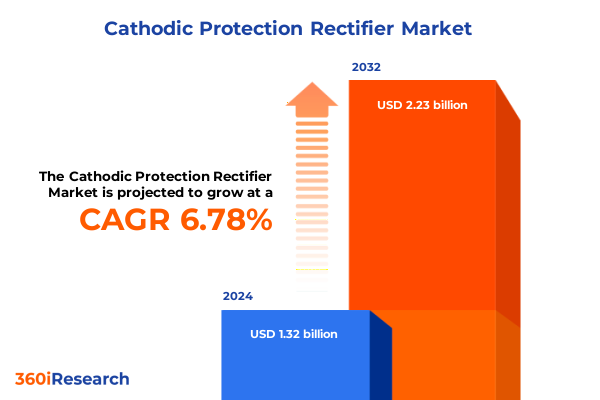

The Cathodic Protection Rectifier Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.51 billion in 2026, at a CAGR of 6.78% to reach USD 2.23 billion by 2032.

Exploring the Critical and Strategic Role of Cathodic Protection Rectifiers in Safeguarding Infrastructure Against Corrosion Risks

Cathodic protection rectifiers serve as the critical linchpin in impressed current cathodic protection systems by converting alternating current into direct current to counteract corrosion on metallic structures. These rectifiers maintain a continuous flow of protective current, ensuring the structural integrity of pipelines, storage tanks, ships, and reinforced concrete foundations over extended service lives. Their precise voltage regulation and ripple control are essential to prevent overprotection or underprotection scenarios that can lead to coating damage or accelerated corrosion rates respectively.

As infrastructure networks expand and age, the demand for reliable cathodic protection rectifiers intensifies. Regulatory bodies such as the U.S. Pipeline and Hazardous Materials Safety Administration updated integrity rules in 2024 to mandate enhanced corrosion control measures across interstate pipelines, heightening the need for advanced rectifier technologies. Concurrently, asset owners are deploying remote monitoring solutions-leveraging drive-by units and IoT-enabled sensors-to gather real-time performance data without labor-intensive site visits, thereby optimizing maintenance cycles and reducing operational costs.

How Digitalization Sustainability Mandates and Hybrid Technologies Are Revolutionizing the Cathodic Protection Rectifier Landscape Globally

The cathodic protection landscape is being reshaped by a wave of digitalization and automation that empowers engineers with real-time visibility into system performance. Smart rectifiers now incorporate embedded IoT sensors that feed live voltage and current data to cloud-based platforms, enabling predictive interventions before corrosion thresholds are breached. Hybrid configurations that blend traditional grid power with solar inputs have emerged to address off-grid applications, while remote diagnostics modules integrate seamlessly with SCADA networks to deliver automated alerts and compliance-ready reports.

Heightened regulatory scrutiny and sustainability mandates are driving manufacturers to embed advanced telemetry and automated compliance features within rectifier units. Software-defined rectifier platforms, often developed through strategic partnerships between legacy equipment providers and software specialists, now offer modular firmware updates to meet evolving ESG criteria. Solar-powered rectifiers, once a niche offering, are rapidly transitioning into mainstream deployments as project stakeholders seek to reduce lifecycle carbon emissions and strengthen resilience against grid outages. This convergence of environmental mandates and digital innovation is prompting consolidation among service providers, who now bundle installation, maintenance, and data analytics into comprehensive service-as-a-solution packages.

Evaluating the Far-Reaching Effects of the 2025 United States Tariffs on Cathodic Protection Rectifier Supply Chains and Cost Structures

In early 2025, the United States imposed targeted tariffs on imported steel, aluminum, and specialized power electronic components integral to rectifier assemblies, exerting upward pressure on costs for diodes, transformers, and switchgear sourced from East Asia and Europe. Original equipment manufacturers responded by accelerating nearshoring initiatives, securing domestic coil and semiconductor capacity, and negotiating long-term supply agreements to hedge against future duties. Service providers, confronting higher parts costs, have extended maintenance intervals and shifted toward predictive maintenance platforms that combine remote diagnostics with proactive parts provisioning to preserve operational budgets and maintain asset protection standards.

Key Segmentation Insights That Illuminate How Diverse End-Use Industries Types and Installations Shape the Cathodic Protection Rectifier Market Dynamics

Insight into the market emerges through multiple segmentation lenses that reveal distinct adoption patterns and investment priorities across the cathodic protection rectifier spectrum. Examining end-use industries demonstrates that critical infrastructure projects such as bridges and water treatment facilities lean toward high-current-rated rectifiers, while marine platforms and oil and gas operators favor solar-powered and hybrid models for remote offshore applications. Analysis by rectifier type shows that silicon controlled rectifiers dominate heavy industrial installations due to their robustness, whereas diode-based units retain popularity in simpler tank protection systems due to cost efficiency. Current rating segmentation highlights that units below 100 amps cater to localized storage tank installations, midrange modules between 100 to 500 amps serve municipal water networks, and high-capacity systems above 1000 amps fulfill pipeline and large marine structure demands. Application insights illustrate that underground tank protection often pairs sacrificial anode configurations with compact rectifier enclosures, whereas offshore platform and pipeline protection projects require modular rectifiers with advanced monitoring capabilities. Installation trends bifurcate between new construction projects adopting integrated smart rectifiers, and retrofit opportunities where legacy transformers are repurposed with digital integration modules. Offering segmentation delineates product sale from long-term service contracts, with many asset owners preferring managed service models that encompass remote monitoring, periodic inspections, and turnkey maintenance. Power source segmentation underscores a balanced portfolio of AC mains–fed units for stable grid-connected sites, battery backup systems for critical redundancy, and solar-driven rectifiers ideal for geographically constrained or environmentally sensitive locations.

This comprehensive research report categorizes the Cathodic Protection Rectifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Current Rating

- Offering

- Power Source

- End Use Industry

- Application

- Installation

Regional Perspectives Unveiling How Americas Europe Middle East Africa and Asia-Pacific Drive Tailored Demands for Cathodic Protection Rectifier Solutions

In the Americas, robust pipeline networks and stringent federal regulations drive high adoption of impressed current cathodic protection rectifiers. Infrastructure operators increasingly integrate rectifier units into broader integrity management platforms, leveraging digital twin frameworks and real-time dashboards to comply with U.S. pipeline safety mandates. Investments in retrofit programs for aging urban water systems have also spurred demand for compact, remote-monitored rectifiers that reduce manned inspection frequency and bolster asset uptime.

Europe, the Middle East, and Africa (EMEA) exhibit heterogeneous demand shaped by the need to maintain aging industrial and municipal infrastructure. In Western Europe, stringent environmental directives compel facility operators to adopt low-ripple rectifiers and non-toxic anode materials to meet EU corrosion control regulations. Meanwhile, the Middle East’s focus on oil and gas expansion and the deployment of renewable-powered rectifiers in Gulf nations reflects a dual mandate for operational efficiency and reduced carbon footprints. Africa’s nascent pipeline and water treatment projects are rapidly incorporating hybrid cathodic protection modules to address logistical challenges in remote locations.

Asia-Pacific leads global growth with rapid industrialization, urbanization, and large-scale infrastructure initiatives driving widespread rectifier deployment. China’s vast pipeline expansion and India’s burgeoning municipal water programs prioritize high-capacity, remote-monitoring–enabled rectifiers to minimize maintenance costs. Australia and Southeast Asian nations capitalize on solar-driven systems for off-grid marine and mining applications, aligning with regional sustainability goals and energy diversification strategies.

This comprehensive research report examines key regions that drive the evolution of the Cathodic Protection Rectifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Company Insights Revealing How Leading Manufacturers and Service Providers Are Shaping the Future of Cathodic Protection Rectifier Technologies

Leading manufacturers continue to innovate along both hardware and service dimensions to capture market share. BAC Corrosion Control has expanded its CP-Guard IoT platform, doubling field-service efficiency through 4G-enabled junction boxes and centralized analytics in its UK facility, resulting in reduced lead times and enhanced adoption across Europe and North America. Cathodic Protection Co Ltd focuses on sacrificial anode modules with prefabricated yards in Singapore and Brazil, shortening offshore installation cycles by a quarter and securing stable service contract revenues with major energy operators. CMP Europe differentiates through 5G-enabled automated junction boxes tailored for municipal water and transportation infrastructure, delivering high-fidelity data streams and optimized maintenance scheduling.

On the North American front, Farwest Corrosion Control has scaled its DCPro switch-mode rectifier line, offering intuitive analog-digital displays and sub-48-hour response teams, thereby cementing its reputation for rapid incident management. Emerging digital-platform providers and niche consultancies like Imenco AS and James Fisher are augmenting traditional rectifier offerings with advanced sensor integration and predictive analytics, while specialty alloy innovators such as MATCOR and Nakabohtec refine anode materials to balance performance with eco-friendly mandates. These strategic efforts across hardware, software, and service layers underscore an industry in flux, where collaborative ecosystems determine competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cathodic Protection Rectifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAC Corrosion Control Ltd

- Cathodic Protection Co Ltd

- Cathodic Rectifiers Inc.

- Derui Corrosion Solutions Co., Ltd

- Evence Technology & Engineering Services

- Hind Rectifiers Limited

- JA Electronics

- Kristron Controls & Systems Pvt. Ltd.

- MATCOR, Inc.

- TSINE Power Co., Ltd.

- Willett Manufacturing Ltd.

- Zhejiang Zenli Rectifier Co., Ltd

Actionable Recommendations to Empower Industry Leaders to Address Supply Chain Challenges and Embrace Technological Advances in Cathodic Protection Rectifiers

To navigate evolving supply chain challenges, industry leaders should diversify procurement channels by establishing partnerships with domestic semiconductor foundries and transformer manufacturers. Long-term supply agreements with key component suppliers can hedge against tariff volatility, while selective nearshoring initiatives help to insulate critical production lines and accelerate lead times.

Investing in digital integration capabilities offers a high return on maintenance efficiency. By retrofitting legacy rectifier units with remote monitoring modules and integrating data feeds into centralized SCADA or digital twin platforms, operators can transition from schedule-based to condition-based maintenance, reducing unplanned downtime and lowering total cost of ownership.

Embracing sustainable power sources and eco-friendly materials enhances both regulatory compliance and stakeholder perception. Implementing solar-backed rectifiers for remote or off-grid sites aligns with net-zero objectives, while specifying non-toxic anode alloys and recyclable enclosures positions operators to meet stringent ESG reporting requirements and secure favorable financing terms.

Research Methodology Integrating Primary Interviews Secondary Research and Data Triangulation for a Rigorous Analysis of Cathodic Protection Rectifier Markets

This report leverages a combination of primary interviews with corrosion engineers asset managers and OEM executives alongside rigorous secondary research of regulatory publications industry white papers and technical journals. Data triangulation ensures synthesis of qualitative insights and quantitative observations, validating trends through cross-referencing multiple data sources. The research framework prioritizes confidentiality and accuracy through stakeholder validation workshops and iterative reviews, culminating in a robust analysis that informs strategic decision-making across the cathodic protection rectifier landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cathodic Protection Rectifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cathodic Protection Rectifier Market, by Type

- Cathodic Protection Rectifier Market, by Current Rating

- Cathodic Protection Rectifier Market, by Offering

- Cathodic Protection Rectifier Market, by Power Source

- Cathodic Protection Rectifier Market, by End Use Industry

- Cathodic Protection Rectifier Market, by Application

- Cathodic Protection Rectifier Market, by Installation

- Cathodic Protection Rectifier Market, by Region

- Cathodic Protection Rectifier Market, by Group

- Cathodic Protection Rectifier Market, by Country

- United States Cathodic Protection Rectifier Market

- China Cathodic Protection Rectifier Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Strategic Conclusion Underscoring the Imperative of Advanced Cathodic Protection Rectifier Solutions for Sustainable Infrastructure and Asset Longevity

Cathodic protection rectifiers stand at the nexus of infrastructural reliability and technological innovation, evolving to meet the rigors of modern corrosion prevention. The integration of digital monitoring cloud-based analytics and sustainable power sources underscores the shift from reactive maintenance toward proactive asset health management. Concurrently, geopolitical developments such as tariffs reinforce the need for agile supply chains and diversified sourcing strategies. As leading companies refine hardware, software, and service offerings, a collaborative ecosystem emerges-one that balances performance imperatives with environmental and regulatory obligations. Together, these dynamics highlight the critical role of advanced rectifier solutions in extending asset lifespan and ensuring sustainable infrastructure resilience.

Act Now to Gain Exclusive Access to the Comprehensive Cathodic Protection Rectifier Report by Connecting with Ketan Rohom Associate Director of Sales Marketing

Ready to elevate your strategic decision-making with unparalleled insights into the cathodic protection rectifier market, reach out directly to Ketan Rohom Associate Director of Sales & Marketing to secure your copy of the comprehensive research report tailored to guide your next moves with confidence

- How big is the Cathodic Protection Rectifier Market?

- What is the Cathodic Protection Rectifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?