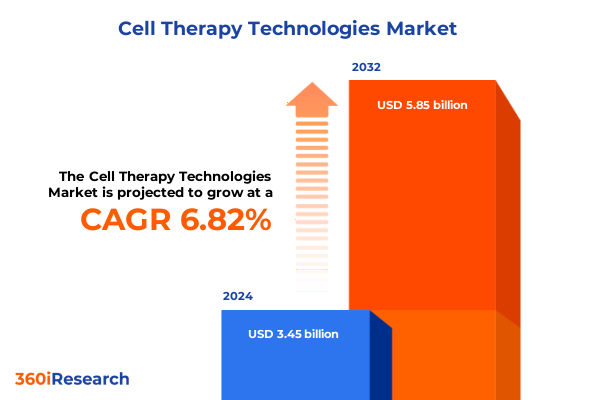

The Cell Therapy Technologies Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 3.86 billion in 2026, at a CAGR of 6.97% to reach USD 5.85 billion by 2032.

Charting the Rise of Cell Therapy Technologies in Modern Healthcare: Innovation, Challenges, and Strategic Implications for Stakeholders

Cell therapy technologies have swiftly transitioned from experimental laboratory procedures to strategic pillars within modern healthcare innovation. Advances in cellular engineering, from precise genetic modifications to scalable bioprocessing, have paved the way for novel treatments addressing a wide range of diseases that were once deemed incurable. This transformative domain encompasses cutting-edge developments in autologous and allogeneic therapies, as well as engineered platforms such as CAR-T and TCR modalities. Overarching regulatory momentum combined with significant investments by biopharmaceutical firms and academic institutions has accelerated the journey from bench to bedside.

However, commercialization hurdles persist, including manufacturing scalability, quality control consistency, and complex supply chain dynamics. Manufacturers must bridge gaps between research protocols and Good Manufacturing Practice requirements, while securing raw materials and proprietary components under evolving trade policies. Concurrently, digital integration across data management and quality assurance is critical to ensure reproducibility and compliance. As healthcare stakeholders navigate this intricate landscape, strategic foresight and cross-sector collaboration have emerged as essential drivers to unlock the full potential of cell therapy. This introductory overview sets the stage for understanding the multifaceted forces shaping this rapidly evolving sector.

The Ongoing Paradigm Shift in Cell Therapy Development Is Reshaping Scientific Research Models and Driving Collaborative Ecosystem Growth

The cell therapy arena is experiencing a paradigm shift driven by convergence of scientific breakthroughs and industry-wide collaboration. Innovations in high-throughput screening, single-cell analytics, and AI-enabled process optimization are enabling more efficient identification of therapeutic candidates and personalized treatment regimens. At the same time, partnerships between biopharmaceutical pioneers and specialized equipment providers are redefining the standards for bioreactor design and cell analyzers, embedding process analytics directly into manufacturing workflows.

Regulatory agencies are evolving frameworks to accommodate accelerated approvals and adaptive clinical trial designs, thereby reducing time-to-market without compromising safety. Simultaneously, the financial ecosystem is demonstrating increasing confidence, with venture capital and strategic investors channeling funds into software solutions that address data management and quality control. This shift is further amplified by growing patient advocacy and payer dialogues focused on long-term outcomes and cost-effectiveness. Collectively, these transformative movements are reshaping traditional R&D models into an integrated, technology-driven ecosystem that promises to elevate cell therapy from niche applications to broadly accessible healthcare solutions.

Navigating the Economic and Supply Chain Consequences of 2025 United States Tariffs on Cell Therapy Components and Innovations

In 2025, the United States implemented targeted tariffs on imported cell therapy equipment, consumables, and ancillary software tools, a move that has introduced tangible cost pressures across the value chain. Bioreactor imports faced duty increases, while specialized reagents and antibodies used in cell culture and separation processes saw elevated import levies. As a result, manufacturers are recalibrating their sourcing strategies, seeking to localize production of critical consumables and establishing domestic partnerships to mitigate tariff-induced price escalations.

These trade measures have also propelled investment in onshore manufacturing infrastructure, prompting technology licensors and contract development organizations to expand capabilities within US borders. While the transition requires upfront capital outlay, long-term benefits include decreased exposure to cross-border delays, improved supply chain transparency, and fortified quality oversight. Nonetheless, smaller biotech firms may experience short-term constraints on research budgets and slower procurement cycles. Industry leaders are responding by diversifying supplier networks, leveraging free trade agreements where possible, and negotiating long-term contracts to stabilize input costs. Navigating this tariff environment demands strategic agility, particularly for organizations operating at the intersection of innovation and manufacturing scale.

Uncovering Critical Market Segmentation Insights to Illuminate Diverse Pathways Across Offerings, Therapies, Processes, Applications, and End Users

Diving into market segmentation provides clarity on the distinct forces shaping demand and investment priorities. In the consumables, equipment, and software/services categories, consumables continue to underpin routine processes while bioreactors and cell analyzers are gaining traction through integrated automation and real-time monitoring. Data management platforms and quality control modules are emerging as essential enablers for traceability and regulatory alignment. Collectively, these layers form a comprehensive ecosystem that drives operational efficiency and compliance.

Therapy types reveal equally nuanced narratives. Allogeneic modalities-particularly dendritic cells, induced pluripotent stem cells, and natural killer cells-are attracting significant research attention for off-the-shelf solutions that can serve larger patient populations. Meanwhile, autologous approaches harness hematopoietic and mesenchymal stem cells, as well as bespoke T-cell therapies, to deliver personalized interventions, albeit with increased manufacturing complexity. Gene-modified platforms, most notably CAR-T and TCR therapies, are transforming treatment paradigms in oncology but also demand rigorous safety and validation protocols.

Manufacturing processes segment into cell culture, expansion, and separation workflows. Two-dimensional and three-dimensional culture systems are being optimized for yield and phenotype maintenance, while adherent and suspension expansion technologies are selected based on cell type and scale requirements. Advanced separation techniques such as fluorescence-activated cell sorting and magnetic-activated cell sorting enhance product purity and potency.

Delivery and application categories further diversify the landscape, contrasting ex vivo manipulations with in vivo administrations and spanning indications from cardiovascular and musculoskeletal disorders to neurodegenerative diseases and oncology. End-user segments-biopharmaceutical companies, hospitals, and research institutes-each place distinct emphasis on throughput, regulatory compliance, and translational potential. Together, these segmentation insights underscore the multifaceted nature of cell therapy development and commercialization.

This comprehensive research report categorizes the Cell Therapy Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Therapy Type

- Manufacturing Process

- Delivery Method

- Application

- End User

Contrasting Regional Dynamics: How Adoption, Regulation, Investment, and Infrastructure Are Shaping Cell Therapy Progress Across the Globe

Regional dynamics in the cell therapy domain reflect variations in policy frameworks, funding mechanisms, and clinical infrastructure. In the Americas, the United States maintains its leadership through accelerated approval pathways, robust venture capital ecosystems, and extensive network of contract development and manufacturing organizations. Latin American countries are gradually engaging through collaborative research agreements and pilot-scale facilities, although broader adoption hinges on local regulatory harmonization and investment incentives.

Europe, the Middle East, and Africa present a mosaic of regulatory environments. The European Union’s advanced therapy medicinal product regulation provides a unified framework, encouraging cross-border clinical trials and centralized approvals. Meanwhile, Gulf Cooperation Council nations are channeling sovereign wealth into biotech hubs, fostering public–private partnerships. In Africa, nascent cell therapy initiatives are emerging, driven by academic centers and global health organizations prioritizing infectious disease and oncology applications.

Asia-Pacific is characterized by distinct subregional trends. Japan’s pioneering regenerative medicine legislation and expedited conditional approvals have catalyzed domestic innovation. South Korea and China are investing heavily in large-scale manufacturing and automation technologies, supported by national biotech strategies. Southeast Asian markets are focusing on capacity building and regulatory alignment to attract foreign direct investment. Across this region, government-backed funding and strategic alliances are key enablers of cell therapy advancement.

This comprehensive research report examines key regions that drive the evolution of the Cell Therapy Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Movers to Reveal Strategic Alliances, Technological Breakthroughs, and Investment Trends in Cell Therapy

Leading industry participants are solidifying their positions through strategic collaborations, acquisitions, and in-house innovation. Global equipment manufacturers are embedding process analytical technologies within next-generation bioreactors, while specialized software vendors are integrating machine learning algorithms to predict cell culture outcomes. Biopharmaceutical incumbents are forging alliances with contract development organizations to secure end-to-end manufacturing capabilities, ensuring smoother scale-up and regulatory compliance.

Noteworthy strategic alliances include partnerships between technology providers focused on single-use manufacturing systems and academic centers developing novel cell substrates. Meanwhile, several pioneering therapy developers are vertically integrating their supply chains by acquiring upstream consumable manufacturers or investing in proprietary cell separation platforms. These moves aim to reduce reliance on external vendors and establish differentiated value propositions based on cost, speed, and quality.

Additionally, mergers and acquisitions are reshaping competitive dynamics, as deep-pocketed pharmaceutical companies absorb smaller cell therapy innovators to bolster their pipelines and expand geographic footprints. Simultaneously, venture-backed startups are securing growth capital to refine automation and analytics solutions, aligning with the broader trend toward digital biomanufacturing. This interplay of consolidation, collaboration, and focused R&D is driving an increasingly sophisticated and integrated cell therapy ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cell Therapy Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allogene Therapeutics Inc.

- Atara Biotherapeutics, Inc.

- Century Therapeutics, Inc.

- Charles River Laboratories International, Inc.

- Gamida Cell Ltd.

- GE HealthCare

- Gilead Sciences, Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Sartorius AG

- Takara Bio Inc.

- Takeda Pharmaceutical Company Limited

- Thermo Fisher Scientific Inc.

- Vericel Corporation

Strategic Action Steps for Industry Veterans to Accelerate Growth, Enhance Resilience, and Capitalize on Emerging Opportunities in the Cell Therapy Arena

To navigate the evolving cell therapy landscape, organizations should prioritize building resilient supply chains through dual sourcing of critical reagents and localized production hubs. Investing in modular, single-use manufacturing platforms can accelerate scale-up while minimizing capital expenditure and reducing cross-contamination risks. Embedding digital twins and real-time analytics into production workflows will enhance process predictability and support adaptive control strategies.

Engagement with regulatory agencies early in development cycles is essential to align on safety expectations and expedite conditional approvals. Developing comprehensive dossiers that integrate robust quality management systems and data integrity practices will facilitate smoother clinical transitions. Collaborative research agreements with academic institutions can unlock access to proprietary cell substrates and advanced separation technologies, fostering co-development of next-generation therapies.

Leaders must also cultivate skilled workforces proficient in both cell biology and digital manufacturing, leveraging cross-functional training programs. Allocating budget for iterative process validation and risk mitigation ensures therapies meet commercial standards without compromising timelines. Finally, diversifying portfolios across autologous, allogeneic, and gene-modified platforms can mitigate modality-specific uncertainties and capture broader market opportunities. By adopting these strategic action steps, industry veterans can strengthen their competitive edge and drive sustainable growth.

Employing Rigorous Research Methodologies Including Primary Intelligence, Secondary Data Analysis, and Expert Validation to Ensure Data Integrity

This research integrates a hybrid methodology combining exhaustive secondary data analysis with primary qualitative insights. Secondary sources encompass peer-reviewed journals, regulatory filings, patent landscapes, and trade publications to establish foundational market and technology trends. Primary intelligence is obtained via structured interviews with key opinion leaders, process development scientists, and senior executives across manufacturing, regulatory, and commercial functions.

A rigorous data validation protocol was employed, cross-referencing quantitative inputs with expert feedback and triangulating findings against real-world case studies. Segmentation frameworks were constructed to reflect offering tiers, therapy types, manufacturing processes, delivery methods, applications, and end users. Regional analyses leverage government databases and clinical trial registries to capture geographic nuances in regulatory and funding environments.

Quality control measures include iterative review cycles with internal subject-matter experts and adherence to ethical guidelines for data collection. Analytical models are designed to ensure reproducibility and transparency, with clear documentation of assumptions and data sources. This methodological rigor underpins the credibility of insights and supports strategic decision-making for stakeholders in the dynamic cell therapy ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cell Therapy Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cell Therapy Technologies Market, by Offering

- Cell Therapy Technologies Market, by Therapy Type

- Cell Therapy Technologies Market, by Manufacturing Process

- Cell Therapy Technologies Market, by Delivery Method

- Cell Therapy Technologies Market, by Application

- Cell Therapy Technologies Market, by End User

- Cell Therapy Technologies Market, by Region

- Cell Therapy Technologies Market, by Group

- Cell Therapy Technologies Market, by Country

- United States Cell Therapy Technologies Market

- China Cell Therapy Technologies Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings to Present a Cohesive Outlook on the Future Trajectory and Impact of Cell Therapy Technologies Worldwide

The cell therapy sector stands at a critical inflection point, propelled by technological innovations and challenged by evolving trade policies. Breakthroughs in cell engineering, process analytics, and digital integration promise to enhance therapeutic efficacy and operational scalability. Yet, the introduction of 2025 tariffs underscores the importance of supply chain resilience and strategic localization.

Segmentation analyses reveal diverse growth pathways across offerings, therapy types, manufacturing modalities, and applications, highlighting the need for tailored approaches to portfolio management. Regional explorations demonstrate that while North America and Asia-Pacific lead in investment and regulatory agility, Europe, the Middle East, and Africa are rapidly positioning themselves through harmonized frameworks and funding initiatives.

Key players are responding with alliances, vertical integration, and targeted acquisitions to fortify their market positions. Looking ahead, industry leaders who adopt recommended strategies-such as diversified sourcing, digital manufacturing adoption, and proactive regulatory engagement-will be best equipped to navigate uncertainties and capture transformative opportunities. This synthesis of findings provides a cohesive roadmap for stakeholders pursuing sustainable advancements in cell therapy.

Propel Your Strategic Decisions with Expert Guidance from Ketan Rohom to Secure the Comprehensive Cell Therapy Market Research Report Today

To explore this cell therapy market research report in depth and leverage its insights for your strategic planning, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise and guidance can help you interpret the data, customize solutions to your organization’s unique needs, and secure a license to the full report. Partnering with him ensures you gain the competitive intelligence required to navigate emerging trends, address tariff impacts, and capitalize on new growth avenues within the cell therapy sphere. Contact Ketan Rohom today to embark on an informed decision-making journey and accelerate your market success.

- How big is the Cell Therapy Technologies Market?

- What is the Cell Therapy Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?