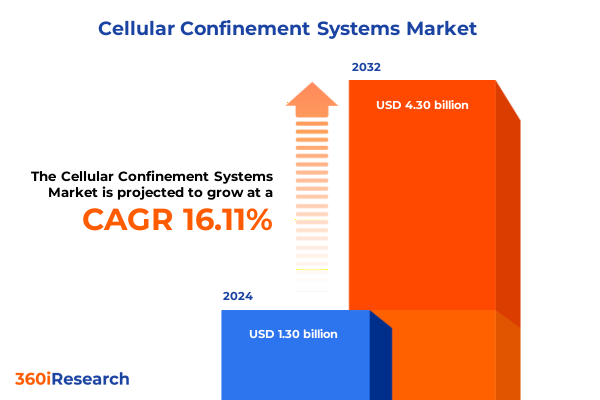

The Cellular Confinement Systems Market size was estimated at USD 1.49 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 16.35% to reach USD 4.30 billion by 2032.

Exploring the Evolution of Honeycomb Geotechnical Solutions and Their Expanding Role in Sustainable Infrastructure Design

Cellular confinement systems (CCS), renowned for their three-dimensional honeycomb-like structure, have emerged as a cornerstone in modern geotechnical engineering. Over the past decade, demand for these solutions has transcended traditional highway stabilization projects, branching into coastal resilience initiatives and innovative landscape restoration schemes. End users now recognize the inherent durability and adaptability of CCS in reinforcing load-bearing structures while simultaneously integrating environmentally responsible design practices.

This executive summary unravels the pivotal developments shaping the CCS sector, highlighting the convergence of material innovations, regulatory paradigms, and stakeholder collaborations. By examining how advanced polymers and fabrication techniques interplay with sustainability mandates, this introduction sets the stage for a comprehensive analysis of market dynamics. As the industry pivots toward holistic infrastructure solutions, understanding the multifaceted role of CCS becomes imperative for decision-makers seeking both performance and compliance.

Examining the Fusion of Material Innovation and Digital Fabrication Transforming Geotechnical Honeycomb Systems

The cellular confinement systems market is undergoing transformative shifts driven by escalating environmental imperatives and ever more stringent performance standards. A pronounced emphasis on lifecycle assessments has galvanized investment in bio-enhanced polymers, enabling stakeholders to reconcile structural reliability with carbon footprint reductions. Consequently, manufacturers are pivoting toward next-generation HDPE formulations that incorporate recycled content without compromising mechanical integrity.

In parallel, digital fabrication techniques have revolutionized installation methodologies. Prefabricated panels featuring integrated monitoring sensors now deliver real-time performance data, empowering engineers to preempt maintenance needs and optimize resource allocation. This digitalization trend complements long-standing in situ fabrication practices, creating a dual approach that balances customization with operational efficiency. As market participants embrace data-driven asset management, the competitive landscape is reshaped by those able to harness both material science breakthroughs and innovative installation paradigms.

Understanding How the 2025 Polymer Import Tariff Revisions Have Catalyzed Domestic Capacity Expansion and Strategic Alliances

The introduction of revised U.S. tariffs on polymer imports in early 2025 has reverberated across the cellular confinement systems supply chain. Heightened duties on specific polyethylene grades have fueled domestic capacity expansions as manufacturers seek to mitigate cost pressures and ensure supply continuity. At the same time, some international suppliers have responded by renegotiating long-term contracts and localizing production footprints in key U.S. ports to circumvent tariff escalations.

Moreover, the tariff environment has accelerated collaborative ventures between polymer producers and CCS fabricators. By co-investing in polymer compounding facilities stateside, these alliances aim to stabilize input costs and maintain margin integrity. While short-term project budgets encountered upward pressure, end users are adapting through value engineering strategies that prioritize high-performance systems capable of extending maintenance intervals. This tariff-induced realignment underscores the market’s resilience, as stakeholders optimize procurement models and reinforce domestic manufacturing corridors.

Analyzing the Interplay of Material Formulations, Installation Methods, and Sectoral Applications Driving Solution Adoption

Diverse material types have carved distinct niches within the cellular confinement systems arena, with high density polyethylene excelling in heavy load support applications while polypropylene finds favor in environments demanding greater chemical resistance, and polyvinyl chloride addressing scenarios where UV and fire retardancy are critical. Installation practices further differentiate market offerings: prefabricated panels deliver rapid deployment in time-sensitive civil construction projects, whereas in situ fabrication retains appeal for tailored landscape restoration schemes requiring granular contour adaptation.

Applications range from coastal protection defenses, where honeycomb cells dissipate wave energy, to retaining structures that capitalize on the system’s tensile reinforcement. Roadway stabilization projects benefit from CCS’s ability to distribute vehicular loads, and slope erosion protection harnesses cellular confinement for soil retention on steep embankments. Meanwhile, end-use industries such as agriculture leverage lighter polymer matrices for soil moisture regulation, while municipal infrastructure and transportation authorities prioritize robust systems that reduce life-cycle maintenance expenses.

This comprehensive research report categorizes the Cellular Confinement Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Installation Type

- Application

- End Use Industry

Unraveling Regional Market Drivers from Coastal Renewal Funding in the Americas to Circular Economy Imperatives in EMEA and Urban Megaprojects in APAC

Regional dynamics shape the deployment of cellular confinement systems, beginning with the Americas, where infrastructure renewal mandates and coastal resilience funding have driven widespread adoption of high-performance HDPE solutions along vulnerable shorelines. Moving across the Atlantic, Europe, Middle East & Africa regions exhibit a strong focus on circular economy frameworks, prompting membrane-integrated systems utilizing recycled polymers to dominate projects spanning from urban flood defenses to desert road reinforcement schemes.

In the Asia-Pacific arena, rapid urbanization and large-scale transportation initiatives underpin robust demand for prefabricated CCS panels, especially in high-growth corridors linking megacities. Stakeholders in this region also demonstrate an affinity for hybrid systems combining polymeric cells with bioengineered geotextiles, reflecting a broader commitment to integrated, resilient design practices. These regional snapshots highlight how divergent regulatory landscapes and investment priorities inform solution customization across global markets.

This comprehensive research report examines key regions that drive the evolution of the Cellular Confinement Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Strategic Alliances, Proprietary Manufacturing Advances, and Consolidation Trends Shaping Industry Leadership

Key players in the cellular confinement systems industry are increasingly differentiating through strategic partnerships and innovation pipelines. Leading polymer suppliers have established joint ventures with engineering firms to co-develop custom composite cells optimized for extreme load conditions. Meanwhile, specialist fabricators are securing long-term framework agreements with transportation authorities, embedding maintenance and performance guarantees into project contracts.

Competitive positioning also hinges on proprietary technological enhancements, such as advanced seam-welding machinery that enables uninterrupted honeycomb continuity over extended spans. Companies investing in localized compounding facilities stand to capture market share by reducing lead times and customizing mechanical profiles to regional soil conditions. Furthermore, acquisitions of niche geosynthetics producers have become prevalent, as industry leaders seek to broaden their solution portfolios with geotextile liners and reinforcement meshes. This strategic consolidation trend underscores an imperative to offer end-to-end infrastructure reinforcement capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellular Confinement Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABG Geosynthetics Ltd

- ACE Geosynthetics Enterprise Co., Ltd

- Armtec LP

- BOSTD Geosynthetics Qingdao Ltd

- Carthage Mills, Inc.

- Feicheng Lianyi Engineering Plastics Co., Ltd

- Genuit Group PLC

- GEO Cell Systems Inc.

- GEO Products, LLC

- Greenfix Soil Stabilisation & Erosion Control Ltd

- HUESKER Synthetic GmbH

- Huifeng Geosynthetics

- Maccaferri S.p.A.

- Polyfabrics Australasia Pty Ltd

- Presto Products Company

- PRS Geo-Technologies Ltd

- Strata Systems, Inc.

- Taian Modern Plastic Co., Ltd

- TechFab India Industries Ltd

- TenCate Geosynthetics

- Tensar International Corporation

- Terram Geosynthetics Pvt Ltd

- TMP Geosynthetics

- Wrekin Products Ltd

- Yixing Shenzhou Earthwork Material Co., Ltd

Formulating Integrated Supply Chain Investments and Service-Oriented Business Models to Elevate Long-Term Competitiveness

Industry leaders should prioritize integrated partnership models that bridge polymer chemistry expertise with geotechnical engineering insights. By co-investing in pilot compounding plants located near major port clusters, firms can de-risk supply chains and tailor material properties to local soil profiles. Additionally, adopting digital monitoring platforms as a service enhances customer value propositions by enabling predictive maintenance and performance benchmarking.

Leaders should also explore strategic acquisitions of geotextile and membrane specialists to craft comprehensive reinforcement systems that appeal to large infrastructure clients. Moreover, embedding circular economy principles through recycled polymer content not only addresses regulatory mandates but also positions suppliers as sustainability champions. Ultimately, a dual focus on material innovation and service-based contracts will help differentiate offerings in a maturing market and drive long-term revenue resilience.

Detailing a Robust Combination of Executive Interviews, Regulatory Analysis, and Strategic Frameworks Ensuring Data Rigor

The research underpinning this analysis integrates primary and secondary methodologies to ensure rigor and relevance. Primary data was gathered through in-depth interviews with senior executives in polymer manufacturing, geotechnical engineering consultancies, and infrastructure development agencies. These dialogues illuminated emerging material preferences, installation efficiencies, and procurement strategies.

Secondary research encompassed review of regulatory filings, environmental impact assessments, and industry association publications to validate evolving tariff policies and sustainability mandates. Analytical frameworks applied include a strengths-weaknesses-opportunities-threats assessment combined with Porter’s five forces to appraise competitive intensity and supplier bargaining power. Market triangulation techniques were employed to cross-verify qualitative insights, ensuring the conclusions reflect a comprehensive view of the cellular confinement systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellular Confinement Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellular Confinement Systems Market, by Material Type

- Cellular Confinement Systems Market, by Installation Type

- Cellular Confinement Systems Market, by Application

- Cellular Confinement Systems Market, by End Use Industry

- Cellular Confinement Systems Market, by Region

- Cellular Confinement Systems Market, by Group

- Cellular Confinement Systems Market, by Country

- United States Cellular Confinement Systems Market

- China Cellular Confinement Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing the Strategic Nexus of Innovation, Sustainability, and Collaborative Models Defining the Next Growth Era in Infrastructure Reinforcement

The cellular confinement systems market stands at an inflection point, propelled by the confluence of heightened infrastructure resilience needs, sustainability regulations, and digital innovation. Stakeholders that anticipate material science breakthroughs and adapt installation methodologies accordingly will capture the most compelling growth opportunities. As tariff landscapes continue to reshape procurement strategies, domestic manufacturing investments and strategic alliances will prove essential for supply stability.

In conclusion, understanding the nuanced interplay of segmentation dimensions, regional market drivers, and competitive tactics offers a strategic blueprint for industry participants. By leveraging deep technical expertise, embracing circular economy imperatives, and integrating service-oriented solutions, organizations can solidify their position in a rapidly evolving geotechnical sector.

Unlock Comprehensive Market Insights by Connecting with the Associate Director of Sales and Marketing to Obtain the Full Research Report

To gain an in-depth understanding of detailed market dynamics and strategic opportunities in the cellular confinement systems landscape, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the report’s comprehensive insights and help tailor solutions to your organization’s unique priorities. Secure your copy of the full market research analysis today and position your enterprise for sustainable growth in an evolving infrastructure environment. Your next strategic advantage awaits.

- How big is the Cellular Confinement Systems Market?

- What is the Cellular Confinement Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?