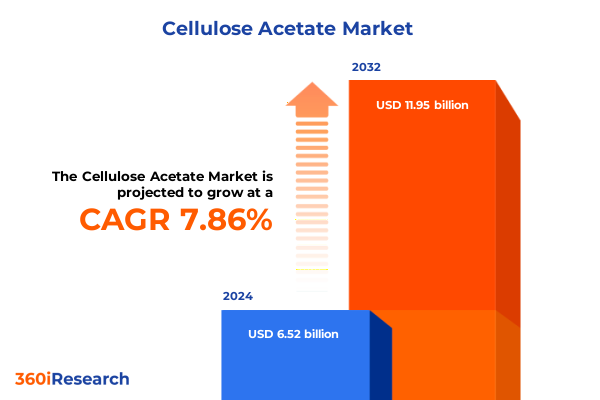

The Cellulose Acetate Market size was estimated at USD 6.93 billion in 2025 and expected to reach USD 7.36 billion in 2026, at a CAGR of 8.10% to reach USD 11.95 billion by 2032.

Unlocking the Versatility of Cellulose Acetate as a Sustainable Biopolymer Revolutionizing Filters, Eyewear, Coatings, Textiles and Medical Applications

Cellulose acetate is an organic polymer produced by acetylating cellulose derived from renewable sources such as wood pulp or cotton linters. These acetate esters of cellulose exist in diacetate, monoacetate, and triacetate forms, each characterized by distinct acetylation levels that influence solubility, thermal behavior, and mechanical properties. As a bio-based thermoplastic, cellulose acetate can be molded, extruded, or spun into fibers, offering versatility across film, fiber, and injection-molded part applications while reducing reliance on fossil feedstocks.

Emerging Sustainability Imperatives and Technological Innovations Catalyzing Transformational Shifts Reshaping the Cellulose Acetate Industry Landscape

Sustainability imperatives and environmental regulations are reshaping the cellulose acetate sector, driving manufacturers to embrace renewable feedstocks and closed-loop processing methods. Under pressure from single-use plastics directives and extended producer responsibility mandates, stakeholders are accelerating development of biodegradable filter fibers and waterborne resin systems that limit volatile organic compound emissions. These shifts are prompting material suppliers to reengineer production processes to meet stringent compliance standards and rising consumer expectations for material circularity.

Technological breakthroughs in green chemistry and process optimization have further catalyzed industry transformation by reducing energy consumption, minimizing solvent usage, and cutting waste generation. Innovations in solvent-free acetylation and cellulose recycling enhance lifecycle performance, while digitalization and data analytics optimize manufacturing parameters for consistent quality. Concurrently, digital disruption in photographic film has prompted suppliers to focus on triacetate formulations tailored to high-end cinematography and medical imaging, preserving niche demand in the face of broader declines.

Across coatings, adhesives, and textiles, demand for high-performance sustainable materials is driving advances in resin chemistry and fiber morphology. Waterborne coating systems integrating cellulose acetate esters now offer superior adhesion and environmental compliance, while specialty textile fibers are engineered for soft hand feel, cross-dyeing versatility, and controlled biodegradation. Together, these trends underscore the industry’s agility in aligning material science innovation with global sustainability benchmarks and evolving end-use requirements.

Analyzing the 2025 United States Tariff Policies on Cellulose Acetate and Their Cumulative Impact on Supply Chains and Cost Structures

In early April 2025, the U.S. administration invoked the International Emergency Economic Powers Act to impose a universal 10% tariff on all imports, supplemented by reciprocal duties on major trading partners, resulting in an effective 54% levy on goods from China. This landmark policy, announced in the White House Rose Garden as a national emergency measure, immediately affected cellulose acetate feedstocks and intermediate esters, marking a significant protectionist shift unseen since the Smoot-Hawley era.

Simultaneously, the 2025 Harmonized Tariff Schedule revision introduced a 7.5% general duty on cellulose acetate classified under HTS code 5502.10.00.00 for non-preferred sources, while maintaining duty-free status for designated partners such as Australia and Korea. The combined effect of elevated baseline tariffs and increased levies on specific origins has driven up landed costs, prompting buyers to reevaluate procurement strategies and intensify considerations for domestic polymerization and nearshoring initiatives.

These tariff measures have catalyzed substantial supply chain realignments, with downstream processors seeking alternative feedstocks, renegotiating long-term raw material agreements, and investing in capacity expansions to mitigate duty exposure. Manufacturers reliant on cotton linter and wood pulp imports are accelerating the development of integrated onshore acetate production facilities, while cigarette filter and photographic film producers explore tariff-exempt trade corridors and collaborative ventures to stabilize supply and manage cost volatility effectively.

Unveiling Key Market Segmentation Insights Across End Use, Material Type, and Physical Form to Drive Strategic Decision Making

The market’s end-use segmentation reveals distinct performance and regulatory drivers across key applications. In cigarette filters, stringent filtration and biodegradability requirements shape tow development and recycling initiatives. Coatings and adhesives break down into specialized formulations for metal coatings demanding corrosion resistance, wood coatings targeting durability and finish quality, and adhesive blends optimized for diverse substrate bonding. Photographic film persists in medical imaging with exacting optical clarity, motion picture with high-performance cinematic needs, and still photography with archival stability. Textiles encompass a spectrum from apparel fibers engineered for drape and moisture management to home furnishing yarns emphasizing comfort and dimensional stability, and industrial fabrics designed for tensile strength and process resilience.

Material type plays a critical role in aligning performance with application demands. Diacetate variants strike a balance between solvent solubility and thermal stability, making them suitable for injection molding and basic film applications. Monoacetate grades feature enhanced water solubility for specialty coatings and membrane technologies. Triacetate offers superior moisture resistance, dimensional stability, and optical clarity, positioning it as the preferred choice for high-end photographic applications and advanced coating systems.

The physical form of cellulose acetate further refines process and performance outcomes. Granules serve as the primary feedstock for extrusion and injection molding, delivering consistent melt characteristics and ease of handling. Powder formulations enable precise rheological control in adhesive compounding and specialty coating operations. Solution-based grades, dissolved in suitable solvents, underpin the production of fine denier fibers, high-clarity films, and advanced membranes, where uniform casting and solvent compatibility are paramount.

This comprehensive research report categorizes the Cellulose Acetate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- End Use

Navigating Regional Nuances: Key Insights into Americas, EMEA, and Asia-Pacific Dynamics Shaping the Cellulose Acetate Market

In the Americas, the United States and Canada continue to lead demand for cellulose acetate across cigarette filters, coatings and adhesives, and emerging sustainable textiles. Despite long-term declines in smoking rates, waste studies indicate that over 766,000 tons of acetate-based filters were discarded in the U.S. in 2022, with less than 10% properly processed, highlighting persistent environmental and collection challenges. Concurrently, automotive and consumer electronics sectors are boosting consumption of acetate films and coatings for their renewable origin and favorable optical properties, while domestic producers navigate volatile raw material markets and evolving trade policies.

Across Europe, the Middle East and Africa, stringent regulations such as the EU Single-Use Plastics Directive have mandated extended producer responsibility fees for tobacco producers, exceeding $15 million in compliance costs for leading manufacturers and spurring accelerated R&D in biodegradable filter alternatives. The automotive coating industry in the Middle East is leveraging cellulose acetate esters for improved environmental compliance, while Africa’s nascent textile market presents incremental opportunities as brands seek affordable, sustainable fibers for local apparel and home furnishing applications.

In Asia-Pacific, rapid industrialization and urbanization in China, India and Southeast Asia have driven significant expansions in acetate tow and film capacity. Daicel Corporation’s recent 20% production increase in Southeast Asia is emblematic of regional investment to address rising demand in cigarette filters and technical textiles. Meanwhile, medical device manufacturers in Japan and South Korea are adopting specialized medical-grade acetate variants for surgical tapes and diagnostic membranes, reflecting a premiumization trend in high-value healthcare segments and reinforcing the region’s strategic importance for advanced cellulose acetate applications.

This comprehensive research report examines key regions that drive the evolution of the Cellulose Acetate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Company Strategies and Innovations Driving Competitive Advantage in the Evolving Cellulose Acetate Industry Landscape

The competitive landscape is anchored by global chemical leaders that integrate upstream acetylation with downstream fiber and film production. Pioneers like Celanese Corporation and Eastman Chemical Company maintain significant market presence through legacy operations dating back to the early 20th century, continuously optimizing capacity and process efficiency. Japanese conglomerate Daicel Corporation, along with specialty producers such as Sappi Ltd and Mitsubishi Chemical Holdings, has pursued regional expansions and product innovations-ranging from biodegradable eyewear frames to medical-grade acetate variants-to secure leadership across diverse market segments.

These key players are channeling R&D investments into green chemistry for solvent reduction, advanced fiber morphologies to enhance filtration efficiency, and bio-based feedstock programs to strengthen sustainability credentials. Strategic alliances with downstream converters, coupled with digital process control platforms, streamline operations and accelerate time to market for novel acetate grades. Collaborative supply chain initiatives focused on cellulose recycling and closed-loop material recovery further position these incumbents as frontrunners in delivering sustainable and high-performance cellulose acetate solutions across global markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellulose Acetate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Borregaard ASA

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Kuraray Co., Ltd

- Mitsubishi Chemical Corporation

- Rotuba Extruders, Inc.

- Sekisui Chemical Co., Ltd

- SK chemicals Co., Ltd.

- SPI Film Technologies Inc.

- Triom Industries Pvt. Ltd.

Actionable Recommendations for Leaders to Capitalize on Sustainability Trends, Navigate Market Complexities and Build Resilient Cellulose Acetate Supply Chains

Industry leaders should diversify raw material sourcing by establishing partnerships with sustainable forestry and cotton linter suppliers, while investing in scalable bio-based cellulose programs to mitigate the risks posed by volatile international trade policies. Strengthening integrated onshore polymerization capabilities will reduce exposure to import tariffs and logistics disruptions, and accelerate responsiveness to evolving regulatory requirements for biodegradability and environmental compliance.

To bolster supply chain resilience, stakeholders are encouraged to adopt digital technologies and advanced analytics for real-time monitoring and predictive maintenance of production assets. Nearshoring critical capacity and exploring tariff-exempt trade corridors can optimize landed cost structures. Collaborative investments in recycling infrastructure and circularity initiatives will not only address end-of-life waste challenges but also unlock value through recovered cellulose feedstocks, positioning companies to lead in a sustainability-driven marketplace.

Outlining a Comprehensive Research Methodology Incorporating Secondary Data Analysis, Expert Interviews and Rigorous Data Triangulation Techniques

This analysis was developed through comprehensive secondary research, including review of government publications, trade association reports and peer-reviewed technical literature. Data triangulation incorporated quantitative trade statistics, harmonized tariff schedules and environmental waste studies to validate emerging trends and regional dynamics.

Primary insights were gathered via structured interviews with senior executives at leading cellulose acetate producers, feedstock suppliers and downstream converters. Rigorous data validation protocols ensured consistency by cross-referencing multiple independent sources, while qualitative inputs from industry experts contextualized quantitative findings and informed actionable strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellulose Acetate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellulose Acetate Market, by Type

- Cellulose Acetate Market, by Form

- Cellulose Acetate Market, by End Use

- Cellulose Acetate Market, by Region

- Cellulose Acetate Market, by Group

- Cellulose Acetate Market, by Country

- United States Cellulose Acetate Market

- China Cellulose Acetate Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Emerging Imperatives to Conclude the Strategic Outlook for the Global Cellulose Acetate Landscape

The global cellulose acetate landscape is undergoing transformative shifts driven by sustainability mandates, evolving trade policies and rapid technological innovation. As regulatory frameworks tighten around single-use plastics and environmental compliance, the industry’s focus on biodegradable fibers, waterborne coatings and advanced membrane applications underscores its commitment to a circular economy.

Strategic segmentation by end use, material type and form reveals nuanced performance demands that inform targeted product development and supply chain optimization. Regional dynamics in the Americas, EMEA and Asia-Pacific highlight the importance of localized capacity expansions, regulatory compliance and premium application growth in steering market evolution. Leading companies that integrate green chemistry advances, digital process control and robust feedstock strategies will be best positioned to capture emerging opportunities and navigate the complex, interconnected landscape of cellulose acetate production and consumption.

By aligning material innovation with sustainability imperatives and resilient supply chain practices, stakeholders can solidify competitive advantage and drive long-term value creation in this essential bio-based materials sector.

Connect with Ketan Rohom to Secure Your Comprehensive Cellulose Acetate Market Research Report and Gain Strategic Intelligence Today

Engage directly with Ketan Rohom to secure your comprehensive cellulose acetate market research report and unlock actionable insights tailored to your strategic objectives. By partnering with Ketan, you gain access to in-depth analysis of end-use dynamics, tariff impacts, and regional nuances that will empower your organization to make informed decisions and capitalize on emerging opportunities. Reserve your report today and position your business at the forefront of innovation in the evolving cellulose acetate landscape.

- How big is the Cellulose Acetate Market?

- What is the Cellulose Acetate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?