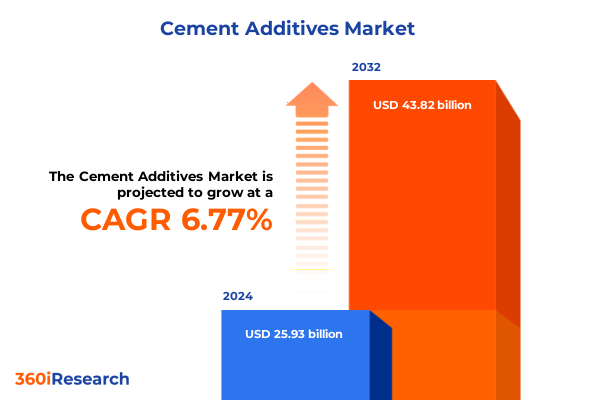

The Cement Additives Market size was estimated at USD 27.59 billion in 2025 and expected to reach USD 29.37 billion in 2026, at a CAGR of 6.82% to reach USD 43.82 billion by 2032.

Unveiling the Pivotal Role of Advanced Cement Additives in Redefining Concrete Performance and Sustainability Strategies for Next-Generation Construction

The cement additive market has emerged as a critical enabler in addressing the dual challenges of enhanced concrete performance and environmental stewardship. As global infrastructure development accelerates, industry leaders are under mounting pressure to deliver high-strength, durable structures while mitigating the carbon footprint of production. The sector’s evolution is driven by an imperative to optimize concrete workability, accelerate setting times in harsh climates, and extend service lifespans-all under the watchful eye of stringent emission regulations that position cement among the top contributors to industrial greenhouse gases. In response, manufacturers are innovating increasingly sophisticated admixtures that cater to bespoke formulations and sustainable mandates.

Amid these pressures, digitalization is reshaping the additive landscape. Artificial intelligence and IoT-enabled dosing platforms provide real-time monitoring of additive consumption, fine-tuning mix designs to reduce cement usage and minimize waste. Progressive firms are leveraging these tools to deliver precise, data-driven results that align with net-zero objectives and cost-efficiency targets. This convergence of chemical innovation and digital control redefines traditional supply chains, resulting in customizable additive solutions that meet diverse project requirements.

Further accelerating change, research breakthroughs are unlocking novel pathways for carbon sequestration within concrete matrices. A recent study demonstrated that the integration of sodium bicarbonate during mixing can mineralize up to 15 percent of the process-related CO₂, creating an early-forming composite phase that enhances setting kinetics without compromising structural integrity. These advancements cement the role of additives not just as performance enhancers but as pivotal agents in the industry’s journey toward carbon-neutral construction.

Navigating the Transformative Shifts Redefining the Cement Additive Landscape with Sustainable Practices, Digital Integration and Performance-Driven Innovations

Over the past two years, the cement additive sector has undergone transformative shifts in response to environmental mandates, technological innovations, and evolving customer demands. Sustainability has ascended from a peripheral consideration to a central market driver, catalyzing the development of low-carbon formulations, bio-based grinding aids, and geopolymer alternatives that reduce reliance on traditional limestone clinker. Industry consortia, national regulations, and green building certifications now underpin these initiatives, propelling a wave of investments in carbon capture, utilization, and storage projects targeting supply chain decarbonization.

Concurrently, digital transformation is redefining product development and supply management. Leading producers are embedding sensors and analytics into bulk silo systems to optimize additive dosing, reduce material overuse, and predict performance outcomes. These advancements in digital control systems foster enhanced batch consistency and minimize variability across diverse site conditions. Meanwhile, additive manufacturers are forging strategic alliances with technology firms to co-create smart packaging solutions that enable traceability and adaptive mix adjustments on the fly.

Innovation in materials science is further amplifying the landscape’s complexity and opportunity. Geopolymer-based solidifiers derived from industrial byproducts offer circular-economy benefits, converting construction waste into high-performance matrices with compressive strengths exceeding construction-grade thresholds. Such breakthroughs underscore a paradigm where performance, sustainability, and resource efficiency converge, establishing a new standard for next-generation construction materials.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Cement Additive Sector’s Supply Chains, Costs, and Competitive Dynamics

The introduction of acute tariff measures in early 2025 has imposed new dynamics on the cement additive supply chain, reshaping import strategies, cost structures, and regional production footprints. Effective April 5, 2025, the United States applied variable duties on imported cement from key sourcing countries-levying 10 percent on Turkish exports, 25 percent on shipments from Canada and Mexico, and up to 46 percent on Vietnamese imports. These surcharges translate into significant incremental costs for distributors, compelling many to reevaluate established procurement flows and consider domestic alternatives.

Complementing sector-specific levies, broad-spectrum reciprocal tariffs targeting chemical imports have imposed baseline duties of 10 percent across integrated supply chains, with destination-specific rates reaching as high as 50 percent on select product lines. Even items previously exempt, such as titanium dioxide, face potential future inclusion under industrial policy reviews. As freight costs escalate under these regimes, total landed costs for specialty admixtures have risen by more than one-third in some cases, straining margins for downstream concrete producers.

In response, additive suppliers are accelerating onshore capacity expansion and inbound logistics realignment. Strategic stockpiling and nearshoring initiatives are gaining traction to mitigate tariff exposure and secure uninterrupted supply. Moreover, the heightened policy uncertainty underscores the need for agile trade compliance frameworks and flexible sourcing agreements, ensuring that product availability and cost competitiveness remain resilient amid evolving trade tensions.

Uncovering Key Segmentation Insights That Illuminate Diverse Product Types, Forms, Applications, End Uses and Distribution Pathways Driving Market Differentiation

Examining market segmentation through the prism of product type reveals water reducers as a primary catalyst for performance gains, with normal plasticizers delivering basic efficiency improvements and superplasticizers-such as polycarboxylate ether, sulfonated melamine formaldehyde, and sulfonated naphthalene formaldehyde-driving advanced workability and strength optimization. These multifunctional chemistries are tailored to specific cement chemistries and environmental conditions, enabling concrete formulations to meet exacting standards for slump retention, set control, and durability.

When considering form factors, liquid additives are increasingly preferred for their rapid dispersion and ease of on-site dosing, although powder variants maintain relevance where storage stability and logistics efficiency are paramount. This dichotomy informs warehouse configurations and application protocols, influencing both operational agility and cost management across diverse project scales.

From an application standpoint, the additive portfolio spans grouts, mortar systems, oil well cement, precast concrete, and ready-mix operations. Each category presents unique performance imperatives-such as enhanced fluidity in grouts, retardation control in mortar, and robust thermal stability in oil well environments-driving specialized product development and technical support services.

End users across commercial, industrial, infrastructure, and residential sectors demand tailored formulations that balance cost, performance, and sustainability criteria. Meanwhile, distribution channels-from direct sales and authorized distributors to burgeoning online platforms-shape market reach and customer engagement, underscoring the importance of omnichannel strategies that address both legacy relationships and evolving procurement models.

This comprehensive research report categorizes the Cement Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Distribution Channel

- End Use

Revealing Key Regional Insights Highlighting Unique Dynamics Across the Americas, Europe, Middle East and Africa and Asia-Pacific Cement Additive Markets

Regional dynamics in the cement additive market reflect the interplay between economic development, regulatory frameworks, and infrastructure investment patterns. In the Americas, robust public spending on transportation and utility networks-underpinned by legislation such as the U.S. infrastructure act and incentives in the Inflation Reduction Act-has galvanized demand for advanced admixtures that deliver sustainable performance and lifecycle cost savings. Producers in North America are aligning R&D with decarbonization goals, focusing on low-carbon binder systems and bio-based formulations to meet stringent environmental standards.

The Europe, Middle East and Africa (EMEA) markets feature heterogeneous adoption curves shaped by local regulations and project profiles. Western European nations emphasize carbon neutrality targets and circular-economy mandates, driving uptake of supplementary cementitious materials and high-range water reducers. In the Middle East, megaprojects demand heat- and sulfate-resistant admixtures, while African markets leverage simplified formulations to balance cost-efficiency with performance in emerging infrastructure initiatives. Interregional collaboration through trade groups and sustainability frameworks continues to influence product approvals and certification pathways.

Asia-Pacific retains its dominant position, anchored by rapid urbanization and infrastructure development in China, India and Southeast Asia. Local cement producers are integrating green additives to reduce clinker ratios, responding to government roadmaps that target a 2050 decarbonization trajectory. This region’s sheer volume of construction activity sustains robust demand for all additive categories, reinforcing its status as the sector’s growth engine.

This comprehensive research report examines key regions that drive the evolution of the Cement Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delivering Key Company Insights Into Leading Cement Additive Producers And Their Strategic Positioning In A Rapidly Evolving Market Landscape

The competitive landscape in cement additives is concentrated among a handful of global players, with BASF, Sika, Mapei, RPM, Saint-Gobain and W.R. Grace commanding upwards of 80 percent market share in North America alone. These companies leverage extensive product portfolios, technical service networks and strategic alliances to maintain leadership positions. Recent antitrust litigation highlighted the market’s oligopolistic structure but ultimately affirmed that price fluctuations reflect normal supply-demand dynamics rather than coordinated collusion.

Innovation remains a key battleground, with leading producers unveiling bio-based and multifunctional formulations. For instance, Sika advanced its portfolio with a bio-based grinding aid that reduces emissions by 14 percent while boosting early strength gain by more than 10 percent. Dow’s hybrid polyether-amino blend targets high-clay cement raw materials, and CHRYSO’s chloride-free aid demonstrates enhanced shelf stability and regional climate adaptability. Meanwhile, GCP Applied Technologies has integrated AI-ready compatibility into its new additive lines, reporting mill throughput improvements nearing 20 percent in pilot deployments.

Mid-tier and regional specialists are carving out niches through agile customer service and application-specific expertise, addressing underserved segments such as oil well cement and precast markets. As supply chain pressures mount, partnerships with chemical distributors and collaborative innovation platforms are gaining prominence, fostering a more dynamic and resilient competitive ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cement Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Birla Corporation

- Borregaard AS

- Cement Australia Holdings Pty Limited

- Chevron Phillips Chemical Company LLC

- Compagnie de Saint-Gobain S.A.

- Concrete Additives & Chemicals Pvt. Ltd.

- Crommelin Waterproofing & Sealing

- Elkem ASA

- Fosroc International Limited

- Heidelberg Materials AG

- Hindcon Chemicals Ltd.

- Huntsman International LLC

- Kao Corporation

- Lafarge Group by Holcim Ltd

- Lanxess AG

- MR BOND POLYCHEM

- Oscrete UK Ltd.

- Productos Químicos para el Cemento, S. L.

- Shandong Gaoqiang New Materials Technology Co., Ltd.

- Sika AG

- The Dow Chemical Company

- USG Corporation

- W. R. Grace & Co. by Standard Industries Inc.

- Yara International ASA

- Yuan Wang Imp & Exp Co., Ltd.

Charting Actionable Recommendations For Industry Leaders To Capitalize On Sustainability, Innovation And Supply Chain Resilience With Digital Transformation

Industry leaders must adopt a multi-pronged strategy to thrive amid intensifying sustainability mandates, tariff pressures and technological disruption. First, prioritizing R&D investment in low-carbon and bio-based additive chemistries will secure long-term competitiveness while aligning with regulatory frameworks and customer expectations. Embedding carbon sequestration pathways and supplementary cementitious materials into product pipelines enhances both environmental performance and value propositions.

Second, accelerating digital transformation across production and delivery channels is critical. Implementing IoT-driven dosing systems and advanced analytics platforms will optimize material usage, reduce operational variance, and create real-time feedback loops for continuous improvement. Integrating digital tools with customer-facing portals can enhance service quality and foster deeper project collaboration.

Third, strengthening supply chain resilience through geographic diversification and nearshoring will mitigate tariff-induced cost volatility. Strategic partnerships with regional distributors and investments in local manufacturing assets ensure reliable access to key raw materials and finished products. Finally, proactive regulatory engagement-participating in standards development and advocating for industry-friendly policies-will shape favorable market conditions and support sustainable growth trajectories.

Detailing The Rigorous Research Methodology Employed To Deliver Comprehensive Insights Through Data Triangulation And Expert Validation

This report synthesizes insights derived from a dual-pronged research approach encompassing primary expert consultations and comprehensive secondary analysis. Primary data were secured through structured interviews with executives, technical specialists and procurement leaders across cement manufacturing and construction end-user sectors, ensuring firsthand perspectives on emerging trends, challenges and strategic imperatives.

Secondary research involved systematic reviews of peer-reviewed journals, regulatory filings, industry white papers and reputable news outlets. Data triangulation techniques were applied to validate qualitative findings against publicly available quantitative benchmarks, maintaining rigor and objectivity throughout the analysis. Wherever possible, information was cross-checked for consistency across multiple sources to mitigate potential biases.

Market segmentation and competitive assessments leverage proprietary databases and performance metrics, enriched by scenario modeling to examine tariff impacts and adoption rates. The methodology adheres to best practices in market research, with transparent documentation of data sources, assumptions and analytical frameworks to support reproducibility and stakeholder confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cement Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cement Additives Market, by Product Type

- Cement Additives Market, by Form

- Cement Additives Market, by Application

- Cement Additives Market, by Distribution Channel

- Cement Additives Market, by End Use

- Cement Additives Market, by Region

- Cement Additives Market, by Group

- Cement Additives Market, by Country

- United States Cement Additives Market

- China Cement Additives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights Highlighting The Pivotal Role Of Cement Additives In Driving Sustainable Performance, Innovation And Competitive Advantage In Construction

The cement additive industry stands at a pivotal juncture, where the convergence of sustainability imperatives, technological progress and evolving trade dynamics demands strategic agility. Advanced admixtures are redefining concrete performance, enabling more durable, resilient and eco-friendly infrastructure. At the same time, digital platforms are transforming supply chains and customer engagement, fostering an era of precision engineering and adaptive mix designs.

Concurrent tariff measures and geopolitical reshuffling underscore the importance of flexible sourcing strategies and localized production footprints. Companies that invest in low-carbon chemistries, digital integration and supply chain optimization will outpace peers in value creation and market resilience. As global construction activity intensifies-particularly in Asia-Pacific and emerging markets-the ability to tailor additive solutions to regional specifications and regulatory landscapes will unlock new growth vectors.

In sum, the future of cement additives hinges on innovation that balances environmental responsibility with performance excellence, supported by data-driven operations and proactive stakeholder collaboration. Providers that champion these principles will not only capture market share but also contribute materially to the decarbonization of one of the world’s most essential industries.

Unlock The Full Depth Of Cement Additive Market Intelligence And Connect With Ketan Rohom To Secure Your Comprehensive Research Report Today

Unlock unparalleled intelligence on the cement additive landscape by securing our comprehensive market research report today. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore tailored data, strategic insights, and in-depth analyses designed to empower your decision-making. Whether you seek granular segmentation breakdowns, a deep dive into tariff impacts, or robust competitive intelligence, this report delivers actionable knowledge to drive your business forward. Contact Ketan Rohom to arrange a personalized presentation, discuss your specific research needs, and complete your purchase of the definitive cement additive market study-your roadmap to industry leadership awaits.

- How big is the Cement Additives Market?

- What is the Cement Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?