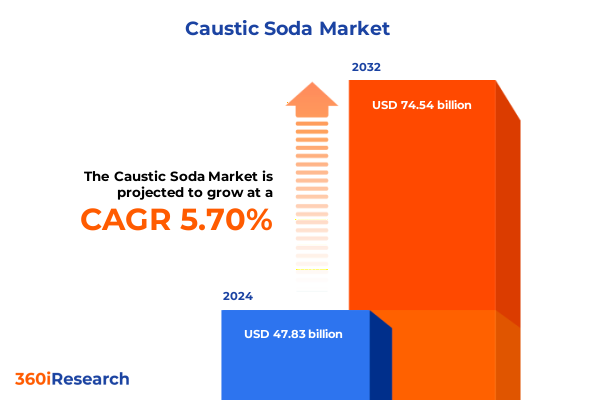

The Caustic Soda Market size was estimated at USD 50.39 billion in 2025 and expected to reach USD 53.15 billion in 2026, at a CAGR of 5.75% to reach USD 74.54 billion by 2032.

Understanding the Foundational Electrochemical Production and Versatile Industrial Applications of Caustic Soda in Global Chemical Manufacturing

The chlor-alkali electrolysis process remains the cornerstone of caustic soda production, transforming brine solutions into sodium hydroxide, chlorine, and hydrogen within membrane or diaphragm cells. This industrial method, first commercialized in the late 19th century, has evolved significantly, with membrane cell technology now dominating due to its superior energy efficiency and environmental performance. The process consumes between 1.94 and 2.51 kWh of electrical energy per kilogram of NaOH and requires thermal energy in the range of 0.038 to 0.196 kWh per kilogram, highlighting the substantial energy footprint of this foundational chemical process

Navigating a New Era of Decentralized Supply Chains and Sustainability Imperatives Reshaping the Caustic Soda Market Dynamics Worldwide

The global caustic soda landscape is undergoing transformative shifts driven by geopolitical realignments and a move toward industrial sustainability. The rise of friendshoring and regional supply chains, prompted by recent tariffs and political uncertainties, is fragmenting historically integrated trade routes and prioritizing localized production hubs. This deglobalization trend is reshaping trade patterns, compelling producers to reevaluate long-established logistics strategies to safeguard continuity of supply and cost stability

Characterized by an imperative to minimize environmental impact, industry leaders are accelerating the conversion of older diaphragm and mercury-based plants to membrane cell technology. Such conversions, driven by regulatory bans on asbestos and the pursuit of higher purity outputs, not only align with tightening emissions standards but also deliver significant operational savings. The adoption of advanced membrane systems reduces impurity levels in caustic soda, satisfies stringent quality requirements across various end-use sectors, and enhances the long-term viability of production assets

Assessing the Far-Reaching Consequences of United States Trade Tariffs Implemented in 2025 on Caustic Soda Supply and Costs

In 2025, the United States implemented a layered tariff framework encompassing a baseline 10% duty on most imports, escalating reciprocal tariffs of up to 50%, and exceptional levies of 245% on certain Chinese chemical goods. These measures, justified by national security considerations, have disrupted global chemical supply chains and raised feedstock costs across multiple sectors. Trade associations have warned that these tariffs introduce substantial uncertainty for import-dependent producers, with the American Chemistry Council projecting raw material price hikes of up to 37% for key chemicals

Although caustic soda imported into the United States constitutes only 3–5% of domestic consumption, the new tariff regime and evolving port fee regulations have reoriented trade flows. Importers on the U.S. west coast anticipate continued reliance on East Asian suppliers despite higher costs, while Gulf Coast producers are positioned to capture increased demand from regions seeking tariff-advantaged domestic supply. Exemptions for specialized chemical vessels, as stipulated by the U.S. Trade Representative, have mitigated some additional port fees, yet overall logistics expenses remain elevated

Industry stakeholders have responded by optimizing production footprints and recalibrating supply strategies to exploit tariff differentials. Gulf Coast facilities, benefiting from lower inland logistics costs, are expanding output to serve both domestic and export markets. Meanwhile, specialty chemical manufacturers are exploring partnerships with downstream users to refine contract terms, shifting cost pressures through value-added service offerings. These strategic realignments underscore the enduring resilience of the caustic soda market amid evolving trade policies

Drawing Strategic Conclusions from Purity Grades Distribution Channels Product Forms and Diverse Application Areas within the Caustic Soda Market Segmentation

Market segmentation reveals critical insights into how caustic soda is tailored to serve varied industrial demands. Industrial grade caustic soda continues to underpin heavy sectors such as alumina refining and pulp and paper production, where cost efficiency and large-volume supply dominate purchasing decisions. At the same time, pharmaceutical and reagent grades are gaining market share as high-purity formulations become indispensable for sensitive applications. Innovation pipelines reflect this shift, with over 31% of R&D initiatives focused on low-emission variants and high-purity grades that meet stringent regulatory and quality standards

The distribution landscape is equally nuanced, with traditional direct sales channels retaining prominence among large-scale industrial clients, while specialized distributors serve mid-tier customers requiring tailored logistics and technical support. Online sales platforms are emerging as a supplementary route, enabling faster order processing and improved transparency. In parallel, product forms-ranging from flakes and micropearls to liquid solutions-are optimized for distinct handling and processing requirements, facilitating seamless integration across applications. In chemical manufacturing, caustic soda feedstocks support both petrochemical and specialty chemical synthesis, while in soaps, detergents, textiles, and water treatment, formulations are adjusted to meet specific pH control, bleaching, and purification needs

This comprehensive research report categorizes the Caustic Soda market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Process

- Form

- Purity

- Application

- Distribution Channel

Uncovering Distinctive Regional Characteristics Driving Demand for Caustic Soda across Americas EMEA and Asia-Pacific Regions

In the Americas, the United States maintains its status as a net exporter of caustic soda, leveraging Gulf Coast production capacity and robust domestic demand to offset global supply disruptions. Proximity to feedstock sources and integrated logistics infrastructure underpin the region’s resilience, while trade policy shifts continue to refine export opportunities and import dependencies

Europe, the Middle East, and Africa are characterized by a growing emphasis on sustainable chemical production and regulatory compliance. Capacity expansions in the Middle East, driven by favorable energy costs and strategic investment in low-carbon chlor-alkali technologies, are reshaping export corridors. European producers, however, face elevated energy prices and stringent environmental standards that catalyze plant modernizations and membrane cell conversions

The Asia-Pacific region continues to lead in capacity additions, with significant investments in both traditional diaphragm and advanced membrane facilities. Formosa Plastics’ dedicated flake production line in Taiwan exemplifies the drive to serve regional textile and soap sectors. Rapid industrialization across India and Southeast Asia further bolsters demand, while favorable tariff structures in select nations create new export hubs for competitively positioned producers

This comprehensive research report examines key regions that drive the evolution of the Caustic Soda market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Producers and Innovators Shaping the Competitive Landscape of the Global Caustic Soda Industry

Key industry participants are advancing strategic initiatives to capture emerging opportunities. Olin Corporation’s expansion of its U.S. membrane cell capacity underscores a commitment to energy-efficient production and high-purity output. Westlake Chemical has pursued backward integration through regional salt mine acquisitions, stabilizing feedstock costs and enhancing margin predictability. Formosa Plastics and Tosoh Corporation have introduced specialized flake lines and AI-driven safety systems to support the textiles and specialty chemical segments. INEOS Chemicals’ launch of a pharmaceutical-grade variant targets the food and pharma industries, reflecting a broader trend toward tailored, high-value product offerings

This comprehensive research report delivers an in-depth overview of the principal market players in the Caustic Soda market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- BASF SE

- Covestro AG

- DCM Shriram Ltd.

- FMC Corporation

- Formosa Plastics Corporation

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Hanwha Corporation

- INEOS Group

- Kakdiya Chemicals

- Kemira Oyj

- LG Chem, Ltd.

- Merck KGaA

- Nobian Industrial Chemicals B.V.

- Olin Corporation

- PPG Industries, Inc.

- Pursuit Industries Pvt. Ltd.

- Saudi Basic Industries Corporation

- Tata Chemicals Ltd.

- The Dow Chemical Company

- Tosoh Corporation

- Vinmar International

- Vizag Chemical International

- Vynova Group

- Westlake Corporation

Implementing Proactive Strategies and Operational Enhancements to Strengthen Market Position and Resilience in the Caustic Soda Sector

To thrive amid ongoing market shifts, producers should diversify supply chains by establishing additional membrane cell facilities in tariff-advantaged regions. Embracing advanced electrolyzer technologies and renewable energy integration will align production with evolving sustainability mandates and reduce operational costs over time. Formalizing strategic partnerships with downstream users can facilitate long-term offtake agreements, mitigating price volatility and securing demand commitments. Digital transformation of distribution channels, including e-commerce platforms and real-time logistics tracking, will enhance responsiveness and strengthen customer relationships

Operational enhancements should include targeted investment in high-purity product lines and specialized formulations to capitalize on growth in pharmaceutical and electronics sectors. Engaging proactively with regulatory bodies to anticipate policy changes and streamline compliance efforts will safeguard production continuity. Finally, maintaining agility through scenario planning and flexible manufacturing capabilities will allow industry leaders to pivot swiftly in response to future trade or regulatory developments

Employing Rigorous Multisource Data Collection Analysis and Expert Validation to Ensure Robust Caustic Soda Market Research Methodology

This study synthesizes data from industry publications, trade associations, and customs databases, complemented by primary interviews with senior executives and technical experts across major production hubs. Findings are validated through multi-source triangulation and benchmarked against ESOMAR’s International Code on Market, Social and Opinion Research Practice to ensure research integrity and methodological rigor

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Caustic Soda market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Caustic Soda Market, by Production Process

- Caustic Soda Market, by Form

- Caustic Soda Market, by Purity

- Caustic Soda Market, by Application

- Caustic Soda Market, by Distribution Channel

- Caustic Soda Market, by Region

- Caustic Soda Market, by Group

- Caustic Soda Market, by Country

- United States Caustic Soda Market

- China Caustic Soda Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Outlook on Caustic Soda Market Evolution amid Economic and Regulatory Transformations

The convergence of tariff‐driven realignments, sustainability imperatives, and technological advancements is redefining the caustic soda market. While trade policy introduces complexity, it also creates avenues for differentiated production strategies and regional specialization. Producers that invest in energy‐efficient technologies, diversify supply chains, and focus on high‐value product segments will be best positioned to navigate uncertainty and capture long‐term growth opportunities.

Connect with Ketan Rohom to Access In-Depth Market Insights Purchase the Comprehensive Caustic Soda Industry Research Report Today

Leverage this opportunity to gain a competitive edge by accessing comprehensive data and strategic insights tailored to your needs. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how the granular analysis of regional dynamics, tariff impacts, and segmentation nuances can inform your investment and operational decisions. Ketan’s expertise in customizing solutions ensures you receive the most relevant findings, empowering you to optimize supply chains, refine product portfolios, and navigate regulatory complexities with confidence. Reach out to secure your copy of the definitive market research report and position your organization at the forefront of the caustic soda industry’s evolution

- How big is the Caustic Soda Market?

- What is the Caustic Soda Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?