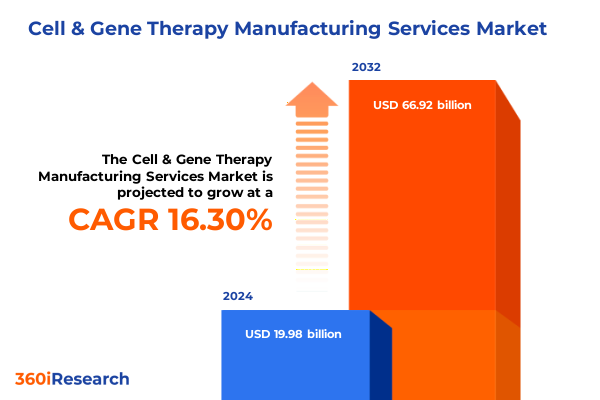

The Cell & Gene Therapy Manufacturing Services Market size was estimated at USD 23.06 billion in 2025 and expected to reach USD 26.61 billion in 2026, at a CAGR of 16.43% to reach USD 66.92 billion by 2032.

Unveiling the Critical Importance of Advanced Cell and Gene Therapy Manufacturing Services to Propel Cutting-Edge Biopharmaceutical Innovations

The promise of cell and gene therapies has ushered in a new era in biopharmaceutical innovation, transforming once-theoretical medical concepts into life-altering treatments for a variety of diseases. Precision medicine is increasingly contingent on the capacity to produce cells and viral or non-viral vectors at scale with impeccable quality. Advanced manufacturing services lie at the heart of this evolution, enabling the translation of sophisticated laboratory protocols into robust commercial processes. The intricate interplay of regulatory requirements, process reproducibility, and cost containment demands service providers to adopt rigorous frameworks that go beyond conventional biomanufacturing models.

In this context, manufacturers must navigate an expanding and complex supplier ecosystem, integrate cutting-edge automation and analytical technologies, and adapt their platforms to support both clinical trial volumes and full-scale commercial distribution. Success in this environment hinges on agility, cross-functional collaboration, and a deep understanding of the biology underpinning each modality. As emerging therapies shift from autologous to allogeneic approaches, and from viral to non-viral delivery systems, the capability to pivot resource allocations rapidly becomes paramount. This introduction lays the foundation for exploring how stakeholders across the value chain can optimize processes, mitigate risk, and ultimately accelerate patient access to groundbreaking treatments.

Charting the Transformative Shifts from Traditional Biomanufacturing to Modular Agile Platforms Driving Cell and Gene Therapy Production Evolution

Over the past decade, the manufacturing landscape for cell and gene therapies has undergone seismic transformation. Initially anchored in traditional bioreactors and manual workflows, the sector has pivoted toward modular, closed systems that dramatically reduce contamination risk and enhance reproducibility. Innovations in single-use technologies, automated filling and finish platforms, and real-time analytics now enable flexible production batches tailored to patient-specific requirements. Concurrently, digital twins and predictive modeling have begun to streamline process development, compressing timelines and lowering costs.

These shifts are not merely technological; regulatory frameworks across key markets have evolved to encourage accelerated approval pathways while imposing more stringent quality control expectations. Collaborative initiatives between manufacturers and regulatory bodies are fostering harmonized guidelines that facilitate global trial execution and commercial rollout. Moreover, the advent of allogeneic “off-the-shelf” therapies is redefining supply chain architectures, prompting investments in cryopreservation logistics and distributed manufacturing hubs. Together, these transformative dynamics are reshaping how stakeholders design, validate, and scale manufacturing processes, underscoring the imperative for service providers to stay at the forefront of innovation.

Assessing the Cumulative Impact of United States Tariff Policies Implemented in 2025 on Supply Chains and Cost Structures within the Sector

In 2025, the United States implemented targeted tariff measures affecting certain categories of biologics, viral vector components, and specialized raw materials. These policies were designed to protect domestic manufacturing but have yielded complex repercussions throughout the cell and gene therapy ecosystem. Service providers have experienced increased import costs for critical enzymes, plasmid backbones, and single-use consumables. As a result, production budgets have been recalibrated to absorb these surcharges without compromising process integrity or extending clinical timelines.

The ripple effects extend beyond sticker price adjustments. Many developers have sought to qualify alternate domestic suppliers or to localize production of intermediates, introducing new validation challenges and elongating supply chain lead times. In response, contract manufacturers are investing in backward integration strategies and strategic partnerships to secure priority access to essential inputs. At the same time, developers and service organizations are pursuing inventory hedging and demand aggregation models to insulate against future tariff escalations. These adaptations demonstrate the sector’s resilience but also highlight the importance of agile procurement frameworks and cross-border collaboration in sustaining uninterrupted therapy development and delivery.

Revealing In-Depth Segmentation Insights to Illuminate Demand Variances across Service Types Technologies Therapeutic Areas Applications and End Users

An examination of service type segmentation reveals that analytical and quality control services continue to see heightened demand as developers emphasize robust release testing protocols. Cell banking services are expanding in scope, driven by the need to preserve multiple cell lines and donor profiles for allogeneic products. Consulting services are evolving into comprehensive outsourcing solutions, integrating regulatory strategy with process development insights. Meanwhile, fill and finish services are increasingly automated to accommodate complex vial sizes and dual drug-device combinations. GMP manufacturing services remain the cornerstone, yet process development and technology transfer remain essential for bringing novel modalities from concept to commercialization.

The technology type dimension underscores the vital role of gene editing platforms. CRISPR/Cas9 leads the pack in ease of programming, while TALENs and zinc finger nucleases are leveraged for specific therapeutic targets requiring high precision. Within vector production, demand for non-viral vectors such as cationic lipids, liposomes, and polymeric vectors is growing as safety profiles and payload versatility expand. Viral vectors remain indispensable for systemic delivery, with adeno-associated viruses commanding significant manufacturing capacity alongside adenovirus, herpes simplex, and retrovirus platforms.

Therapeutic area analysis highlights oncology and monogenic disorders as spearheading commercial launches, while cardiovascular and infectious disease pipelines continue to mature. The distinction between clinical manufacturing and commercial manufacturing applications reveals a bifurcated investment landscape, requiring versatile facility designs. Finally, end-user segmentation shows that pharmaceutical and biotech companies remain the principal sponsors, supported by contract research organizations, hospitals, and academic institutions that drive early-stage innovation and clinical validation.

This comprehensive research report categorizes the Cell & Gene Therapy Manufacturing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology Type

- Therapeutic Area

- Application

- End-User

Highlighting Critical Regional Dynamics and Strategic Opportunities across the Americas Europe Middle East Africa and Asia Pacific Cell and Gene Therapy Markets

The Americas region leads in technology innovation and capacity expansion, bolstered by robust venture capital funding and favorable regulatory initiatives in both the United States and Canada. Investment in state-of-the-art facilities and forging public-private partnerships have accelerated commercial readiness. In Europe, Middle East, and Africa, regulatory harmonization efforts across the European Medicines Agency and local health authorities have catalyzed cross-border clinical studies, though infrastructure disparities in certain markets have necessitated targeted technology transfer initiatives.

Asia-Pacific stands out for its rapid scaling of manufacturing capabilities, driven by strategic government incentives and a growing base of contract development and manufacturing organizations. China and South Korea have emerged as leading hubs for both viral vector production and advanced analytics services, while Japan continues to pioneer regulatory pathways for expedited approvals. Collaboration between global developers and regional service providers has enhanced supply chain resilience, yet considerations around intellectual property management and export controls remain critical. Together, these regional dynamics define a mosaic of opportunities and constraints that stakeholders must navigate to optimize their global footprint.

This comprehensive research report examines key regions that drive the evolution of the Cell & Gene Therapy Manufacturing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Contract Development And Manufacturing Organizations And Innovative Biotech Firms Are Shaping The Manufacturing Ecosystem

Leading contract development and manufacturing organizations are differentiating themselves by investing in end-to-end services that integrate process development, scale-up, and commercial production. Several prominent CDMOs have adopted multiproduct facility designs that can pivot swiftly between viral vector manufacturing and non-viral payload assembly. Other service providers are forging collaborations with technology suppliers to embed real-time release testing capabilities within production lines, reducing cycle times and accelerating batch release.

Innovative biotech firms are establishing strategic alliances with academic research centers to access cutting-edge gene editing platforms and novel vector technologies. These partnerships are unlocking new avenues for first-in-human trials and fostering knowledge transfer across the ecosystem. Meanwhile, pharmaceutical companies are consolidating their vendor networks, preferring a select group of integrated service providers that can meet their clinical and commercial demands under unified quality management systems. This convergence of capabilities is fostering a more streamlined manufacturing ecosystem, though it also raises the bar for smaller service providers to demonstrate specialized expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell & Gene Therapy Manufacturing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced BioScience Laboratories, Inc. by Institut Mérieux

- AGC Biologics

- AmplifyBio

- Bio-Techne Corporation

- C.H. Boehringer Sohn AG & Co. KG

- Catalent, Inc.

- Cell Therapies Pty Ltd.

- Cell-Easy

- Charles River Laboratories International, Inc.

- Danaher Corporation

- eXmoor Pharma Concepts Limited

- FUJIFILM Diosynth Biotechnologies

- Genezen Laboratories, Inc.

- Laboratory Corporation of America Holdings

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- Minaris Regenerative Medicine GmbH by Resonac Corporation

- Nikon Corporation

- Novartis AG

- Oxford Biomedica PLC

- ProPharma Group Holdings, LLC

- Recipharm AB

- Samsung Biologics Co., Ltd.

- SGS S.A.

- STEMCELL Technologies Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- uBriGene Biosciences Inc.

- WuXi AppTec Co., Ltd.

Providing Actionable Strategic Recommendations To Empower Industry Executives In Overcoming Challenges And Driving Sustainable Growth In This Complex Landscape

Industry leaders should prioritize the diversification of their supply chains to mitigate the risk of future tariff disruptions and raw material shortages. Establishing secondary sourcing agreements and pursuing backward integration into critical reagent manufacturing can provide greater control over production timelines. Simultaneously, investment in modular facility architectures and single-use technologies will enable rapid batch changeovers and cost-efficient scaling between clinical and commercial volumes.

To stay ahead of regulatory shifts, organizations are advised to engage proactively with health authorities through joint workshops and pilot programs that foster early alignment on novel modalities. Developing a cross-functional governance structure encompassing quality, regulatory, engineering, and commercial teams will streamline decision-making and ensure that process changes are documented and implemented swiftly. Finally, forging strategic alliances with academic institutions and technology innovators can accelerate access to next-generation platforms, while data-driven process optimization and digital twins will be instrumental in reducing cycle times and minimizing operational variances.

Detailing The Rigorous Research Methodology Utilized Through Expert Interviews Data Triangulation And Industry Validation Protocols For Robust Market Insight

This research synthesis is anchored in a multi-stage framework combining primary and secondary data. First, a series of in-depth interviews was conducted with senior executives from leading contract development and manufacturing organizations, academic research centers, and regulatory authorities. These qualitative insights were triangulated with secondary sources, including published regulatory guidance, industry consortium reports, and patent filings. Data from regional trade statistics and customs records was incorporated to assess the impact of tariff measures on supply chains.

An analytical model was developed to map the interplay between service type demand and technological modality adoption, while thematic coding of interview transcripts highlighted emerging operational challenges. Validation workshops with expert panels ensured that assumptions around process scalability, cost structures, and regulatory timelines were rigorously tested. The resulting methodology provides a robust, triangulated foundation upon which stakeholders can base their strategic decisions in the cell and gene therapy manufacturing arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell & Gene Therapy Manufacturing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell & Gene Therapy Manufacturing Services Market, by Service Type

- Cell & Gene Therapy Manufacturing Services Market, by Technology Type

- Cell & Gene Therapy Manufacturing Services Market, by Therapeutic Area

- Cell & Gene Therapy Manufacturing Services Market, by Application

- Cell & Gene Therapy Manufacturing Services Market, by End-User

- Cell & Gene Therapy Manufacturing Services Market, by Region

- Cell & Gene Therapy Manufacturing Services Market, by Group

- Cell & Gene Therapy Manufacturing Services Market, by Country

- United States Cell & Gene Therapy Manufacturing Services Market

- China Cell & Gene Therapy Manufacturing Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Insights Around Market Drivers Technological Advancements And Policy Influences To Illuminate The Path Forward In The Sector

Throughout this executive summary, the convergence of technological innovation, shifting regulatory frameworks, and policy influences underscores a sector in rapid evolution. The maturation of allogeneic therapies and non-viral vector platforms is redefining production paradigms, while tariff-induced cost pressures have reinforced the imperative for agile supply chains. Leading CDMOs and biotech firms are setting new benchmarks in integrated service delivery, illustrating the value of end-to-end capabilities.

Regional analyses reveal that different markets offer distinct advantages: the Americas excel in capital availability and regulatory agility, Europe enjoys harmonized oversight, and Asia-Pacific delivers cost-effective scaling. Segmentation insights clarify that specialized analytical services, flexible fill and finish operations, and precise gene editing tools are critical to unlocking the next wave of clinical and commercial launches. By synthesizing these drivers, this summary illuminates the path forward, emphasizing the need for strategic collaboration, technological investment, and proactive regulatory engagement to realize the full promise of cell and gene therapy manufacturing.

Initiate A Strategic Dialogue With The Associate Director Of Sales And Marketing To Access Comprehensive Cell And Gene Therapy Manufacturing Intelligence Now

If you’re ready to deepen your understanding of the dynamic cell and gene therapy manufacturing ecosystem, reach out to Ketan Rohom, Associate Director of Sales and Marketing. He is equipped to provide you with tailored insights that align precisely with your strategic objectives. By engaging in a direct conversation, you can explore the detailed market research report in its entirety and uncover opportunities that may not be immediately apparent through secondary analysis alone. Reach out today to schedule a one-on-one briefing and discover how these in-depth findings can strengthen your competitive positioning and drive sustainable growth.

- How big is the Cell & Gene Therapy Manufacturing Services Market?

- What is the Cell & Gene Therapy Manufacturing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?