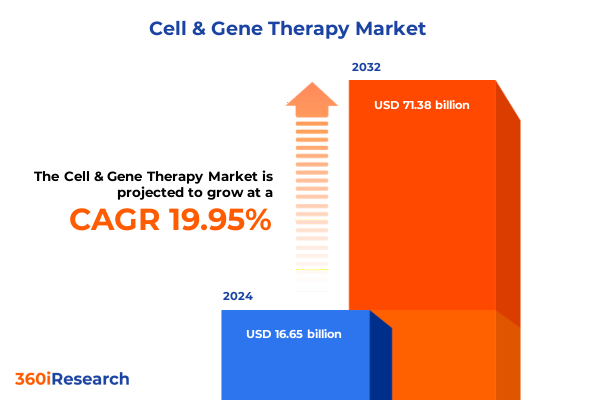

The Cell & Gene Therapy Market size was estimated at USD 19.47 billion in 2025 and expected to reach USD 22.98 billion in 2026, at a CAGR of 20.39% to reach USD 71.38 billion by 2032.

Unveiling the Emerging Dynamics of the Cell and Gene Therapy Sector Navigating a New Era of Biomedical Innovation and Strategic Growth

The field of cell and gene therapy has evolved from experimental clinical trials to a burgeoning frontier in personalized medicine, driven by groundbreaking scientific advances and regulatory momentum. Early milestones, such as the U.S. Food and Drug Administration’s approval of CAR T-cell therapy Kymriah in 2017, laid the foundation for a new era in oncology treatment, demonstrating the potential of engineered cellular treatments to achieve durable remissions in hematological malignancies. More recently, the landmark introduction of Casgevy, the first CRISPR-based therapy authorized in December 2023 for sickle cell disease, underscored the maturation of genome-editing platforms and their practical translation into clinical solutions. These regulatory breakthroughs have been paralleled by significant investments in manufacturing infrastructure and supply chain innovation.

However, the industry continues to grapple with intricate challenges in scalability, cost management, and supply chain resilience. The integration of automation and digitalization has begun to reshape production processes, introducing closed systems and AI-driven analytics to mitigate contamination risks and improve yield. Simultaneously, the shift towards allogeneic therapies promises enhanced accessibility but demands rigorous safety profiling and immune compatibility strategies.

This executive summary provides a structured exploration of these dynamics, offering strategic insights into transformative industry shifts, tariff impacts, market segmentation, regional variances, leading innovators, and actionable recommendations. By synthesizing primary interviews, secondary data, and expert analyses, decision-makers will gain a clear roadmap for navigating the evolving cell and gene therapy ecosystem.

Revolutionizing Treatment Paradigms with Scalable Manufacturing Innovations and Allogeneic Therapeutic Breakthroughs in Cell and Gene Therapy Ecosystem

In recent years, the cellular and genetic medicine landscape has undergone profound transformation, driven by breakthroughs in therapy design, manufacturing innovation, and regulatory adaptation. A pivotal shift is the rise of allogeneic cell therapies, which leverage healthy donor cells to create off-the-shelf treatment products. Unlike patient-specific autologous approaches, allogeneic formats promise enhanced scalability, reduced production timelines, and lower per-dose costs, expanding the therapeutic reach beyond hematological cancers into autoimmune and neurodegenerative conditions.

Complementing this trend is the movement towards decentralized manufacturing. By embedding modular production units closer to treatment sites, developers can shorten cold-chain logistics, lower transportation risks, and accelerate delivery to time-sensitive patient populations. This modular approach improves operational flexibility, though it necessitates harmonized quality control frameworks across multiple sites to ensure consistent product performance.

Automation and digitalization have also become core drivers of operational excellence. Adoption of closed-system bioreactors, real-time process analytics, and machine learning algorithms facilitates robust monitoring and reproducibility, reducing batch failures and bolstering compliance with stringent GMP regulations. These technologies underpin the transition from traditional batch processes to continuous, scalable workflows, ultimately enhancing cost efficiency and product reliability.

Strategic partnerships between biopharma firms and specialized CDMOs have further accelerated capacity expansion and technology transfer. By collaborating with contract manufacturers that offer end-to-end services-from vector production to fill-finish-developers can streamline development timelines, access advanced capabilities, and mitigate capital-intensive infrastructure investments. Such alliances are becoming a hallmark of competitive positioning in the cell and gene therapy sector.

As regulatory agencies introduce adaptive pathways, breakthrough designations, and priority review programs, the ecosystem is poised to support accelerated clinical development without compromising safety and efficacy. Collectively, these transformative shifts are reshaping strategic priorities, driving investment flows, and redefining the competitive landscape for innovative cell and gene therapies.

Assessing the Cumulative Impact of United States Tariffs on Cell and Gene Therapy Supply Chains and Innovation Trajectories in 2025

As the United States enacts a new round of tariffs on imported pharmaceutical inputs in 2025, the cell and gene therapy industry faces multifaceted challenges in its supply chain and innovation pipeline. A recent survey by the Biotechnology Innovation Organization highlighted that nearly 90% of U.S. biotech companies rely on foreign components for at least half of their FDA-approved products, underscoring the sector’s exposure to tariff-related cost escalations. The same survey revealed that 94% of respondents anticipate surging manufacturing costs if tariffs are applied to imports from the European Union, while half of the companies foresee the need to identify new manufacturing or research partners to avoid disruption.

Emerging data points indicate that smaller and early-stage biotechs are particularly vulnerable. According to industry analysis, young cell and gene therapy firms operate on narrow budgets tied to venture capital or grant funding; sudden price increases for reagents, viral vectors, or single-use systems could force these organizations to delay critical research or regulatory submissions, potentially hindering the introduction of novel therapies to market. Moreover, 80% of companies report requiring at least 12 months to secure alternative suppliers, with 44% estimating more than two years for full re-onshoring of key inputs, revealing a temporal risk to project timelines and patient access.

In response, leading cell and gene therapy manufacturers are reevaluating sourcing strategies by blending regionalization with dual-sourcing approaches. By establishing domestic partnerships and leveraging alternative materials where feasible, these companies aim to maintain program continuity and safeguard margins. Nevertheless, increased material costs may translate into higher therapy pricing or compressed R&D budgets, necessitating collaborative policy dialogue between industry and government to balance national security objectives with sustained innovation.

The 2025 tariff environment thus represents a strategic inflection point. Industry stakeholders must prioritize supply chain resilience, diversify procurement channels, and engage proactively with regulators to develop incentive structures that support domestic biomanufacturing while preserving the agility required for cutting-edge cell and gene therapy development.

Dissecting Critical Segmentation Insights Across Therapy Types Delivery Methods and Clinical Applications in the Cell and Gene Therapy Market Landscape

A rigorous understanding of market segmentation is essential to charting targeted strategies in the cell and gene therapy domain. Therapy type segmentation encompasses both cell therapy and gene therapy. Cell therapy subdivides into stem cell treatments-further divided into hematopoietic and mesenchymal stem cell approaches-and T-cell therapies, which include CAR T-cell constructs and T-cell receptor–based modalities. Parallel to this, gene therapy is categorized into ex vivo and in vivo platforms, each presenting unique development and delivery considerations.

Delivery method segmentation evaluates the practical administration routes of therapies, mainly intramuscular and intravenous modalities. Intramuscular formats may offer localized, sustained delivery, whereas intravenous administration provides systemic dissemination and broad tissue targeting, influencing formulation design and clinical monitoring protocols.

Therapeutic area segmentation spans cardiovascular, metabolic, neurological, oncology, and ophthalmology indications. Cardiovascular efforts focus on congestive heart failure and ischemic heart disease, while metabolic programs address diabetes and obesity. Neurological pursuits include Alzheimer’s disease, Huntington’s disease, multiple sclerosis, Parkinson’s disease, and spinal cord injury treatments. Oncology efforts are dedicated to hematological malignancies, lymphomas, and solid tumor interventions, reflecting the field’s earliest successes in immuno-oncology.

Application-based segmentation distinguishes between clinical deployment and research and development pathways. Clinical applications involve preventive and treatment-oriented therapies, whereas R&D efforts drive pipeline innovation and exploratory modalities. Finally, end users are differentiated between academic and research institutions-including private research laboratories and universities-and hospitals and clinical settings, each with distinct operational requirements and procurement processes.

By synthesizing these segmentation insights, stakeholders can align product development, commercialization strategies, and partnership models to the nuanced demands of each segment, optimizing resource allocation and accelerating patient-centric innovation.

This comprehensive research report categorizes the Cell & Gene Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Delivery Method

- Therapeutic Areas

- Application

- End User

Unearthing Strategic Regional Insights from the Americas Through Europe Middle East and Africa to Asia Pacific Driving Cell and Gene Therapeutic Adoption

Regional dynamics play a decisive role in shaping the adoption and commercialization of cell and gene therapies across global markets. In the Americas, the United States remains the epicenter of clinical development and innovation, buoyed by substantial venture capital flows, advanced manufacturing hubs in regions such as Boston and the San Francisco Bay Area, and a supportive regulatory framework that includes the FDA’s RMAT designation. Canada complements this ecosystem with publicly funded research institutions and emerging domestic manufacturing initiatives, fostering collaborative networks that accelerate translational research.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts under the European Medicines Agency’s PRIME scheme have catalyzed clinical trial expansion in Germany, the United Kingdom, and France. The cell and gene therapy manufacturing infrastructure in the UK has benefited from significant public–private investments, notably through the Cell and Gene Therapy Catapult, which has driven over £2 billion in sector funding and established manufacturing hubs in Stevenage and Scotland. Meanwhile, emerging markets in the Middle East, such as Saudi Arabia and the United Arab Emirates, are investing in gene therapy partnerships and clinical infrastructure to capture medical tourism and address unmet genetic disease burdens.

Asia-Pacific has emerged as a powerhouse for cell and gene therapy research, with Japan’s regenerative medicine fast-track programs, China’s rapid expansion of CAR T-cell clinical trials, and South Korea’s strategic “Bio Vision 2030” roadmap allocating billions toward advanced therapies. Singapore’s Biopolis and Taiwan’s genomic research initiatives have established the region as a testing ground for innovative delivery models and real-world evidence generation. Increasing government support, streamlined approval processes, and sizable patient populations underpin Asia-Pacific’s growing prominence as both a development and manufacturing hub.

These regional insights underscore the diversity of policy environments, investment incentives, and ecosystem capabilities that cell and gene therapy stakeholders must navigate to optimize clinical development, regulatory approval, and market access strategies across the globe.

This comprehensive research report examines key regions that drive the evolution of the Cell & Gene Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Roles of Leading Innovators and Biotech Powerhouses Shaping the Cell and Gene Therapy Arena with Flagship Products

Leading biopharma innovators and emerging biotech enterprises are charting the competitive contours of the cell and gene therapy arena with distinctive pipelines, technology platforms, and strategic alliances. Novartis continues to leverage its pioneering CAR T-cell therapy franchise, exemplified by Kymriah, while advancing its AAV-based gene therapy portfolio through strategic partnerships and internal research initiatives. Meanwhile, Gilead Sciences, through its subsidiary Kite Pharma, has solidified its presence in hematological oncology via Yescarta and Tecartus, demonstrating robust clinical adoption and revenue performance in complex lymphomas and leukemias.

Vertex Pharmaceuticals has distinguished itself in the gene-editing space with its co-developed CRISPR-Cas9 therapy Casgevy for sickle cell disease, alongside multiple allogeneic stem cell programs for metabolic and endocrine disorders. This dual focus on precision gene editing and stem cell–derived islet therapies exemplifies a diversified approach to addressing both rare and prevalent conditions. Bluebird Bio, despite facing financial headwinds in recent years, maintains momentum in beta-thalassemia and cerebral adrenoleukodystrophy through Zynteglo and Skysona, and continues to invest in lentiviral vector optimization for next-generation treatments.

Other notable players include Spark Therapeutics, a Roche subsidiary with its approved Luxturna therapy for inherited retinal dystrophies; Bristol Myers Squibb, which has expanded its CAR T-cell portfolio with Abecma and Breyanzi in multiple myeloma and large B-cell lymphoma; and emerging entities such as Fate Therapeutics and Adaptimmune Therapeutics, which focus on off-the-shelf allogeneic NK-cell and T-cell receptor–engineered products, respectively. Collectively, these companies reflect a competitive mosaic of platform technologies, disease targets, and commercialization strategies, each contributing to the sector’s rapid evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell & Gene Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Abeona Therapeutics Inc.

- Adaptimmune Therapeutics PLC

- AGC Inc.

- Alnylam Pharmaceuticals, Inc.

- American Gene Technologies Inc.

- Amgen Inc.

- AnGes, Inc

- Astellas Pharma Inc.

- Becton, Dickinson and Company

- Biogen Inc.

- Bluebird Bio, Inc.

- BridgeBio Pharma, Inc.

- Bristol-Myers Squibb Company

- C.H. Boehringer Sohn AG & Co. KG

- Cellectis SA

- CRISPR Therapeutics AG

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Intellia Therapeutics, Inc.

- Ionis Pharmaceuticals, Inc.

- Johnson & Johnson Services Inc.

- Kyowa Kirin Co., Ltd.

- Merck KGaA

- Moderna, Inc.

- Mustang Bio, Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer, Inc.

- REGENXBIO Inc.

- Sangamo Therapeutics, Inc.

- Sarepta Therapeutics, Inc.

- Shoreline Biosciences

- Sibiono GeneTech Co. Ltd.

- Syncona Limited

- Thermo Fisher Scientific Inc.

- Vertex Pharmaceuticals Incorporated

Proposing Actionable Recommendations to Enhance Supply Chain Resilience Regulatory Alignment and Innovation Pathways in Cell and Gene Therapy Industry

Industry leaders can fortify their competitive edge by proactively enhancing supply chain resilience, aligning regulatory strategies, and advancing innovation pathways. To mitigate tariff and sourcing risks, companies should pursue dual-sourcing models that blend domestic and international suppliers, complemented by strategic inventory buffers for critical reagents and viral vectors. This approach not only reduces exposure to trade policy fluctuations but also supports continuity of clinical programs and commercial supply chains.

Regulatory engagement should be elevated through sustained dialogue with agencies such as the FDA, EMA, and regional authorities in Asia-Pacific. Early alignment on trial designs, real-world evidence collection, and post-approval commitments can expedite review timelines under adaptive pathways and breakthrough designations. Moreover, cross-stakeholder consortia can advocate for incentive frameworks that balance national security goals with the imperative to foster advanced therapeutic innovation.

Manufacturing modernization through automation, closed processing platforms, and digital twins will enhance process robustness and reduce batch variability. Investment in decentralized, modular production units can bring therapies closer to patients, shortening delivery lead times and lowering logistical complexities. Concurrently, partnerships with CDMOs and technology vendors will enable rapid scaling of capacity and access to specialized expertise without incurring disproportionate capital expenditures.

Finally, fostering collaborations across academic, clinical, and industry ecosystems can accelerate translational research and broaden access. By engaging key opinion leaders, payers, and patient advocacy groups early in development, sponsors can anticipate reimbursement challenges and adapt evidence strategies to maximize patient benefit and market uptake. These concerted actions will position organizations to navigate evolving policy landscapes, emerging competition, and dynamic patient needs, cementing leadership in the cell and gene therapy marketplace.

Detailing a Robust Research Methodology Integrating Primary Interviews Secondary Data Triangulation and Quantitative Qualitative Analyses

This analysis integrates a comprehensive multi-step methodology to ensure robust, reliable insights. Initially, secondary research encompassed review of peer-reviewed journals, industry reports, regulatory guidelines, and publicly available company disclosures to establish a foundational understanding of cell and gene therapy trends, regulatory frameworks, and competitive landscapes.

Subsequently, primary research was conducted through in-depth interviews with senior executives, manufacturing experts, clinical thought leaders, and policy analysts. These interviews provided qualitative perspectives on supply chain challenges, therapeutic pipeline priorities, and regional policy impacts, enabling nuanced interpretation of quantitative findings.

Data triangulation was employed to validate findings across diverse sources. Quantitative analyses leveraged proprietary databases tracking clinical trial activity, therapy approvals, manufacturing investments, and clinical pipeline metrics. Cross-validation with regulatory filings and patent literature ensured alignment of technical and commercial intelligence.

Finally, insights were synthesized into strategic frameworks and actionable recommendations. Scenario modeling considered variables such as tariff developments, manufacturing capacity expansion, and regulatory shifts, providing stakeholders with a forward-looking perspective on potential market trajectories. This rigorous research design guarantees that conclusions are grounded in empirical evidence and expert judgment, equipping decision-makers with credible guidance for informed strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell & Gene Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell & Gene Therapy Market, by Therapy Type

- Cell & Gene Therapy Market, by Delivery Method

- Cell & Gene Therapy Market, by Therapeutic Areas

- Cell & Gene Therapy Market, by Application

- Cell & Gene Therapy Market, by End User

- Cell & Gene Therapy Market, by Region

- Cell & Gene Therapy Market, by Group

- Cell & Gene Therapy Market, by Country

- United States Cell & Gene Therapy Market

- China Cell & Gene Therapy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights and Strategic Imperatives Illuminating the Future Trajectory of Cell and Gene Therapy Innovations and Market Evolution

The convergence of scientific innovation, regulatory evolution, and strategic investment has propelled cell and gene therapy from nascent clinical experiments to a vibrant industrial sector. Transformative shifts-such as the adoption of allogeneic formats, decentralized manufacturing, and advanced digital analytics-are driving improved scalability, access, and cost efficiencies across therapy development and production.

Tariff pressures in 2025 underscore the critical importance of supply chain resilience and policy engagement. Companies that diversify sourcing strategies and collaborate on domestic manufacturing initiatives will be best positioned to maintain clinical progress and commercial viability. Simultaneously, precise market segmentation and regional insights illuminate targeted opportunities, enabling organizations to optimize resource allocation and tailor approaches to distinct therapeutic areas, delivery methods, and end-user requirements.

Leading innovators-including Novartis, Gilead Sciences/Kite Pharma, Vertex, and Bluebird Bio-alongside emerging biotechs, continue to shape the competitive landscape with differentiated platforms and therapeutic pipelines. By embracing actionable recommendations on supply chain management, regulatory alignment, and manufacturing modernization, industry stakeholders can accelerate patient access while sustaining scientific excellence.

This analysis provides an integrated roadmap for navigating the evolving cell and gene therapy ecosystem. As the sector advances, agile adaptation to policy shifts, technological breakthroughs, and global market variances will be essential to realizing the full promise of these life-changing modalities.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Cell and Gene Therapy Market Research Report and Empower Strategic Decisions

To acquire the comprehensive intelligence and strategic guidance contained within this detailed analysis of the cell and gene therapy landscape, including nuanced segmentation, regional perspectives, and actionable recommendations, reach out directly to Associate Director Ketan Rohom. His expertise in sales and marketing will ensure you receive tailored support and a seamless purchasing experience, empowering your organization to navigate emerging opportunities, mitigate challenges, and shape the future of advanced therapeutic innovation with confidence.

- How big is the Cell & Gene Therapy Market?

- What is the Cell & Gene Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?