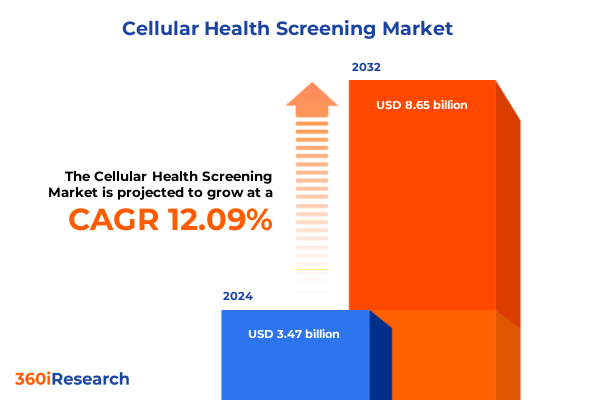

The Cellular Health Screening Market size was estimated at USD 3.83 billion in 2025 and expected to reach USD 4.23 billion in 2026, at a CAGR of 12.33% to reach USD 8.65 billion by 2032.

Understanding the Evolving Dynamics of Cellular Health Screening as Precision Medicine and Single-Cell Technologies Revolutionize Healthcare Delivery

A profound shift is underway in healthcare as cellular health screening emerges at the forefront of precision medicine and molecular diagnostics. Traditional assays that once relied on bulk measurements of cell populations are now giving way to advanced techniques capable of interrogating individual cells. This evolution is driven by the convergence of high-throughput flow cytometry, next-generation sequencing platforms, and digital PCR systems that offer unprecedented sensitivity and specificity. The integration of artificial intelligence into data analysis pipelines has further expedited the interpretation of complex single-cell datasets, enabling researchers and clinicians to uncover subtle cellular heterogeneity with remarkable speed and accuracy.

As payers and providers alike focus on improving patient outcomes while reducing costs, the demand for comprehensive cellular profiling solutions has surged. Screening technologies that assess cell viability, gene expression, and immunophenotyping are now integral to drug development programs, immunotherapy monitoring, and early disease detection initiatives. With regulatory frameworks such as the U.S. FDA’s guidance on companion diagnostics evolving to accommodate innovative single-cell and multiomics assays, stakeholders across academia, pharmaceutical companies, and clinical laboratories are recalibrating their strategies. This introduction sets the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, regional trends, and actionable recommendations designed to guide decision-makers in this critical domain.

Breakthrough Advances in Single-Cell and Multiomics Technologies Are Shaping the Future of Cellular Health Screening Diagnostics Worldwide

Recent breakthroughs in dynamic single-cell readout systems are redefining how cellular responses are measured over time. Traditional static assays have been complemented by platforms enabling compartmentalized live-cell analysis, offering functional insights into cell–cell interactions and immune signaling pathways before genetic profiling. At the same time, the fusion of spatial transcriptomics and proteomics is providing a holistic view of tissue architecture at a resolution that was once the realm of theory. These multiomics approaches are accelerating discoveries in oncology, immunology, and neuroscience, empowering researchers to link molecular signatures to phenotypic behaviors within complex microenvironments.

Parallel to these analytical advances, the proliferation of compact, benchtop sequencing and cytometry instruments is democratizing access to cellular health screening. Innovations such as automated library preparation workstations, AI-driven image analysis modules, and integrated cloud-based bioinformatics tools are streamlining workflows from sample collection to result interpretation. These technological leaps are fostering a new era of decentralized testing, where even smaller clinics and specialized research centers can deploy high-resolution cellular assays with minimal infrastructure investments. As a result, the landscape is shifting from centralized core facilities toward networked, point-of-care screening models that promise faster turnaround times and broader patient reach.

Assessing the Multifaceted Consequences of 2025 U.S. Tariff Policies on the Global Supply Chain for Cellular Health Screening Tools

In 2025, sweeping changes in U.S. trade policy have introduced tariffs ranging from 20 percent on European imports to over 30 percent on certain Chinese-made life science tools, directly affecting manufacturers and end users in the cellular health screening space. Firms that relied heavily on overseas production have faced increased cost of goods sold, prompting industry leaders to reevaluate supply chain dependencies. Several companies have mitigated these impacts through targeted price surcharges on instruments and consumables, while simultaneously exploring alternative manufacturing hubs in lower-cost markets.

A reprieve appeared in mid-May 2025 when a temporary U.S.-China agreement slashed retaliatory tariffs from 145 percent to 30 percent, offering a measure of relief for those supplying high-value sequencing machines and cytometers. Nevertheless, the specter of emergency duties-invoked under the International Emergency Economic Powers Act and imposing an additional 20 percent ad valorem duty on goods from China and Hong Kong-continues to loom over the sector. As a result, companies are intensifying efforts to diversify sourcing, localize component production, and negotiate bonded logistics arrangements. These strategic responses underscore the industry’s resilience but also highlight the persistent uncertainty and cost volatility introduced by evolving tariff regimes.

Deciphering Product Technology Application End User and Distribution Channel Segments to Unlock Strategic Opportunities in Cellular Health Screening

A nuanced understanding of product type segmentation reveals that while instruments such as flow cytometers, PCR machines, and sequencing platforms command attention for their capital-intensive deployment, the recurring revenue from kits and reagents-spanning assay kits, cell staining reagents, and culture media-forms the backbone of ongoing operations. Meanwhile, service offerings including contract research and custom assay development are becoming pivotal as organizations seek to outsource specialized workflows and accelerate time to insight. Within this framework, the rise of digital PCR assays and their absolute quantification capabilities is illustrating how sub-segments can redefine both cost structures and clinical impact.

On the technology front, core modalities such as flow cytometry, microarray analysis, next-generation sequencing, and polymerase chain reaction coexist in a complementary ecosystem. Flow cytometry’s cell sorting and immunophenotyping applications remain indispensable for immune profiling, whereas gene expression and SNP genotyping microarrays maintain their foothold in large-scale population studies. The expanding array of next-generation sequencing options-from targeted panels to whole genome platforms-continues to lower per-sample costs, and advanced digital PCR approaches are setting new benchmarks in sensitivity and reproducibility.

Application-based insights show that disease diagnostics, personalized medicine, and research each present distinct dynamics. Cancer screening, immunological profiling, and infectious disease testing drive diagnostic volume, while nutrigenomics and pharmacogenomics in precision medicine underscore the shift toward individualized treatment strategies. In parallel, research domains such as drug development and stem cell biology are increasingly reliant on high-throughput cellular health screening to validate targets and monitor cellular behavior under experimental conditions.

End users spanning academic institutes, diagnostic laboratories, home care services, and hospitals & clinics are shaping demand profiles. Academic and research institutes leverage cutting-edge instruments for exploratory studies, whereas hospital labs and independent diagnostic centers focus on validated assays for clinical decision support. The burgeoning home care segment, including both home monitoring services and testing kits, is poised to reshape patient engagement models, offering decentralized access to cellular health metrics. Finally, distribution channel evolution highlights the coexistence of offline direct-sales models with burgeoning online platforms, where company websites and third-party marketplaces facilitate broader geographic reach and flexible purchasing options.

This comprehensive research report categorizes the Cellular Health Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Regional Market Drivers and Challenges Unveiled Comparing Americas Europe Middle East Africa and Asia Pacific Dynamics in Cellular Health Screening

In the Americas, advanced healthcare infrastructure, substantial R&D funding, and a robust regulatory environment have cemented the region’s leadership in adopting and validating novel cellular health screening assays. The United States, in particular, continues to spearhead innovation through extensive collaborations between academic medical centers, biotech startups, and established life science corporations, driving early clinical adoption of single-cell methodologies. Meanwhile, Canada and Latin America are witnessing increased government incentives and public–private partnerships aimed at expanding access to molecular diagnostics in underserved communities.

Europe, the Middle East, and Africa (EMEA) present a diverse tapestry of market conditions influenced by regulatory harmonization efforts and local healthcare policies. The European Union’s implementation of the IVDR has bolstered the quality and safety of in vitro diagnostics, but transitional bottlenecks and notified body capacity constraints have posed challenges for smaller manufacturers. Reform initiatives led by professional societies are advocating for streamlined approval pathways to maintain momentum in oncology and personalized medicine research across member states. In the Middle East, strategic investments in biotechnology hubs and regional center-of-excellence programs are driving capacity building, while Africa’s market is characterized by a growing emphasis on point-of-care solutions to address infectious disease burdens.

Asia-Pacific is emerging as the fastest-growing regional market, propelled by expanding healthcare infrastructure, rising disposable incomes, and proactive government funding for biotech innovation. Countries such as China, Japan, and India are channeling resources into genomics research, personalized medicine pilots, and domestic manufacturing of life science tools. The region’s growth trajectory is further supported by a surge in local clinical trials and a burgeoning contract research organization (CRO) ecosystem, underscoring Asia-Pacific’s increasing influence in global oncology and infectious disease screening initiatives.

This comprehensive research report examines key regions that drive the evolution of the Cellular Health Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Initiatives Driving Innovation in Cellular Health Screening Technologies and Solutions

Leading organizations are intensifying innovation through both organic R&D and strategic collaborations. Thermo Fisher Scientific recently announced the launch of its Ion Proton system optimized for single-cell RNA sequencing, merging high throughput with integrated data analysis to accelerate translational research programs. Illumina, amid tariff-related pressures and a temporary China ban on sequencer exports, has responded by bolstering cost-reduction initiatives and focusing on markets outside of China to maintain revenue growth.

BD Biosciences continues to cement its leadership in flow cytometry, unveiling next-generation cytometers with AI-augmented imaging and automation features designed to streamline immunophenotyping workflows. 10x Genomics and Fluidigm Corporation remain at the forefront of microfluidics and high-throughput single-cell genomics, expanding multiomics capabilities through new reagent kits and automated library preparation solutions. Bio-Rad Laboratories is enhancing its digital droplet PCR and imaging platforms to support high-sensitivity detection in rare cell populations, while Agilent Technologies and Qiagen are augmenting their reagent portfolios to improve assay robustness and reproducibility.

In parallel, Danaher Corporation is advancing portfolio integration through bolt-on acquisitions, reinforcing its presence in cell-based assay development, and strengthening its distribution network through partnerships with regional distributors. Collectively, these strategic initiatives underscore an industrywide drive toward integrated, end-to-end cellular health screening solutions that address emerging clinical and research needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellular Health Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 23andMe, Inc.

- Abbott Laboratories

- Agilent Technologies, Inc.

- BioReference Laboratories, Inc.

- Bloom Diagnostics GmbH

- Cell Biolabs, Inc.

- Cell Science Systems Corporation

- Cleveland HeartLab, Inc.

- DNA Labs India Private Limited

- Genova Diagnostics, Inc.

- Illumina, Inc.

- Immundiagnostik AG

- Laboratory Corporation of America Holdings

- Life Length S.L.

- MyDNAge

- OPKO Health, Inc.

- Quest Diagnostics Incorporated

- Repeat Diagnostics, Inc.

- Segterra, Inc.

- SpectraCell Laboratories, Inc.

- Telomere Diagnostics, Inc.

- Thermo Fisher Scientific Inc.

- Titanovo, Inc.

- TruDiagnostic LLC

- Zimetry LLC

Strategic Roadmap and Best Practices for Industry Leaders to Navigate Technological Disruption Regulatory Complexities and Market Growth in Cellular Health Screening

Organizations should diversify their supply chains by exploring regional manufacturing hubs and near-shoring critical component production to mitigate tariff-induced cost fluctuations. Establishing strategic partnerships with local contract manufacturers and logistics providers can also safeguard against geopolitical disruptions. Concurrently, investing in modular, automated manufacturing platforms will enhance production agility and reduce lead times.

To capitalize on evolving technological paradigms, industry leaders must allocate resources toward R&D programs that prioritize multiomics integration and AI-driven data analytics. Forming cross-disciplinary consortia with academic institutions and technology vendors can accelerate innovation while sharing development risks. Equally important is engaging proactively with regulatory bodies to influence policy reforms that streamline approval processes for advanced cellular assays, such as those addressing unmet clinical needs under the IVDR.

Embracing digital transformation across sales and distribution channels is imperative. Building robust e-commerce platforms and leveraging data analytics to optimize inventory management and customer engagement will enhance market penetration. Finally, organizations should cultivate talent pipelines in bioinformatics, AI, and regulatory affairs to ensure sustained competitive advantage in this rapidly evolving landscape.

Comprehensive Research Framework Combining Primary Stakeholder Interviews Expert Consultations and Rigorous Secondary Analysis Ensuring Depth and Accuracy

This study employs a rigorous multi-tiered approach combining expert interviews, secondary data synthesis, and triangulation techniques. Initially, comprehensive secondary research tapped peer-reviewed journals, patent databases, and reputable industry publications to map the technological landscape and regulatory environment. Subsequently, in-depth interviews with C-suite executives, principal investigators, and key opinion leaders provided qualitative insights into adoption drivers, unmet needs, and competitive positioning.

Quantitative validation was conducted through structured surveys of laboratory managers and procurement specialists across North America, EMEA, and Asia-Pacific, ensuring representative sampling of end-user perspectives. Data were cross-verified against publicly available financial disclosures and trade data to validate trends in pricing, tariffs, and M&A activities. Finally, findings underwent iterative review cycles and stakeholder workshops to refine assumptions, address biases, and ensure analytical rigor. This methodology underpins the report’s credibility and provides a transparent audit trail for all data sources and analytical frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellular Health Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellular Health Screening Market, by Product Type

- Cellular Health Screening Market, by Technology

- Cellular Health Screening Market, by Application

- Cellular Health Screening Market, by End User

- Cellular Health Screening Market, by Distribution Channel

- Cellular Health Screening Market, by Region

- Cellular Health Screening Market, by Group

- Cellular Health Screening Market, by Country

- United States Cellular Health Screening Market

- China Cellular Health Screening Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Summative Reflections on Key Trends Strategic Imperatives and Future Outlook Underscoring the Evolution of the Cellular Health Screening Landscape

The cellular health screening domain is undergoing an unprecedented transformation driven by advances in single-cell analysis, multiomics integration, and AI-powered data interpretation. Market participants face a complex interplay of technological innovation, regulatory evolution, and trade policy dynamics that collectively shape strategic imperatives. Key segmentation analyses highlight the critical roles of instruments, consumables, and services across diverse applications ranging from disease diagnostics to personalized medicine.

Regional insights underscore the Americas’ leadership in innovation, EMEA’s regulatory harmonization challenges, and Asia-Pacific’s rapid growth fueled by infrastructure investments and local manufacturing initiatives. Leading companies are responding through targeted product launches, strategic acquisitions, and operational optimizations to navigate tariff pressures and supply chain vulnerabilities. For industry leaders, the path forward requires a balanced focus on supply chain diversification, collaborative R&D, digital channel expansion, and proactive regulatory engagement.

As this market continues to evolve, stakeholders who leverage comprehensive, data-driven insights and implement adaptable strategies will be best positioned to drive growth and deliver on the promise of cellular health screening to improve patient outcomes.

Unlock In-Depth Insights and Drive Business Growth by Partnering with Ketan Rohom to Access the Comprehensive Cellular Health Screening Market Report

If your organization is poised to capitalize on the burgeoning opportunities within the cellular health screening market and seeks unparalleled insights to inform strategic decision-making, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep expertise in life sciences market intelligence and can guide you through the detailed findings of this comprehensive report. By partnering with him, you’ll gain tailored access to in-depth analyses spanning technology, segmentation, regulatory impacts, regional dynamics, and competitive landscapes. Take the next step toward driving growth and innovation: reach out to Ketan Rohom today to secure your copy of the full market research and unlock data-driven strategies for success in this dynamic sector.

- How big is the Cellular Health Screening Market?

- What is the Cellular Health Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?