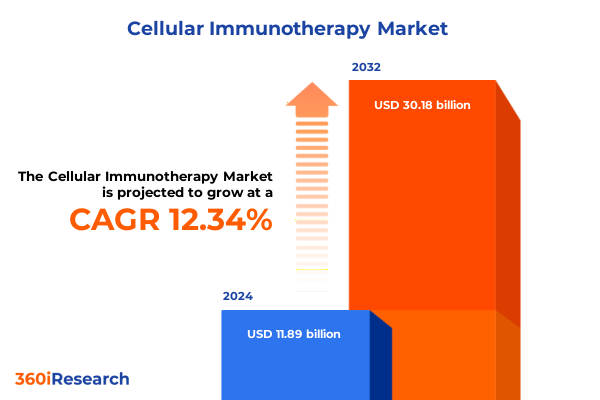

The Cellular Immunotherapy Market size was estimated at USD 24.62 billion in 2025 and expected to reach USD 26.19 billion in 2026, at a CAGR of 6.71% to reach USD 38.81 billion by 2032.

Discover how cellular immunotherapy is redefining oncology by mobilizing the body’s own defenses to target cancers with unprecedented precision and patient personalization across diverse indications and disease stages

Cellular immunotherapy harnesses the precision of the immune system to eradicate cancer cells, representing a paradigm shift in oncology treatment. Through the genetic reprogramming of immune cells, therapies such as chimeric antigen receptor T-cell (CAR-T) treatments have achieved durable remissions in hematologic malignancies that were once refractory to standard care. By redirecting a patient’s own T cells to recognize tumor antigens, these adoptive cell therapies have demonstrated unprecedented efficacy against B-cell malignancies, fundamentally altering long-term survival outcomes for many patients.

Examine the pivotal scientific breakthroughs and engineering innovations that are propelling cellular immunotherapy beyond its traditional boundaries to address solid tumors and broaden therapeutic applications

The cellular immunotherapy landscape has been transformed by scientific breakthroughs in genetic engineering and synthetic biology. Advances in CAR design, including the integration of co-stimulatory domains and optimized transmembrane motifs, have significantly enhanced T-cell activation and persistence, overcoming limitations of first-generation constructs. Concurrently, the application of CRISPR/Cas9 gene editing has streamlined the creation of universal or allogeneic CAR-T cells by reducing immunogenicity and alloreactivity, paving the way for off-the-shelf therapeutic models that could drastically cut manufacturing timelines. Equally important has been the exploration of alternative cell types; engineered macrophages and NK cells are entering clinical pipelines, offering novel mechanisms to penetrate solid tumors and modulate the immunosuppressive microenvironment. These converging innovations are expanding the reach of adoptive cell therapies beyond hematologic cancers, establishing new avenues for personalized interventions in solid tumors and autoimmune diseases.

Analyze the multifaceted repercussions of United States tariffs enacted in 2025 on cellular immunotherapy supply chains, research funding, and global collaboration dynamics

The United States tariffs implemented in 2025 have introduced a new layer of complexity for cellular immunotherapy stakeholders. Although finished pharmaceuticals were broadly exempted from baseline duties, the import tariffs on essential reagents, equipment, and services have led to higher input costs for manufacturers and research organizations. Many biotech firms, particularly those reliant on specialized reagents from Europe or China, anticipate supply chain disruptions and a year-long adjustment period to establish alternate sourcing strategies. These increased operating expenses threaten to divert critical funding away from early-stage research and clinical development, with smaller biotechs and academic institutes facing disproportionate challenges in absorbing higher costs and securing reliable ingredient supply.

Unearth strategic segmentation insights revealing how therapy types, technological modalities, clinical indications, and institutional stakeholders shape the cellular immunotherapy landscape

Segmenting the cellular immunotherapy ecosystem reveals distinct dynamics across therapy modalities, technology platforms, clinical indications, and institutional stakeholders. When examining therapy types, CAR T-Cell Therapy remains the most established, while Dendritic Cell Therapy, NK Cell Therapy, T-Cell Receptor Therapy, and Tumor-Infiltrating Lymphocytes Therapy each contribute unique mechanisms of action and clinical profiles. In parallel, the interplay between Cytokines and Immunomodulators and Monoclonal Antibodies underpins the manufacturing and delivery systems that enhance cell expansion, trafficking, and functionality. Furthermore, the diversity of indications-from B-Cell Malignancies to Liver Cancer, Prostate Cancer, and Renal Cell Carcinoma-drives prioritization of pipeline assets and trial designs. Beyond the therapies themselves, institutional roles vary widely: Academic Institutes foster innovation through fundamental research, Biotech and Pharmaceutical Companies advance clinical translation, Contract Organizations offer specialized manufacturing and regulatory expertise, while Hospitals and Research Institutes serve as critical conduits for patient enrollment and real-world evidence generation.

This comprehensive research report categorizes the Cellular Immunotherapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology Type

- Indication

- Institution Category

Illuminate regional dynamics by exploring how the Americas, Europe Middle East & Africa, and Asia Pacific regions uniquely contribute to cellular immunotherapy research and adoption

Regional variations in cellular immunotherapy adoption and infrastructure delineate the global growth trajectory of this field. In the Americas, robust venture capital ecosystems and leading academic medical centers have propelled clinical trial activity and commercial launches, establishing the region as a primary innovation hub. Europe, Middle East & Africa have benefited from harmonized regulatory frameworks and collaborative consortia that facilitate pan-regional trials and cohort expansion. Meanwhile, the Asia-Pacific is experiencing rapid investments in domestic manufacturing capacity, particularly in China and South Korea, alongside government incentives to bolster biotech exports and onshore production, positioning the region as an emerging powerhouse in cell therapy development and distribution.

This comprehensive research report examines key regions that drive the evolution of the Cellular Immunotherapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight the strategic maneuvers of leading biopharma and biotech innovators driving advancements in cellular immunotherapy pipelines and competitive positioning

Leading companies are shaping the competitive contours of cellular immunotherapy through strategic investments, clinical milestones, and technology partnerships. Atara Biotherapeutics faced a setback when its tabelecleucel therapy failed to gain FDA approval in early 2025, prompting the company to reevaluate its manufacturing processes and resubmit after addressing compliance concerns. In contrast, Autolus Therapeutics advanced its fast-off kinetic CAR design, reporting promising remission rates in ongoing B-ALL studies and positioning its obecabtagene autoleucel asset as a differentiated therapy in hematologic malignancies. Emerging players like EsoBiotec are pioneering in vivo CAR-T approaches, dosing the first patient with an in-body reprogramming strategy for multiple myeloma that could significantly reduce production complexities. Additionally, Adaptimmune’s approval of afamitresgene autoleucel marked the first FDA-cleared TCR therapy for synovial sarcoma, illustrating the maturation of T-cell receptor engineering beyond hematologic indications. Other industry stalwarts-including Novartis, Gilead (Kite), Bristol Myers Squibb, and Johnson & Johnson-continue to expand their CAR-T and NK-cell pipelines through licensing deals and manufacturing scale-ups.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellular Immunotherapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adaptimmune Therapeutics PLC

- Adicet Bio, Inc.

- Apac Biotech Private Limited

- AstraZeneca PLC

- Atara Biotherapeutics, Inc.

- Bellicum Phamaceuticals, Inc.

- Bio-Rad Laboratories, Inc.

- Bristol-Myers Squibb Company

- Celyad Oncology SA

- Corning Incorporated

- Dendreon Pharmaceuticals LLC

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Glycostem Therapeutics B.V.

- Immatics N.V.

- Inovio Pharmaceuticals, Inc.

- Iovance Biotherapeutics, Inc.

- Johnson & Johnson Services, Inc.

- JW Therapeutics (Shanghai) Co., Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

Implement actionable strategies for industry leaders to navigate regulatory complexity, streamline supply chains, and foster collaboration to accelerate immunotherapy adoption

Industry leaders should prioritize supply chain resilience by diversifying reagent and equipment sources beyond tariff-affected regions, thus mitigating cost volatility and ensuring continuity of critical clinical supplies. Investing in modular and automated manufacturing platforms can reduce reliance on specialized labor and enhance scalability for both autologous and allogeneic therapies. In parallel, engaging proactively with regulatory agencies to establish clear guidelines for novel modalities-such as in vivo CAR-T and TCR therapeutics-will accelerate development timelines and minimize approval risk. Strategic collaborations between academic centers and commercial entities can foster knowledge transfer and accelerate the translation of emerging cell types, while multi-stakeholder consortiums may offer economies of scale for shared manufacturing infrastructure and real-world data collection. Finally, decision-makers should incorporate geopolitical considerations into site selection and trial design, leveraging regions with supportive policy frameworks to optimize cost, speed, and market access.

Detail a robust research methodology combining primary expert interviews with secondary data analysis to ensure rigorous insights into the cellular immunotherapy domain

This research incorporates a multi-phase methodology to ensure robust insights into the cellular immunotherapy landscape. Primary data was gathered through in-depth interviews with key opinion leaders at leading academic institutions, biotech pioneers, and regulatory authorities, providing firsthand perspectives on emerging technologies and clinical challenges. Secondary research involved a comprehensive review of peer-reviewed literature, clinical trial registries, and industry white papers to capture recent breakthroughs, therapeutic approvals, and manufacturing innovations. Quantitative analysis was conducted on aggregated trial outcomes and patent filings to identify patterns in modality adoption and development pipelines. Data triangulation across these sources, combined with iterative validation by subject-matter experts, underpins the credibility and precision of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellular Immunotherapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellular Immunotherapy Market, by Type

- Cellular Immunotherapy Market, by Technology Type

- Cellular Immunotherapy Market, by Indication

- Cellular Immunotherapy Market, by Institution Category

- Cellular Immunotherapy Market, by Region

- Cellular Immunotherapy Market, by Group

- Cellular Immunotherapy Market, by Country

- United States Cellular Immunotherapy Market

- China Cellular Immunotherapy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesize key discoveries and forward-looking perspectives that underscore cellular immunotherapy’s transformative potential and roadmap for future breakthroughs

The cellular immunotherapy sector is at a pivotal juncture, characterized by groundbreaking scientific advances and evolving market dynamics. Innovations in CAR engineering, gene-editing, and next-generation cell types have expanded therapeutic possibilities beyond hematologic cancers, while regulatory and economic factors-such as the 2025 United States tariffs-underscore the need for strategic adaptability. Segmentation analysis highlights the intricate interplay between therapy modalities, technology platforms, and stakeholder roles, whereas regional insights reveal differentiated growth patterns shaped by funding ecosystems, policy frameworks, and manufacturing capabilities. Leading companies demonstrate both the promise and complexity of advancing novel therapies through clinical and regulatory milestones. Collectively, these findings point to a trajectory of sustained innovation tempered by operational and geopolitical challenges, setting the stage for the next era of precision immunotherapy.

Engage with Associate Director Ketan Rohom to secure tailored cellular immunotherapy market research insights and propel strategic decision making

To further explore these insights and obtain comprehensive market research on cellular immunotherapy, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan offers tailored consultations to help you align strategic priorities with the latest industry developments. Connect today to secure actionable intelligence and gain a competitive edge in harnessing the transformative potential of cellular immunotherapy.

- How big is the Cellular Immunotherapy Market?

- What is the Cellular Immunotherapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?