triangulation of findings through cross-referencing supplier databases, customs records, and corporate disclosures ensured rigorous data integrity.

Quantitative insights were derived via a bottom-up approach that synthesized production capacity metrics, process yields, and price benchmarks across regions. Qualitative perspectives were enriched through interactive workshops with industry stakeholders, enabling scenario planning for tariff changes and supply disruptions. Quality control procedures, including data validation protocols and peer review, underpin the credibility and reliability of the research outputs, enabling stakeholders to leverage actionable intelligence with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catharanthine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catharanthine Market, by Source

- Catharanthine Market, by Grade

- Catharanthine Market, by Form

- Catharanthine Market, by End Use

- Catharanthine Market, by Region

- Catharanthine Market, by Group

- Catharanthine Market, by Country

- United States Catharanthine Market

- China Catharanthine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Insights Synthesizing Key Findings Reflections and Future Considerations for Stakeholders Engaged in Catharanthine Markets

The collective insights reveal a Catharanthine landscape shaped by technological innovation, regulatory evolution, and strategic realignments in sourcing and production. Advancements in both natural extraction and synthetic biology pathways are converging to enhance product consistency and cost efficiency, while differentiated segmentation highlights the nuanced requirements of cosmetic, nutraceutical, pharmaceutical, and research applications. Regional variations underscore the importance of localized strategies, from agronomic initiatives in Latin America and Africa to high-value processing in Europe and dynamic market expansion in Asia-Pacific.

Looking ahead, stakeholder success hinges on the ability to integrate supply chain resilience with ongoing R&D investments and proactive regulatory engagement. By synthesizing these threads, organizations can anticipate shifts, capitalize on emerging therapeutic and consumer trends, and safeguard their market positioning. These concluding reflections set the stage for actionable decision making and sustained value creation in the evolving Catharanthine market.

Encouraging Immediate Engagement to Unlock In-Depth Market Intelligence and Partner with Ketan Rohom for Comprehensive Catharanthine Research Purchase

Are you ready to access tailored insights into the complex dynamics of the Catharanthine market and drive informed decision making for your organization? Ketan Rohom, Associate Director of Sales & Marketing, warmly invites you to engage with our robust, in-depth market research report. By partnering with Ketan, you gain personalized guidance on leveraging the latest intelligence to uncover strategic opportunities and mitigate risks across supply chains, therapeutic developments, and extraction innovations. His expertise in translating detailed analysis into clear, actionable plans ensures that you will unlock the full potential of the Catharanthine landscape.

Secure your competitive edge today by reaching out to Ketan Rohom. His collaborative approach and deep industry knowledge will help you tailor the report’s findings to your unique needs, whether you are focused on optimizing sourcing strategies, expanding into emerging regions, or refining product portfolios. Act now to transform data into strategy and elevate your market positioning with confidence. Contact Ketan to discover the unparalleled advantages of our Catharanthine research and chart a proactive path forward for sustainable growth and innovation.

- How big is the Catharanthine Market?

- What is the Catharanthine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?