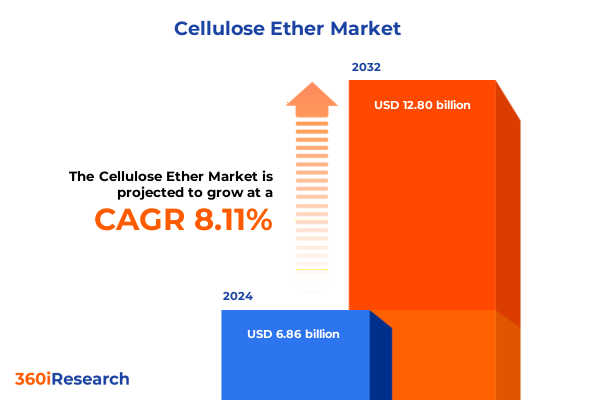

The Cellulose Ether Market size was estimated at USD 7.38 billion in 2025 and expected to reach USD 7.96 billion in 2026, at a CAGR of 8.16% to reach USD 12.80 billion by 2032.

Unveiling the Core Fundamentals of Cellulose Ether Chemistry and Its Foundational Role in Accelerating Multifunctional Industrial and Consumer Applications

Cellulose ether represents a versatile class of water-soluble polymers derived from cellulose, offering unique rheological, binding, and film-forming properties. At its core, these etherified cellulose derivatives exhibit tailored functional characteristics that can be finely adjusted by modifying substituent groups and polymer chain lengths. For example, Carboxymethyl Cellulose contributes exceptional viscosity and stability in aqueous media, whereas Hydroxyethyl Cellulose delivers superior thickening performance and clarity. Hydroxypropyl Methylcellulose combines thermal gelation and hydration control, and Methylcellulose serves as an efficient binder and emulsifier. This spectrum of chemistries creates a foundation for a wide range of performance attributes, from shear-thinning behavior in coatings to film integrity in pharmaceutical coatings.

Transitioning from fundamental chemistry to applied significance, cellulose ethers play an instrumental role across industrial formulations and consumer products. Their ability to modulate viscosity profiles, enhance water retention, and improve adhesion has positioned them as indispensable ingredients in sectors such as construction, personal care, and oilfield operations. In construction, they optimize mortar workability and tile adhesive consistency, while in personal care they enable stable gel textures and controlled release of actives. Moreover, the renewable nature of cellulose feedstock aligns with evolving sustainability goals, further amplifying their appeal. As regulatory bodies increasingly favor bio-based materials, cellulose ethers continue to stand out as a vital component that bridges performance with environmental responsibility.

Identifying Transformative Shifts in Cellulose Ether Market Dynamics Driven by Sustainability Initiatives and Innovative Formulation Technologies

Recent years have witnessed transformative shifts in the cellulose ether landscape, driven by a confluence of sustainability imperatives and technological breakthroughs. A major driver has been the push toward bio-based and renewable feedstocks, prompting manufacturers to explore novel cellulose sources such as agricultural residues and wood pulp certified by sustainable forestry initiatives. This trend has encouraged the adoption of greener processing techniques that minimize energy consumption and reduce solvent use, propelling the market toward a lower carbon footprint.

Simultaneously, formulation scientists have achieved significant advances in microencapsulation and nano-dispersion technologies, enabling cellulose ethers to deliver enhanced performance in demanding environments. Such innovations facilitate precise control of rheological properties, enabling ultra-fine film coatings in pharmaceuticals and stable drag-reducing additives in oilfield applications. Additionally, digitalization and machine learning tools are being integrated into process optimization, allowing for real-time monitoring of key parameters such as viscosity development and molecular weight distribution. As a result, manufacturers can achieve tighter quality control and accelerated time to market. In parallel, stricter regulatory frameworks surrounding volatile organic compounds and plasticizers have underscored the importance of inert cellulose-based thickeners, further cementing the role of cellulose ethers as a high-value, adaptive solution.

Analyzing the Cumulative Economic and Supply Chain Impact of Newly Implemented United States Tariffs on Cellulose Ether Imports in 2025

The implementation of new United States tariffs on cellulose ether imports in early 2025 has catalyzed a significant shift in cost structures and supply chain strategies for downstream processors. These measures, aimed at addressing concerns over unfair trade practices and supporting domestic producers, have introduced additional duties on key derivatives such as Carboxymethyl Cellulose and Hydroxypropyl Methylcellulose sourced from major exporting economies. As import costs rise, formulators are experiencing incremental price pressures, prompting them to reevaluate sourcing strategies and negotiate longer-term contracts to stabilize input costs.

In reaction to these tariffs, there has been a discernible trend toward regional reshoring of production capacities, particularly within North America. Several manufacturers have accelerated capital investment plans to expand local manufacturing of cellulose ethers, thereby reducing dependence on foreign supply and mitigating tariff-related cost escalations. At the same time, supply chain stakeholders are exploring alternative origins, including Southeast Asia and Eastern Europe, seeking favorable trade agreements or lower tariff brackets. This realignment of supply chains has also underscored the importance of agile logistics networks, as lead times and freight rates have become pivotal variables in total landed cost calculations. Consequently, businesses are investing in more integrated supply chain visibility tools to anticipate disruptions and optimize inventory levels.

Extracting Actionable Insights from Diverse Product Types Physical Forms Viscosity Grades Applications and Sales Channels within the Cellulose Ether Marketplace

The cellulose ether industry exhibits a rich diversity in product type, each offering distinct molecular structures and performance benefits. Formulators can select from Carboxymethyl Cellulose, Hydroxyethyl Cellulose, Hydroxypropyl Methylcellulose, or Methylcellulose to address targeted needs such as water retention, viscosity control, and thermal gelling properties. This granular segmentation extended by physical form encompasses Flake, Granule, and Powder morphologies. In particular, the Flake category is subdivided into Coarse Flake and Fine Flake, where particle size influences dissolution rate and rheological response.

Viscosity grade constitutes another critical segmentation axis, partitioning offerings into High Viscosity, Medium Viscosity, and Low Viscosity grades to accommodate everything from thick structural adhesives to thin film coatings. Application segmentation further highlights the versatility of cellulose ethers, which find use in Construction, Food & Beverages, Oil & Gas, Personal Care, and Pharmaceuticals. Within construction, these polymers specifically enhance Mortar and Tile Adhesives by improving workability, sag resistance, and bonding strength. Finally, the distribution landscape is characterized by two primary sales channels-Direct Sales to major formulators and Distributor Sales that provide localized access and value-added logistics. Together, these segmentation dimensions offer a comprehensive framework for understanding product positioning and market penetration.

This comprehensive research report categorizes the Cellulose Ether market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Physical Form

- Viscosity Grade

- Application

- Sales Channel

Comparative Regional Analysis of Cellulose Ether Adoption Trends and Growth Drivers Spanning the Americas EMEA and Asia Pacific Territories

A nuanced view of regional dynamics reveals that the Americas region remains a vital growth engine, propelled by substantial construction and infrastructure initiatives across North America and rising consumer demand in Latin America. In the United States, investments in renewable energy and water management infrastructures have increased the uptake of cellulose ether technologies in specialty applications, while Mexico and Brazil are leveraging agricultural cellulose feedstocks to produce locally relevant grades.

Turning to Europe, Middle East & Africa, stringent sustainability regulations in the European Union have spurred innovation in bio-based formulations, leading to advanced cellulose ether products with reduced environmental impact. Concurrently, Middle Eastern oil & gas projects have driven demand for high-performance grades tailored to extreme-temperature drilling fluids. In Africa, infrastructure development and rising pharmaceutical manufacturing capacities create pockets of emerging demand.

Asia-Pacific demonstrates a complex balance of mature and high-growth markets. China and India continue to expand domestic production capabilities, supported by government incentives for chemical manufacturing and renewable materials. Japan and South Korea remain innovation hubs, focusing on ultra-pure grades for electronics and advanced pharmaceuticals. Meanwhile, Southeast Asian economies are optimizing cellulose ether supply chains to serve regional markets more efficiently, leveraging preferential trade agreements and cost-effective production methods.

This comprehensive research report examines key regions that drive the evolution of the Cellulose Ether market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning and Competitive Advantages of Leading Global Manufacturers in the Evolving Cellulose Ether Industry Landscape

Leading global manufacturers have strategically positioned themselves to capture the evolving opportunities within the cellulose ether landscape. One major player has concentrated on vertical integration, securing upstream cellulose feedstocks and investing in downstream specialty formulation capabilities. This dual approach ensures consistent raw material supply while enabling rapid innovation cycles for advanced product launches. Another prominent producer has focused on sustainability differentiation by offering third-party certifications and transparent supply chain traceability, which resonate strongly with environmentally conscious end users.

Collaborative ventures between specialty chemical companies and academic institutions are also reshaping competitive dynamics. These partnerships enable the development of next-generation cellulose ether derivatives with tailored molecular architectures, optimized for emerging applications such as smart coatings and responsive hydrogels. In parallel, several manufacturers are pursuing co-development agreements with leading formulators in personal care and pharmaceuticals, granting them privileged access to application insights and accelerating time to market. Additionally, key players are expanding regional footprints via strategic acquisitions of local blending facilities, ensuring proximity to growth markets and enhanced responsiveness to shifting demand patterns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellulose Ether market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- China Ruitai International Holdings Co., Ltd.

- Colorcon Inc.

- CP Kelco U.S., Inc.

- Daicel Corporation

- Dai‑Ichi Kogyo Seiyaku Co., Ltd.

- DKS Co., Ltd.

- Fenchem Biotek Ltd.

- Hebei Jiahua Cellulose Co., Ltd.

- Henan Tiansheng Chemical Industry Co., Ltd.

- Hercules Inc.

- J.M. Huber Corporation

- J. Rettenmaier & Söhne GmbH + Co. KG

- Lamberti S.p.A.

- LOTTE Fine Chemical Co., Ltd.

- Qingdao Tianya Chemical Co., Ltd.

- Reliance Cellulose Products Ltd.

- SE Tylose GmbH & Co. KG

- Shandong Head Co., Ltd.

- Shanghai Ever Bright Chemical Co., Ltd.

- Shin‑Etsu Chemical Co., Ltd.

- The Dow Chemical Company

- Weifang Lude Chemical Co., Ltd.

- Zhejiang Kehong Chemical Co., Ltd.

Formulating Actionable Strategic Recommendations to Strengthen Market Position Enhance Innovation Pipelines and Optimize Supply Chains in the Cellulose Ether Sector

Industry leaders must embrace a multifaceted approach to sustain and grow their market positions amid accelerating change. First, investing substantially in R&D to develop bio-based and biodegradable cellulose ether variants can unlock new application areas and fortify environmental credentials. This includes exploring novel derivatization techniques that enhance functional properties without compromising biodegradability. Second, companies should diversify their supply chains by establishing multiple production sites across different trade zones to mitigate the risk of tariffs and geopolitical disruption. Strengthening relationships with regional distributors and leveraging digital platforms for inventory management will further enhance supply chain resilience.

Furthermore, integrating data analytics and process-automation tools into production workflows can significantly reduce cycle times and improve quality consistency. Adopting advanced digital twins and machine-learning-driven process control allows manufacturers to optimize reaction parameters in real time, driving both efficiency and sustainability. Lastly, forging strategic alliances with downstream end users, particularly in high-growth sectors such as personal care and pharmaceuticals, can secure early customer insights and co-create bespoke solutions. By aligning innovation pipelines with customer roadmaps, industry leaders will be better positioned to anticipate shifts in demand and deliver value-added products ahead of competitors.

Detailing a Robust MultiStage Research Methodology Integrating Primary Interviews Secondary Research and Rigorous Data Validation for Cellulose Ether Insights

The research framework underpinning this analysis integrates both quantitative and qualitative methodologies to ensure comprehensive and reliable insights. Secondary research commenced with a thorough review of publicly available technical papers, industry association publications, and regulatory filings to map the chemical and application landscape. This desk research phase provided foundational understanding of cellulose ether chemistries, sustainability initiatives, and macroeconomic factors influencing regional markets.

Complementing this, an extensive primary research program was executed, involving in-depth interviews with senior executives at leading specialty chemical manufacturers, formulation experts at global end-user companies, and supply chain management authorities. These discussions explored dynamic market drivers, emerging technology trends, and the operational impact of new trade policies. All findings underwent rigorous triangulation and validation against multiple independent sources, including proprietary technical databases and market intelligence platforms. Finally, advanced analytical techniques such as scenario analysis and sensitivity testing were employed to evaluate the robustness of key insights and to identify potential risk factors, ensuring that the conclusions presented here are both actionable and defensible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellulose Ether market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellulose Ether Market, by Product Type

- Cellulose Ether Market, by Physical Form

- Cellulose Ether Market, by Viscosity Grade

- Cellulose Ether Market, by Application

- Cellulose Ether Market, by Sales Channel

- Cellulose Ether Market, by Region

- Cellulose Ether Market, by Group

- Cellulose Ether Market, by Country

- United States Cellulose Ether Market

- China Cellulose Ether Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and ForwardLooking Perspectives to Provide a Cohesive Conclusion on the Future Trajectory of the Cellulose Ether Industry

Bringing together the chemical fundamentals, market disruptors, trade policy ramifications, segmentation insights, regional nuances, and competitive landscapes reveals a cohesive narrative: cellulose ether continues to evolve as a critical enabler of high-performance formulations across diverse industries. The growing emphasis on sustainable feedstocks and bio-based processing underscores a clear trajectory toward greener products, while digitalization and advanced analytics are unlocking new dimensions of quality control and process efficiency.

Regional analyses confirm that strategic diversification of production and distribution networks will be essential for navigating tariff-driven cost changes and geopolitical shifts. Moreover, collaborative innovation between manufacturers and end users is accelerating the development of specialty grades tailored to emerging application demands. Collectively, these dynamics point to a future in which cellulose ether not only maintains its core roles but also expands into novel technology domains such as smart materials and responsive hydrogels. By synthesizing these findings, decision makers can chart a path forward that balances performance, sustainability, and resilience in the rapidly transforming cellulose ether industry.

Engage Directly with Industry Expert Ketan Rohom to Secure Comprehensive Cellulose Ether Market Research Insights and Drive Strategic Decision Making Today

Are you ready to translate deep market insights into actionable strategies and transformative growth opportunities? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the comprehensive cellulose ether market research report. Ketan’s deep understanding of formulation requirements and supply chain dynamics ensures that your organization will receive personalized guidance tailored to its unique strategic objectives. By connecting with Ketan, you can secure detailed intelligence on product innovations, regional trends, and regulatory shifts, enabling you to make data-driven decisions with confidence. Engage with an expert who can clarify complex market nuances, outline key competitive moves, and highlight emerging opportunities before they become mainstream. Whether you are evaluating new product development, optimizing sourcing strategies, or exploring untapped geographic segments, Ketan provides the resolution and support needed to navigate the evolving cellulose ether landscape. Don’t miss the opportunity to elevate your competitive advantage; contact Ketan Rohom today and invest in the insights that will power your next phase of growth.

- How big is the Cellulose Ether Market?

- What is the Cellulose Ether Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?