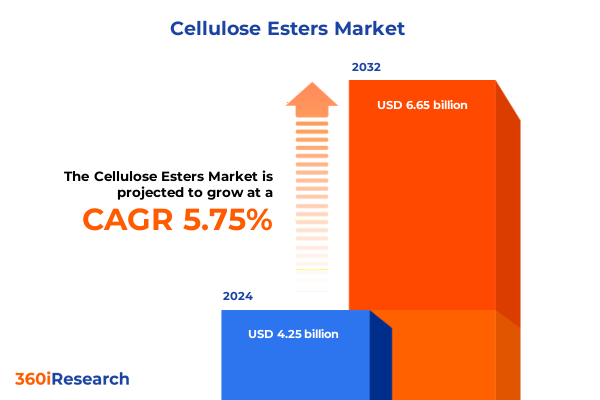

The Cellulose Esters Market size was estimated at USD 4.46 billion in 2025 and expected to reach USD 4.68 billion in 2026, at a CAGR of 5.86% to reach USD 6.65 billion by 2032.

Cellulose Esters Driving Eco-Conscious Innovation and Performance in Diverse Industrial Sectors Under Intensifying Environmental and Regulatory Frameworks

Cellulose esters have emerged as a critical class of bio-based polymers, offering versatile performance across a broad array of industrial settings. Derived from renewable cellulose sources, these derivatives provide compelling alternatives to conventional petrochemical-based materials by combining mechanical strength with enhanced biodegradability. Their capacity to form fibers, films, coatings, membranes, and molded plastic components has unlocked new possibilities for sustainable product differentiation.

Over the past decade, growing environmental regulations and consumer expectations have heightened demand for materials that reduce reliance on fossil resources and minimize ecological footprint. In parallel, ongoing innovations in polymer chemistry and processing technologies have improved the functional attributes of cellulose esters, empowering formulators to develop lighter, more durable, and more recyclable products. As the global materials landscape continues to shift toward circularity and low-carbon solutions, cellulose esters stand at the forefront of a transformative materials revolution.

Moving from niche specialty applications to mainstream adoption, cellulose esters have garnered interest from diverse sectors, including packaging, textiles, and automotive. Their compatibility with existing manufacturing infrastructure further accelerates uptake, enabling seamless integration without heavy capital investments. Consequently, industry stakeholders are increasingly treating cellulose esters not just as a sustainable alternative, but as a strategic enabler of product innovation.

Unprecedented Technological Breakthroughs and Sustainability Mandates Reshaping the Cellulose Ester Landscape Across Value Chains

The cellulose ester landscape is undergoing fundamental shifts driven by simultaneous technological breakthroughs and evolving sustainability mandates. Advances in chemical modification methods have expanded the palette of functional properties, allowing manufacturers to fine-tune ester chain lengths and substituent groups to achieve targeted performance in humidity resistance, tensile strength, or optical clarity. At the same time, digital transformation initiatives are introducing real-time process controls and predictive analytics, which enhance production efficiency while minimizing waste generation.

Regulatory momentum toward circular economy principles has elevated the role of life cycle assessments in material selection, pushing cellulose esters into the top consideration for eco-design programs. This shift is further amplified by brand owners seeking to bolster their sustainability credentials, creating pull-through effects along the value chain. Moreover, the integration of bio-derived feedstocks with green solvent systems is reshaping supply chain configurations, reducing environmental impact while securing resilience against volatile crude prices and geopolitical uncertainties.

In conjunction with these developments, end-use industries are reimagining product architectures to leverage the barrier, biodegradability, and mechanical advantages of cellulose esters. From next-generation packaging films that prolong shelf life with minimal environmental tradeoffs to innovative membrane technologies for water treatment, cellulose esters are catalyzing a new wave of product differentiation. As such, manufacturers and brand owners are forging closer collaborations to co-develop tailored cellulose ester solutions, fundamentally redefining how sustainable materials deliver value.

Assessing the Far-Reaching Consequences of New United States Trade Tariffs on Cellulose Ester Supply Chains and Cost Structures in 2025

In 2025, sweeping tariff policies in the United States have introduced a complex web of duties that directly affect cellulose ester imports and downstream manufacturing economics. The implementation of broad-based import levies under a universal tariff framework has driven a marked increase in raw material input costs, particularly for processors reliant on global supply channels. As a result, many firms are reassessing sourcing strategies to mitigate margin pressures and maintain competitive positioning.

These cumulative duties have triggered a strategic pivot toward domestic or near-shore production, with several industry participants evaluating partnerships with local chemical producers or establishing tolling agreements to secure tariff-free access to cellulose acetate and its derivatives. This reconfiguration is not without challenges, as domestic capacity expansion requires significant capital investment and careful alignment with environmental permitting regimes. Nevertheless, these shifts are creating a fertile environment for innovation in process intensification and feedstock diversification.

Simultaneously, the tariff environment has prompted a renewed focus on product formulation efficiency, driving R&D efforts to reduce polymer loading and maximize performance per unit of cellulose ester. Brands and converters are collaborating more closely to redesign product formulations, ensuring that sustaining performance thresholds can be met even amidst fluctuating input costs. Through these adaptations, the industry is forging a more agile supply chain architecture that can better absorb policy-driven shocks and anticipate future regulatory developments.

Unlocking Strategic Segmentation Perspectives Through a Comprehensive Examination of Types, Forms, End-Use Industries, and Application for Cellulose Esters

A nuanced understanding of cellulose ester segmentation is essential for identifying white space opportunities and tailoring market strategies. Within the type landscape, cellulose acetate, cellulose acetate butyrate, and cellulose acetate propionate each deliver distinct balances of rigidity, clarity, and thermal properties, informing product selection across high-performance applications. As such, formulators must weigh the trade-offs between processability and end-use performance when choosing the optimal type for their needs.

Form factors further diversify market possibilities, with flakes excelling in convenient melt homogeneity, granules offering streamlined dosing and handling for compounding operations, and powder facilitating fine dispersion in coatings and specialty applications. The choice among these forms directly influences operational parameters on extruders, mixers, or spray systems, highlighting the importance of aligning physical form with downstream processing technologies.

Diving into end-use industries reveals varied adoption profiles: agricultural films that require moisture regulation, automotive interior components demanding flame retardancy and tactile appeal, construction materials prized for fire safety and dimensional stability, packaging solutions needing barrier protection and regulatory compliance for food, industrial, and pharmaceutical segments, and textile fibers balancing durability with softness in both nonwoven and woven formats. Each vertical imposes its own performance matrix and regulatory constraints, calling for targeted product design.

Finally, application-focused insights underscore the multifaceted role of cellulose esters across fibers, films and coatings, membranes, and plastics. Nonwoven fibers find utility in filtration or hygiene, textile fibers in sustainable performance fabrics, while packaging films and protective coatings deliver moisture management or surface protection. Membrane technologies leverage cellulose ester chemistries for microfiltration, nanofiltration, and ultrafiltration tasks, and plastics-based processing methods such as injection molding and thermoforming expand opportunities for consumer and industrial components. Mastery of these segmentation dimensions enables market participants to prioritize investments and accelerate innovation cycles.

This comprehensive research report categorizes the Cellulose Esters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- End Use Industry

- Application

Exploring Critical Regional Dynamics and Market Drivers Impacting Cellulose Ester Adoption Across the Americas, EMEA, and Asia-Pacific Territories

Regional market dynamics are shaping divergent growth trajectories and competitive landscapes across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a combination of supportive agricultural policy frameworks and growing packaging innovation has fueled steady demand for cellulose ester commodities. North American converters have been particularly active in integrating these derivatives into flexible packaging lines, leveraging state-of-the-art extrusion and coating capabilities to meet regulatory requirements for food contact materials.

Within Europe, Middle East & Africa, stringent environmental regulations and ambitious circularity targets are driving demand for cellulose esters in high-barrier packaging and sustainable textile applications. The European Union’s emphasis on recycling-friendly materials has incentivized material suppliers to enhance the recyclability profiles of cellulose esters, while manufacturers in the Middle East are exploring membrane-based desalination projects to address water scarcity challenges.

Asia-Pacific remains a hotbed of production and consumption, supported by abundant biomass feedstocks and rapidly expanding manufacturing infrastructure. In China and India, cellulosic polymer plants are scaling up to support domestic and export markets, spurred by government incentives for bio-based materials. Meanwhile, Japan and South Korea continue to prioritize high-value applications such as advanced coating systems and precision membrane technologies, reflecting a shift toward specialized cellulose ester derivatives with premium performance attributes.

Collectively, these regional variations create a mosaic of opportunity for global players to tailor their offerings, forge strategic alliances, and optimize supply chain footprints. A deep appreciation for each region’s technical standards, regulatory demands, and consumption drivers is crucial for successfully navigating this multifaceted ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Cellulose Esters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Shaping the Competitive Landscape of Cellulose Ester Production and Sustainable Material Solutions

Leading participants in the cellulose ester arena are advancing proprietary technologies, optimizing production processes, and forging collaborative partnerships to fortify their market positions. One notable trend is the adoption of continuous processing platforms that reduce energy consumption and enhance product consistency, enabling scale-up of specialty grades tailored to high-performance applications. Several global chemical firms are also investing in downstream compounding and color-matching services to capture additional value and reduce time to market for converters.

Strategic joint ventures and licensing agreements have become common, as companies seek access to novel catalyst systems or bio-based solvent alternatives that lower environmental impact. Partnerships between feedstock suppliers and polymer producers are accelerating the development of next-generation cellulose derivatives, with co-located biorefinery models emerging in biomass-rich regions to ensure secure access to cellulose feedstocks.

On the innovation front, R&D pipelines are heavily focusing on improving the sustainability profile of cellulose esters through closed-loop solvent recovery systems and enhanced polymer recyclability. Moreover, leading players are deploying digital twins and advanced analytics to fine-tune reaction parameters and minimize batch variability. These capabilities not only strengthen quality control but also accelerate the commercialization of differentiated cellulose ester products.

Through these initiatives, market incumbents are not only defending existing revenue streams but also unlocking new growth horizons in segments such as medical filtration membranes, high-precision optical films, and advanced packaging formats. Their collective efforts are establishing higher technical and sustainability benchmarks that will guide the next phase of industry evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellulose Esters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- BASF SE

- Borregaard AS

- Borregaard AS

- Celanese Corporation

- Cerdia International GmbH

- Daicel Corporation

- DIC Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Holdings Corporation

- Rayonier Advanced Materials Inc.

- Rotuba Extruders Inc.

- Sappi Limited

- Sichuan Push Acetati Co., Ltd.

- Solvay SA

Strategic Imperatives and Actionable Pathways for Industry Leaders to Navigate Disruptions and Capitalize on Emerging Opportunities in Cellulose Esters

To navigate this dynamic environment and capitalize on emerging growth vectors, industry leaders must adopt a proactive, multi-pronged strategic approach. First, diversifying raw material sources through a blend of domestic production, strategic tolling arrangements, and alternative biomass feedstocks will enhance supply chain resilience against policy shifts and commodity volatility. Such measures should be complemented by investments in process intensification technologies, including continuous reactors and solvent recovery systems, which can drive down costs while supporting sustainability targets.

Second, forging deeper collaborations across the value chain-from biomass suppliers to brand owners-will be essential for aligning R&D roadmaps with market demands. Co-development partnerships can accelerate innovation cycles, enabling rapid introduction of custom cellulose ester grades for specialized applications. Concurrently, embedding circularity principles into product design through recyclability testing and life cycle assessment will position organizations to meet evolving regulatory benchmarks and consumer preferences.

Third, leveraging digitalization and Industry 4.0 frameworks can unlock operational excellence and faster time to market. Implementing advanced analytics, predictive maintenance, and digital twins can optimize plant performance and reduce batch variability. These initiatives should be reinforced by a comprehensive talent development strategy, ensuring that teams possess the cross-functional expertise needed to drive continuous improvement.

By executing these imperatives in concert, industry leaders will be well-placed to not only weather near-term disruptions but also to seize long-term opportunities in the rapidly evolving cellulose ester sector.

Robust Research Methodology Leveraging Multi-Dimensional Data Collection and Rigorous Analysis to Unveil Actionable Insights in Cellulose Ester Markets

This research employs a robust methodology grounded in both primary and secondary data collection to ensure comprehensive coverage and reliable insights. Primary research included in-depth interviews with over fifty industry stakeholders, spanning polymer producers, converters, brand owners, regulatory experts, and academic researchers, to capture nuanced perspectives on technological developments, market drivers, and supply chain challenges.

Secondary research leveraged a diverse array of reputable sources, including industry journals, patent databases, regulatory filings, and trade association publications, to assemble historical context and validate emerging trends. Data triangulation techniques were applied to reconcile information across multiple inputs, enhancing the overall accuracy of qualitative assessments. The analytical framework incorporated SWOT and PESTEL analyses to systematically evaluate internal capabilities against external market forces and regulatory environments.

Segmentation analysis followed a bottom-up approach, dissecting the market across type, form, end-use industry, and application dimensions to uncover granular intelligence and white space opportunities. Regional evaluation combined shipment data with policy mapping to elucidate growth differentials and competitive dynamics in the Americas, EMEA, and Asia-Pacific. Throughout the process, rigorous cross-verification protocols ensured that each insight reflects current realities and aligns with best practices in market research.

This methodology underpins the actionable nature of the findings and recommendations presented, providing stakeholders with a clear, empirically grounded roadmap for strategic decision-making in the cellulose ester domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellulose Esters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellulose Esters Market, by Type

- Cellulose Esters Market, by Form

- Cellulose Esters Market, by End Use Industry

- Cellulose Esters Market, by Application

- Cellulose Esters Market, by Region

- Cellulose Esters Market, by Group

- Cellulose Esters Market, by Country

- United States Cellulose Esters Market

- China Cellulose Esters Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Takeaways and Strategic Outlook for Continued Growth and Innovation in the Evolving Cellulose Ester Industry Ecosystem

Bringing together the analysis of technology trends, policy impacts, segmentation breakdowns, and competitive dynamics, a cohesive picture emerges: cellulose esters are poised to play an increasingly vital role in global material strategies. Their unique synergy of sustainable sourcing, performance versatility, and compatibility with existing manufacturing systems positions them as a go-to solution for brands and converters striving to meet environmental imperatives without compromising on quality.

The runway for growth is shaped by a confluence of forces-advancements in polymer modification, rising environmental regulations, trade policy fluctuations, and regional market nuances-that collectively create both challenges and opportunities. Companies that proactively address tariff-related cost pressures, integrate circularity into product design, and harness digital tools for operational excellence will differentiate themselves in this competitive landscape.

Moreover, strategic investments in domestic or near-shore capacity, coupled with collaborative R&D partnerships, will enable faster market response times and secure access to critical feedstocks. By aligning innovation roadmaps with the precise needs of key end-use sectors-whether high-barrier packaging, advanced membrane technologies, or specialty performance fibers-organizations can capture premium growth streams.

In sum, the cellulose ester market is at an inflection point, driven by transformative shifts that demand agile, forward-looking strategies. Stakeholders who embrace these dynamics and leverage the insights outlined in this research are well positioned to unlock sustainable competitive advantage and drive the next frontier of materials innovation.

Engage with Associate Director Ketan Rohom to Secure Your Cellulose Ester Market Research Report for Strategic Decision Making and Business Advantage

To explore in depth how cellulose esters can accelerate your strategic objectives and gain exclusive access to proprietary market insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of expertise in polymer market dynamics and is uniquely positioned to guide you through the intricacies of the cellulose ester landscape. By engaging directly, you will receive personalized support in understanding how the report’s findings align with your organization’s long-term initiatives and competitive priorities.

Connecting with Ketan will grant you detailed guidance on tailoring the report’s insights to your specific product portfolios or investment plans. Whether you are seeking to refine your supply chain strategies, evaluate partnership opportunities, or identify white space for innovation, Ketan can facilitate a tailored engagement that maximizes the report’s impact. Secure your copy today and transform high-level intelligence into actionable roadmap steps, driving sustainable growth and market leadership.

Don’t miss the opportunity to advance your business with this comprehensive analysis of cellulose ester technologies, applications, and market dynamics. Contact Ketan Rohom to discuss how this research can accelerate your decision-making and strengthen your competitive edge.

- How big is the Cellulose Esters Market?

- What is the Cellulose Esters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?