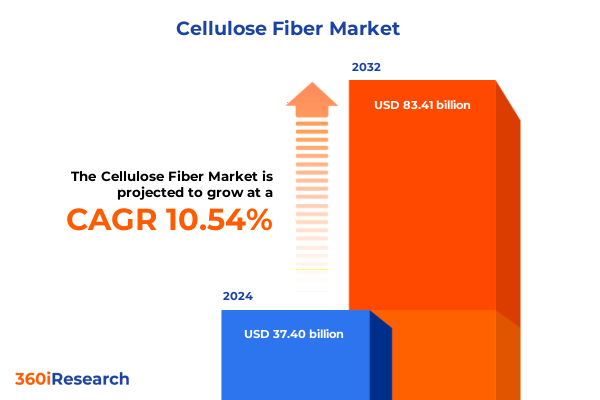

The Cellulose Fiber Market size was estimated at USD 41.03 billion in 2025 and expected to reach USD 45.01 billion in 2026, at a CAGR of 10.66% to reach USD 83.41 billion by 2032.

Unveiling the Foundations of Cellulose Fiber Market Dynamics and Strategic Imperatives for Stakeholders Navigating Global Shifts

The cellulose fiber market sits at the confluence of natural resource management, technological innovation, and evolving consumer preferences. As the world shifts toward sustainable materials, regenerated and specialty cellulose fibers have emerged as pivotal solutions, offering both environmental benefits and versatile performance attributes. Over the past several years, strategic investments and R&D breakthroughs have accelerated the adoption of these fibers, particularly lyocell, modal, and viscose rayon, across textile, nonwoven, and industrial applications. This momentum is underpinned by growing regulatory scrutiny on carbon emissions, water usage, and chemical inputs, prompting stakeholders to reevaluate traditional synthetic and cotton-based fibers in favor of renewable alternatives.

In response to these dynamics, leading fiber producers have ramped up their commitments to circularity, integrating post-consumer textile recycling and closed-loop manufacturing processes within their operations. Notably, capacity expansions in Asia, Europe, and North America reflect a collective industry move to diversify supply chains and enhance regional self-sufficiency. Concurrently, major end-use markets-from apparel brands to hygiene product manufacturers-are intensifying their focus on traceability and responsible sourcing, further elevating cellulose fibers as a strategic differentiator. Against this backdrop, a comprehensive analysis of market drivers, supply chain shifts, and emerging trade policies is essential for executives aiming to optimize sourcing decisions and align growth strategies with sustainability imperatives.

Examining the Transformational Forces Reshaping the Cellulose Fiber Ecosystem from Technological Breakthroughs to Sustainability and Supply Chain Evolution

In recent years, the cellulose fiber sector has undergone a profound transformation driven by technological breakthroughs and the urgency of environmental stewardship. Transitioning from traditional viscose manufacturing, industry pioneers have introduced novel solvent-spinning processes that significantly reduce chemical waste and energy usage. For example, the development of lyocell production lines featuring closed-loop solvent recovery has set a new benchmark for eco-efficiency, enabling producers to reclaim up to 99 percent of the processing solvents in a single cycle. Similarly, innovations in waterless and low-impact dyeing technologies are mitigating one of the most resource-intensive stages of textile manufacturing, as demonstrated by partnerships between fiber producers and dyeing specialists that have achieved water consumption reductions of up to 95 percent.

Moreover, strategic collaborations across the value chain are accelerating the transition to a circular economy. Pilot projects integrating textile-to-textile recycling are now scaling toward industrial viability, with several suppliers co-developing feedstock recovery systems to transform post-consumer garments into regenerated fibers. At the same time, digital traceability platforms leveraging blockchain and IoT-enabled tracking devices are enhancing transparency from forest to final product, reaffirming brand commitments to environmental and social compliance. Taken together, these transformative shifts underscore a sector-wide pivot toward sustainable growth models and a redefinition of competitive advantage based on ecological performance and supply chain resilience.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Cellulose Fiber Supply Chains Cost Structures and Industry Realignment Strategies

The introduction of U.S. tariffs in early 2025 has exerted marked pressure on cellulose fiber supply chains and cost structures across multiple segments of the industry. First announced on February 1, the administration imposed a 25 percent duty on imports from Canada and Mexico alongside an additional 10 percent tariff on goods of Chinese origin. Although the Mexican and Canadian duties were briefly paused for 30 days, the resumption on March 4 reinstated trade barriers that disrupted established cross-border flows of pulp and intermediates critical to fiber production. As domestic pulp mills recalibrated their procurement strategies, the industry faced logistical bottlenecks, prompting manufacturers to accelerate inventory replenishment earlier than planned and, in turn, inflate working capital requirements.

Consequently, major consumer goods companies reported significant cost pressures in Q1. One global personal care manufacturer disclosed roughly $300 million in additional tariff-related expenses for 2025, leading to a revision of its profit outlook and signaling that supply chain cost inflation was more pervasive than anticipated. In parallel, pulp exporters in Brazil recorded a 20 percent year-over-year decline in U.S.-bound shipments during April, attributing much of the drop to the tariff-induced uncertainty in pricing and contract execution. Meanwhile, downstream firms in the printing and packaging sectors, reliant on uncoated paperboard and specialty fibers, announced planned price increases for April to absorb the additional duties and protect their margins. In light of these developments, U.S. stakeholders are exploring alternative sourcing corridors, supply chain diversification, and potential reshoring initiatives to stabilize input costs and maintain market competitiveness.

Deriving Key Insights from Segment Analysis Covering Fiber Type Form Source Material and Application Perspectives Driving Market Pathways

A nuanced understanding of market segmentation is critical for identifying the distinct value propositions and growth trajectories within the cellulose fiber domain. Fiber types such as acetate, lyocell, modal, and viscose rayon each offer unique performance profiles, spanning moisture management and tensile strength characteristics that appeal to specific end-use categories. While lyocell fibers have gained traction in premium apparel and nonwoven hygiene applications due to their inherent softness and high wet strength, modal continues to serve as a versatile option for everyday wear, leveraging its wrinkle resistance and breathability. Advances in acetates have preserved their niche in luxury textiles and specialty film applications, whereas viscose rayon remains a cost-effective choice for high-volume home textiles and technical fabrics.

In terms of form factor, filament fibers command a presence in high-performance textiles where continuous length and uniformity deliver superior fabric aesthetics and mechanical properties, whereas staple fibers underpin staple-spun yarns commonly found in casual apparel and industrial felts. Source materials also define market segments: bacterial cellulose finds application in biomedical substrates and cosmetics, cotton linter serves as a refined feedstock for cellulose derivatives, recycled cellulose fosters circularity within nonwoven and hygiene markets, and wood pulp remains the foundational raw material for most viscose and lyocell lines. Across applications, the spectrum ranges from fashion and performance apparel to automotive interiors, home décor, industrial filters, and single-use nonwovens. Recognizing these segmentation nuances empowers businesses to tailor product development roadmaps, refine positioning strategies, and align capacity investments with evolving demand signals.

This comprehensive research report categorizes the Cellulose Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Form

- Source Material

- Application

Analyzing Regional Trends in the Americas EMEA and AsiaPacific to Reveal Strategic Opportunities and Growth Drivers in the Cellulose Fiber Landscape

Regional dynamics continue to shape the competitive landscape of the cellulose fiber industry, with each geography presenting distinct strategic implications. In the Americas, robust demand anchored by well-established apparel and hygiene sectors has spurred local initiatives to enhance supply chain security and reduce lead times. Regional pulp capacity expansions coupled with closer integration between North American mills and downstream converters aim to mitigate the impact of global trade uncertainty and fulfill sustainability commitments to domestic consumers.

Meanwhile, Europe, the Middle East, and Africa have emerged as hotbeds for sustainable innovation, bolstered by stringent environmental regulations and strong policy incentives for circular bioeconomy models. European market leaders are pioneering integrated biorefineries that co-produce cellulose fibers, lignin-based co-products, and bioenergy, thereby unlocking new value streams and reducing waste outputs. The Middle East’s investments in advanced manufacturing hubs, often powered by renewable energy sources, are positioning the region as a future center for midstream fiber processing and nonwoven technologies.

Across Asia-Pacific, production capacity continues its rapid ascent, driven by favorable feedstock availability, low-cost labor, and government-backed industrial upgrading programs. China, in particular, has witnessed the commissioning of multiple large-scale lyocell facilities, while Southeast Asian nations are leveraging abundant biomass resources to scale sustainable fiber production. This regional cluster effect not only intensifies competition but also offers opportunities for global players to establish strategic alliances and joint ventures that accelerate market access and technology transfer.

This comprehensive research report examines key regions that drive the evolution of the Cellulose Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Dynamics Among Leading Cellulose Fiber Producers Highlighting Innovation Sustainability and Capacity Expansion Strategies for Market Leadership

The competitive arena of cellulose fiber production is defined by a handful of vertically integrated organizations and agile specialty providers advancing distinct value propositions. Lenzing AG stands out for its science-based net-zero commitment and pioneering role in sustainable fiber innovation. At Hannover Messe 2025, the company showcased its CELLFIL project and glacier protection-textile recycling initiative, underlining its dedication to circularity and climate action. Its 2024 Annual and Sustainability Report further highlighted significant investments in biomass power, photovoltaic installations, and wastewater treatment upgrades across European and Asian production sites, reflecting a holistic approach to emissions reduction and resource optimization.

Similarly, Sateri Group has made rapid strides toward capacity leadership in lyocell, commencing operations of its phase II 150 kiloton per annum fiber line in Changzhou in June 2025, which cemented its status as a global top-tier producer. The company’s EcoCosy and FINEX recycled fiber offerings underscore its strategic focus on sustainability-driven product differentiation. By aligning expansion plans with national green development policies and forging partnerships across the value chain, Sateri is positioning itself to meet surging demand for eco-friendly textiles and nonwoven substrates. These strategic maneuvers by Lenzing and Sateri exemplify how scale, technology leadership, and environmental stewardship converge to define market leadership in the cellulose fiber sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellulose Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bacterial Cellulose Solutions

- Birla Cellulose

- Bisley International LLC

- Celotech Chemical Co., Ltd.

- CFF GmbH & Co. KG

- Daicel Corporation

- Eastman Chemical Company

- Fulida Group Holding Co. Ltd.

- Grasim Industries Limited

- Heliaks (opc) Private Limited

- Ioncell Oy

- JELU-WERK J. Ehrler GmbH & Co. KG

- Jiangxi Hebang Fiber Co., Ltd.

- Kelheim Fibres GmbH

- Madhu Hydrocolloids Pvt. Ltd.

- Maple Biotech Pvt. Ltd.

- MCA International

- Nabco Microtech

- Rayonier Advanced Materials Inc.

- Sakshi Chem Sciences Private Limited

- Sappi Limited

- Sateri Holdings Limited

- Tangshan Sanyou Group Xingda Chemical Fiber Co. Ltd.

- The Lenzing Group

- Weyerhaeuser Co.

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Sustainable Innovation Efficiency Improvements and Strategic Partnerships in Cellulose Fiber

To navigate the rapidly evolving landscape and secure a leadership position, industry stakeholders should prioritize several strategic actions. First, investing in closed-loop processing technologies for both fiber spinning and finishing will minimize environmental impact and differentiate offerings in sustainability-conscious markets. Collaboration with cross-functional R&D consortia and academic institutions can accelerate the development of next-generation solvent and water recovery systems, yielding operational efficiencies and regulatory goodwill.

Second, companies must diversify supply chain footprints to buffer against trade policy fluctuations and geopolitical risks. Establishing regional conversion facilities and forging local feedstock sourcing partnerships will reduce logistical bottlenecks and enhance agility in responding to tariff changes. Simultaneously, strengthening relationships with key raw material suppliers through long-term agreements can lock in competitive cost structures while promoting traceability and responsible sourcing practices.

Lastly, forging strategic alliances with leading apparel brands, nonwoven converters, and technology incubators will foster co-innovation and open new application corridors. By leveraging digital traceability platforms and sustainability certification frameworks, market participants can align product portfolios with consumer expectations for transparency and circularity. Moreover, tailored go-to-market strategies-prioritizing high-growth segments such as performance apparel, hygiene nonwovens, and bio-based composites-will position organizations to capture disproportionate value as end-use demand shifts toward premium, eco-friendly solutions.

Detailing the Rigorous Research Methodology Employed Including Data Collection Validation Framework and Analytical Techniques Ensuring Robust Insights

This analysis synthesizes qualitative and quantitative insights derived from a multi-faceted research methodology encompassing primary and secondary data collection, expert interviews, and rigorous validation protocols. Initially, a comprehensive review of industry publications, peer-reviewed journals, trade association reports, and regulatory filings established the macroeconomic and policy context. Subsequently, over twenty structured interviews were conducted with representatives from leading fiber manufacturers, converters, brand owners, and sustainability consultancies to capture firsthand perspectives on market drivers and technological advancements.

To ensure analytical robustness, key data points underwent triangulation against third-party databases, including import-export customs statistics and proprietary sustainability metrics. Scenario analyses evaluated the potential impact of trade policy developments, capacity expansion timelines, and emerging feedstock innovations. Finally, cross-validation workshops with subject matter experts refined the interpretations and highlighted strategic inflection points. Throughout the process, adherence to ethical research principles and transparent documentation of data sources underpinned the credibility of findings, equipping decision-makers with actionable intelligence to guide strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellulose Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellulose Fiber Market, by Fiber Type

- Cellulose Fiber Market, by Form

- Cellulose Fiber Market, by Source Material

- Cellulose Fiber Market, by Application

- Cellulose Fiber Market, by Region

- Cellulose Fiber Market, by Group

- Cellulose Fiber Market, by Country

- United States Cellulose Fiber Market

- China Cellulose Fiber Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Cellulose Fiber Market Evolution Highlighting Strategic Imperatives and the Path Forward for Stakeholders in a Dynamic Environment

As the cellulose fiber market navigates the twin imperatives of sustainability and supply chain resilience, stakeholders are compelled to adapt and innovate continuously. The convergence of advanced manufacturing technologies, circularity frameworks, and dynamic trade environments presents both challenges and unprecedented opportunities. Organizations that proactively align their operations with stringent environmental standards and cultivate diversified sourcing networks will not only insulate themselves from policy volatility but also unlock new growth vectors in high-value segments.

Looking ahead, the integration of digital traceability, bio-based co-products, and emerging feedstock streams such as recycled textiles and bacterial cellulose is set to redefine competitive landscapes. By embracing a holistic value chain perspective and fostering collaborative ecosystems, industry participants can chart a course toward a more sustainable, resilient, and profitable future. Ultimately, the ability to marry strategic foresight with operational excellence will distinguish market leaders from followers, shaping the evolution of the cellulose fiber sector in the years to come.

Engaging with Ketan Rohom to Secure Comprehensive Cellulose Fiber Market Analysis and Transform Strategic Decision Making through Tailored Market Research Solutions

For industry professionals seeking an in-depth, actionable understanding of the cellulose fiber landscape and its strategic inflection points, connecting with Ketan Rohom will unlock tailored insights and support your organization’s innovation and growth agendas. By engaging directly, you gain early access to customized market intelligence, priority briefing sessions, and expert guidance to refine your commercial strategies and navigate evolving trade environments.

Act now to secure unparalleled expertise and empower your team with the data-driven foresight necessary to capitalize on emerging opportunities, mitigate supply chain risks, and drive sustainable value creation. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to learn how our comprehensive market research report can be instrumental in shaping your competitive advantage and fulfilling your business objectives.

- How big is the Cellulose Fiber Market?

- What is the Cellulose Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?