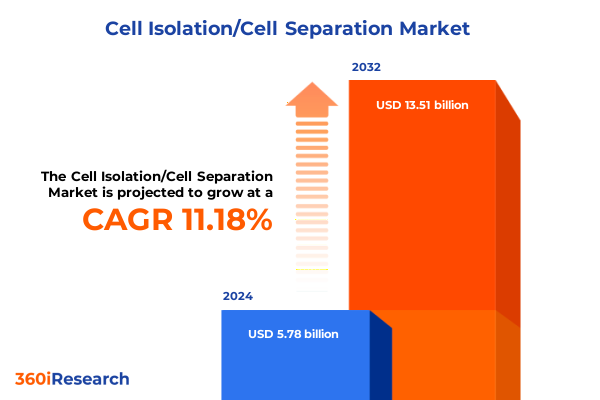

The Cell Isolation/Cell Separation Market size was estimated at USD 6.34 billion in 2025 and expected to reach USD 6.97 billion in 2026, at a CAGR of 11.39% to reach USD 13.51 billion by 2032.

Pioneering the Future of Cell Isolation with a Comprehensive Overview of Emerging Technologies, Market Drivers, and Strategic Imperatives

The rapid evolution of cell isolation methodologies demands a proactive understanding of both technological innovations and shifting market dynamics. This executive summary sets the stage by introducing the foundational drivers reshaping the industry, highlighting the growing emphasis on precision, throughput, and integration. Advances in single-cell analysis, coupled with rising demand for personalized medicine, have propelled cell separation from a niche laboratory procedure to a cornerstone of translational research. Moreover, increased cross-disciplinary collaboration has fostered a convergence of microfluidics, magnetic separation, and cytometry, leading to hybrid platforms that address complex biological questions. Transitioning from traditional gravity- and density-based approaches, the landscape now prioritizes automation and data-driven workflows, ensuring reproducibility and scalability across research and clinical environments. As stakeholders navigate regulatory frameworks and cost pressures, understanding the interplay between innovation and market constraints is essential. This introduction underscores the importance of a holistic perspective, blending technological foresight with strategic imperatives to guide decision-makers through a landscape characterized by rapid change and opportunity.

Revolutionary Technologies and Strategic Innovations Driving a Paradigm Shift in Cell Separation Methodologies Across Diverse Research Applications

Innovations in microfabrication and digital analytics are driving transformative shifts in cell separation methodologies that extend far beyond incremental improvements. Label-free techniques, such as dielectrophoresis and acoustic sorting, are gaining traction by preserving cell viability and reducing reagent dependency. Concurrently, the integration of artificial intelligence and machine learning into data analysis software is revolutionizing downstream interpretation, enabling real-time decision support for sorting and characterization processes. Furthermore, modular platforms that combine magnetic beads with microfluidic cartridges are streamlining workflows, reducing hands-on time and error rates. These shifts are underpinned by growing interdisciplinary collaboration between engineers, biologists, and data scientists, fostering ecosystems where iterative feedback accelerates innovation. Regulatory agencies are adapting guidelines to encompass novel separation modalities, with an emphasis on quality-by-design principles. In this context, successful market participants are those that align product development with evolving compliance frameworks while anticipating user needs for flexibility and scalability. As a result, the cell isolation landscape is marked by a convergence of precision engineering, computational prowess, and application-specific customization, setting the stage for the next wave of breakthroughs.

Assessing the Ripple Effects of 2025 US Tariff Measures on the Cell Separation Value Chain Across Consumables, Instruments, and Service Sectors

The imposition of new U.S. tariffs in early 2025 on key instrument components and consumable imports has introduced both challenges and strategic opportunities for the cell separation market. Increased duties on microfluidic chips, magnetic bead reagents, and cytometry optics have elevated costs for domestic labs, prompting supply chain reevaluations. In response, several manufacturers have accelerated the localization of critical manufacturing processes, leveraging onshore partnerships to mitigate duty impacts and maintain competitive pricing. Moreover, service providers offering maintenance and calibration have seen a surge in demand as end users seek to extend the lifecycle of existing assets. Import substitution efforts have also spurred innovation in reagent formulations, with firms investing in proprietary chemistries that can be produced domestically. At the same time, distributors are adjusting inventory strategies to absorb tariff shocks and prevent downstream price volatility. These adaptations underscore the market’s agility: while short-term cost pressures persist, the incentive to strengthen regional supply chains and diversify sourcing channels promises greater resilience. Ultimately, the 2025 tariff measures have catalyzed structural shifts, compelling stakeholders to rethink manufacturing footprints and embrace strategic partnerships that will shape the competitive landscape for years to come.

Unlocking Critical Market Segmentation Perspectives to Illuminate Product, Technology, Cell Type, Application, and End User Dynamics

Deep analysis of market segmentation reveals nuanced growth drivers and potential white spaces across multiple dimensions. When considering product offerings comprised of consumables, instruments, kits, and software and services, the most dynamic subsegments include reagents under disposables and data analysis platforms within software, where integration and ease of use are paramount. From a technological standpoint, centrifugal and magnetic bead–based methods continue to dominate volume applications, while flow cytometry’s subdivisions of analytical cytometry and sorting cytometry unlock precise phenotyping and isolation of rare populations. The ascendancy of nano beads over macro beads reflects demand for higher purity protocols. Looking at cell types, the pursuit of T cells and stem cells for therapeutic development has driven specialized toolkits, whereas research into dendritic and cancer cells accelerates in vitro disease modeling. In application areas spanning immunology, oncology, and prenatal testing, turnkey solutions that combine kits with maintenance services are capturing attention. Finally, end users including academic and research institutes, biotech and pharma, contract research organizations, and hospitals all exhibit divergent priorities, from cost-efficiency in academic environments to regulatory compliance in clinical settings. This granular perspective informs targeted strategies to address specific user requirements and maximize market penetration.

This comprehensive research report categorizes the Cell Isolation/Cell Separation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Cell Type

- Application

- End User

Exploring Regional Nuances and Growth Catalysts Shaping the Cell Isolation Market Across Americas, EMEA, and Asia-Pacific Territories

Regional analysis of the cell isolation ecosystem underscores distinct demand patterns and investment priorities. In the Americas, specifically the United States, the imperative for rapid translational research and the strength of local biopharma hubs drive robust uptake of high-throughput instruments and associated software services. North American end users are particularly focused on integrating multi-omic workflows to support personalized medicine initiatives. Transitioning to Europe, Middle East & Africa, regulatory harmonization efforts and public funding programs are accelerating adoption in academic centers, with a growing emphasis on cryopreservation-compatible consumables and standardized protocols. In parallel, collaborations between clinical laboratories and biotech startups are fostering novel applications in infectious disease surveillance. Meanwhile, Asia-Pacific markets exhibit dual characteristics: mature markets like Japan and South Korea demand advanced analytical cytometry solutions, while emerging markets across Southeast Asia show momentum in cost-effective disposable kits and basic instrumentation. Local manufacturing initiatives in China and India are increasingly catering to regional price sensitivities, enhancing accessibility. This regional mosaic highlights the importance of tailored go-to-market approaches, with success hinging on aligning product portfolios with local regulatory landscapes and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Cell Isolation/Cell Separation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Spearheading Innovation and Collaboration in Cell Isolation Through Strategic Investments and Technology Partnerships

The competitive landscape is defined by a core group of established players and innovative challengers that are collectively driving advancements. Legacy instrument manufacturers continue to invest heavily in automation, integrating microfluidics and digital analytics to broaden their portfolios. Simultaneously, specialist reagent companies are forging alliances with system providers to develop turnkey kits optimized for specific cell types, enhancing ease of use for end users. Emerging software vendors are disrupting traditional models by offering cloud-based data analysis subscriptions that facilitate remote collaboration and advanced visualization, while service organizations are diversifying their offerings to include predictive maintenance and real-time performance monitoring. Venture-backed startups are entering the fray with label-free separation and novel bead technologies, challenging incumbents to accelerate their innovation cycles. Strategic partnerships between research institutes and commercial entities are also gaining prominence, yielding new assay formats and validation studies that expand clinical applicability. This dynamic interplay of investment, collaboration, and competition is fostering an ecosystem that balances the stability of mature platforms with the agility of cutting-edge solutions, ultimately benefiting researchers, clinicians, and diagnostics developers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Isolation/Cell Separation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc

- Agilent Technologies, Inc.

- Beckman Coulter, Inc

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc

- Corning Incorporated

- Danaher Corporation

- GE Healthcare

- Lonza Group AG

- Merck KGaA

- Sartorius AG

- Terumo Corporation

- Thermo Fisher Scientific Inc

Actionable Strategies for Industry Leaders to Enhance Competitiveness, Optimize Supply Chains, and Accelerate Adoption of Next-Generation Platforms

To capitalize on emerging opportunities, industry leaders must adopt a multipronged approach. First, investing in modular platforms that can be customized to specific cell types and applications will enhance flexibility and drive broader adoption. Furthermore, establishing resilient supply chains through diversified sourcing and regional manufacturing partnerships will mitigate tariff and logistics risks. In addition, integrating artificial intelligence into both hardware and software solutions will accelerate data interpretation and improve throughput, positioning organizations to meet rising demands for single-cell resolution. Emphasizing service excellence through predictive maintenance agreements and embedded training programs will strengthen customer loyalty and reduce downtime. Moreover, cultivating strategic alliances with academic and clinical research centers will generate high-impact validation studies, paving the way for regulatory approvals and reimbursement pathways. Leadership teams should also monitor evolving guidelines to ensure compliance and invest in quality-by-design frameworks that streamline development cycles. By executing these strategies holistically, companies can not only adapt to current market pressures but also shape the future trajectory of cell separation technologies.

Adhering to Rigorous Research Protocols and Methodological Frameworks for Ensuring Accuracy, Relevance, and Robustness in Market Analysis

Our research methodology adheres to rigorous standards to ensure the integrity and applicability of findings. Primary interviews with senior executives, product managers, and end users across academic, biotech, and clinical sectors provided firsthand insights into operational challenges and unmet needs. Secondary research encompassed peer-reviewed journals, industry association reports, and patent analysis to capture technological advancements and regulatory updates. Market triangulation was performed by cross-referencing supplier data, procurement records, and conference proceedings to validate trends. Quantitative modeling techniques were applied to historical adoption rates and reagent consumption patterns to identify growth accelerators, while qualitative sensitivity analyses assessed potential disruption factors such as policy changes and supply chain interruptions. Throughout the process, data points were subjected to multiple rounds of verification, ensuring consistency and reliability. This mixed-methods approach, combining qualitative depth with quantitative rigor, forms the foundation of our conclusions and recommendations, providing stakeholders with a robust and comprehensive market perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Isolation/Cell Separation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Isolation/Cell Separation Market, by Product

- Cell Isolation/Cell Separation Market, by Technology

- Cell Isolation/Cell Separation Market, by Cell Type

- Cell Isolation/Cell Separation Market, by Application

- Cell Isolation/Cell Separation Market, by End User

- Cell Isolation/Cell Separation Market, by Region

- Cell Isolation/Cell Separation Market, by Group

- Cell Isolation/Cell Separation Market, by Country

- United States Cell Isolation/Cell Separation Market

- China Cell Isolation/Cell Separation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Insights to Define the Trajectory of Cell Separation Innovations and Empower Stakeholders with Strategic Foresight

In summary, the cell isolation landscape is at a pivotal juncture where technological innovation, regulatory developments, and market dynamics converge. Breakthroughs in label-free sorting, AI-driven data analysis, and modular instrument design are redefining workflow efficiency and opening new avenues for personalized medicine. The 2025 tariff landscape has underscored the critical importance of supply chain resilience, pushing stakeholders to localize production and seek strategic partnerships. Deep segmentation analysis reveals targeted opportunities across consumables, instruments, software, and services, each influenced by unique factors spanning product intricacies and end-user demands. Regional insights highlight that a one-size-fits-all approach is no longer viable; instead, success hinges on tailoring solutions to distinct geographic and regulatory contexts. Competitive pressures among established corporations and innovative startups continue to foster rapid advancements, necessitating proactive strategies for differentiation. Ultimately, organizations that leverage these insights to inform strategic investment, partnership, and product development decisions will be best positioned to lead the next wave of cell separation innovation.

Engage with Ketan Rohom to Unlock Exclusive Market Intelligence and Propel Strategic Decision-Making with Our Comprehensive Research Report

Engaging with Ketan Rohom offers direct access to tailored market intelligence solutions that are designed to align with specific organizational objectives and accelerate strategic initiatives. By initiating a consultation, stakeholders gain a clear roadmap for navigating emerging trends, regulatory challenges, and evolving customer needs in the cell isolation sector. Ketan’s expertise in sales and marketing ensures that recommendations are not only comprehensive but also actionable, bridging the gap between research insights and business impact. Discover how you can leverage this exclusive report to secure a competitive edge, drive innovation, and make informed investments in next-generation platforms. Reach out today to unlock personalized guidance and access proprietary data that will inform your decision-making and fuel sustained growth

- How big is the Cell Isolation/Cell Separation Market?

- What is the Cell Isolation/Cell Separation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?