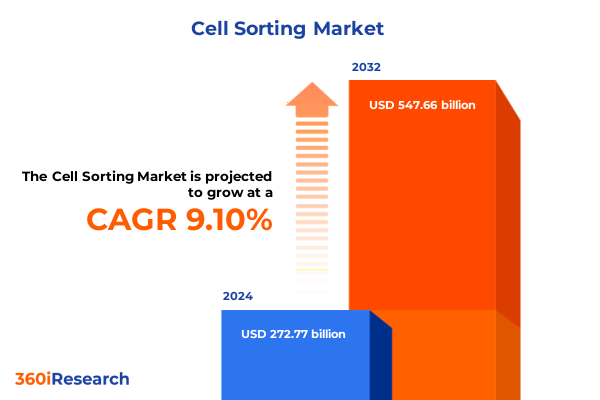

The Cell Sorting Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.85 billion in 2026, at a CAGR of 8.79% to reach USD 3.07 billion by 2032.

Setting the stage for innovation in cell sorting by exploring foundational technologies and emerging market context driving the industry forward

Cell sorting is defined as the process of separating a heterogeneous mixture of cells into purified fractions of homogeneous cells based on physical or biological properties, including size, granularity, and the presence of specific biomarkers. This capability enables researchers to obtain highly pure populations for downstream applications ranging from functional assays to therapeutic manufacturing, underscoring its critical role in modern life science workflows.

Over the last decade, advances in cell sorting methodologies-spanning fluorescence-activated, immunomagnetic, microfluidic, acoustic, and imaging-based techniques-have propelled the field into new frontiers of precision and throughput. These developments have been driven by the growing demand for single-cell analyses in immunology, oncology, and stem cell research, where understanding cellular heterogeneity is foundational to innovation and clinical translation.

Uncovering paradigm shifts reshaping cell sorting as cutting-edge innovations redefine precision and throughput across research and clinical workflows

One of the most transformative shifts in the cell sorting landscape has been the integration of high-resolution imaging with spectral flow cytometry, exemplified by the BD FACSDiscover S8 Cell Sorter. This instrument combines spectral flow capabilities with real-time microscopic imaging to enable researchers to visualize morphological features and sort based on nuanced visual cues, thereby enhancing the capacity to distinguish complex phenotypes with high-speed analytics

Meanwhile, microfluidic sorting platforms have matured, leveraging acoustic and dielectrophoretic forces to achieve label-free, contact-free separation with exceptional biocompatibility. Acoustofluidic systems now allow for the precise manipulation of cells using surface acoustic waves, enabling point-of-care devices that can process samples rapidly and with minimal sample volume, expanding the accessibility of cell sorting to decentralized laboratory settings

Furthermore, the infusion of artificial intelligence into data analysis pipelines has revolutionized decision-making within sorting workflows. AI-driven platforms, such as ThinkCyte’s VisionSort, apply machine learning algorithms for real-time classification and sorting based on high-dimensional morphological and fluorescence data, reducing reliance on manual gating strategies and accelerating throughput while maintaining purity.

Evaluating the ripple effects of recent United States tariff adjustments on cell sorting equipment supply chains and operational costs in 2025

Effective January 1, 2025, the Office of the United States Trade Representative implemented a Section 301 tariff increase, raising duties on imports of specific polysilicon and wafer products from China to 50 percent and certain tungsten components to 25 percent. As these materials are integral to the sensors and optical modules used in cell sorting instruments, the adjustments have directly affected manufacturers’ procurement costs and pricing strategies within the biopharma equipment sector

GE Healthcare has publicly acknowledged an estimated $500 million impact in 2025 from bilateral tariffs with China, underscoring the financial burden faced by cell sorting equipment providers. The company projects that costs will peak in the second half of the year before strategic measures-such as diversifying supply chains and localizing manufacturing-mitigate the effects in subsequent periods

Despite ongoing diplomatic efforts to prevent retaliatory tariffs, including high-level talks that have so far averted broad Chinese countermeasures, uncertainty persists for equipment suppliers reliant on global supply networks. The USTR’s extension of certain exclusions through August 31, 2025 has provided temporary relief for select laboratory goods, yet the looming expiration of these exclusions continues to challenge import planning and pricing stability

Deciphering pivotal market segmentation across technologies products end users and applications to unveil strategic insights into cell sorting adoption

When viewed through the lens of technology segmentation, fluorescence-activated cell sorting remains a benchmark for multi-parameter analysis, leveraging fluorophore-labeled antibodies for high specificity and throughput. Magnetic-activated cell sorting provides a cost-effective and gentle alternative by coupling magnetic beads to target cell surface markers, while emerging approaches-such as imaging flow cytometry, acoustic-based acoustofluidics, and microfluidic devices-offer novel pathways for label-free or high-content sorting in increasingly compact formats

In terms of product categorization, instruments themselves represent significant upfront investments, encompassing optics, fluidics, and electronic control systems that underpin performance. Consumables-including sheath fluids, microfluidic chips, fluorescent probes, and magnetic beads-drive recurring revenue streams and are critical for ensuring data quality and reproducibility by minimizing cross-contamination and maintaining system integrity

End users span contract research organizations offering cell sorting as a service for preclinical and clinical workflows, hospitals and clinics applying immunophenotyping for diagnostic decision-making, pharmaceutical and biotechnology companies utilizing sorting in drug discovery and cell therapy manufacturing, and academic research institutes investigating fundamental cellular processes across disciplines

Finally, applications divide into clinical diagnostics and research domains. Within clinical diagnostics, sorting facilitates infectious disease testing, oncological biomarker isolation, and prenatal cell analysis, whereas research applications encompass cancer research, circulating tumor cell detection, hematopoietic stem cell isolation, and immunology studies-each benefiting from tailored sorting protocols to meet sample purity and viability requirements

This comprehensive research report categorizes the Cell Sorting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Offering

- Sorting Technology

- Sample Source

- Application Area

- End User

Highlighting regional dynamics across Americas Europe Middle East Africa and Asia Pacific to contextualize cell sorting trends and opportunities worldwide

Contract research organizations in the Americas have reported stronger-than-expected earnings, signaling stabilizing biotech and pharmaceutical spending and driving demand for cell sorting services within CRO laboratories across the region

Within Europe, academic core facility networks are fostering knowledge exchange and operational excellence, as evidenced by the over 100 core facility members attending the German Flow Core Summit, demonstrating widespread adoption of advanced sorting workflows at university and research institutions

In the Middle East and Africa, emerging investments in life sciences infrastructure and rising prevalence of chronic and infectious diseases have created new opportunities for deploying flow cytometry and cell sorting technologies, particularly in centers of excellence and specialized diagnostic laboratories across GCC countries and South Africa

Asia-Pacific adoption is propelled by increasing emphasis on multi-parameter analysis in cancer and immunology research, supported by government-backed initiatives to enhance healthcare and research infrastructure in countries such as Australia, South Korea, and India where portable and high-throughput sorting solutions bridge resource gaps in remote and urban settings

This comprehensive research report examines key regions that drive the evolution of the Cell Sorting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading corporate innovators and strategic partners shaping technological advancement and competitive positioning in the cell sorting arena

Established incumbents like BD Biosciences and Thermo Fisher Scientific continue to lead innovation with breakthrough instruments such as the BD FACSDiscover S8-featuring SpectralFX™ and real-time CellView™ imaging-and the Attune CytPix Flow Cytometer, which combines acoustic focusing with high-speed brightfield imaging for morphometric analysis at rates up to 6,000 images per second

Biotechnology companies including Sony Biotechnology and Beckman Coulter leverage microfluidic chip designs and automated fluidics controls to simplify workflows and make sorting more accessible. Sony’s SH800S Cell Sorter supports versatile nozzle options for gentle handling, while the CytoFLEX SRT Benchtop Cell Sorter automates stream setup and maintenance to support multi-color and complex sort logic with minimal operator intervention

Emerging players such as Cytek Biosciences and Miltenyi Biotec are expanding the horizons of cell sorting with full spectrum profiling and immunomagnetic sample preparation. Cytek’s Aurora CS system now offers the Enhanced Small Particle (ESP™) Detection Option for isolating extracellular vesicles down to 70 nm, and Miltenyi Biotec’s magnetic-activated cell sorting platforms deliver gentle, high-purity separations across diverse applications

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Sorting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Becton, Dickinson, and Company

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Bio-Techne Corporation

- Sino Biological, Inc.

- Cytonome/St, LLC by STgenetics group

- RayBiotech Life, Inc.

- Menarini Silicon Biosystems SpA

- Cytek Biosciences, Inc.

- XIAMEN TOB NEW ENERGY TECHNOLOGY Co., LTD

- Sony Biotechnology Inc.

- Akadeum Life Sciences, Inc.

- Miltenyi Biotec B.V. & Co. KG

- NanoCellect Biomedical

- On-Chip Biotechnologies Co., Ltd.

- Sepmag Systems, SL

- Sphere Fluidics Limited

- Sysmex Partec GmbH

- uFluidix LLC

- Union Biometrica, Inc.

Delivering targeted actionable recommendations for industry leaders to navigate technological disruptions and supply chain challenges in cell sorting

To mitigate tariff-related cost pressures, industry leaders should develop localized manufacturing strategies and diversify supply chain partnerships, as demonstrated by GE Healthcare’s plan to reduce US tariff exposure through nearshore production arrangements

Investment in artificial intelligence and machine learning frameworks within sorting platforms can yield significant gains in throughput and data quality, a value proposition supported by the successful deployment of AI-driven systems like ThinkCyte’s VisionSort

Strategic collaborations between instrument vendors and contract research organizations can expand service offerings and optimize utilization of sorting capabilities, responding to the robust demand signals reported by CROs in the Americas

Finally, fostering regulatory engagement and pursuing tariff exclusion petitions for critical components can safeguard access to advanced sorting technologies, preserving research continuity and ensuring that temporary relief measures remain in place beyond mid-2025

Detailing rigorous research methodologies employed to gather validate and analyze comprehensive information on cell sorting technologies and applications

This analysis employed comprehensive secondary research, gathering information from official publications, peer-reviewed journals, industry news, corporate press releases, and regulatory announcements. Credible sources were identified through systematic searches and cross-validated to ensure accuracy and relevance.

Primary insights were supplemented through expert consultations with field practitioners to validate trends and interpret the implications of tariff developments, technological innovations, and application-driven segmentation, followed by iterative data triangulation to refine the strategic narrative.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Sorting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Sorting Market, by Product Offering

- Cell Sorting Market, by Sorting Technology

- Cell Sorting Market, by Sample Source

- Cell Sorting Market, by Application Area

- Cell Sorting Market, by End User

- Cell Sorting Market, by Region

- Cell Sorting Market, by Group

- Cell Sorting Market, by Country

- United States Cell Sorting Market

- China Cell Sorting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding key insights and future outlook that consolidate the transformative potential and strategic imperatives within the cell sorting landscape

In summary, the current cell sorting landscape is characterized by rapid technological evolution, from high-definition imaging and AI-enabled analytics to label-free acoustofluidic and microfluidic platforms. These innovations are unlocking new dimensions of single-cell resolution within both research and clinical contexts, driving adoption across diverse end users and applications.

Looking ahead, strategic management of tariff dynamics, continued investment in digital analytics, and strengthened partnerships across the value chain will be essential for sustaining momentum. By aligning emerging technologies with regulatory strategies and regional priorities, stakeholders can harness the full potential of cell sorting to advance precision medicine and translational research.

Empowering decision makers to act now by connecting with Ketan Rohom for exclusive cell sorting research insights and tailored strategic guidance

For decision makers seeking to gain deeper visibility into the strategic trajectories and operational benchmarks of the cell sorting industry, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to purchase the full market research report and unlock tailored guidance for your organization’s success.

- How big is the Cell Sorting Market?

- What is the Cell Sorting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?