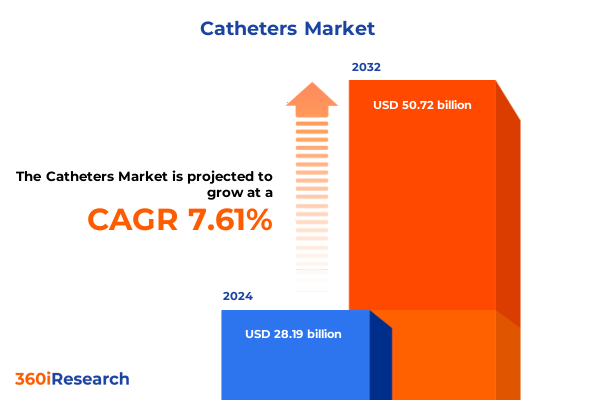

The Catheters Market size was estimated at USD 30.21 billion in 2025 and expected to reach USD 32.41 billion in 2026, at a CAGR of 7.68% to reach USD 50.72 billion by 2032.

Introducing the dynamic world of catheter innovations driving minimally invasive interventions and elevating procedural precision and patient care outcomes

The catheter landscape has evolved from simple medical tubing into a complex ecosystem of life-saving devices that facilitate diagnostics and therapy across a broad spectrum of clinical procedures. Innovation in catheter design, materials, and functionality has enabled healthcare providers to perform intricate interventions with greater precision, reduced patient trauma, and improved recovery times. Over the past decade, catheters have become indispensable tools in cardiovascular, neurological, urological, and gastroenterological applications, supporting minimally invasive approaches that minimize hospital stays and lower the risk of complications.

As healthcare systems worldwide prioritize value-based care and procedural efficiency, catheters have emerged as critical enablers of enhanced patient outcomes. Clinicians now leverage smart catheters equipped with integrated sensors to obtain real-time physiological data, guiding treatment decisions and minimizing procedural uncertainties. At the same time, material science advancements have introduced biocompatible polymers and innovative coatings to reduce friction and inhibit bacterial colonization, addressing critical concerns around infection control and device longevity.

Looking ahead, the convergence of digital health platforms, additive manufacturing, and next-generation materials is set to redefine what catheters can achieve. Stakeholders must understand the interplay between technology, regulation, and clinical demand to position themselves for success in this dynamic market. This report offers a strategic roadmap to the most impactful innovations and emerging trends, providing clarity on where the catheter industry is headed and how to capitalize on its transformative potential.

Exploring transformative paradigm shifts in catheter technology reshaping clinical practices through smart sensors antimicrobial coatings and advanced materials

Emerging smart catheter technologies are revolutionizing minimally invasive procedures by integrating sensors that deliver real-time feedback and diagnostics at the point of care. These advanced devices can monitor intracardiac pressure, temperature, and chemical markers during cardiac catheterization, guiding electrophysiologists as they map arrhythmias and deliver targeted therapies with unprecedented accuracy. Meanwhile, miniaturized, steerable catheter designs navigate complex vascular pathways, enabling neurosurgeons to access previously unreachable lesions and cardiologists to perform precise angioplasties with reduced fluoroscopy time and improved patient comfort.

Parallel advancements in coating technologies are addressing the persistent threat of catheter-associated infections. Antimicrobial catheters leverage silver alloy, chlorhexidine, or antibiotic-infused hydrophilic coatings to disrupt biofilm formation and reduce bacterial colonization by up to 50%, significantly lowering the incidence of catheter-associated urinary tract infections. Next-generation polymer matrices control the sustained release of antimicrobial agents, extending efficacy well beyond procedural timeframes and aligning with stringent infection control protocols.

Innovations in biodegradable and bioresorbable catheter materials promise to eliminate the need for device retrieval and reduce long-term foreign body complications. Polymers that safely dissolve in vivo over a specified duration are under clinical investigation, with the potential to transform urological and vascular interventions where temporary access is required. Simultaneously, AI-driven geometric optimization is informing the design of anti-infection surface structures, reducing upstream bacterial adherence and prolonging catheter dwell times without the need for novel chemical coatings.

Digital integration of catheter systems with cloud-based analytics and robotic guidance platforms is another transformative shift. Connected devices capture procedural metrics and patient data in real time, feeding machine-learning models that predict complications and recommend pathway adjustments during interventions. As regulatory frameworks evolve to accommodate data-enabled devices, industry players are forging partnerships to integrate catheters into broader digital health ecosystems, securing their role in the next era of precision medicine.

Evaluating the cumulative implications of 2025 United States tariff policies on catheter supply chains raw material costs and healthcare delivery dynamics

In April 2025, the United States implemented a comprehensive tariff regime introducing a baseline 10% duty on most imported medical goods, with escalated levies of up to 25% on products originating from China and 20% on select European imports. This policy shift aims to incentivize domestic manufacturing and address perceived trade imbalances. Non-exempt medical devices such as catheters, often sourced from low-cost manufacturing hubs, now face higher entry costs, raising concerns among hospitals and device distributors regarding supply stability and budgetary impacts.

The catheter segment, categorized under consumables largely supplied by China and Costa Rica, has experienced price increases and intermittent supply constraints. Industry analysis indicates that tariffs on these markets could curtail export volumes of low-margin, high-volume products such as urinary and suction catheters, risking shortages in high-demand settings. As raw material expenses climb due to higher duties on polymers, stainless steel, and silicone components, device manufacturers face squeezed margins and the prospect of passing costs through to healthcare providers and payers.

Healthcare associations have urged policymakers to grant exemptions for critical medical supplies, emphasizing that broad-based tariffs jeopardize patient access and strain hospital finances. Some manufacturers are pursuing tariff mitigation strategies, including relocating assembly operations closer to end markets, diversifying supplier networks, and accelerating clinical domestic approvals. Despite these efforts, industry stakeholders anticipate a period of adjustment in which inventory repricing, supply chain reconfiguration, and provider reimbursement negotiations will dominate the operational landscape.

Uncovering key segmentation insights across product types materials coatings end users and applications to inform strategic decision making in the catheter domain

The catheter market encompasses a diverse range of product categories tailored to specific clinical needs, spanning from cardiac and neurovascular catheters designed for vascular diagnostics and interventions to specialized gastroenterology devices that facilitate endoscopic procedures. Urinary and suction catheters address fluid management across acute and chronic care settings, each segment presenting unique functional requirements and procedural contexts. Differentiated by usage profile, external catheters support short-term external drainage, while indwelling devices fulfill long-term access needs, and intermittent self-catheters empower patient autonomy in home care environments.

Material selection plays a pivotal role in device performance and patient safety. Polymer-based catheters offer flexibility and cost efficiency, rubber constructions provide enhanced tensile strength, and silicone options deliver superior biocompatibility and reduced tissue irritation. Coating strategies, ranging from hydrophilic agents that improve maneuverability to antimicrobial surfaces that combat biofilm formation, further refine device functionality and support infection control initiatives across care settings.

End users of catheter technologies span ambulatory surgical centers that rely on procedural efficiency and turnover, home healthcare environments where ease of use and patient comfort are paramount, and hospitals and clinics that demand versatile device inventories to support high-volume case mixes. In application, diagnostic catheters facilitate imaging and monitoring functions, while therapeutic devices enable interventions such as angioplasty, drug delivery, and hemostasis, highlighting the sector’s dual role in both patient evaluation and treatment.

This comprehensive research report categorizes the Catheters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Material

- Coating

- End User

- Application

Revealing critical regional dynamics influencing catheter adoption patterns in the Americas Europe Middle East Africa and Asia Pacific markets

The Americas region maintains leadership in catheter adoption, driven by robust healthcare infrastructure, favorable reimbursement frameworks, and high per-capita procedural volumes. North America in particular benefits from advanced clinical environments that prioritize minimally invasive therapies, while Latin American markets are strengthening capacity through targeted investments in interventional cardiology and urology services. Despite some variations in healthcare expenditure across countries, the region’s commitment to procedural innovation underpins steady demand for both standard and next-generation catheter solutions.

In Europe, the Middle East, and Africa, catheter use is influenced by a confluence of aging populations in Western Europe, which drive demand for cardiovascular and urological interventions, and emerging healthcare investments in Gulf Cooperation Council states where infrastructure modernization is expanding access to advanced procedural care. Regulatory harmonization under the European Medical Device Regulation framework has accelerated CE certifications for novel catheters, while Africa’s markets remain focused on basic consumables and infection-resistant coatings to address public health priorities.

Asia-Pacific stands out as the fastest-growing region for catheter technologies, fueled by the high burden of cardiovascular disease in East and South Asia-accounting for nearly 45% of global incident cases-and government initiatives to bolster domestic manufacturing capabilities. Rising healthcare spending in China and India, along with expanding private insurance coverage, is increasing access to both diagnostic and therapeutic catheter procedures. Although cost sensitivity remains a factor, the region’s large patient populations and growing clinical expertise present significant opportunities for market expansion of advanced catheter platforms.

This comprehensive research report examines key regions that drive the evolution of the Catheters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing strategic initiatives investments and competitive positioning of leading catheter manufacturers shaping innovation and market trajectories

Key industry players continue to refine and expand their catheter portfolios through targeted investments, strategic partnerships, and product enhancements. Medtronic has strengthened its electrophysiology offerings with next-generation steerable mapping catheters and has accelerated development of biodegradable polymer designs to support temporary vascular access. Boston Scientific leverages its pulsed field ablation catheter technology, expanding regulatory approvals across North America and Europe, while introducing versatile balloon dilatation platforms that address both coronary and peripheral vascular markets.

Teleflex remains at the forefront of antimicrobial catheter innovation, deploying advanced coating systems that integrate silver alloys and chlorhexidine matrices to reduce infection rates. B. Braun focuses on sustainability by integrating eco-friendly silicone compounds and supporting hospital sterilization programs to extend device lifecycles. Coloplast emphasizes patient-centric design for intermittent self-catheters, enhancing ease of use and comfort for home healthcare patients.

Emerging competitors such as Cook Medical are leveraging custom extrusion processes to deliver specialized silicone urinary catheters and novel dual-balloon drainage devices. Cardinal Health and Becton Dickinson, while known for broader supply chain capabilities, are optimizing distribution networks for faster replenishment of catheter consumables in high-volume settings. Together, these activities underscore an industry-wide commitment to innovation, quality, and operational efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Catheters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Advin Group

- ALVIMEDICA

- Amsino International, Inc.

- Andocor

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- B. Braun SE

- Becton, Dickinson, and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Coloplast A/S

- Convatec Group PLC

- Cook Group Incorporated

- Freudenberg Medical

- GE HealthCare Technologies Inc.

- Getinge AB

- Hollister Incorporated

- HR HealthCare

- Johnson & Johnson Services Inc.

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medline Industries LP

- Medtronic PLC

- Merit Medical Systems Inc.

- Nipro Corporation

- Olympus Corporation

- Q3 Medical Group

- Siemens Healthcare GmbH

- Stryker Corporation

- Surmodics, Inc.

- Teleflex Incorporated

- Terumo Medical Corporation

Presenting actionable recommendations for industry leaders to capitalize on emerging catheter technologies optimize supply chains and drive sustainable growth

Industry leaders should prioritize strategic investments in smart catheter technologies that integrate real-time sensor analytics and AI-driven decision support to differentiate offerings and enable premium pricing models. Collaborating with digital health partners to develop closed-loop procedural platforms will accelerate adoption and generate recurrent service revenues. In parallel, expanding antimicrobial and hydrophilic coating portfolios will address persistent infection control challenges, reinforcing clinical value propositions in both inpatient and ambulatory care settings.

Supply chain resilience must be bolstered through diversified sourcing strategies and nearshoring initiatives that mitigate tariff exposure and raw material volatility. Organizations should evaluate reshoring selective production of polymer tubing and silicone components, securing government incentives where available and reducing lead times for critical consumables. Establishing dynamic inventory management systems linked to real-time demand forecasts will help align manufacturing output with provider needs.

To capture growth in emerging markets, companies need to tailor product offerings to address varying regulatory environments, cost sensitivities, and healthcare infrastructure maturity levels. In Asia-Pacific, partnerships with local contract manufacturers can expedite market entry, while in EMEA, securing CE mark extensions for key catheter platforms will streamline cross-border commercialization. Ultimately, balancing global scale with regional customization and partnership models will be essential for sustainable expansion.

Detailing robust research methodology and analytical framework employed to ensure comprehensive insights and rigorous evaluation of the catheter market landscape

This analysis employs a mixed-method research framework combining qualitative and quantitative data sources to ensure comprehensive market insights. Primary research involved in-depth interviews with healthcare professionals, procurement specialists, and R&D leaders at major catheter manufacturers to validate emerging trends, technological priorities, and supply chain strategies. Secondary research synthesized industry publications, regulatory filings, peer-reviewed journals, and credible news outlets to map technological developments, competitive landscapes, and policy impacts.

An analytical hierarchy was applied to segment market dynamics across product categories, materials, coatings, and end-user applications. Regional assessments leveraged epidemiological data from the Global Burden of Disease study, regulatory timelines under FDA and CE jurisdictions, and macroeconomic indicators to project adoption patterns without extending into explicit forecasting. Competitive profiling integrated recent product launches, clinical trial outcomes, and strategic partnerships, emphasizing activities through mid-2025.

All sources were critically evaluated for credibility, recency, and relevance, excluding any reports from vendor-sponsored market research firms listed in the exclusion criteria. Findings were triangulated across multiple data points to mitigate bias and enhance the robustness of insights. The resulting framework provides an objective, forward-looking perspective on innovation drivers, market disruptors, and strategic imperatives shaping the catheter landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Catheters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Catheters Market, by Product

- Catheters Market, by Type

- Catheters Market, by Material

- Catheters Market, by Coating

- Catheters Market, by End User

- Catheters Market, by Application

- Catheters Market, by Region

- Catheters Market, by Group

- Catheters Market, by Country

- United States Catheters Market

- China Catheters Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing critical findings and strategic perspectives to provide a compelling overview of catheter market dynamics and future directions for stakeholders

The catheter market stands at an inflection point where technological innovation, evolving regulatory landscapes, and shifting trade policies converge to redefine industry trajectories. Smart catheters with integrated sensors and AI-driven analytics are unlocking new clinical pathways, while advanced materials and antimicrobial coatings address fundamental challenges of biocompatibility and infection control. These developments, coupled with regional healthcare investments and market policy adjustments, are reshaping how catheters are manufactured, distributed, and deployed in patient care.

As industry stakeholders navigate the cumulative effects of 2025 tariff measures, they must balance cost pressures with investments in R&D, strategic partnerships, and agile supply chain models. Key companies are responding with portfolio expansions, technology alliances, and nearshoring initiatives to maintain competitive advantage. Regional growth in Asia-Pacific and EMEA markets highlights the importance of tailored strategies that consider local regulations, infrastructure maturity, and cost sensitivities.

Ultimately, success in this dynamic market will hinge on the ability to integrate innovation with operational resilience and strategic foresight. By aligning product development with clinical priorities, optimizing sourcing strategies, and leveraging data-driven decision support, organizations can position themselves to lead the next era of catheter-enabled care.

Driving decisive action: connect with Associate Director Ketan Rohom to secure the definitive catheter market research report and empower strategic decision making

Are you ready to leverage in-depth insights and actionable intelligence to navigate the evolving catheter market with confidence? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to discuss how this comprehensive market report can empower your growth strategies and inform critical business decisions. Secure your copy today to stay ahead of industry trends and capitalize on emerging opportunities.

- How big is the Catheters Market?

- What is the Catheters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?