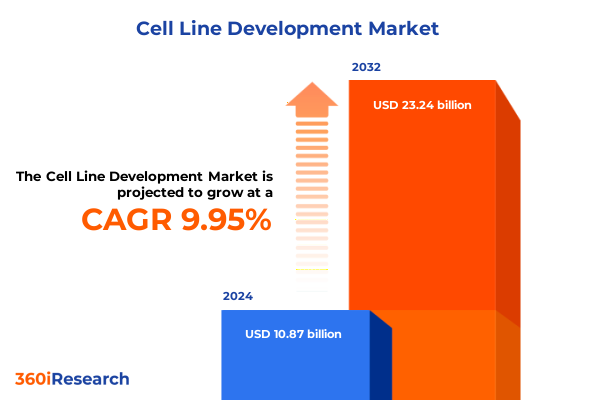

The Cell Line Development Market size was estimated at USD 11.91 billion in 2025 and expected to reach USD 13.05 billion in 2026, at a CAGR of 10.02% to reach USD 23.24 billion by 2032.

Unveiling the foundational context of cell line development, innovation drivers, and strategic imperatives fuelling next-generation biopharmaceutical breakthroughs

The field of cell line development has rapidly evolved from a specialized research endeavor into a cornerstone of the biopharmaceutical industry. High-quality cell lines underpin the production of monoclonal antibodies, recombinant proteins, viral vectors, and advanced cell therapies, enabling groundbreaking treatments for cancer, autoimmune disorders, and genetic diseases. Regulatory agencies worldwide have placed increased emphasis on robust characterization and long-term stability of cell banks, driving innovation in both finite and continuous cell line technologies. Concurrently, strategic collaborations between academic institutions, contract development organizations, and large pharmaceutical companies are accelerating time-to-clinic and reducing development attrition.

This executive summary provides a holistic overview of the current cell line development ecosystem, highlighting transformative shifts in technology and regulation, the cumulative impact of United States tariff policies enacted in 2025, and key insights derived from detailed segmentation and regional analyses. It also examines leading industry participants, offers targeted recommendations for organizational resilience and growth, and outlines the rigorous research methodology that underpins these findings. Together, these sections form a comprehensive foundation for stakeholders seeking to navigate the complex landscape of cell line development and capitalize on emerging opportunities.

Charting paradigm-shifting technological and strategic transitions revolutionizing cell line workflows and accelerating bioprocess efficiency globally

Recent years have witnessed unprecedented convergence of automation, single-use technologies, and continuous processing that is redefining cell line development workflows. Integrated single-use bioreactor systems now embed perfusion and cell retention modules, enabling seamless scale-up from laboratory to production scales without complex equipment reconfiguration. The adoption of embedded process analytical tools allows real-time monitoring of critical quality attributes, reducing cycle times and enhancing reproducibility.

At the same time, high-throughput, multi-parallel microbioreactor platforms are accelerating clone selection and process optimization. These systems replicate large-scale bioreactor conditions in a miniaturized format, ensuring predictive scale-up and delivering process insights in hours instead of weeks. Digital transformation initiatives, including the integration of artificial intelligence for cell line engineering and digital twins for bioprocess simulation, further streamline development pipelines. Together, these technological and strategic shifts are empowering organizations to reduce development timelines, enhance consistency, and support the next generation of personalized medicine.

Assessing the cumulative ramifications of 2025 United States tariff policies on supply chain costs, innovation cadence, and global cell line development operations

In April 2025, the United States implemented a universal 10% tariff on most imported goods, followed by country-specific escalations that raised the cumulative tariff on Chinese-sourced laboratory equipment and reagents to 145%. This sweeping policy has significantly increased the landed cost of critical single-use bioreactor bags, media supplements, and specialized consumables, prompting many organizations to reassess supply strategies and inventory buffers.

Thermo Fisher Scientific, a leading supplier of life sciences tools, projected that U.S.-China tariffs would reduce its 2025 revenue by $400 million and adjusted operating income by $375 million, driving a $2 billion investment plan in domestic manufacturing and R&D to mitigate these impacts. Across the industry, contract development and manufacturing organizations are recalibrating capital investment plans, with some delaying facility upgrades or seeking alternative components from tariff-exempt regions.

A survey of Biotechnology Innovation Organization members found that 94% of U.S. biotech companies anticipated surging manufacturing costs if European Union imports were subjected to tariffs, with half of those surveyed predicting the need to scramble for new partners or face regulatory delays if supply disruptions occurred. In response, many firms are exploring localized supply chains, engaging with domestic distributors, and diversifying raw material sources to sustain program timelines while managing cost escalation.

Strategic exploration of cell line market segmentation revealing nuanced opportunities across types, offerings, sources, applications, and end-user dynamics

Understanding the landscape of cell line development requires a nuanced view of distinct market segments that align with evolving customer needs. Differentiation by cell line type reveals a balance between continuous lines-such as hybridomas optimized for monoclonal antibody secretion and stem cell lines engineered for regenerative applications-and finite lines historically leveraged for vaccine production and early-stage research. This duality underscores the importance of selecting the right platform for both clinical supply and discovery workflows.

Offerings further stratify the market, ranging from comprehensive cell line services-including in-depth characterization and bespoke cell line engineering-to the core consumables, media, and reagents that sustain daily laboratory operations. Equipment investments, spanning from high-throughput microbioreactors to large-scale bioreactors and incubators, reflect the need for scalable, flexible infrastructure. The cell line ecosystem also differentiates by source, with mammalian systems dominating biologics production while non-mammalian platforms-such as insect and amphibian cell lines-gain traction for specialized protein expression and virology research.

Applications for these segments span bioproduction, drug discovery, research and development, tissue engineering, and toxicity testing, each demanding tailored protocols and regulatory considerations. End users, including biotechnology firms, pharmaceutical companies, and research institutes, navigate these intersecting segments to optimize workflows, accelerate timelines, and manage cost structures in a competitive global environment.

This comprehensive research report categorizes the Cell Line Development market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Offerings

- Source

- Application

- End User

Comprehensive regional examination highlighting distinctive growth drivers, supply chain strengths, and strategic partnerships across the Americas, EMEA and Asia-Pacific

The Americas region remains a critical hub for cell line development, driven by significant domestic investment in manufacturing infrastructure and R&D. Major suppliers are expanding U.S. production capabilities to reduce exposure to import tariffs and streamline supply chains. For instance, Thermo Fisher’s committed $2 billion investment in local manufacturing and research facilities underscores a broader industry shift toward on-shore production to safeguard against external economic shocks.

Europe, the Middle East, and Africa (EMEA) benefit from a long-standing biopharmaceutical heritage, supported by robust regulatory frameworks and a collaborative innovation ecosystem. Leading companies have leveraged tariff relief and strategic partnerships to optimize cross-border logistics. Merck KGaA’s removal of temporary surcharges on Chinese life sciences orders following a tariff reduction agreement exemplifies the region’s adaptability in balancing cost pressures and supply continuity. Concurrently, integrated biologics facilities in Switzerland and Germany are expanding capacity to meet global demand while maintaining high compliance standards.

Asia-Pacific is emerging as a powerhouse of growth in cell line development, spurred by investments in biotechnology parks and supportive government policies. Notably, Sartorius’ forthcoming cell culture media facility in South Korea aims to locally produce sterile consumables, reducing lead times and enabling regional value creation for researchers and manufacturers by 2027. This facility, alongside expanding research clusters in China, India, and Singapore, is transforming supply dynamics and fostering innovation across the APAC landscape.

This comprehensive research report examines key regions that drive the evolution of the Cell Line Development market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-depth insights into leading cell line development ecosystem participants driving innovation in equipment, services, and strategic capacity expansions

Industry leaders are executing strategic initiatives to reinforce their positions within the cell line development ecosystem. Thermo Fisher Scientific is accelerating domestic capacity expansion, deploying a $2 billion capital program focused on U.S. manufacturing and R&D hubs to offset tariff-related revenue losses and improve supply chain resilience. Merck KGaA has demonstrated agility in tariff management, rolling back temporary surcharges on cross-border orders after diplomatic resolutions, reaffirming its commitment to cost-efficient service delivery.

Sartorius continues to pioneer integrated bioprocess solutions with its Biostat STR series, embedding perfusion and cell retention technology into a single controller. This innovation streamlines intensified seed-train workflows and exemplifies the drive toward modular, user-friendly equipment platforms. In parallel, Sartorius’ planned cell culture media facility in Korea underscores its long-term regional growth strategy in Asia-Pacific.

Lonza’s “One Lonza” strategy, operational since Q2 2025, has simplified its organizational structure to enhance customer experience and accelerate capacity utilization. The acquisition of Roche’s Vacaville site doubled its large-scale mammalian production capacity, complemented by new perfusion-enabled facilities in Visp that commenced operations in H1 2025. Fujifilm Diosynth Biotechnologies is scaling its footprint across Europe and North Carolina, adding multi-20,000 L bioreactors to meet surging demand for monoclonal antibodies and advanced therapies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Line Development market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Instruments, LLC

- AGC Group

- Ajinomoto Co., Inc

- Akadeum Life Sciences, Inc.

- Aragen Life Sciences Ltd.

- Avioq, Inc.

- Catalent, Inc. by Novo Holdings A/S

- Charles River Laboratories International, Inc.

- Corning Incorporated

- Cyagen Biosciences, Inc.

- Danaher Corporation

- EuBiologics Co.,Ltd.

- Eurofins Scientific SE

- FUJIFILM Diosynth Biotechnologies

- GenScript Biotech Corporation

- KBI Biopharma, Inc.

- Lonza Group AG

- Merck Group

- PromoCell GmbH

- Rentschler Biopharma SE

- Samsung Biologics Co., Ltd.

- Sartorius AG

- Syngene International Limited

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

- WuXi Biologics Co., Ltd.

Actionable strategic imperatives empowering industry leaders to harness innovation, fortify resilience, and optimize cell line development portfolios moving forward

Industry leaders should prioritize the integration of single-use and continuous processing platforms that embed real-time analytical capabilities, reducing development cycle times and enhancing process robustness. Establishing dual sourcing strategies for critical media, reagents, and consumables will mitigate exposure to tariff fluctuations and supply-chain disruptions while strengthening resilience.

Accelerating digital transformation through the adoption of artificial intelligence and machine learning for clone optimization, as well as deploying digital twin simulations for process validation, can elevate quality and reproducibility. Organizations must also engage proactively with regulatory agencies to shape evolving guidance on cell line characterization, ensuring compliance and expediting approval timelines.

Strategic alliances between biopharma companies, CDMOs, and equipment suppliers can foster co-innovation, sharing risks and resources to develop novel platforms and accelerate commercialization. Finally, targeted regional investments-leveraging incentives and local partnerships-will optimize logistical efficiency and drive cost competitiveness in key markets, reinforcing global supply chain agility.

Transparent outline of multidisciplinary research methodology employed to ensure rigorous, validated insights and comprehensive market intelligence integrity

This analysis is grounded in a rigorous, multi-tiered research methodology designed to deliver accurate, validated insights. Primary research included in-depth interviews with senior executives, scientific directors, and regulatory experts within biotechnology companies, pharmaceutical firms, and contract development organizations. These discussions provided firsthand perspectives on operational challenges, technology adoption, and strategic priorities.

Secondary research encompassed extensive review of peer-reviewed journals, industry white papers, regulatory guidelines, and company disclosures. Proprietary databases and real-world transaction data were analyzed to identify trends in capacity expansions, M&A activity, and technology investments. Quantitative data points were triangulated with qualitative insights to ensure comprehensive coverage and minimize bias.

Expert panels comprising academic leaders and industry consultants were convened to validate key findings, challenge assumptions, and refine recommendations. This iterative validation process ensures that the conclusions and strategic imperatives presented here reflect the current state of the cell line development ecosystem and are resilient to emerging market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Line Development market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Line Development Market, by Type

- Cell Line Development Market, by Offerings

- Cell Line Development Market, by Source

- Cell Line Development Market, by Application

- Cell Line Development Market, by End User

- Cell Line Development Market, by Region

- Cell Line Development Market, by Group

- Cell Line Development Market, by Country

- United States Cell Line Development Market

- China Cell Line Development Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding synthesis of transformative trends, strategic imperatives, and key takeaways shaping the future trajectory of cell line development innovation

The cell line development landscape is defined by converging technological innovations, evolving regulatory frameworks, and dynamic geopolitical forces. Integrated single-use and high-throughput platforms are catalyzing efficiency gains, while tariff pressures and supply-chain disruptions underscore the need for diversified sourcing and localized manufacturing. Regional developments in the Americas, EMEA, and Asia-Pacific highlight distinct competitive advantages, from scale economics to regulatory facilitation and market access.

Leading companies are responding with significant capacity investments, strategic realignments, and collaborative partnerships that reinforce their market positions. Going forward, organizations that embrace digital transformation, align closely with regulatory bodies, and pursue flexible sourcing strategies will be best positioned to navigate complexity and accelerate time-to-clinic. This synthesis provides a foundation for informed decision-making, enabling stakeholders to capitalize on the multifaceted opportunities emerging in cell line development.

Discover actionable intelligence for cell line development decision-makers and engage directly with Ketan Rohom to unlock the full market research report insights

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this in-depth executive summary can guide your strategic initiatives and operational planning. Drawing upon meticulously analyzed industry data, forward-looking insights, and comprehensive segmentation analysis, this report equips decision-makers with the actionable intelligence needed to optimize cell line development strategies and anticipate emerging opportunities. Ketan can provide tailored guidance on leveraging these findings to enhance competitive positioning, streamline resource allocation, and mitigate supply chain risks. Reach out to initiate a conversation about unlocking the full scope of this market research report and invest in the strategic clarity that will inform your next phase of growth in the evolving cell line development landscape.

- How big is the Cell Line Development Market?

- What is the Cell Line Development Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?