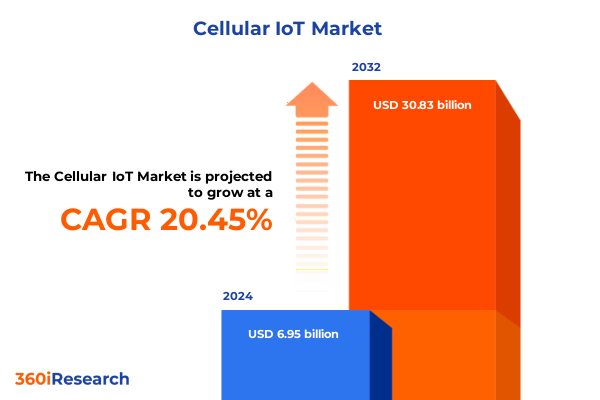

The Cellular IoT Market size was estimated at USD 8.31 billion in 2025 and expected to reach USD 9.92 billion in 2026, at a CAGR of 20.60% to reach USD 30.83 billion by 2032.

Exploring the Core Principles and Strategic Importance of Cellular IoT in Driving Innovation and Operational Efficiency Across Industries

This report begins by laying out the foundational concepts and strategic relevance of cellular IoT technologies in today’s interconnected world. It introduces the critical role that mobile network connectivity plays in bridging the physical and digital realms, enabling devices to communicate seamlessly and reliably across vast distances. Readers will gain an understanding of how the cellular IoT ecosystem has evolved from early 2G and 3G networks into robust platforms capable of supporting massive device deployments and diverse applications.

Contextualizing this evolution, the introduction frames the interplay between emerging network standards, device capabilities, and backend integration as the cornerstone of innovation. It highlights how organizations are increasingly leveraging cellular connectivity to optimize asset management, enhance operational visibility, and unlock new revenue streams. By outlining the scope of the analysis, including component breakdowns, network variations, application verticals, end-user segments, and regional trends, this section establishes a coherent roadmap for the insights that follow. Transitioning from broad context to specific explorations, the reader is equipped to appreciate the transformative shifts and strategic considerations that define the cellular IoT landscape.

Uncovering the Pivotal Technological Shifts That Are Reshaping the Cellular IoT Landscape and Enabling New Market Opportunities

In recent years, cellular IoT has undergone transformative shifts driven by advancements in network technologies and deployment paradigms. The maturation of 4G networks and the rollout of 5G architectures have unlocked ultra-low latency connections and enhanced bandwidth, empowering a new generation of real-time applications. Meanwhile, narrowband technologies such as NB-IoT and LTE-M have emerged as cost-effective solutions for massive device deployments that demand extended battery life and widespread coverage.

Furthermore, the convergence of edge computing and artificial intelligence with cellular networks is reshaping operational models. By decentralizing data processing closer to devices, enterprises can achieve faster decision-making and reduce backhaul traffic. This shift enables predictive maintenance in industrial settings, real-time analytics in smart cities, and immersive experiences in connected vehicles. Additionally, virtualization of network functions and the rise of software-defined architectures provide operators with unprecedented flexibility to scale services and tailor connectivity based on application needs. Together, these advancements are redefining how organizations design, deploy, and manage cellular IoT solutions, setting the stage for sustainable growth and continuous innovation.

Evaluating the Cumulative Effects of 2025 United States Tariffs on Cellular IoT Supply Chains and Technology Deployment Strategies

United States tariff policies implemented in 2025 have introduced notable complexities into cellular IoT supply chains and cost structures. Duties imposed on imported semiconductor components, modules, and related manufacturing equipment have increased procurement expenses for hardware manufacturers, prompting a reassessment of global sourcing strategies. These additional levies have translated into higher bill-of-materials costs for actuators, gateways, modules/chips, and sensors, compelling suppliers to explore alternative manufacturing hubs or negotiate new vendor agreements.

In response to these pressures, many stakeholders have accelerated efforts to diversify supplier networks and nearshore critical operations to regions less affected by import duties. This strategic pivot has encouraged partnerships with domestic foundries and contract manufacturers, as well as investments in localized assembly and testing capabilities. Simultaneously, tariff-driven cost inflation has underscored the importance of design optimization, where engineers focus on component consolidation and energy efficiency to offset price increases. The cumulative impact of 2025 tariffs is thus driving a reconfiguration of the cellular IoT value chain, fostering resilience through geographic diversification and leaner product architectures.

Deriving Actionable Insights from Component, Network, Application, and End-User Segmentation to Illuminate Cellular IoT Market Dynamics

Segmenting the cellular IoT market across component, network type, application, and end-user lenses yields a multi-dimensional view of adoption dynamics and opportunity areas. Component analysis illuminates the interplay between hardware subcategories-encompassing actuators, gateways, modules/chips, and sensors-and the expanding role of software platforms that span connectivity management, device management, data analytics, and security. The rise of managed services and professional services further enhances the ecosystem by providing integration expertise, lifecycle support, and customization capabilities.

Network-based segmentation differentiates legacy standards such as 2G and 3G from high-bandwidth 4G and 5G environments, as well as purpose-built LPWAN technologies like LTE-M and NB-IoT optimized for battery-powered devices. This spectrum of connectivity options enables tailored solutions that balance throughput, coverage, and power efficiency. By examining applications ranging from connected vehicles and drones to smart grid automation and VR/AR, the analysis highlights where specific network characteristics best align with use case requirements. Finally, end-user segmentation spanning agriculture, automotive & transportation, construction & building infrastructure, consumer electronics, energy, environmental monitoring, healthcare, and retail showcases how diverse sectors are driving unique demand patterns and shaping the evolution of cellular IoT offerings.

This comprehensive research report categorizes the Cellular IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Type

- Application

- End-User

Assessing Regional Variances in Cellular IoT Adoption and Strategies Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

A regional lens reveals distinct trajectories in cellular IoT adoption across the Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, deployment momentum is propelled by smart agriculture initiatives and fleet management solutions in North America, alongside accelerated rollouts of pipeline monitoring and environmental sensing in Latin America. Infrastructure modernization efforts and regulatory support for spectrum allocation continue to underpin regional growth.

In Europe Middle East Africa, strategic emphasis on smart grid automation and smart metering programs has driven investment in both LTE-M and NB-IoT networks. Cross-border collaborations in EMEA have facilitated shared infrastructure deployments in critical industries such as utilities and transportation. Meanwhile, Asia Pacific leads in consumer electronics and industrial automation, leveraging high-density manufacturing clusters and supportive policy frameworks to scale cellular IoT projects. Across these geographies, factors such as spectrum licensing, public-private partnerships, and digital transformation agendas dictate regional nuances in technology uptake and business model innovation.

This comprehensive research report examines key regions that drive the evolution of the Cellular IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Highlight Strategic Partnerships, Innovation Portfolios, and Competitive Differentiators in Cellular IoT

Leading players in the cellular IoT ecosystem are distinguishing themselves through technology leadership, strategic partnerships, and targeted acquisitions. Semiconductor innovators are integrating advanced connectivity stacks with power management features to address battery longevity and device miniaturization requirements. Network infrastructure providers are expanding end-to-end offerings that combine private network solutions with managed service portfolios to support enterprise deployments.

Software-oriented vendors are deepening capabilities in analytics, security, and orchestration through modular platforms that enable rapid customization. Collaborative ecosystems are emerging as companies join forces with system integrators, cloud service providers, and telecom operators to deliver turnkey solutions. These alliances enhance go-to-market agility and broaden solution footprints. Collectively, these competitive differentiators-ranging from IP-rich hardware platforms and AI-driven analytics engines to robust connectivity management suites-are redefining vendor positioning and raising the bar for value delivery in the cellular IoT domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellular IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Aeris Communications, Inc.

- AT&T Inc.

- China Mobile International Limited

- China Telecom Global Limited

- China Unicom (Hong Kong) Limited

- Huawei Technologies Co., Ltd.

- KDDI CORPORATION

- Microchip Technology Incorporated

- Nokia Corporation

- Nordic Semiconductor ASA

- NTT Group

- NXP Semiconductors N.V.

- Onomondo ApS

- Orange SA

- Particle Industries, Inc.

- Proximus Group

- Qualcomm Technologies, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Reliance Jio Infocom Limited

- Renesas Electronics Corporation

- Rogers Communications Inc.

- Semtech Corporation

- Sequans Communications S.A.

- SK Telecom Co., Ltd.

- STMicroelectronics N.V.

- Tata Communications Limited

- Telefonaktiebolaget LM Ericsson

- Telefónica, S.A.

- Telekom Deutschland GmbH

- Telia Company AB

- Telit Communications PLC

- Telstra Group Limited

- Telus Corporation

- Texas Instruments Incorporated

- u-blox AG

- Verizon Communications Inc.

- Vodafone Group PLC

- Würth Elektronik eiSos GmbH & Co. KG

- Zipit Wireless, Inc

- ZTE Corporation

Formulating Practical Recommendations to Empower Industry Leaders in Harnessing Cellular IoT Technologies for Sustainable Growth and Resilience

Industry leaders should consider a multi-pronged approach to capitalize on cellular IoT opportunities and navigate prevailing challenges. Prioritizing investment in NB-IoT and LTE-M networks offers a scalable path to support massive sensor deployments while optimizing total cost of ownership and energy consumption. Simultaneously, forging alliances with analytics service providers can accelerate the development of predictive maintenance and anomaly-detection applications that deliver tangible ROI.

Moreover, organizations must proactively diversify their supply chains by cultivating relationships with multiple component suppliers and exploring nearshoring options to mitigate tariff-related risks. Strengthening cybersecurity frameworks-through end-to-end encryption, secure boot mechanisms, and continuous monitoring-will be critical as regulatory scrutiny intensifies. Finally, embracing open standards and participating in industry consortia can drive interoperability, reduce integration complexities, and seed broader ecosystem growth. By following these strategic imperatives, decision-makers can position their organizations to harness the full potential of cellular IoT and build sustainable advantage.

Detailing Rigorous Research Methodologies Employed to Ensure Comprehensive, Objective, and Actionable Insights in the Cellular IoT Analysis

This analysis draws upon a robust research framework designed to deliver comprehensive and objective insights. Primary data were gathered through in-depth interviews with senior executives across hardware manufacturing, network infrastructure, software development, and end-user organizations. Secondary research incorporated publicly available information from regulatory agencies, industry associations, corporate disclosures, and technical white papers to validate and enrich primary inputs.

Data triangulation techniques were applied to reconcile discrepancies and ensure the accuracy of qualitative findings. A structured evaluation matrix segmented technologies, applications, and regions, enabling cross-comparison and trend identification. In addition, expert reviews from academic and industry practitioners provided critical validation of emerging patterns and future directions. Together, these methodological rigor elements underpin the reliability and actionability of the conclusions presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellular IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellular IoT Market, by Component

- Cellular IoT Market, by Network Type

- Cellular IoT Market, by Application

- Cellular IoT Market, by End-User

- Cellular IoT Market, by Region

- Cellular IoT Market, by Group

- Cellular IoT Market, by Country

- United States Cellular IoT Market

- China Cellular IoT Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Key Takeaways to Reinforce Strategic Imperatives and Future Directions for Stakeholders in the Cellular IoT Ecosystem

In conclusion, cellular IoT has matured into a versatile platform that underpins innovation across a wide array of industries. The convergence of advanced network standards, edge computing capabilities, and robust analytics is catalyzing operational efficiencies and unlocking new service paradigms. At the same time, evolving tariff landscapes require stakeholders to reexamine supply chain strategies and emphasize design optimization to maintain competitiveness.

Regional dynamics highlight the importance of tailoring solutions to local regulatory environments, infrastructure readiness, and end-user expectations. Leading companies are differentiating through integrated hardware-software stacks, strategic partnerships, and investment in security and interoperability. Moving forward, industry players who adopt a holistic approach-balancing network selection, technology partnerships, and ecosystem engagement-will be best positioned to capitalize on the expanding cellular IoT opportunity.

Engaging with Our Associate Director to Secure the Full-Scale Cellular IoT Market Research Report and Drive Informed Decision Making

To explore the full depth of this report and gain exclusive insights tailored to your strategic goals, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through customized packages and data deliverables aligned with your organization’s priorities.

By partnering with Ketan Rohom, you ensure direct access to specialized support, detailed briefing sessions, and a robust roadmap for leveraging cellular IoT advances. Connect today to secure a competitive edge and translate cutting-edge analysis into practical, high-impact actions that drive growth and innovation in your business.

- How big is the Cellular IoT Market?

- What is the Cellular IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?