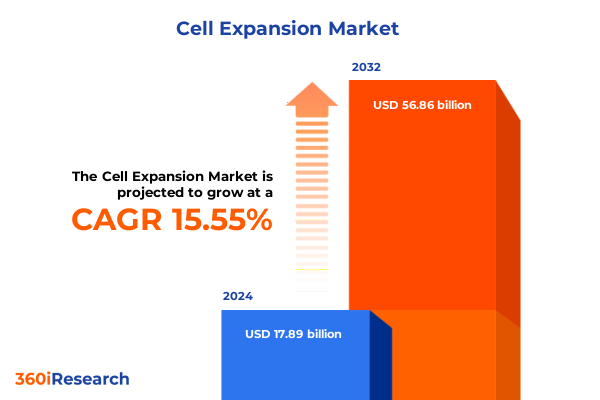

The Cell Expansion Market size was estimated at USD 20.36 billion in 2025 and expected to reach USD 23.18 billion in 2026, at a CAGR of 15.80% to reach USD 56.86 billion by 2032.

Pioneering the Frontier of Cell Expansion Research with Unparalleled Insight into Emerging Opportunities and Collaborative Challenges Ahead

The accelerating pace of innovation in cell expansion has placed the industry at a crossroads, where emerging technologies and evolving therapeutic demands converge to reshape the future of regenerative medicine and immunotherapy. This introduction offers a panoramic view of the current landscape, illuminating the critical drivers that are redefining how cells are cultivated at scale. From the shifting priorities among research institutions to the escalating demand for cost-effective manufacturing processes, the ecosystem is undergoing profound transformation. Moreover, the intersection of biological complexity and engineering excellence has never been more pronounced, demanding a holistic perspective that integrates scientific breakthroughs with pragmatic operational strategies.

In addition to technological advances, regulatory developments and policy initiatives are exerting significant influence, necessitating agile responses from stakeholders. The emergence of novel cell types and the refinement of expansion protocols underscore the importance of adaptability and robust quality control measures. Consequently, this introduction sets the stage for a detailed examination of transformative shifts, market barriers such as tariffs, segmentation nuances, and regional distinctions. By framing these dynamics within the broader context of global health priorities and investment trends, this section establishes the foundation upon which the subsequent analysis builds, thereby guiding readers through a coherent narrative of opportunity and challenge in cell expansion.

Navigating Dramatic Transformations Shaping the Cell Expansion Landscape through Technological Breakthroughs and Shifting Regulatory Paradigms

The cell expansion landscape is undergoing dramatic metamorphosis as disruptive technologies and new regulatory benchmarks alter the trajectory of development and commercialization. Advancements in closed-system bioreactors have significantly reduced contamination risks while enhancing scalability, driving a paradigm shift in how laboratories and manufacturing facilities approach the cultivation of both primary and engineered cells. Simultaneously, the integration of real-time monitoring sensors and automation platforms has elevated process control, enabling stakeholders to achieve unprecedented levels of consistency and reproducibility.

Furthermore, regulatory bodies globally are refining guidelines to accommodate the unique complexities of cell-based therapies, prompting companies to adopt more rigorous process validation and documentation practices. This evolving environment is fostering collaboration between technology providers, contract development and manufacturing organizations, and end users to expedite market readiness. In parallel, funding landscapes have diversified, with venture capital and public-private partnerships catalyzing projects that promise to accelerate clinical translation. As a result, the interplay of technological breakthroughs, regulatory evolution, and capital influx is forging a new frontier in cell expansion that emphasizes speed to market, quality assurance, and cost efficiency.

Assessing the Cumulative Impact of Recent United States Tariff Measures on Cell Expansion Supply Chains and Market Accessibility in 2025

In 2025, the United States implemented a series of tariff adjustments that have reverberated across the global cell expansion supply chain, influencing the cost and availability of critical reagents and equipment. Key raw materials, including specialized culture media components and single-use plastics, have faced increased import duties, prompting manufacturers to reevaluate sourcing strategies and pass incremental expenses downstream. Consequently, organizations with established local production capabilities have gained a competitive edge by mitigating exposure to tariff-induced price volatility.

Moreover, these measures have accelerated the drive toward supply chain resilience, with companies expanding relationships with domestic suppliers and exploring regional partnerships to ensure continuity. However, smaller academic institutions and early-stage biotechs, which often rely on international vendors, have experienced tighter margins and longer procurement timelines. In response, many stakeholders are adopting just-in-time inventory models and collaborative purchasing agreements, fostering greater transparency and risk sharing. Ultimately, the cumulative impact of U.S. tariffs in 2025 has galvanized the cell expansion sector to strengthen operational agility, diversify sourcing, and prioritize cost containment without compromising product integrity.

Unlocking Core Segmentation Insights That Illuminate Divergent Cell Expansion Strategies Across Cell Types, Technologies, Applications, and End Users

The cell expansion market exhibits distinct dynamics when viewed through the prism of core segmentation criteria, each offering unique insights into strategic priorities and investment opportunities. Based on cell type, the market is driven by both stem cells, prized for their pluripotent potential in regenerative applications, and T cells, central to the burgeoning field of immunotherapy. Stem cell expansion platforms emphasize precise control over differentiation cues and self-renewal conditions, whereas T cell workflows prioritize activation, proliferation rate, and functional phenotype preservation.

When considered from a technology standpoint, bag expansion solutions provide a low-touch, cost-efficient entry point for smaller batch scales, while bioreactors deliver advanced control over environmental parameters for larger volumes. Culture flasks remain ubiquitous in early-stage research due to their simplicity, whereas well plates support high-throughput screening protocols. In terms of application, expansion methodologies underpin critical segments such as cell banking operations, immunotherapy manufacturing, and regenerative medicine development, with research and development functions further dissected into drug screening and toxicology studies. These varied use cases underscore the necessity for versatile platforms that seamlessly transition from discovery to commercialization.

Finally, when analyzing end users, academic research institutes spearhead exploratory studies and protocol optimization, biotechnology firms drive commercialization with bespoke expansion platforms, contract manufacturing organizations focus on scale-up services, and pharmaceutical companies integrate cell expansion into broader therapeutic pipelines. Each segment demands tailored solutions that address unique throughput requirements, quality standards, and regulatory compliance obligations.

This comprehensive research report categorizes the Cell Expansion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cell Type

- Technology

- Application

- End User

Exploring Regional Dynamics and Strategic Imperatives across Americas, EMEA, and Asia Pacific Markets in the Evolving Cell Expansion Sector

Global regional disparities play an instrumental role in shaping the strategic contours of the cell expansion market, with the Americas standing at the forefront due to a robust network of research institutions, substantial government funding, and a thriving biotechnology ecosystem. The region’s emphasis on rapid translation of cell therapies into clinical trials, coupled with a mature regulatory framework, creates fertile ground for both incumbents and emerging players to innovate without undue delay.

Across Europe, the Middle East, and Africa, collective regulatory harmonization efforts are streamlining cross-border collaborations, while local incentives stimulate investment in advanced manufacturing facilities. The EMEA region balances stringent quality standards with a supportive policy environment that encourages academic-industry partnerships and pilot production initiatives, fostering a mosaic of innovation clusters.

Meanwhile, the Asia-Pacific region continues to experience exponential growth driven by expansive contract development and manufacturing capacity, cost advantages, and burgeoning research talent. Regional centers in East Asia emphasize automation and process intensification strategies, whereas Southeast Asia and Australia leverage public-private consortia to build infrastructure for large-scale cell banking and therapeutic development. These geographic nuances underscore the importance of region-tailored approaches that harness local strengths and address specific regulatory and economic landscapes.

This comprehensive research report examines key regions that drive the evolution of the Cell Expansion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Industry Players Driving Innovation and Competitive Differentiation in the Global Cell Expansion Marketplace

Industry leaders are distinguishing themselves through strategic investments in automation, partnerships, and platform diversification, fostering competitive differentiation in the densely contested cell expansion space. Thermo Fisher Scientific has expanded its footprint by integrating real-time analytics with single-use bioreactor offerings, thereby enabling customers to achieve heightened process transparency and operational speed. Similarly, Cytiva’s bioprocessing portfolio emphasizes modular design and digital twin simulations, aligning with end-user demands for seamless scale-up and risk mitigation.

Sartorius maintains its market leadership by broadening service capabilities, encompassing both equipment leasing models and remote process monitoring, which appeal to organizations seeking to optimize capital expenditures and access expert technical support. Miltenyi Biotec leverages its proprietary magnetic separation technology to streamline cell isolation workflows, complementing its expansion solutions and reinforcing its position in immunotherapy manufacturing. Lonza’s approach centers on strategic alliances with academic institutions and contract manufacturers to co-develop next-generation expansion protocols, reinforcing its collaborative ethos.

Collectively, these key players exemplify how differentiated value propositions-rooted in technological innovation, service excellence, and ecosystem engagement-are shaping competitive dynamics. Their initiatives underscore the criticality of continuous enhancement and customer-centric development to sustain leadership in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Expansion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Danaher Corporation

- Eppendorf AG

- Eppendorf SE

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- Sartorius AG

- STEMCELL Technologies Canada Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Formulating Actionable Recommendations to Propel Strategic Growth, Drive Operational Excellence, and Foster Collaborative Ecosystem Development for Leaders in Cell Expansion

To navigate the complexities of the cell expansion sector and secure sustainable growth, industry leaders must adopt a multifaceted strategic framework. First, prioritizing automation investment will not only reduce manual variability and operational costs but also enable scalability and adaptive process controls that align with evolving regulatory requirements. Thus, stakeholders should evaluate and integrate closed-system platforms complemented by real-time monitoring capabilities to enhance consistency and throughput.

Furthermore, diversifying supply chains and forging strategic partnerships with domestic and regional suppliers will mitigate exposure to external tariff fluctuations and logistic disruptions. Consequently, establishing collaborative procurement consortia and exploring nearshoring opportunities can bolster supply chain resilience. In addition, synchronizing cross-functional teams-spanning R&D, quality assurance, and regulatory affairs-will accelerate protocol refinement and facilitate smoother market approvals.

Moreover, fostering collaborative ecosystems that unite equipment manufacturers, service providers, and end users will catalyze co-innovation, optimize resource utilization, and accelerate the translation of novel expansion methodologies. Finally, investing in workforce training and digital literacy initiatives will ensure that organizations possess the human capital necessary to leverage emerging technologies effectively. By implementing these actionable recommendations, leaders can drive operational excellence and maintain competitive advantage in the dynamic cell expansion landscape.

Detailing Robust Research Methodologies Employed to Ensure Comprehensive, Objective, and Reproducible Insights in the Cell Expansion Study

This report’s findings are grounded in a rigorous, multi-tiered research methodology designed to ensure objectivity, depth, and reproducibility. A combination of primary research, including in-depth interviews with senior executives, process engineers, and regulatory specialists, was conducted to glean firsthand perspectives on technological trends, operational challenges, and strategic priorities. These qualitative insights were supplemented by secondary research, encompassing peer-reviewed journals, industry white papers, and regulatory guidance documents, to validate and contextualize emerging themes.

In addition, data triangulation techniques were employed to reconcile discrepancies and reinforce the robustness of the conclusions. Quantitative analysis drew upon proprietary databases tracking capital investments, published clinical trial metrics, and manufacturing capacity expansions. These datasets were subjected to both bottom-up and top-down validation processes, ensuring alignment between micro-level observations and macro-level industry patterns.

Furthermore, periodic workshops with cross-functional experts provided iterative feedback loops, enabling the refinement of key findings and the resolution of potential biases. Quality assurance protocols mandated multiple rounds of peer review by independent subject matter experts, thereby guaranteeing the integrity and reliability of the research outputs. This comprehensive methodology ensures that the insights presented in this report are both actionable and reflective of the latest advances in cell expansion science and commercialization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Expansion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Expansion Market, by Cell Type

- Cell Expansion Market, by Technology

- Cell Expansion Market, by Application

- Cell Expansion Market, by End User

- Cell Expansion Market, by Region

- Cell Expansion Market, by Group

- Cell Expansion Market, by Country

- United States Cell Expansion Market

- China Cell Expansion Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Concluding Perspectives that Reinforce Core Findings and Illuminate Future Directions in Cell Expansion Innovation

As the cell expansion field continues to advance, the critical interplay between technological innovation, regulatory adaptation, and operational excellence will define the contours of future success. The preceding analysis underscores that stakeholders who can seamlessly integrate automated platforms, secure resilient supply chains, and cultivate collaborative ecosystems are best positioned to capitalize on emerging opportunities. Moreover, the segmentation insights highlight the necessity of tailoring solutions to distinct cell types, technological modalities, application domains, and end-user requirements, thus reinforcing the importance of strategic agility.

Regional dynamics further emphasize that a one-size-fits-all strategy is untenable; instead, organizations must navigate local regulatory landscapes and leverage geographic strengths to optimize market entry and expansion. The examination of tariff impacts serves as a cautionary reminder that external economic factors can swiftly disrupt established supply chains, underscoring the need for diversified sourcing and proactive risk management.

In conclusion, the convergence of scientific breakthroughs, evolving policy frameworks, and competitive pressures demands a holistic approach to cell expansion strategy. By synthesizing these findings, industry leaders can chart a clear path forward, balancing innovation with operational rigor to drive sustained growth and therapeutic advancement in the global cell expansion market.

Empowering Strategic Decision Making with a Personalized Invitation to Secure the Definitive Cell Expansion Market Research Report

Unlock a comprehensive understanding of the cell expansion landscape by securing the definitive market research report through a personalized consultation with Ketan Rohom at 360iResearch

Elevate your strategic planning with exclusive access to in-depth analysis, proprietary data, and forward-looking insights that will drive your competitive advantage. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this report can be tailored to meet your specific informational needs and empower your decision-making. Seize this opportunity to leverage expert guidance and ensure your organization remains at the forefront of innovation in the rapidly evolving cell expansion sector. The future of cell expansion begins with informed action-contact Ketan Rohom today to procure your copy and embark on a journey toward sustained growth and market leadership.

- How big is the Cell Expansion Market?

- What is the Cell Expansion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?