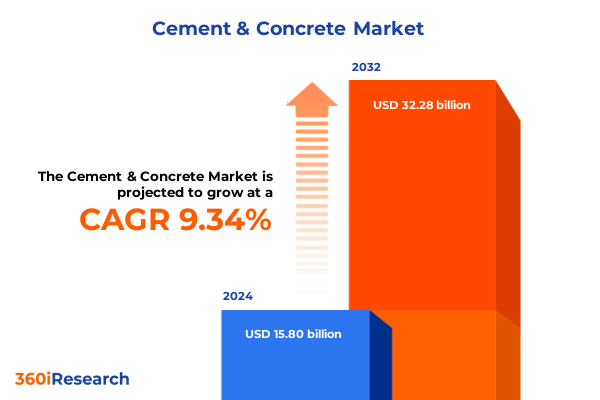

The Cement & Concrete Market size was estimated at USD 17.29 billion in 2025 and expected to reach USD 18.62 billion in 2026, at a CAGR of 9.32% to reach USD 32.28 billion by 2032.

Unveiling the core dynamics that define the modern cement and concrete industry and set the stage for strategic decision-making and market understanding

The cement and concrete market serves as the foundational backbone of global infrastructure and construction, driving urbanization and economic development. This sector has witnessed an intricate interplay of supply chain dynamics, technological advancements, and evolving regulatory frameworks, all of which form the backdrop for strategic investment and operational decisions. As stakeholders navigate shifting demand patterns and sustainability pressures, understanding the underlying drivers becomes paramount for charting future growth trajectories and mitigating risks.

In recent years, heightened emphasis on carbon footprint reduction, digital transformation, and resource-efficient production has challenged traditional operating models. At the same time, emerging economies continue to demand robust construction materials for residential, commercial, and infrastructural projects, while mature markets focus on renovation, retrofitting, and upgrading aging concrete assets. Collectively, these factors set the stage for a nuanced analysis of market forces, competitive positioning, and potential areas for strategic differentiation.

Exploring the pivotal trends and disruptive innovations reshaping cement and concrete production and the competitive dynamics across international markets

Fundamental shifts are reconfiguring the cement and concrete landscape, driven by disruptive innovations and macroeconomic realignments. On the technology front, the advent of low-carbon cement formulations, additive-enhanced concrete mixes, and advanced digitized plant operations has accelerated efficiency and product performance. Concurrently, national industrial strategies and infrastructure stimulus programs have redirected capital towards sustainable building materials, amplifying the uptake of greener alternatives.

Moreover, evolving customer expectations are reshaping project specifications and procurement criteria, compelling suppliers to broaden their portfolios and embrace circular economy principles. In this context, the integration of automation, predictive maintenance, and real-time quality control is redefining production protocols, while alliances between material science firms and construction conglomerates underscore a growing trend toward co-innovation. These transformative forces collectively illustrate how technology, policy, and collaboration are steering the sector into a new era of value creation.

Assessing the cumulative repercussions of recent United States tariff measures on cement imports and domestic producers throughout 2025

United States tariff measures enacted through 2025 have exerted observable influences on both import volumes and domestic manufacturing strategies. Heightened duties on clinker and cement imports have prompted some global producers to adapt by establishing local blending facilities or partnering with regional cement plants. Simultaneously, domestic producers have recalibrated supply chain networks to optimize capacity utilization and to mitigate cost pressures arising from duty escalations.

While these tariffs sought to bolster local employment and secure strategic material self-sufficiency, downstream concrete producers have confronted tightened margins and fluctuating raw material costs. In response, the industry has witnessed accelerated investments in alternative binders and supplementary cementitious materials to counterbalance cost increases. Overall, the cumulative tariff environment in 2025 has reinforced the importance of supply chain agility and continuous product innovation as key competitive levers.

Uncovering differentiated market opportunities through comprehensive segmentation analysis spanning product types, applications, end uses, and distribution channels

When viewed through the lens of product differentiation, the market segregates into cement and concrete segments, where cement itself encompasses blended, oil well, ordinary Portland, and white variants, while concrete extends across decorative, pervious, precast, and ready mix types. This bifurcation illuminates opportunities for specialized formulations and value-added service offerings. In parallel, applications span commercial, infrastructure, and residential uses-ranging from hospitality, office, and retail projects to bridges, marine construction, roads, and both multi-unit and single-family housing developments-underscoring how sector-specific demands shape material selection and project execution.

Beyond product and application delineations, end-use segmentation distinguishes between new construction activities and repair and renovation initiatives, with refurbishment efforts further split into commercial and residential contexts. This classification highlights distinct procurement dynamics and service models, as renovation projects often emphasize rapid turnaround and minimal disruption compared to greenfield builds. Lastly, distribution channels bifurcate into direct and indirect pathways, where manufacturer sales and online procurement coexist alongside dealer and distributor networks, revealing diverse go-to-market approaches and the strategic importance of channel partnerships in widening market penetration.

This comprehensive research report categorizes the Cement & Concrete market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use

- Distribution Channel

Navigating the nuanced regional distinctions and growth drivers shaping the cement and concrete market across the Americas, EMEA, and Asia-Pacific

Regional dynamics exhibit marked variations in growth catalysts and operational imperatives. In the Americas, sustained investment in transportation infrastructure, housing developments, and commercial real estate projects underpins demand for both conventional and specialty concrete solutions. North American markets in particular are witnessing escalating interest in low-carbon cement offerings, driven by state-level emissions targets and corporate sustainability commitments.

Across Europe, the Middle East & Africa, the regulatory landscape and logistical complexity yield a tapestry of market conditions. Western European nations are leaders in circular construction models, emphasizing recycled aggregates and eco-efficient binders, whereas Middle Eastern markets prioritize large-scale infrastructure and megaprojects, often supported by sovereign funding. African markets, though nascent, are gradually embracing public-private partnerships to address critical needs in road networks and housing, creating pockets of high growth potential.

In Asia-Pacific, rapid urbanization and expansive infrastructure drives in major economies continue to fuel robust consumption of cement and concrete products. Governments across the region are balancing ambitious urban renewal agendas with the imperative to curb CO₂ emissions, fostering investments in blended cements and next-generation admixtures. Consequently, suppliers operating in Asia-Pacific must navigate a heterogeneous array of regulatory frameworks and customer requirements while capitalizing on scale efficiencies and local partnerships.

This comprehensive research report examines key regions that drive the evolution of the Cement & Concrete market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading corporations and examining the initiatives driving innovation, partnerships, and competitive strength in the cement and concrete industry

Leading corporations are pursuing multifaceted strategies to cement their market positions and foster innovation. Major players are augmenting their portfolios through targeted acquisitions and joint ventures that expand their geographic footprint and technical capabilities. The pursuit of low-carbon cement technologies has also catalyzed collaboration between industry veterans and materials research institutes, enabling breakthroughs in alternative clinker compositions and carbon capture integration.

In tandem, digitalization efforts have gained traction, as companies deploy predictive analytics and advanced process controls to enhance operational uptime, optimize energy consumption, and maintain consistent product quality. Some organizations are forging partnerships with technology providers to roll out remote monitoring platforms and AI-driven logistics solutions, streamlining delivery windows and reducing on-site waste. Collectively, these strategic initiatives demonstrate how industry leaders are leveraging resource commitment, R&D synergies, and digital transformation to secure enduring competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cement & Concrete market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACC Limited

- Ambuja Cements Limited

- Anhui Conch Cement Company Limited

- Buzzi Unicem S.p.A.

- Cementos Argos S.A.

- Cemex S.A.B. de C.V.

- China National Building Material Co., Ltd.

- CRH plc

- Dalmia Bharat Limited

- Dangote Cement Plc

- Heidelberg Materials AG

- Holcim Limited

- India Cements Limited

- JK Cement Limited

- Shree Cement Limited

- Summit Materials, Inc.

- Taiwan Cement Corporation

- The Siam Cement Public Company Limited

- UltraTech Cement Limited

- Vicat S.A.

Delivering practical strategies to optimize production, improve sustainability performance, and seize emerging opportunities in the cement and concrete ecosystem

To bolster competitiveness and resilience, industry leaders should focus on optimizing manufacturing footprints by integrating modular kiln designs and flexible blending units that can adapt to fluctuating demand profiles. Parallel investments in advanced process automation will unlock cost efficiencies and minimize variability, serving as a cornerstone for consistent quality and regulatory compliance. Furthermore, embedding sustainability into product roadmaps-through increased use of supplementary cementitious materials and carbon capture-enabled processes-will align with evolving stakeholder expectations and position organizations favorably in policy-driven procurement.

On the commercial front, strengthening value-added services such as just-in-time delivery platforms, technical support, and digital quality assurance tools can differentiate offerings and enhance customer loyalty. Cultivating strategic alliances across the construction value chain-spanning equipment manufacturers, logistics providers, and technology firms-will further expand market reach and accelerate innovation. Lastly, upskilling the workforce with targeted training in green construction practices, digital competencies, and safety protocols will reinforce operational excellence and future-proof organizational capabilities.

Outlining the rigorous research framework, data collection techniques, and analytical methods underpinning this comprehensive cement and concrete market study

This market study is built upon a rigorous research framework combining primary and secondary data collection techniques. Primary insights were gathered through in-depth interviews with senior executives, technical experts, and procurement specialists from leading material suppliers, contractors, and industry associations. These qualitative engagements provided nuanced perspectives on emerging trends, competitive dynamics, and regulatory drivers.

Complementing this, secondary research drew upon a wide range of publicly available sources, including industry publications, journal articles, corporate filings, and government reports. Data triangulation methodologies were employed to cross-validate findings and ensure consistency across multiple information streams. Quantitative analysis leveraged historical shipment data, input cost indices, and trade statistics to inform the contextual narrative without relying on explicit market sizing or forecasting models. Throughout the process, methodological rigor and transparency were prioritized to deliver actionable, high-confidence conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cement & Concrete market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cement & Concrete Market, by Product Type

- Cement & Concrete Market, by Application

- Cement & Concrete Market, by End Use

- Cement & Concrete Market, by Distribution Channel

- Cement & Concrete Market, by Region

- Cement & Concrete Market, by Group

- Cement & Concrete Market, by Country

- United States Cement & Concrete Market

- China Cement & Concrete Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing the pivotal findings and highlighting the strategic imperatives that will influence future trajectories of the cement and concrete industry

The analysis synthesized herein illuminates the critical inflection points and strategic levers poised to shape the future of cement and concrete industries. From the transformative impact of sustainable innovations and digitalization to the nuanced effects of tariff landscapes and regional growth differentials, the sector is at a crossroads of opportunity and challenge. Strategic segmentation offers clarity on where value pools are emerging, while leading companies exemplify how collaboration and technology adoption can yield competitive distinction.

As the industry navigates environmental mandates and shifting demand paradigms, actionable recommendations underscore the importance of operational agility, sustainability integration, and partnership ecosystems. By embracing these imperatives, organizations can not only safeguard their market positions but also drive meaningful advancements in construction practices and infrastructure resilience. Ultimately, the insights presented form a blueprint for decision-makers seeking to capitalize on evolving megatrends and secure long-term growth.

Take the next step toward unlocking strategic market intelligence on cement and concrete by engaging Ketan Rohom to gain exclusive report insights and access

For decision-makers eager to access comprehensive intelligence and actionable insights, Ketan Rohom stands ready to facilitate direct engagement and personalized guidance. Harnessing his deep industry expertise and sales leadership, he can provide exclusive access to the full market research report along with tailored perspectives that address your organization’s strategic goals. Reach out today to initiate a conversation that will empower your team with the clarity and competitive edge needed to thrive in the evolving cement and concrete landscape and unlock the full potential of your next projects

- How big is the Cement & Concrete Market?

- What is the Cement & Concrete Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?