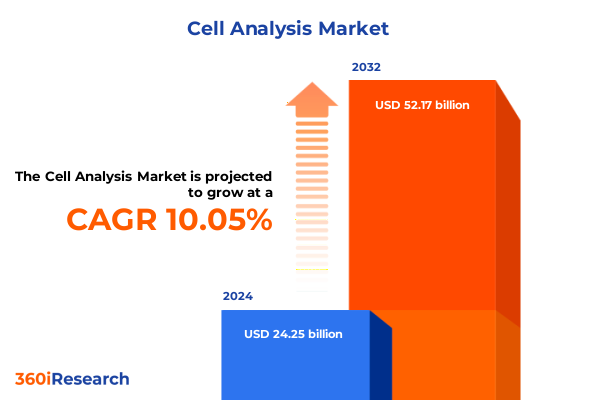

The Cell Analysis Market size was estimated at USD 26.00 billion in 2025 and expected to reach USD 27.88 billion in 2026, at a CAGR of 10.46% to reach USD 52.17 billion by 2032.

Exploring the Transformational Journey of Cell Analysis Technology: Comprehensive Overview of Industry Drivers, Innovations, and Emerging Trends

The realm of cell analysis stands at a pivotal juncture, driven by breakthroughs in technology and an increasing demand for precise cellular insights. As researchers and industry stakeholders navigate this complex territory, an informed understanding of the foundational principles and emerging innovations is essential. This section offers a comprehensive introduction to the evolving field, illuminating how advanced methodologies are redefining the way cells are characterized, quantified, and leveraged for both scientific discovery and clinical applications.

Stepping beyond traditional practices, this narrative outlines the convergence of cutting-edge techniques that have emerged over recent years. By integrating optical, electrical, and molecular approaches, practitioners can now achieve unprecedented resolution and throughput. These advancements not only expedite the pace of discovery but also enhance the reliability of results, fostering deeper insights into cellular heterogeneity and function. Moreover, the proliferation of automated platforms and intuitive software has democratized access to complex analytical workflows, enabling a broader spectrum of laboratories to harness these capabilities.

Looking ahead, the interplay between novel instrumentation and computational analytics promises to further revolutionize the landscape. Rapid developments in machine learning algorithms, coupled with the increasing affordability of high-dimensional data acquisition, are redefining benchmarks for sensitivity and specificity. This introduction sets the stage for a detailed exploration of the forces shaping the industry, emphasizing the importance of a strategic perspective in navigating the dynamic advancements that lie at the heart of modern cell analysis.

Unveiling the Disruptive Shifts Reshaping Cell Analysis Landscape Through Technological Convergence and Strategic Collaborations

The cell analysis domain has undergone a series of transformative shifts that have collectively redefined its scope and impact. Initially centered on foundational techniques, such as basic staining and microscopy, the field has expanded through the integration of high-throughput methodologies capable of delivering both depth and breadth in cellular characterization. This evolution has been propelled by a confluence of technological breakthroughs, enabling researchers to dissect cellular processes with remarkable precision and to address increasingly complex biological questions.

Among the most salient changes is the ascendancy of multiplexed assays, which permit simultaneous interrogation of multiple biomarkers within individual cells. This capability has not only accelerated experimental workflows but also unveiled new layers of biological complexity, from immune cell profiling to tumor microenvironment analysis. Alongside these multiplexed approaches, the advent of label-free technologies has introduced noninvasive methods for assessing cellular properties, reducing dependency on chemical reagents and minimizing workflow variability.

Strategic collaborations between instrument manufacturers, software developers, and end users have further catalyzed innovation. By fostering open platforms and standardized protocols, the industry has achieved greater interoperability and data harmonization. Meanwhile, the growing emphasis on single-cell analysis has intensified efforts to miniaturize and parallelize workflows, laying the groundwork for next-generation applications in diagnostics, therapeutics, and personalized medicine. These transformative shifts illustrate the dynamic trajectory of cell analysis, highlighting the synergistic interplay between technological advancement and collaborative frameworks.

Assessing the Broad Repercussions of United States Tariffs on the Cell Analysis Ecosystem Throughout 2025

The United States’ decision to impose revised tariffs on key biotechnological imports throughout 2025 has had far-reaching repercussions across the cell analysis landscape. These measures, aimed at balancing trade obligations and domestic industry interests, have introduced new cost structures for critical reagents, consumables, and high-value instrumentation. As suppliers recalibrate their pricing models, end users are reassessing procurement strategies and operational budgets to accommodate the altered economic environment.

In response to these tariff-induced shifts, laboratories and research institutions have begun exploring alternative sourcing channels, fostering local partnerships with domestic manufacturers and distributors. This realignment has spurred investment in regional supply chains, driving innovation in reagent formulation and manufacturing processes. Concurrently, some organizations are adopting modular procurement frameworks, leveraging competitive bidding and consortium-based purchasing to mitigate price volatility and ensure continuity of critical analytical workflows.

Despite these adaptations, the heightened cost pressures have also accelerated discussions around sustainable practices and waste reduction. Stakeholders are increasingly prioritizing reagent efficiency and instrument longevity, seeking ways to optimize experimental design and extend the functional lifecycle of high-value assets. As the industry navigates this tariff-driven landscape, the collective emphasis on resilience and strategic flexibility underscores the capacity of the cell analysis community to adjust to external economic forces while preserving the integrity of scientific inquiry.

Illuminating Core Market Segments in Cell Analysis With Insights Across Techniques, Applications, and End User Domains

Within the expansive field of cell analysis, a nuanced understanding of market segments is essential for guiding strategic decision-making and research priorities. Techniques such as cell sorting, flow cytometry, imaging cytometry, and mass cytometry collectively define the technological backbone, each offering distinct advantages in throughput, sensitivity, and specificity. Cell sorting platforms facilitate the isolation of rare populations, enabling downstream analyses that require purified cell subsets, while flow cytometry remains a workhorse for quantitative multiparametric assessments. Imaging cytometry merges visual context with quantitative data, delivering spatially resolved insights, whereas mass cytometry harnesses metal-tag conjugates to measure an extensive array of biomarkers at single-cell resolution.

Equally important are the diverse applications that harness these methodologies. Clinical diagnostics rely on precise cellular measurements to guide patient management across hematology, immunology, and oncology, ensuring that treatment decisions are informed by accurate cellular phenotyping. In the realm of drug discovery, both safety testing and target identification benefit from high-content analyses that reveal cellular responses to novel compounds, reducing attrition rates and accelerating development timelines. Quality control laboratories deploy robust cytometric assays to verify product integrity in biopharmaceutical manufacturing, while academic research institutes continually push the boundaries of basic science, elucidating fundamental cellular processes.

The end users of these technologies encompass academic and research institutes that drive foundational insights, contract research organizations that deliver specialized services, hospitals and diagnostic centers that translate findings into patient care, and pharmaceutical and biotechnology companies that integrate cellular analytics into pipeline development. This layered segmentation provides a holistic perspective on the ecosystem, highlighting areas of convergence and opportunity across the cell analysis value chain.

This comprehensive research report categorizes the Cell Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Application

- End User

Deciphering Regional Dynamics in Cell Analysis Across Americas, Europe Middle East Africa, and Asia Pacific Territories

A regional lens offers critical insights into the dynamics shaping the cell analysis sphere, revealing how geographic factors influence innovation uptake, regulatory frameworks, and market maturity. In the Americas, robust funding environments and a strong concentration of research institutions have propelled widespread adoption of advanced cytometric platforms. North American hubs, in particular, benefit from an established ecosystem of technology providers and a regulatory environment conducive to rapid translation of laboratory discoveries into commercial solutions.

In contrast, the Europe, Middle East, and Africa territory presents a heterogeneous landscape, where pockets of excellence in life sciences coexist with varied regulatory pathways and economic conditions. European Union member states have harmonized standards that facilitate cross-border collaboration, while regulatory complexity in certain regions can pose challenges for market entry. Nevertheless, the growing emphasis on precision medicine and government-led initiatives in the Middle East has spurred targeted investments, fostering a more integrated approach to cellular diagnostics and therapeutics development.

Meanwhile, the Asia Pacific region has emerged as a high-growth frontier, driven by expanding research capacity, supportive policy frameworks, and cost-competitive manufacturing. Countries across East and Southeast Asia are increasingly prioritizing bioscience R&D, with academic centers and contract research organizations scaling up cytometry capabilities to meet both domestic and global demand. This dynamic environment is further augmented by strategic partnerships between local players and multinational corporations, enabling knowledge transfer and accelerating technology diffusion.

This comprehensive research report examines key regions that drive the evolution of the Cell Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Collaborators Driving Progress in the Global Cell Analysis Industry

Leading organizations within the cell analysis arena have distinguished themselves through a combination of technological innovation, strategic alliances, and comprehensive support services. These entities have continuously invested in research and development, unveiling instrument platforms that push the boundaries of analytical performance while simultaneously refining user interfaces to streamline workflow integration. As a result, they have set new benchmarks for data quality and experimental reproducibility, earning strong reputational equity among scientific and clinical end users alike.

Moreover, collaborations with academic institutions and contract research organizations have enabled these companies to co-develop application-specific assays, enhancing the relevance and utility of their offerings. Joint ventures and licensing agreements have further expanded their product portfolios into adjacent areas such as assay kits, software analytics, and consumables, creating comprehensive ecosystems that address diverse customer needs. This strategic diversification has allowed leading players to capture synergies across product lines and to deliver turnkey solutions that reduce the barriers to adopting advanced cell analysis techniques.

In tandem with product and service expansion, top-tier organizations have established dedicated training and support networks that ensure customers can maximize the value of their investments. By offering on-site workshops, online educational resources, and rapid-response technical assistance, these companies foster long-term partnerships and cultivate brand loyalty. This focus on holistic customer engagement underscores their ability to transform cutting-edge innovations into accessible, scalable solutions for a wide spectrum of research and clinical applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Cytek Biosciences

- Danaher Corporation

- F. Hoffmann-La Roche AG

- GE HealthCare Technologies Inc.

- Illumina

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec

- Olympus Corporation

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- Sysmex Corporation

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Strategic Pathways for Industry Stakeholders to Capitalize on Opportunities and Navigate Challenges in Cell Analysis

To thrive in the swiftly evolving cell analysis environment, industry leaders must adopt a proactive posture that aligns technological capabilities with shifting market demands. Prioritizing modular and interoperable solutions can streamline implementation and facilitate seamless integration into existing infrastructure. By embracing open data standards and fostering vendor-neutral ecosystems, organizations can reduce complexity and empower end users to leverage cross-platform analytics without encountering compatibility barriers.

In parallel, forging strategic alliances with reagent suppliers, instrument developers, and data analytics providers can accelerate time-to-market and broaden the scope of application-specific solutions. These partnerships should emphasize co-innovation, with shared objectives around assay development, regulatory compliance, and customer training. Such collaborative endeavors not only optimize resource allocation but also generate synergistic value propositions that resonate with diverse end user segments.

Furthermore, embedding sustainability principles into procurement and operational strategies can yield both economic and environmental benefits. By selecting consumables with recyclable components and extending instrument lifecycles through proactive maintenance programs, leaders can demonstrate commitment to responsible research practices. Finally, investing in workforce development-through targeted training programs and certification pathways-will ensure that technical personnel possess the expertise required to fully exploit emerging capabilities. This multifaceted approach will position organizations to capture new growth avenues while maintaining resilience against external uncertainties.

Methodological Framework Underpinning Comprehensive Cell Analysis Market Research and Data Validation Processes

The foundation of this comprehensive market research lies in a structured methodology that integrates both primary and secondary data sources to deliver robust insights. Initially, an extensive review of scientific literature, industry white papers, and regulatory documents provided contextual understanding of evolving trends and technological advancements. This step was complemented by analysis of publicly available corporate reports, patent filings, and conference proceedings to capture the latest innovations and strategic priorities of leading organizations.

Subsequently, primary data collection was conducted through in-depth interviews with key opinion leaders, including academic researchers, laboratory managers, and product development executives. These qualitative discussions enriched the findings with nuanced perspectives on adoption hurdles, operational inefficiencies, and emergent application demands. To validate and quantify these insights, a targeted survey was deployed among a cross-section of end users, enabling a comparative assessment of technique preferences, budgetary allocations, and regional adoption patterns.

Data triangulation techniques were employed throughout the analysis to ensure consistency and reliability. Insights gleaned from interviews and surveys were cross-verified against secondary sources, and any discrepancies were resolved through follow-up engagements. The result is a cohesive narrative that reflects both the strategic imperatives and practical considerations shaping the cell analysis ecosystem, underpinned by rigorous validation protocols and transparent documentation of data sources.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Analysis Market, by Technique

- Cell Analysis Market, by Application

- Cell Analysis Market, by End User

- Cell Analysis Market, by Region

- Cell Analysis Market, by Group

- Cell Analysis Market, by Country

- United States Cell Analysis Market

- China Cell Analysis Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Articulate Future Directions and Strategic Imperatives in Cell Analysis

Bringing together insights from technological advancements, market drivers, and strategic imperatives offers a panoramic view of the cell analysis landscape’s current state and future trajectory. The introduction of multiplexed assays, the transition toward label-free approaches, and the impact of geopolitical and economic factors have collectively defined a period of rapid transformation. Within this context, understanding core segments-spanning techniques, applications, and end user categories-provides the necessary granularity for targeted investment and development planning.

Regional nuances, from the funding landscapes of the Americas to the heterogeneous regulatory environments of Europe, Middle East, and Africa, as well as the high-growth dynamics of Asia Pacific, emphasize the importance of localized strategies. Meanwhile, leading organizations have demonstrated the efficacy of combining deep technological capabilities with customer-centric services and strategic partnerships. Their experiences underline the value of interoperability, sustainability, and workforce empowerment in driving adoption and maximizing return on investment.

In synthesizing these diverse perspectives, it becomes clear that the next wave of innovation will hinge on collaborative frameworks that integrate instrumentation, reagents, and analytics into seamless end-to-end solutions. As the industry continues to evolve, stakeholders who embrace agility, foster cross-sector alliances, and remain attuned to emerging application needs will be best positioned to shape the next frontier of cell analysis.

Engage with Ketan Rohom to Secure Comprehensive Cell Analysis Market Intelligence Tailored for Strategic Decision Making

Seize this opportunity to elevate your strategic initiatives by partnering with Ketan Rohom, whose deep expertise in cell analysis market dynamics ensures you gain the actionable intelligence needed to stay ahead of emerging trends. Engage directly with the Associate Director of Sales & Marketing to explore how our comprehensive insights can be tailored to your organization’s unique objectives, empowering you to make data-driven decisions with confidence. Reach out now to secure your copy of the market research report and unlock the competitive advantages that come from having a robust understanding of the evolving cell analysis landscape, enabling you to chart a clear path toward sustained growth and innovation.

- How big is the Cell Analysis Market?

- What is the Cell Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?