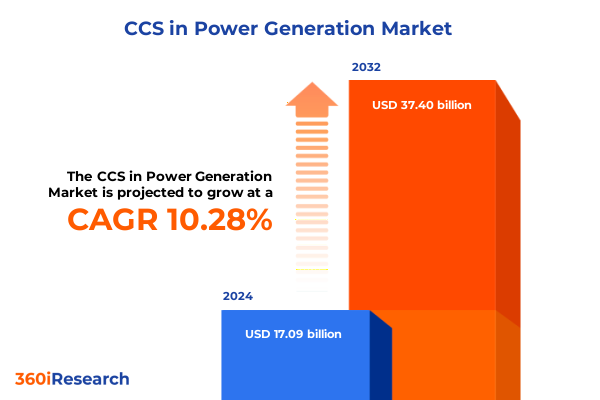

The CCS in Power Generation Market size was estimated at USD 18.58 billion in 2025 and expected to reach USD 20.21 billion in 2026, at a CAGR of 10.50% to reach USD 37.40 billion by 2032.

Unveiling the Strategic Importance of Carbon Capture and Storage in Power Generation and the Underlying Drivers Shaping Its Evolution

Modern power generation faces mounting pressure to reduce greenhouse gas emissions and transition to cleaner energy sources. In this context, carbon capture and storage emerges as a pivotal strategy for utilities seeking to reconcile energy demands with environmental stewardship. By capturing CO2 emissions at the source, power plants can significantly mitigate their carbon footprint while maintaining baseload generation capacity. This introductory overview examines the evolution of carbon capture technologies, situates current initiatives within the broader decarbonization agenda, and highlights the key factors influencing adoption in the power sector.

As regulatory frameworks tighten and corporate sustainability commitments gain momentum, facility operators are increasingly evaluating carbon capture as a strategic investment. Innovations in solvent chemistry, material science, and process engineering have broadened the applicability of capture systems, enabling both retrofit solutions for existing assets and integration into greenfield developments. Moreover, growing collaboration between public agencies, private developers, and research institutions accelerates technology maturation and cost improvements. Against this backdrop, stakeholders must navigate complex policy landscapes, supply chain considerations, and financing models to deploy capture at scale. This section sets the stage for the in-depth analysis that follows by outlining the technological landscape, policy drivers, and market dynamics shaping the future of carbon capture in power generation.

Looking ahead, the interplay between decarbonization targets and energy security imperatives underscores carbon capture’s role as both a compliance mechanism and a pathway to low-carbon hydrogen production. The subsequent sections delve into transformative shifts, policy impacts, segmentation nuances, and actionable recommendations to guide decision-makers in charting a strategic course for carbon capture in the power industry.

Navigating Paradigm Shifts in Energy Production as Technological Advancements and Regulatory Initiatives Reshape Carbon Capture Pathways

Recent years have witnessed a fundamental transformation in the way electricity is produced and managed. The ascendancy of renewable generation has reshaped grid dynamics, necessitating flexible solutions that address both intermittent supply and residual emissions from thermal power plants. In response, carbon capture has evolved from a niche mitigation technology to a core component of integrated energy portfolios. By facilitating continued operation of fossil-based assets in compliance with decarbonization commitments, capture systems bridge the gap between current infrastructure and future zero-carbon ambitions.

In parallel, breakthroughs in process technologies have expanded the feasibility envelope for power-sector applications. Advanced solvent formulations, high-performance membranes, and innovative cryogenic separation techniques have collectively improved capture efficiency and reduced energy penalties. Digital process optimization, including real-time analytics and predictive maintenance, enhances operational reliability and lowers lifecycle costs. Equally important, modular capture units and scalable designs enable phased deployment, allowing operators to adjust capture capacity in line with evolving regulatory requirements and market conditions.

Against this backdrop, policy frameworks have accelerated technology uptake by aligning economic incentives with emissions reduction goals. Tax credits, carbon pricing mechanisms, and sustainable financing vehicles have mobilized investment in capture projects at both utility-scale and distributed generation sites. As regulatory milestones converge with corporate net-zero pledges, industry stakeholders are refining business models and forging partnerships to de-risk projects and secure long-term revenue streams. This confluence of technological and policy shifts sets the stage for a decisive expansion of carbon capture across the power generation landscape.

Assessing the Far-Reaching Effects of 2025 Tariff Policies on Carbon Capture Deployments and Supply Chain Dynamics in the United States

At the dawn of 2025, newly enacted tariff measures targeting select carbon capture equipment and critical raw materials have introduced significant variables into project economics. By imposing duties on imported membranes, advanced solvent components, and specialized alloys, policy makers aimed to stimulate domestic manufacturing capacity while addressing trade imbalances. However, these measures have also exerted upward pressure on capital expenditures for carbon capture installations, compelling project developers and vendors to reassess procurement strategies and cost structures within the United States.

The ripple effects of the tariffs are evident across the supply chain, where increased import costs have prompted a recalibration of vendor relationships and logistics networks. International suppliers are negotiating alternative routes to mitigate duties, while U.S. manufacturers are scaling production of key system components to capture market share. This dynamic has accelerated nearshoring efforts, encouraging the establishment of fabrication facilities and supply hubs closer to major power generation centers. Consequently, project timelines and equipment delivery schedules have shifted, requiring closer coordination among engineering, procurement, and construction teams to manage potential bottlenecks.

In response to these shifts, stakeholders are pursuing collaborative models that leverage shared risk and localized production. Public-private partnerships and joint ventures are increasingly common as companies seek to secure stable access to critical technologies and inputs. Additionally, emerging financing mechanisms that account for tariff-related cost escalations are being developed to preserve project viability. Through proactive adaptation of sourcing strategies and investment in domestic capacity, the industry is navigating the complexities of 2025 tariff policies while maintaining momentum toward carbon capture deployment objectives.

Delving into Core Market Segmentation to Uncover Technology, Capture Methodologies, Plant Configurations, Project Scales, and Deployment Models

Understanding the diverse technical and operational dimensions of the carbon capture market requires a nuanced examination of underlying segmentation. A foundational distinction lies between processes that capture emissions after combustion and those that intercept carbon during fuel conversion. Post combustion systems retrofit existing power plants by extracting CO2 from flue gas, whereas pre combustion approaches integrate capture into upstream gasification units. This dichotomy informs project design parameters and energy integration strategies, shaping both capital allocation and performance outcomes.

Equally critical is the method by which CO2 is separated and purified. Chemical absorption solutions rely on reactive solvents, including alkaline formulations and advanced amine systems, to bind carbon molecules selectively. Cryogenic separation exploits temperature differentials, using liquefaction or refrigeration cycles to condense CO2 from mixed gas streams. Inorganic and polymeric membranes offer a physical barrier approach, permitting selective permeation under pressure gradients, while adsorption materials such as activated carbon and zeolite capture carbon molecules through surface interactions. Each method presents unique trade-offs in terms of energy demand, purity levels, and operational complexity, guiding technology selection across diverse project scenarios.

Deployment context further differentiates market opportunities. Biomass-fired power stations, integrated gasification combined cycle facilities with either entrained flow or fluidized bed configurations, natural gas combined cycle plants, pulverized coal units, and waste-to-energy installations each impose specific capture requirements based on flue gas composition and thermal profiles. This granular segmentation allows developers to tailor capture systems to the underlying plant type, optimizing integration and throughput.

Project scale and deployment strategy constitute additional axes of segmentation. Large scale initiatives leverage economies of scale to drive down unit costs, while small scale units provide modularity and lower upfront investment thresholds. Brownfield projects retrofit existing assets, minimizing site development challenges, whereas greenfield undertakings incorporate capture systems from the ground up. By synthesizing these segmentation insights, decision-makers can align technology pathways with project objectives, risk profiles, and long-term operational goals.

This comprehensive research report categorizes the CCS in Power Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Capture Method

- Plant Type

- Deployment Model

Interpreting Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Unique Carbon Capture Opportunities

North American markets are characterized by a robust alignment of federal incentives, state-level mandates, and private-sector commitments that fuel carbon capture deployments across the region. In the United States, the irrevocable impact of tax credits and emission performance standards has accelerated retrofit projects at coal and gas plants, while Canada’s emphasis on enhanced oil recovery and geological storage facilitates commercial-scale operations. Meanwhile, in South America, evolving climate policies and nascent CCUS hubs in Brazil lay the groundwork for future expansions, especially in biomass and waste-to-energy applications.

Within Europe Middle East & Africa, regulatory ambition and strategic resource endowments intersect to shape divergent trajectories. European Union member states are advancing cluster-based deployment models that aggregate capture, transport, and storage across national borders. These integrated networks benefit from unified policy frameworks and carbon pricing mechanisms. In the Middle East, sovereign-backed energy companies leverage abundant geological formations to develop world-scale storage facilities, creating exportable CCUS services. Africa, though at an earlier stage, is rapidly exploring pilot programs, often in partnership with international stakeholders, to evaluate geological potential and establish governance structures for long-term storage.

Asia-Pacific presents a dynamic mosaic of maturity levels, where major economies pursue bespoke approaches to decarbonization. China has committed to full-scale demonstration projects alongside coal-fired plants and is exploring biomass cofiring. Japan and South Korea are investing heavily in hydrogen production tied to capture technologies, forging international partnerships to secure CO2 transport routes. Australia’s leadership in offshore storage and hydrogen corridors underpins its export-driven decarbonization strategy. Emerging Southeast Asian economies, meanwhile, are conducting feasibility studies and building foundational legal frameworks. Collectively, these regional patterns underscore the importance of tailored strategies that account for regulatory context, resource availability, and market readiness.

This comprehensive research report examines key regions that drive the evolution of the CCS in Power Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Landscapes and Strategic Positioning of Leading Industry Players Driving Innovation and Partnerships in Carbon Capture

In the competitive arena of carbon capture, energy conglomerates and major industrial gas producers are positioning themselves through technology innovation, strategic alliances, and portfolio diversification. Leading oil and gas companies leverage their subsurface expertise and capital strength to pilot capture projects across multiple geographies. They often collaborate with equipment manufacturers to refine solvent chemistries and optimize process integration. These partnerships enable joint technology development, risk sharing in large-scale demonstrations, and accelerated commercialization pathways.

At the same time, engineering, procurement, and construction firms, alongside specialist service providers, play a critical role in translating conceptual designs into operational assets. These organizations bring deep process engineering capabilities, modular construction techniques, and integrated digital solutions that enhance project delivery and operational uptime. Furthermore, global industrial gas companies are extending their supply chains to encompass capture modules, CO2 conditioning, and transportation networks, thereby offering end-to-end services. Collaborative consortiums that unite private developers, technology vendors, research institutions, and government agencies are also becoming prevalent, driving standardization and interoperability in capture technologies.

Startups and technology disruptors add another layer of dynamism by introducing novel materials, such as advanced membranes and sorbents, and pursuing agile pilot tests that showcase rapid innovation cycles. Collectively, these players foster competitive differentiation through proprietary intellectual property, robust field data collection, and a focus on scalable solutions. Their strategic moves shape global market pathways, influence regulatory dialogues, and establish benchmarks for performance, cost efficiency, and sustainability in power sector carbon capture.

This comprehensive research report delivers an in-depth overview of the principal market players in the CCS in Power Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Aker Solutions ASA

- Alstom SA

- Ameresco, Inc.

- Babcock & Wilcox Enterprises, Inc.

- Carbon Clean Solutions Limited

- Chevron Corporation

- Climeworks AG

- Dakota Gasification Company

- Equinor ASA

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton Company

- Hitachi, Ltd.

- Honeywell International Inc.

- JGC Holdings Corporation

- Linde plc

- Mitsubishi Heavy Industries, Ltd.

- NET Power LLC

- Schlumberger Limited

- Shell plc

- Siemens AG

- Sulzer Ltd

- TotalEnergies SE

Formulating Targeted Strategic Recommendations to Accelerate Deployment and Strengthen Value Chains for Carbon Capture in Power Generation

To accelerate the pace of carbon capture deployment within power generation, industry leaders should prioritize integrated project planning that aligns capture systems with existing plant operations. Early involvement of technology vendors and subsurface storage specialists can reduce interface risks and streamline permitting. Concurrently, investing in domestic manufacturing capacity for key equipment components will mitigate supply chain disruptions and enhance cost competitiveness. By fostering supplier development programs and incentivizing local fabrication, developers can secure more predictable delivery schedules and support regional economic growth.

Moreover, establishing collaborative frameworks between utilities, regulators, and financing entities is essential to de-risk project economics. Structured public-private partnerships can pool resources and share long-term liabilities, while innovative financial instruments-such as performance-linked green bonds or carbon-backed revenue guarantees-can attract institutional capital. To sustain continuous innovation, companies should direct resources toward R&D on low-energy solvents, advanced membranes, and digital process optimization tools. Equally important is the cultivation of skilled talent through targeted training programs and academic partnerships, ensuring operational excellence and safety compliance.

Additionally, industry consortia should establish standardized performance metrics and shared data platforms to accelerate learning curves and propagate best practices across projects. This collective knowledge sharing will drive down costs and shorten development timelines. By combining strategic supply chain initiatives, multi-stakeholder engagement, and dedicated research efforts, industry leaders can unlock scalable pathways for carbon capture adoption and bolster resilience across the value chain.

Outlining Rigorous Research Approaches, Data Collection Techniques, and Analytical Frameworks Underpinning the Carbon Capture Market Analysis

This study employs a comprehensive mixed-methods research design to ensure the robustness and credibility of its carbon capture market insights. Primary research consisted of in-depth interviews with senior executives from power producers, technology developers, and policy advisors to capture firsthand perspectives on deployment challenges and technology roadmaps. Complementing these insights, secondary research drew on publicly available data, peer-reviewed publications, regulatory filings, and industry white papers to compile a foundational knowledge base and validate emerging trends.

Analytical rigor was further enhanced through data triangulation and cross-validation techniques, reconciling qualitative inputs with quantitative metrics. Scenario analysis and comparative benchmarking provided frameworks for evaluating technology performance and policy impacts under different market conditions. Structured risk assessments and supply chain mapping identified critical dependencies and potential bottlenecks, informing strategic recommendations. Additionally, expert panel reviews and iterative feedback loops ensured that findings reflect both practical realities and forward-looking considerations. Through a blend of structured interviews, exhaustive literature review, and advanced analytical tools, this methodology delivers nuanced, actionable insights for stakeholders navigating the evolving landscape of carbon capture in power generation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CCS in Power Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CCS in Power Generation Market, by Technology Type

- CCS in Power Generation Market, by Capture Method

- CCS in Power Generation Market, by Plant Type

- CCS in Power Generation Market, by Deployment Model

- CCS in Power Generation Market, by Region

- CCS in Power Generation Market, by Group

- CCS in Power Generation Market, by Country

- United States CCS in Power Generation Market

- China CCS in Power Generation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Takeaways and Future Trajectories to Deliver a Cohesive Perspective on Carbon Capture Integration in Power Generation

This executive summary has highlighted the strategic relevance of carbon capture and storage as a cornerstone of decarbonization pathways for power generation. Key insights include the pivotal role of technological innovation-spanning advanced solvents, membranes, and modular systems-the need to navigate complex policy landscapes such as tariff adjustments and incentive structures, and the importance of tailored regional strategies reflecting resource endowments and regulatory contexts. Segmentation analysis further underscores the necessity of aligning capture methodologies with plant characteristics, project scales, and deployment models to optimize performance and cost.

Looking forward, the integration of carbon capture with emerging low-carbon hydrogen production offers a synergistic route to value creation, enabling power plants to serve both electricity and fuel markets. Digitalization will continue to refine operational efficiency through real-time monitoring and predictive maintenance. Meanwhile, collaborative frameworks between industry, government, and finance institutions will prove essential for de-risking investments and scaling projects. As global net-zero targets intensify, carbon capture is positioned to play an increasingly indispensable role in sustaining reliable energy supplies while achieving emissions reduction objectives. This cohesive perspective informs strategic decision-making and charts a roadmap for future growth in the sector.

Connect with Ketan Rohom to Unlock Detailed Carbon Capture Market Insights and Secure Tailored Strategic Guidance for Power Generation Initiatives

For organizations seeking in-depth analysis, detailed segmentation insights, and strategic guidance on carbon capture deployment, personalized support is available. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides an opportunity to discuss specific project objectives, clarify technical inquiries, and explore customized data packages.

Unlock access to comprehensive datasets, expert commentary, and benchmarking tools that can accelerate decision-making and optimize implementation strategies. To secure your copy of the full market research report and begin transforming your carbon capture initiatives, connect with Ketan today and gain the competitive edge in power generation decarbonization.

- How big is the CCS in Power Generation Market?

- What is the CCS in Power Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?