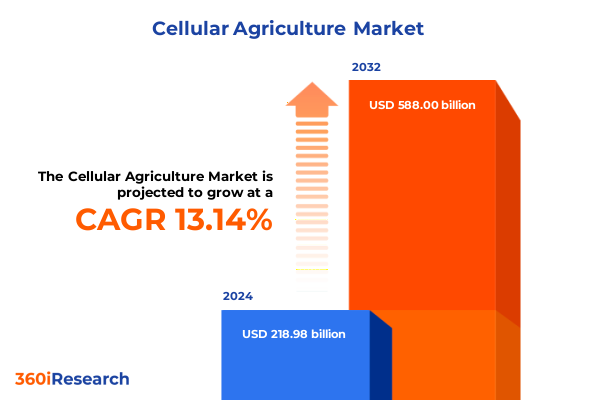

The Cellular Agriculture Market size was estimated at USD 248.38 billion in 2025 and expected to reach USD 277.12 billion in 2026, at a CAGR of 13.10% to reach USD 588.00 billion by 2032.

Discover How Cellular Agriculture Is Reshaping Food Production With Sustainable Biotech Innovation Poised to Transform Global Nutrition

Cellular agriculture represents a paradigm shift in the way society produces and consumes animal-derived products by engineering cells to grow meat, dairy, eggs, and seafood without the need for whole animals. This field combines advances in biotechnology, tissue engineering, and food science to deliver products that mirror the taste, texture, and nutritional profile of conventional animal proteins while dramatically reducing the environmental footprint associated with traditional livestock farming.

In recent years, cellular agriculture has garnered attention for its potential to address pressing global challenges, including climate change, land use constraints, animal welfare concerns, and food security. Fueled by breakthroughs in bioreactor design, scaffold engineering, and serum-free culture media, innovators have scaled cell cultivation protocols from academic labs to pilot facilities, demonstrating increasing efficiencies and product quality that rival conventional counterparts.

As attention shifts to commercialization, stakeholders across industries are forging strategic collaborations and alliances to streamline the transition from proof-of-concept to market-ready products. Regulatory bodies have begun issuing favorable guidance, laying the groundwork for pre-market safety assessments and labeling frameworks that will shape the consumer experience. With growing investor confidence, cellular agriculture is poised to move beyond niche applications to mainstream retail and food service channels, marking the start of an era where biology-driven manufacturing reshapes the global food supply.

Explore the Technological Breakthroughs and Consumer Trends Driving Cellular Agriculture Toward Mainstream Adoption and Industry Evolution

Over the last two years, cellular agriculture has experienced a wave of transformative shifts that have accelerated its evolution from a speculative concept to an industry on the cusp of commercialization. Technological advancements in scaffold engineering and microcarrier-based bioreactor culture have significantly improved cell proliferation rates and tissue maturation processes. These breakthroughs have been complemented by innovations in serum-free and animal-free culture media formulations, reducing dependence on fetal bovine serum and enhancing cost efficiencies.

Concurrent with these scientific developments, consumer attitudes toward alternative proteins have shifted markedly. Surveys indicate increasing willingness among ethically minded and environmentally conscious consumers to trial cultivated meat and dairy products. This has energized foodservice partnerships and pilot menu launches that provide valuable market feedback and build brand visibility. In parallel, regulatory agencies in leading markets have introduced draft frameworks for novel food approval, providing clear pathways for safety assessment and transparent labeling.

Financing trends also signal a maturing landscape. While overall venture funding dipped as macroeconomic conditions tightened, strategic investments by established food conglomerates and impact-focused funds have sustained critical R&D momentum. Public–private partnerships and innovation sandboxes have emerged to support cross-sector collaboration, ensuring that cellular agriculture continues to benefit from diverse expertise and aligns with evolving public policy objectives.

Evaluating the Combined Effects of New U.S. Tariff Policies in 2025 on Cellular Agriculture Supply Chains and Innovation Ecosystems

In early 2025, the United States government enacted new tariffs under Section 232, raising steel and aluminum import duties from 25% to 50% ad valorem to bolster domestic metal production and national security objectives. Given that stainless steel is a foundational component in the manufacture of bioreactors and downstream processing equipment, this tariff increase directly escalates the capital expenditure required for scaling cellular agriculture production lines by driving up raw material costs.

Simultaneously, proposed tariffs on imports of key reagents, growth factors, and laboratory consumables from the European Union, China, and Canada have introduced further uncertainty into the biotech supply chain. A survey by the Biotechnology Innovation Organization found that 94% of biotech firms anticipate surging manufacturing costs if EU imports face additional duties, and 80% of companies report needing at least 12 months to identify and qualify alternative suppliers.

The combined effect of elevated metal tariffs and potential levies on critical inputs risks stalling the pace of innovation in cellular agriculture. Firms report that increased costs could force them to delay regulatory submissions and reallocate funding toward onshoring or inventory build-ups, rather than channeling resources into new product development. In response, some companies are exploring pre-emptive shifts of R&D and trial operations to jurisdictions unaffected by the new duties, potentially diverting skilled talent and research activities away from the U.S. market.

Uncovering Invaluable Segmentation Insights Across Product Categories Technologies Cell Types Media Applications and Distribution Channels

The cellular agriculture market can be viewed through multiple lenses that reveal distinct avenues for innovation and differentiation. When products are organized by end use, cultivated offerings encompass dairy alternatives such as cheese, milk, and yogurt alongside egg substitutes that replicate the binding and emulsification properties of chicken, duck, and quail eggs. The meat segment extends from structured whole cuts of beef, lamb, pork, and poultry to fish and shellfish constructs in the seafood category. Each product tier demands unique bioprocessing techniques, from orchestrating adipocyte and myoblast co-cultures for marbling to engineering lipid-enriched scaffolds that emulate fish fillet textures.

On the technology front, platforms range from extrusion-based and inkjet bioprinting systems to scaffold designs using decellularized matrices, hydrogels, and fiber networks. Cell cultivation methods leverage adherent, microcarrier, suspension, and perfusion bioreactor cultures, while tissue engineering approaches harness organ-on-a-chip models and three-dimensional constructs for advanced research and testing. Cell types span adipocytes and myoblasts to satellite cells and a spectrum of stem cell sources, including adult, embryonic, and induced pluripotent stem cells, each with distinct differentiation and scalability profiles.

Media formulations now offer serum-based and fully defined serum-free options, with animal-free, plant-based, and xeno-free alternatives that minimize animal-derived components. Applications extend beyond food service and retail to cosmetics, nutraceuticals, and pharmaceutical sectors, underscoring the versatility of cellular platforms. Distribution models blend B2B partnerships with direct-to-consumer and online channels, reflecting the industry’s pursuit of both institutional adoption and direct market engagement.

This comprehensive research report categorizes the Cellular Agriculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Cell Type

- Culture Media

- Application

Gaining Strategic Regional Perspectives From the Americas Through EMEA to Asia-Pacific Highlighting Regional Adoption and Growth Opportunities

When examining regional dynamics, the Americas region remains a hotbed for both innovation and investment in cellular agriculture. Leading U.S. and Canadian research institutions collaborate closely with startups to advance bioprocess engineering, while partnerships with foodservice leaders enable high-visibility pilot launches that bolster consumer awareness. North American policymakers engage with industry consortia to establish regulatory blueprints, further cementing the region’s role as a pioneer in novel protein approvals.

Across Europe, the Middle East, and Africa, robust public funding programs and innovation clusters have propelled cellular agriculture research. The Netherlands, Germany, and the United Kingdom host open-access pilot facilities and regulatory sandboxes, while nascent initiatives in the Middle East, including government-backed hubs and strategic partnerships, signal growing interest in food security and sustainable protein strategies. Collaborative frameworks across EMEA foster knowledge exchange, driving harmonization of safety standards and market entry pathways.

In the Asia-Pacific, a convergence of ambitious national food self-sufficiency goals and rapid urbanization has spurred commercial partnerships between local conglomerates and cellular agriculture pioneers. Singapore’s early regulatory approval for cultivated chicken and seafood has catalyzed licensing frameworks, and in Japan, South Korea, and Australia, coordinated government grants and private investments are establishing regional supply chains. Asia-Pacific market momentum reflects an integrated approach to research, commercialization, and consumer education.

This comprehensive research report examines key regions that drive the evolution of the Cellular Agriculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cellular Agriculture Innovators and Strategic Partnerships Fueling the Next Wave of Cultivated Meat Dairy and Seafood Solutions

In the vanguard of cellular agriculture innovation, UPSIDE Foods has solidified its leadership position through record-breaking funding and strategic scaling decisions. The company’s $400 million Series C round, led by Temasek and the Abu Dhabi Growth Fund, underpinned plans to build a commercial-scale facility capable of producing multiple species of cultivated meat at scale. Meanwhile, UPSIDE opted to pause its planned large-scale plant in Glenview, Illinois, focusing instead on expanding its existing Emeryville, California innovation center to optimize cost efficiencies and maintain agility amid funding fluctuations.

European pioneer Mosa Meat has demonstrated strength in regulatory navigation and strategic partnerships. Following its cultivated beef dossier submission to the EU, Mosa Meat filed for novel food authorization in Switzerland, positioning itself to introduce cultivated fat ingredients that enhance hybrid products. Concurrently, the company launched an open-access scale-up facility in Maastricht, supported by the Dutch National Growth Fund, to enable cross-industry access to pilot-scale infrastructure and accelerate the path to commercialization.

Cell-based seafood specialist BlueNalu has leveraged a series B financing round and a network of global alliances to advance its commercial roadmap. The company’s $35.5 million raise, anchored by a $20 million investment from NEOM’s investment fund, underscores a commitment to establishing production in the Middle East. Strategic collaborations with Mitsubishi, Thai Union, and Pulmuone have further embedded BlueNalu within Asia-Pacific supply chains, ensuring that its cell-cultured seafood products can navigate local regulatory and market landscapes.

Israeli trailblazer Aleph Farms has navigated both opportunities and headwinds. A $29 million funding injection via SAFE and existing investors enabled expansion of its pilot facility in Rehovot and deployment of an optimized ‘1.2’ production platform. However, the company also faced an emergency fundraising to sustain operations amid broader downturns, highlighting the sector’s evolving financial landscape and the need for adaptive capital strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellular Agriculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aleph Farms Ltd.

- AquaCultured Foods, Inc.

- Atlantic Fish Co.

- Avant Meats Company Limited

- BioBQ, Inc.

- Change Foods

- Clever Carnivore

- Cultivated Biosciences SA

- Extracellular

- Finless Foods, Inc.

- Integriculture Inc.

- LabFarm Sp. z o.o.

- Magic Valley

- Meatable B.V.

- Mogale Meat Company

- Mosa Meat B.V.

- Opalia Co.

- Peace of Meat

- Real Deal Milk

- Roslin Technologies Limited

- Shiok Meats Pte Ltd.

- Unicorn Biotechnologies

Providing Actionable Strategic Recommendations to Industry Leaders for Navigating Regulatory Hurdles Scaling Production and Building Consumer Trust

Industry leaders in cellular agriculture are advised to proactively engage with regulatory authorities to co-create clear safety and labeling frameworks that support rapid yet responsible market entry. Cultivating open lines of communication with agencies will help align technical specifications with public expectations and mitigate approval delays.

To drive production scale-up, companies should invest in modular bioreactor and media platforms that offer flexibility across product lines and cell types. Standardizing key bioprocess parameters and leveraging shared pilot facilities can spread capital expenditures and accelerate process optimization. Developing partnerships for localized media supply chains will reduce reliance on imported components and insulate operations from tariff-induced cost fluctuations.

Building consumer trust requires transparent messaging around product origin, safety testing, and sustainability benefits. Engaging culinary influencers and foodservice operators in guided tasting events will demystify cultivated products and foster acceptance. Simultaneously, targeted B2B outreach can accelerate institutional adoption in foodservice and ingredient applications, creating early revenue streams that support broader retail launches.

Finally, industry leaders should pursue collaborative research consortia to drive pre-competitive innovation in scaffolding, cell line development, and cost-effective media formulations. By sharing non-proprietary insights, stakeholders can accelerate technology maturation, reduce duplication of effort, and expand the overall market potential for cellular agriculture.

Detailed Overview of Research Methodology Including Data Collection Primary Interviews Secondary Analysis and Validation Protocols Ensuring Report Rigor

This report integrates a rigorous research methodology that blends primary and secondary sources to ensure comprehensive coverage of cellular agriculture trends. Primary research comprised structured interviews with executive-level stakeholders across leading cultivated meat and seafood companies, technology providers, regulatory experts, and strategic investors. Expert dialogues provided qualitative insights into operational challenges, innovation roadmaps, and commercialization timelines.

Secondary research involved systematic analysis of industry publications, peer-reviewed journals, patent filings, government tariff announcements, and press releases. Information from public financial disclosures, regulatory filings, and technical white papers was triangulated with proprietary data to validate trends and identify emerging themes. Key segmentation frameworks and regional analyses were mapped against macro-economic indicators and trade policy shifts to contextualize growth drivers and risk factors.

Data synthesis employed a triangulation approach, cross-referencing quantitative findings from investment databases and media coverage with qualitative inputs from expert interviews. All projections and thematic classifications were peer-reviewed by a panel of scientific advisory board members and industry practitioners to ensure accuracy and relevance. This layered methodology underpins the report’s strategic recommendations and provides stakeholders with a robust, evidence-based foundation for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellular Agriculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellular Agriculture Market, by Product

- Cellular Agriculture Market, by Technology

- Cellular Agriculture Market, by Cell Type

- Cellular Agriculture Market, by Culture Media

- Cellular Agriculture Market, by Application

- Cellular Agriculture Market, by Region

- Cellular Agriculture Market, by Group

- Cellular Agriculture Market, by Country

- United States Cellular Agriculture Market

- China Cellular Agriculture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Insights on the Challenges Opportunities and Future Trajectory of Cellular Agriculture as It Moves Closer to Commercial Viability

Cellular agriculture stands at a critical juncture where scientific advancements and regulatory progress converge with evolving consumer preferences to shape a new era in protein production. The collective momentum from breakthrough bioprocess technologies, escalating strategic investments, and nascent regulatory frameworks underscores the sector’s transition from concept to commercialization.

Challenges remain in scaling production economically, managing geopolitical trade headwinds, and fostering widespread consumer acceptance. The imposition of higher tariffs on both bioreactor materials and key reagents has underscored the importance of resilient supply chains and versatile manufacturing strategies. Concurrently, funding volatility highlights the need for adaptive capital deployment and sector-wide collaboration to sustain innovation trajectories.

Nonetheless, the diversity of segmentation pathways-from dairy and eggs to meat and seafood-combined with expanding technology portfolios and emerging regional clusters signal significant growth potential. Strategic alignment among industry players, regulators, investors, and consumer-facing partners will be pivotal in negotiating the final hurdles toward profitability and market penetration.

With informed planning, targeted investments, and concerted efforts to educate end users, cellular agriculture can fulfill its promise of delivering sustainable, high-quality protein solutions that align with global objectives for environmental stewardship, food security, and ethical responsibility.

Take the Next Step and Connect With Ketan Rohom to Secure Your Comprehensive Cellular Agriculture Market Research Report Today

To explore the comprehensive findings and gain a strategic advantage in the burgeoning field of cellular agriculture, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan and his team will guide you in selecting the tailored report package that meets your specific market, technology, and application priorities. Engage with Ketan to discuss bespoke data needs, priority segmentation analyses, or custom benchmarking inquiries. Embark on a data-driven journey that equips your organization with actionable insights, expert recommendations, and a clear roadmap for success in the rapidly evolving cellular agriculture ecosystem. Connect with Ketan Rohom today to secure your definitive market research report and drive your strategic initiatives forward without delay

- How big is the Cellular Agriculture Market?

- What is the Cellular Agriculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?