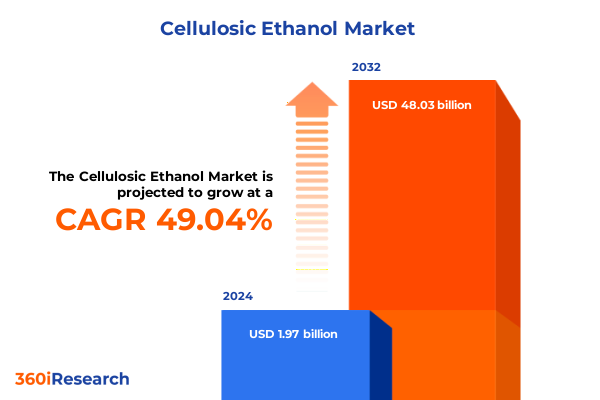

The Cellulosic Ethanol Market size was estimated at USD 2.92 billion in 2025 and expected to reach USD 4.33 billion in 2026, at a CAGR of 49.16% to reach USD 48.03 billion by 2032.

Examining the Evolution, Environmental Benefits, and Strategic Importance of Cellulosic Ethanol in the Modern Renewable Energy Landscape

Cellulosic ethanol represents a pivotal advancement in the quest for sustainable energy solutions, drawing upon the complex structure of lignocellulosic biomass to produce renewable fuel at scale. Originating from agricultural residues, forestry byproducts, and dedicated energy crops, this technology evolved from laboratory breakthroughs to commercial demonstration plants in under two decades. Early pilot efforts laid the foundation for continuous improvements in pretreatment, hydrolysis, and fermentation processes that now enable the conversion of non-food biomass into high-value bioethanol at commercial volumes. Transitioning from concept to reality, these advancements underscore the strategic importance of cellulosic ethanol to national energy independence and climate objectives.

Mapping the Transformational Policy, Technological, and Market Shifts Reshaping the Future of Cellulosic Ethanol Production Worldwide

The cellulosic ethanol industry is undergoing transformative shifts driven by converging policy incentives, technological breakthroughs, and market dynamics. Recent extensions of the Clean Fuel Production Tax Credit through 2029 have narrowed eligibility to North American feedstocks, enhancing regional supply-chain resilience and cost competitiveness. Concurrently, innovations in dilute acid and enzymatic hydrolysis techniques, coupled with steam explosion and supercritical hydrolysis pretreatments, have driven down processing times and enzyme usage, thus lowering production costs. Meanwhile, public–private partnerships are unlocking financing for advanced biorefineries, with private investment in low-emissions fuels projected to exceed $25 billion this year, a 30 percent increase over last year. These combined forces are redefining the competitive landscape, compelling established producers and new entrants alike to adopt integrated biorefinery models, diversify feedstock portfolios, and pursue collaboration across the value chain.

Assessing How New U.S. Tariff Regimes Enacted in 2025 Are Altering Trade Dynamics, Cost Structures, and Competitive Forces in Cellulosic Ethanol Markets

The onset of new tariff measures in 2025 has introduced notable complexity to the United States cellulosic ethanol market, altering both input costs and trade flows. A 10 percent baseline tariff on all ethanol imports has elevated feedstock prices for processors reliant on biomass from Canada and Brazil, while Brazil’s calls for reciprocity underscore growing trade tensions. In response, domestic producers are reassessing supply agreements, shifting toward locally sourced corn stover and agricultural residues to mitigate import duties. Simultaneously, export-oriented refineries face contracting margins as retaliatory threats from trading partners cast uncertainty on international offtake. These evolving trade barriers are reshaping strategies across the sector, prompting companies to invest in feedstock logistics optimization, regional alliance-building, and advocacy for bilateral trade negotiations to restore tariff parity.

Uncovering Critical Feedstock, Technology, Application, and Production Scale Segmentation Insights That Drive Strategic Decision Making in Cellulosic Ethanol Investments

Feedstock diversity lies at the heart of strategic investment decisions in the cellulosic ethanol industry, encompassing agricultural residues such as corn stover, rice husk, sugarcane bagasse, and wheat straw alongside hybrid energy crops like poplar, miscanthus, and switchgrass. Commercial projects increasingly integrate forestry residues including bark and logging byproducts, while industrial waste streams such as pulp and paper sludge and spent liquors present complementary feedstock options. Meanwhile, municipal solid waste fractions-ranging from organic material to yard debris and paper fibers-offer additional volume and circular-economy benefits. In parallel, leading biorefineries deploy a range of conversion technologies, from dilute acid and enzymatic hydrolysis to gasification paired with Fischer-Tropsch synthesis, further augmented by steam explosion or supercritical treatment steps. Across applications, cellulosic ethanol serves as a versatile feedstock for bio-based chemicals and solvents, a low-carbon input for power generation, and a high-octane component in transportation fuel blends spanning E10, E85, and E100 formats. Finally, production scales vary from small demonstration units to medium-scale modular plants and large-scale industrial complexes, with each scale delivering distinct trade-offs in capital intensity, feedstock logistics, and local economic impact.

This comprehensive research report categorizes the Cellulosic Ethanol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock

- Technology

- Production Scale

- Application

Highlighting Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific That Define Growth Opportunities and Challenges for Cellulosic Ethanol

Regional dynamics exert a decisive influence on the strategic opportunities and operational challenges confronting cellulosic ethanol stakeholders. In the Americas, robust policy frameworks such as the Renewable Fuel Standard and extended tax credits underpin the expansion of biomass supply chains across the Midwest and Western Canada, where proximity to feedstock sources and established infrastructure lower logistics costs and enable rapid scale-up. Conversely, the Europe, Middle East & Africa region navigates a nuanced policy environment characterized by binding carbon intensity mandates, incentives for advanced biofuels, and evolving waste-to-energy regulations, prompting pilots that integrate municipal solid waste with crop residues. In the Asia-Pacific, governments in Indonesia and Vietnam are accelerating blend mandates for ethanol and biodiesel, spurring nascent cellulosic projects that leverage abundant agricultural residues and forestry byproducts. Yet, supply chain fragmentation, land-use considerations, and evolving sustainability criteria introduce complexity, requiring dynamic market entry strategies and region-specific partnerships to capture growth in each geography.

This comprehensive research report examines key regions that drive the evolution of the Cellulosic Ethanol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Initiatives Driving Innovation, Scale Deployment, and Market Leadership in the Cellulosic Ethanol Sector

Leading organizations in the cellulosic ethanol sector are distinguished by their integrated value-chain approaches, proprietary technology platforms, and strategic alliances. The joint venture of POET and DSM at the Emmetsburg, Iowa facility has demonstrated sustained operations at up to 25 million gallons per year of ethanol from corn stover, underscoring the commercial viability of enzymatic hydrolysis at scale. Abengoa’s Hugoton, Kansas biorefinery, co-funded by the Department of Energy, processes over 325,000 dry tons of mixed agricultural residues into 25 million gallons annually while generating 21 MW of renewable electricity, exemplifying industrial symbiosis and energy self-sufficiency. Emerging entrants such as LanzaTech are advancing gas fermentation pathways for cellulosic feedstocks, while enzyme innovators like Novozymes and Iogen refine hydrolytic efficiency, collectively driving down production costs and accelerating deployment. Collaborative research alliances with national laboratories, strategic offtake agreements, and targeted capital investments further distinguish these market leaders as architects of tomorrow’s cellulosic ethanol value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cellulosic Ethanol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abengoa Bioenergy New Technologies S.A.

- Aemetis, Inc.

- American Process, Inc.

- Beta Renewables S.p.A.

- BlueFire Renewables, Inc.

- Borregaard ASA

- Clariant AG

- COFCO Corporation

- DuPont de Nemours, Inc.

- Enerkem Inc.

- Fiberight LLC

- GranBio Investimentos S.A.

- Inbicon A/S

- INEOS Bio Innovene LLC

- Iogen Corporation

- LanzaTech, Inc.

- Longlive Bio‑Technology Co. Ltd.

- Mascoma LLC

- Novozymes A/S

- POET LLC

- Raízen SA

- Synata Bio

- Verbio Vereinigte BioEnergie AG

- Versalis

- ZeaChem, Inc.

Crafting Actionable Strategic Recommendations to Guide Industry Leaders Through Regulatory Complexities, Technological Adoption, and Supply Chain Optimization

To navigate the evolving cellulosic ethanol landscape, industry leaders should prioritize strategic actions that address regulatory headwinds, technological maturation, and supply chain resilience. First, proactive engagement with policymakers at both federal and state levels will help shape stable long-term mandates, tariffs, and tax incentives that underpin investment certainty. Next, deploying integrated preprocessing hubs near feedstock sources will lower transportation costs and improve biomass quality, enabling more predictable plant operations. Concurrently, pursuing incremental improvements in enzyme efficiency and co-product valorization-such as biogas or bio-electricity generation-can bolster profitability and reduce risk. Additionally, forging consortium-based offtake agreements with end-users in power generation and chemicals will secure market access across applications. Finally, fostering public–private research partnerships to pilot next-generation technologies such as consolidated bioprocessing and catalytic conversion will position companies at the forefront of cost reduction and performance breakthroughs.

Detailing the Rigorous Research Approach Including Data Sources, Analytical Frameworks, and Quality Assurance Processes Underpinning This Cellulosic Ethanol Study

This study employs a robust methodological framework combining primary interviews with key stakeholders, proprietary data modeling, and extensive secondary research from regulatory filings and industry publications. Quantitative analysis integrates plant-level performance metrics, tariff schedules, and tax credit structures to evaluate cost-competitiveness across feedstocks, technologies, and geographies. Qualitative insights derive from expert consultations with process engineers, feedstock aggregators, and policy analysts to capture emerging trends and risk factors. The research synthesizes findings through scenario mapping and sensitivity analyses to assess the impact of tariff changes, policy shifts, and feedstock price volatility. Rigorous validation protocols, including cross-referencing with publicly available data and peer review by an advisory panel of industry veterans, ensure the credibility and relevance of conclusions drawn in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cellulosic Ethanol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cellulosic Ethanol Market, by Feedstock

- Cellulosic Ethanol Market, by Technology

- Cellulosic Ethanol Market, by Production Scale

- Cellulosic Ethanol Market, by Application

- Cellulosic Ethanol Market, by Region

- Cellulosic Ethanol Market, by Group

- Cellulosic Ethanol Market, by Country

- United States Cellulosic Ethanol Market

- China Cellulosic Ethanol Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesis of Key Insights on the Strategic Implications, Industry Outlook, and Sustainability Impacts of Cellulosic Ethanol in the Transition to Low Carbon Economies

The maturation of cellulosic ethanol technologies, supported by expanding policy incentives and investor interest, heralds a new era for advanced biofuels in global energy portfolios. Despite challenges posed by evolving tariff regimes and feedstock logistics, the industry’s momentum is evident in active deployment of commercial-scale biorefineries and growing collaboration among technology providers and feedstock suppliers. As cellulosic ethanol projects achieve economies of scale and cost parity approaches, the fuel’s role in transport decarbonization, power generation, and chemical feedstock applications will become increasingly pronounced. Ultimately, the strategic interplay of regulatory stability, technological innovation, and regional market development will determine the trajectory of cellulosic ethanol as a cornerstone of decarbonized energy systems.

Engage with Our Associate Director to Access Exclusive Market Intelligence and Propel Your Strategic Decisions in Cellulosic Ethanol

Don’t miss the opportunity to gain a competitive edge with our comprehensive market research insights on cellulosic ethanol. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions that align with your strategic objectives and investment priorities. Our team is ready to guide you through our detailed findings, answer your questions, and facilitate access to the full report so you can make informed decisions that drive growth and innovation within your organization.

- How big is the Cellulosic Ethanol Market?

- What is the Cellulosic Ethanol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?